Author: 1912212.eth, Foresight News

In 2024, investors holding Ethereum have experienced a mix of ups and downs, but no sweetness. In terms of return multiples, it has not only significantly underperformed Bitcoin but also pales in comparison to other public chains. Solana has already reached an all-time high, with returns exceeding 20 times from its bottom, while SUI has surged from $0.5 to nearly $5, yielding close to 10 times returns.

Ethereum has faced intense scrutiny this year, with a lackluster ecosystem. Compared to the previous cycle's DeFi and NFT boom, this round of innovation has performed poorly, which is reflected in the coin's price. So, will 2025 be the year of Ethereum's comeback?

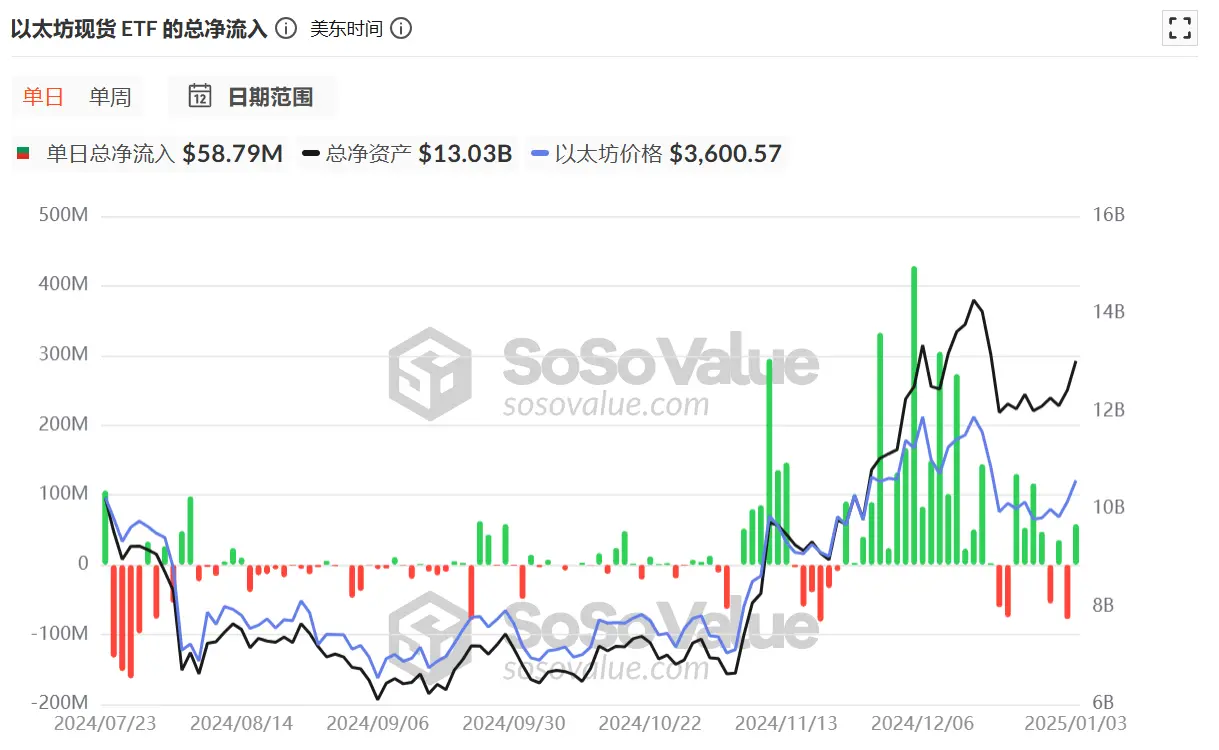

Ethereum Spot ETF Net Inflows

After the U.S. Ethereum spot ETF was officially approved in mid-2024, the market initially did not respond positively, as the market was relatively sluggish, resulting in significant negative net inflows.

After a three-month period of stagnation, influenced by a market rebound and other factors, Ethereum finally began to see significant inflows in early November, with net inflows consistently far exceeding net outflows.

By the end of November, its Ethereum spot ETF even experienced a rare 18 consecutive days of net inflows, with a single-day peak net inflow exceeding $400 million. Adjusted for market capitalization, this is equivalent to nearly $1.2 billion in daily inflows for Bitcoin, as Ethereum's market cap is about one-fourth that of Bitcoin. This flow of funds may reflect a reallocation or expansion of investment direction, coinciding with the new fiscal year that U.S. mutual funds typically start on December 1, and also demonstrates the market's optimistic expectations for 2025. If this demand continues, Ethereum's price in 2025 could rise significantly.

As of the time of writing, the total net inflow for the Ethereum spot ETF has reached $2.64 billion.

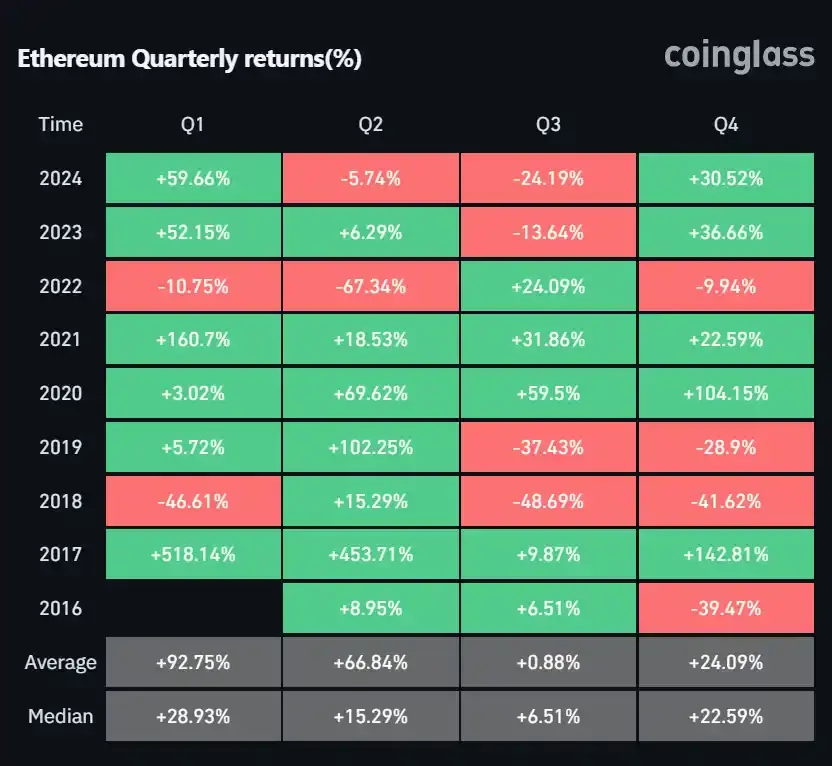

Ethereum's Strong Q1 Performance Over the Past Few Years

In the past eight years, Ethereum has seen price increases in six of its first quarters. Especially in the first quarter of the new year following U.S. elections, such as in 2017 and 2021, Ethereum achieved quarterly gains of 518.14% and 160.7%, respectively.

The crypto market often has self-fulfilling prophecies; if history repeats itself, Ethereum's performance in Q1 this year may once again attract market attention.

Ethereum's price performance often resonates with the market; during Q1, when the market generally performs well, it tends to benefit from factors like DeFi and liquidity, leading to price increases.

Long-Term Holders of ETH Are Still Accumulating

Observing the dynamics of long-term holders is one way to gain insight into the market. A continuous significant reduction in long-term holders often indicates that the coin price is approaching a peak, while during significant price declines or when the future outlook is optimistic, long-term holders tend to increase their accumulation, engaging in a cycle of high selling and low buying.

The data in the chart shows that BTC long-term holders are continuously reducing their holdings, possibly indicating that some long-term investors believe the price has reached their profit-taking zone. In contrast, Ethereum's data appears relatively optimistic, rising from a total proportion of less than 60% at mid-year to over 80%, with some recent pullback.

From the chart data, it can be seen that there are currently no significant returns for Bitcoin above $100,000, but long-term holders in the market believe that Ethereum still has good opportunities next year.

Staking and Re-Staking Data Remain Stable and Upward

Ethereum's staking and re-staking data can also serve as indicators of market confidence.

Ethereum's staking volume has increased from less than 35 million ETH at the beginning of 2024 to 55 million ETH by the end of the year. In terms of re-staking data, after explosive growth at the beginning of the year, it has entered a stable period, maintaining above 4 million ETH.

Ethereum Spot ETF Expected to Support Staking

Currently, the market only trades through the Ethereum spot ETF, which does not support staking yields. However, the future possibility of "Ethereum ETF staking" may be on the horizon. For investors in the Ethereum spot ETF, holding ETH through the ETF means missing out on staking yields, and they also need to pay the ETF issuer a management fee ranging from 0.15% to 2.5%.

SEC Commissioner Hester Peirce recently stated that the possibility of physical redemption and the initiation of staking for the Ethereum ETF may be reconsidered. Unlike last time, when under Chairman Gary Gensler, the realization of these two measures was almost zero, Hester Peirce expressed optimism about the potential for changes under the new management.

Cynthia Lo Bessette, head of Fidelity Digital Assets, also stated in an interview that the launch of Ethereum ETF staking is just a matter of time, not if it will happen.

It is foreseeable that once the Ethereum spot ETF supports staking, it will have a positive impact on Ethereum's price.

Conclusion

While Ethereum remains promising, it also faces significant challenges. Observing its gas fee data reveals that the activity level of its ecosystem is sluggish in 2024, with trading volumes stagnating, and it faces strong competition from Solana and Sui. Ethereum needs to consider whether its core narrative positioning is still accepted and recognized by the public.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。