Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.4 trillion, with BTC accounting for 56.33%, which is $1.92 trillion. The market cap of stablecoins is $205.8 billion, with a 7-day increase of 0.27%, of which USDT accounts for 66.79%.

This week, BTC's price showed a fluctuating upward trend, with the current price at $97,905; ETH also showed a fluctuating upward trend, with the current price at $3,586.

Among the top 200 projects on CoinMarketCap, most have declined while a few have risen, including: ZEREBRO with a 7-day increase of 90.02%, SPX with a 7-day increase of 62.36%, DEXE with a 7-day increase of 46.87%, and FARTCOIN with a 7-day increase of 64.64%.

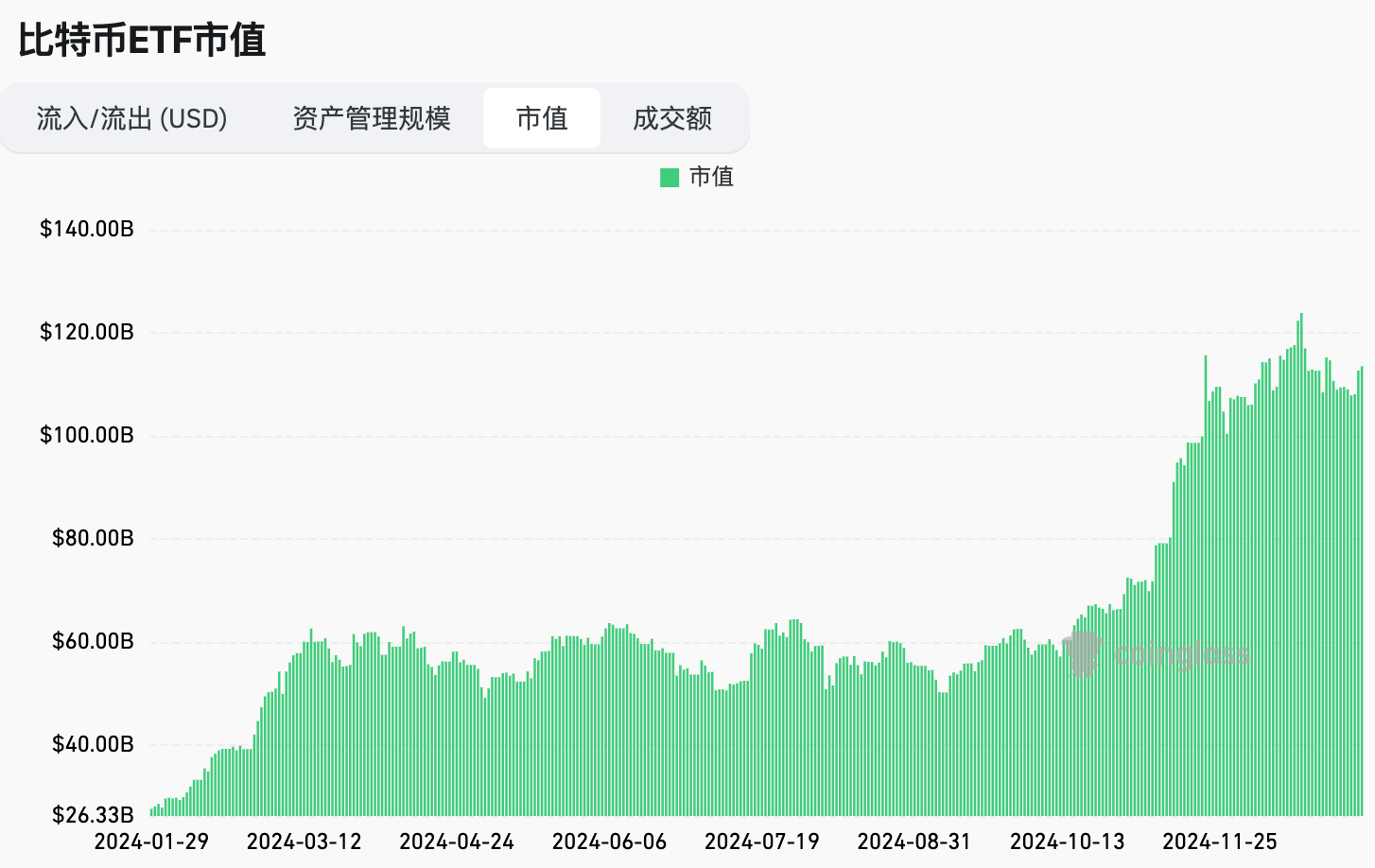

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $255.3 million; the net outflow for Ethereum spot ETFs in the U.S. was $72 million.

On January 3, the "Fear & Greed Index" was at 73 (lower than last week), indicating a sentiment of greed over the past 7 days.

Market Prediction: After Christmas, liquidity in the crypto market began to recover, with the overall market showing a fluctuating upward trend this week. The AI Agent sector saw significant growth, but the inflow of ETFs was average, with a slight increase in stablecoins. The Federal Reserve is unlikely to cut interest rates in January, and the market is expected to continue warming up next week, but explosive growth will take time. This week, focus on the AI and Desci sectors.

Understanding Now

Review of Major Events of the Week

On December 28, Nick Timiraos, a prominent journalist from The Wall Street Journal known as the "Fed's mouthpiece," stated that the Federal Reserve is trying to reassess the impact of Trump's new government on the U.S. economy and inflation. The market generally believes that the Fed may slow down, reduce, and be more cautious in future rate cuts. The uncertainty surrounding the Fed's rate cut prospects in 2025 is rising, and investors must face the possibility of the Fed pausing rate cuts for some time, as well as potential turmoil from Trump's new government;

On December 30, a16z Crypto supported a lawsuit filed by the Blockchain Association, DeFi Education Fund, and Texas Blockchain Council, claiming that the IRS and Treasury have exceeded their statutory authority, violated the Administrative Procedure Act (APA), and are unconstitutional. DeFi builders should be confident that industry lawyers are working to protect this technology;

On December 30, Placeholder partner Chris Burniske tweeted on X, stating: "Although BTC is playing with fire, ETHBTC, SOLETH, and SOLBTC are still performing well. This makes me think it is not a sign of reduced market risk appetite, but more likely driven by year-end liquidity factors, as people are organizing their books for 2024";

On December 31, according to GitHub data, the autonomous agent framework Eliza developed by the a16z team topped the GitHub December trends chart, gaining 4,531 stars this month, for a total of 7,015 stars;

On January 3, Aave founder Stani Kulechov tweeted that the team will release innovative contracts on the modular social feature network Lens Network. These include social (expanded information flow, groups, charts, username rules), ICO/crowdfunding, ERC20 new flavor, novel bonding curves, new ERC721 contracts, governance, point systems, and yield plans. All content will be open source for users to use freely;

On January 3, the cryptocurrency prediction platform Polymarket previously stated that the likelihood of a Solana ETF being listed in the U.S. in 2025 is about 77%. VanEck's research director Matthew Sigel commented that this prediction is "underestimated." In June 2024, VanEck and competitor asset management firm 21Shares are seeking approval from U.S. regulators to list a spot Solana ETF. Last November, shortly after Trump's victory in the U.S. presidential election, Matthew Sigel stated that the likelihood of the U.S. approving a SOL ETF in 2025 is "very high";

MicroStrategy, Tether, and CleanSpark increased their Bitcoin purchases.

On December 30, MicroStrategy acquired 2,138 BTC for approximately $209 million, at an average price of $97,837, achieving a 47.8% BTC return for the quarter to date and a 74.1% BTC return year-to-date. As of December 29, 2024, MicroStrategy holds 446,400 BTC, with an average cost of $62,428, totaling $27.9 billion.

On December 31, CleanSpark's Cold Wallet spent $293.39 million to withdraw 3,158 BTC from Coinbase Prime Deposit, currently holding approximately 9,907 BTC.

Tether withdrew 7,628.9 BTC from Bitfinex this quarter, amounting to approximately $705 million. This should be Tether's BTC purchase for this quarter: Tether announced in May 2023 that it would regularly use 15% of the company's profits to purchase Bitcoin to enhance reserves. Tether currently holds a total of 82,983 BTC (worth $7.68 billion), making it the 6th largest BTC wallet address. Its average purchase price is approximately $36,222, currently yielding a profit of up to $4.72 billion.

Macroeconomics

On December 28, Nate Geraci, president of ETF Store, posted on social media that Volatility Shares has submitted an ETF application based on Solana futures to the U.S. Securities and Exchange Commission, covering 1x, 2x, and -1x leveraged exposure. Solana futures contracts are only traded on exchanges registered with the Commodity Futures Trading Commission;

On December 30, Cointelegraph reported that former German Finance Minister Christian Lindner called for Bitcoin to be included in the reserves of the European Central Bank and the German central bank;

On December 31, according to CME's "FedWatch" data, the probability of the Fed cutting rates by 25 basis points in January next year is 11.8%, while the probability of maintaining rates is 88.2%;

On January 2, Goldman Sachs released a report stating that its forecast for the Fed's rate cuts this year has been reduced from 100 basis points to 75 basis points, and reports of a rebound in core inflation have been greatly exaggerated;

On January 3, European Central Bank Governing Council member Stournaras stated that he expects the ECB's interest rates to be lowered to 2% by this fall;

On January 3, the reserves of the U.S. banking system are a crucial factor for the Fed in deciding to continue reducing its balance sheet, having fallen to about $2.89 trillion in the week ending January 1, below the $3 trillion mark, reaching the lowest point since October 2020.

ETF

According to statistics, from December 30 to January 3, the net inflow of Bitcoin spot ETFs in the U.S. was $255.3 million; as of January 3, GBTC (Grayscale) had a total outflow of $21.473 billion, currently holding $20.17 billion, while IBIT (BlackRock) currently holds $54.306 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $113.567 billion.

The net outflow of Ethereum spot ETFs in the U.S. was $72 million.

Envisioning the Future

Upcoming Events

a16z GAMES will hold the SPEEDRUN 004 accelerator event in San Francisco from January 6 to March 23, 2025;

METAVSUMMIT will be held in Dubai, UAE from January 7 to 8, 2025;

Move DevCon will be held in Shenzhen on January 11, 2025;

CoinDesk will host Consensus Hong Kong from February 18 to 20, 2025.

Project Progress

The presale date for the AI agent protocol BAD on BNB Chain is January 6, 2025. Floki will support the launch of the AI agent protocol BAD on BNB Chain, with 35% of tokens airdropped to the Floki ecosystem;

The Base LP incentive program on Synthetix will continue until January 7, targeting liquidity providers (LP) on the Base chain, with rewards including 80,000 SNX and 100,000 USDC.

Token Unlocking

Kaspa (KAS) will unlock 182 million tokens on January 6, worth approximately $21.39 million, accounting for 0.72% of the circulating supply;

Ethereum Name Service (ENS) will unlock 1.46 million tokens on January 7, worth approximately $54.66 million, accounting for 1.46% of the circulating supply;

GMT (GMT) will unlock 92.22 million tokens on January 9, worth approximately $14.99 million, accounting for 1.54% of the circulating supply;

Cheelee (CHEEL) will unlock 11.66 million tokens on January 10, worth approximately $95.26 million, accounting for 1.17% of the circulating supply.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play to Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed breakdowns of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking deeper insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors make investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。