Continuing to submit assignments over the weekend, what I mentioned yesterday has been realized today. Unfortunately, I didn't manage to make a short-term trade. In fact, today's price movement was exactly as I expected yesterday, rising to $98,500 and falling to $97,500 (the actual was $97,276), which would have been perfect for a short-term trade. But sadly, I woke up and went out for drinks, and by the time I returned, it was too late.

Some friends asked me why I don't use preset orders. The reason is that my goal for short-term trading is not to sell, but to lower costs. Therefore, what I need to focus on is the range and frequency of price fluctuations. If the price rises significantly above $98,500 or falls below $97,500 for a long time, it does not align with my expectations for short-term trading. In such cases, if I sell, I need to buy back as soon as possible, and once I buy, I won't make any further moves.

Of course, my lack of experience is also one reason why I don't constantly monitor price movements; I wouldn't choose to engage in short-term trading.

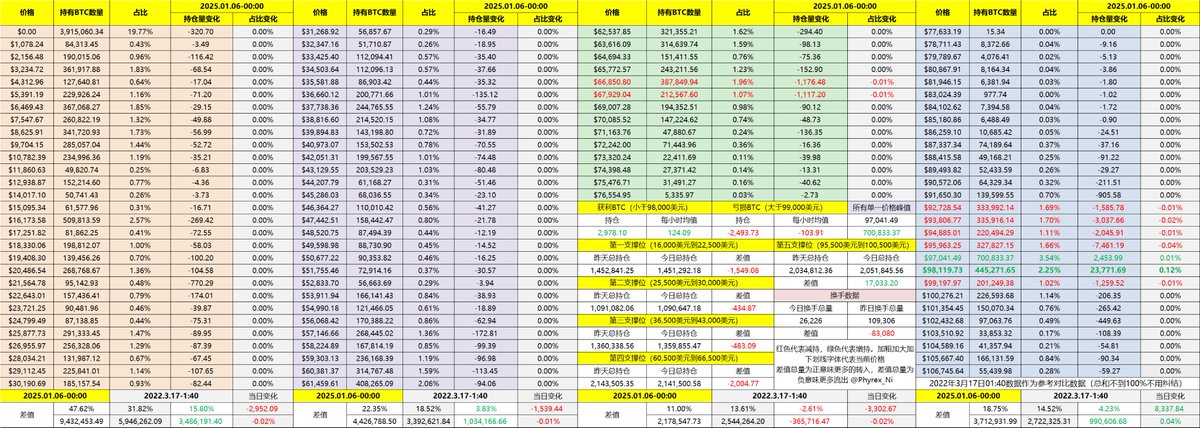

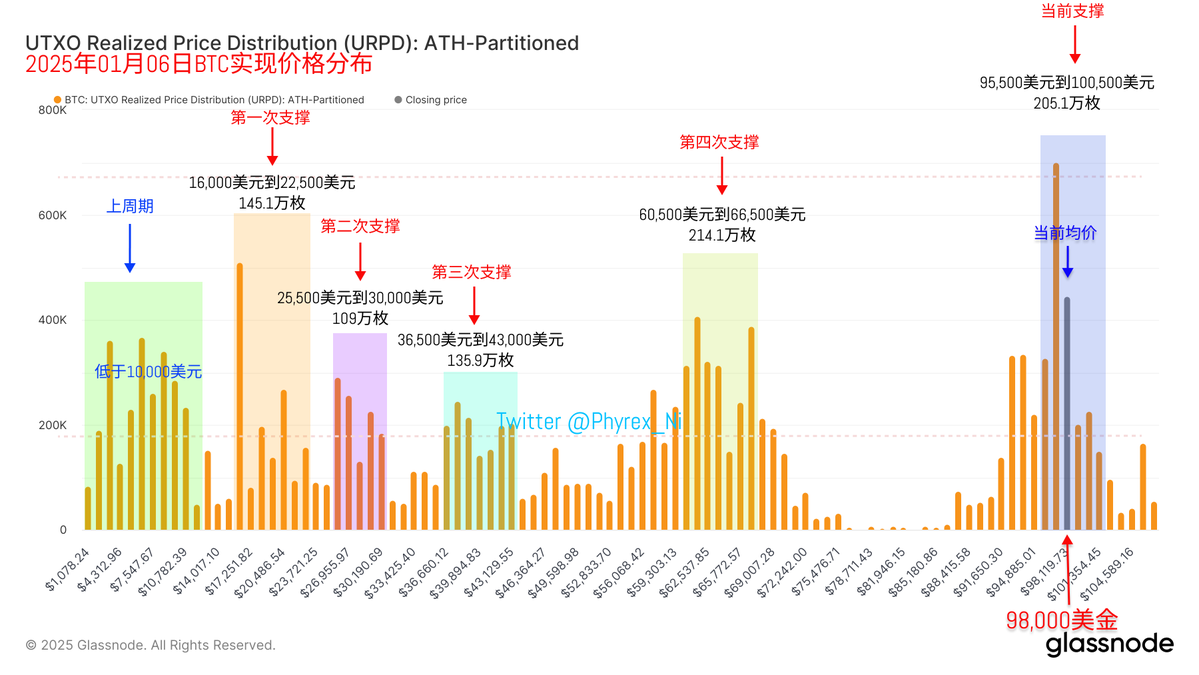

Looking back at BTC data, weekends are still weekends, with liquidity remaining very low and turnover rate still low. It’s primarily short-term investors who are trading, while earlier investors have been inactive over the weekend. From the detailed data, the current turnover rate has dropped to bear market levels. This has happened many times before elections, but is rarely seen afterward, indicating that real investors currently have no plans to buy or sell during the holiday.

What does this tell us? In fact, we have mentioned this issue multiple times before the elections, representing that investors are more optimistic about future price movements. The current price does not attract real investors, and there is no interest in buying or selling. Often, in such cases, a large amount of #BTC leaves exchanges. This is the current situation.

I won't say much about support; the turnover rate itself is very low, so it naturally won't affect support. Liquidity will gradually recover starting next Monday, and then we can see if support needs to change a week later.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。