Author: @xingpt

Before analyzing the AI Agent sector, it might be better to step back and look at what crypto has actually experienced in this cycle from a broader perspective:

Bitcoin Decouples from the Crypto Sphere

Before this round, Bitcoin was almost synonymous with the crypto sphere; buying Bitcoin meant buying crypto assets, which implied an endorsement of crypto and decentralization.

However, after the approval of Bitcoin spot ETFs, from the U.S. President to publicly listed companies, purchasing Bitcoin and acknowledging its value seems to have become mainstream opinion. Yet, the significance of crypto, especially Ethereum and Altcoins, does not seem to have gained recognition from mainstream society and capital.

The reasons are complex.

The main reason is asset positioning: Bitcoin is viewed as an alternative asset linked to gold, widely recognized for its hedging against inflation and its property of preserving value beyond sovereign currencies.

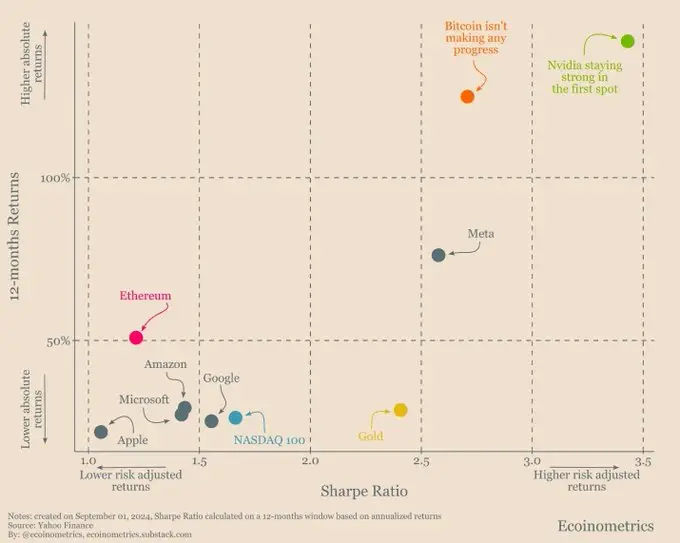

In contrast, Ethereum and other altcoins are still seen by old money on Wall Street as tech meme stocks without mature and sustainable business models. Compared to hard tech companies like Nvidia, Microsoft, and Amazon, which have users, products, and demand, the valuations of Ethereum and other crypto assets are not low, and their return elasticity is insufficient, making them low-risk-return assets from an asset allocation perspective.

As shown in the chart below, Ethereum's Sharpe Ratio is lower than that of tech companies like Meta and Google. Bitcoin's Sharpe Ratio, however, is second only to the super-performing Nvidia in this cycle.

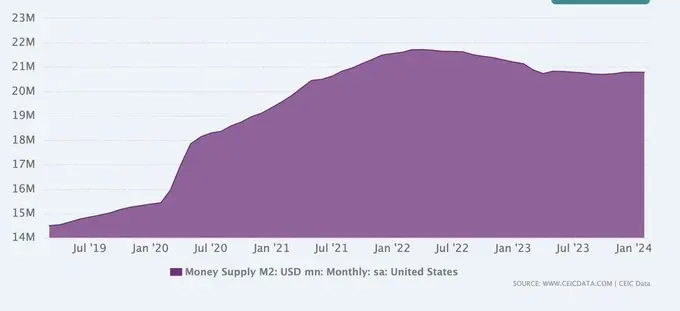

Another important factor is that the overall macro interest rates and the degree of monetary easing cannot be compared to the massive liquidity injection during the previous cycle's pandemic. Coupled with the booming AI industry, this has led to insufficient attraction of crypto for off-market funds. The reasoning is straightforward: there is only so much money available; if it is spent on buying AI stocks and GPUs, there is none left for altcoins and Ethereum.

The M2 money supply in USD has still not recovered to the 2022 peak (Data source: CEIC)

Imbalance in the Crypto Ecosystem

Since the crypto sphere lacks the ability to attract off-market funds, can the on-market funds leverage enough purchasing power?

If we roughly estimate the on-market funds using the total amount of stablecoins plus contract positions, it is not hard to find that the current total amount of on-market funds has far exceeded that of the last bull market. However, apart from BTC, most altcoins have not reached new highs. Where exactly is the problem?

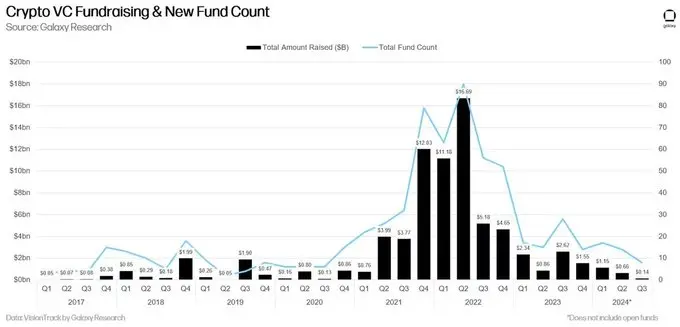

The root of the problem lies in the supply-demand imbalance. On the supply side, there are numerous new projects with extremely high valuations, most of which have not found actual application scenarios (PMF) and have few real users.

These projects exist due to the excessive financing of crypto VCs during the bull market of 2022. Because crypto VCs raised too much capital, most of which is limited to five years, with about three years for investment and a two-year exit period, funds have overlooked project quality in their rush to fulfill investment tasks.

So, who will provide buying power for these projects?

Previously, the exit channels were mainly centralized exchanges, but after the FTX incident, centralized exchanges have become the target of criticism. The long arm of regulatory oversight has made centralized exchanges suffer, as they not only fear hefty fines but also the risk of founders going to prison. As a result, the goals of centralized exchanges have shifted from expanding users and increasing trading volume to achieving profitability.

Exchanges focused on user expansion must offer benefits to users, including lowering new project valuations, sharing early project participation opportunities (IEOs), and a series of offline activities to attract new users.

Under the heavy hand of regulation, exchanges have simultaneously reduced offline and regional expansion efforts while also actively or passively halting profit-sharing businesses like IEOs. This has led to insufficient growth momentum for on-market demand and buying power.

Unique Advantages of AI Agents Compared to Meme Coins

It is well known that the core application scenarios in the crypto sphere are asset trading and asset issuance. In every bull market, only by involving users in new modes of asset issuance and trading can a wealth effect be generated, which in turn triggers the phenomenon of leveraged on-market funds and off-market funds entering the crypto sphere.

However, under the premise of high valuations for on-market projects and severe supply-demand imbalance, Meme coins have become the first sector to break the deadlock.

Meme coins, characterized by no VC financing and fair launches, create wealth effects through rapid surges in low market cap, and have also driven new sectors in asset issuance (pump.fun) and asset trading (Gmgn, TG bot).

One of the most important features of Meme coins is that they have no actual use. This financial nihilism can deconstruct VC schemes and is suitable for both IQ 50 and IQ 150 crypto users. For most IQ 100 practitioners and institutions, the difficulty of participation is still too high; it is hard to imagine explaining to a fund's LP that the reason for investing in Moodeng is that it is too cute, while the reason for selling Moodeng is that it has become fat and no longer cute (I still love moodeng).

But AI Agents can unite the consensus of the majority: with fund LPs, one can tell the story of investing in AI infrastructure; with IQ 50 and IQ 150 Degens, one can discuss the logic of on-chain memes and golden dogs; with IQ 100 crypto practitioners and crypto VCs, one can discuss the logic of investing in AI Agent sector projects.

In short, AI Agents are the greatest common divisor of the web3 industry in this cycle.

My Perspective on AI Agent Projects

How should IQ 100 view AI Agents - From Dapp to AgentApp

IQ 100 includes the vast majority of crypto practitioners and investment institutions, including myself, so let’s analyze AI Agents using an investment framework I am familiar with.

I believe that for investment institutions in the crypto sphere, the most important point is to understand that AI Agents are reshaping the upstream and downstream industrial chains and valuation logic of crypto.

Through the two waves of bull markets in 2017-18 and 2020-21, the industrial chain and valuation logic of blockchain projects have gradually taken shape:

Bottom layer public chains; the market cap ceiling is Ethereum, currently valued at 400 billion USD; the second-tier Solana, with a market cap of about 1/4 of Ethereum, may reach 1/3 or even 1/2 in the future;

Middle layer: such as the oracle Chainlink, with a fully diluted market cap of 20 billion USD, about 5% of Ethereum;

Basic protocols like DeFi, with Uniswap's FDV at 13 billion USD; AAVE at about 5 billion USD; which are approximately 3% and 1.25% of Ethereum, respectively;

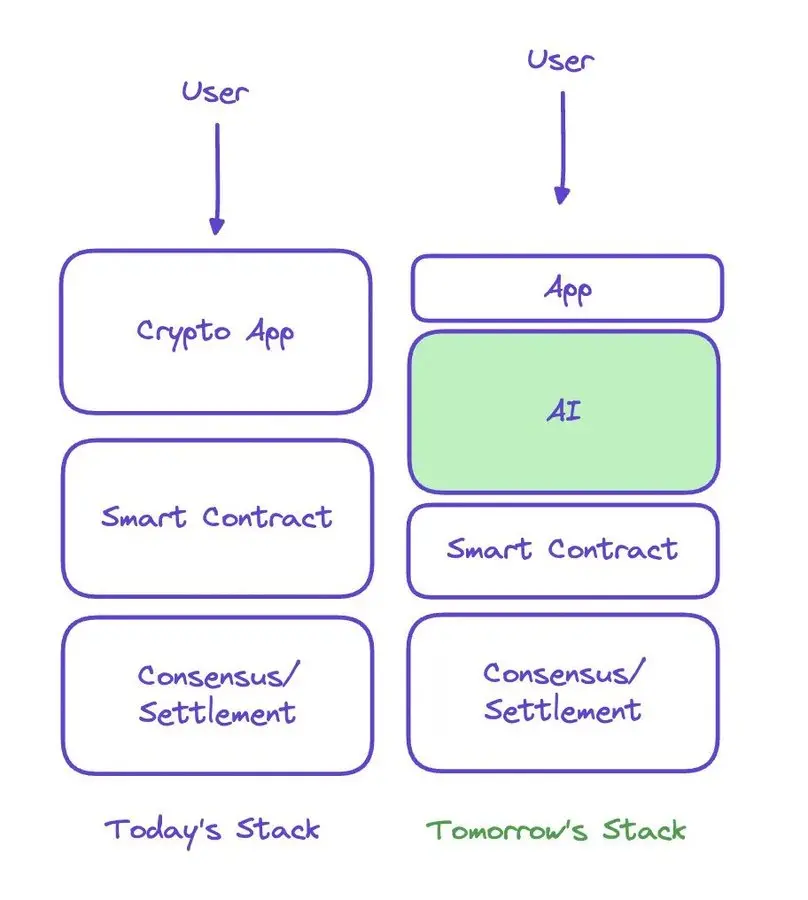

The underlying logic of DeFi is based on smart contracts (Smart Contract), and the functional limitations of smart contracts also restrict innovation in other applications in the crypto sphere.

Now, by incorporating AI into the underlying technology stack of blockchain, the AI layer becomes a parallel technical foundation alongside smart contracts, known as the Fully-onchain AI Agent Layer.

Image source: (https://x.com/karsenthil/status/1874471383066984706)

This also explains another question: why previous AI projects did not lead to a new narrative. Because whether it is token incentives for shared GPUs, data, or data labeling projects, they still treat blockchain as an incentive layer and have not stepped out of the realm of smart contract applications (DAPP). In contrast, the application of AI Agents exists as a glue between the blockchain's underlying layer and off-chain data, providing a better UX interface. (Refer to https://x.com/jolestar/status/1872935141326373237)

Based on this logic for valuation, if the leading middleware in DeFi, Chainlink, can capture 5% of Ethereum's market cap; analogously, if we assume that the leading framework of AI Agents can also capture 5%; currently, ai16z has a market cap of about 2.5 billion USD, indicating a potential 8-10x growth space; here, ai16z is just an example, as there may be other better Agent frameworks emerging.

Platforms like Virtual that come with their own frameworks are equivalent to Chainlink + Uni; currently, Chainlink + Uni has a market cap of 33 billion USD, while Virtual at 5 billion USD suggests a potential 6x growth space.

Freysai (FAI) is somewhat like AAVE, low-key but delivering products of extremely high quality. The verifiable applications of AI TEE will also become standard for future AgentApps, with a market cap ceiling of 1.25%-3% of Ethereum, corresponding to 5 to 10 billion USD.

Other leading counterparts, such as Spore, are equivalent to the stable or Launchpad of the previous cycle, while aixbt is comparable to DeFi aggregators like 1inch, with a lower limit of 1 billion USD valuation and an upper limit depending on market developments.

Other AI projects can be compared accordingly, and I won't elaborate on each one here.

How should IQ 100 view AI Agents - How they change the crypto ecosystem

In this cycle, the wealth effect has almost entirely occurred on-chain since the rise of Memes, but on-chain memes still present too high an operational threshold for off-chain users and IQ 100 institutions, as most users remain accustomed to trading on exchanges.

However, the greatest advantage of AgentApps lies in their interactivity.

Buying Assets: In the past - from centralized exchange apps and websites, users would deposit funds and place orders to buy coins;

In the Agent era - Agent applications allow users to buy coins using natural language directly, and can even assist with trading and investment decisions intelligently;

Financing: In the past - conceptualizing ideas, assembling teams for packaging, seeking VC funding for seed rounds, and gathering top VCs or exchanges to boost valuations;

In the Agent era - directly uploading to GitHub and products, spreading the word to the community, and the community directly funds the project;

Issuing Tokens: In the past - launching on testnets, announcing high valuation information from VC funding six months prior to attract studios to test the network, negotiating terms with exchanges only to face cuts, and then issuing tokens to dump and recover funds;

In the Agent era - AI automatically issues tokens, the Agent holds the private keys, the Agent adds to the liquidity pool, and the Agent calls out to the community for trades;

The entire cycle adheres to several important standards:

- Projects are open-source, applications are real and visible, and code is verifiable and auditable.

- Funds are relatively secure, with private keys held by the Agent to prevent developers from withdrawing liquidity.

- Financing and token issuance are transparent, avoiding issues like insider trading on exchanges, opaque airdrop rules, and the core circle of VCs banding together.

Of course, issuing tokens through Agents also faces issues like on-chain front-running and KOL information advantages, but compared to the past opaque operational methods, there has clearly been significant progress.

AgentApps that can win user trading entry points are very likely to match the valuations of exchange platform tokens.

How should IQ 150 view AI Agents

As I am Mid-Curve, I will reference my friend Alen's viewpoint from over a month ago (https://x.com/qiqileyuan/status/1858357959807635854), where he believes that AI Agents will form a new AI society, and the AI population within this society will create a social economy exceeding one trillion USD. In this AI economy, Bitcoin and crypto will become important assets in the monetary and economic cycle.

For AI entities, AGI is the brain, robots are the body, and crypto provides autonomous identity and economic systems.

In summary: Don't think about what AI can do for you, but rather think about what you can do for AI.

How should IQ 50 view AI Agents

Whoever has the biggest chest goes all in.

At what stage is the Agent project?

According to cookie.fun data, the total market cap of AI Agents is approximately 18.6 billion USD; about 64% of the total market cap of DeFi projects at 29 billion USD; 75% of the total market cap of GameFi projects at 24.6 billion USD; and 62% of the total market cap of all Layer 2s at 30 billion USD. (Sector classification based on Coingecko)

Data source: cookie.fun

Although the market cap statistics are somewhat rough, judging by market sentiment, AI Agents have just passed the halfway mark, equivalent to the sun being around noon to 1 PM, in its prime.

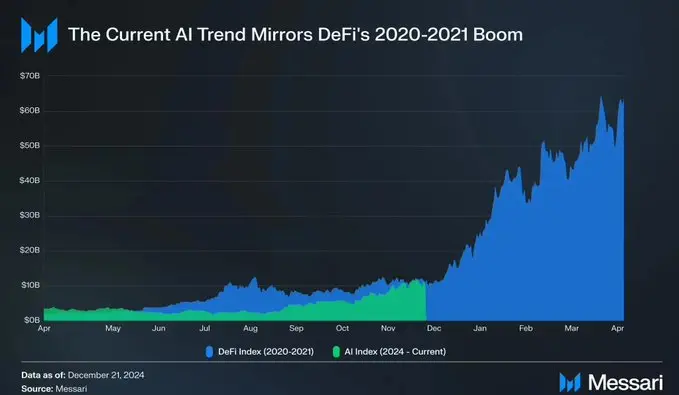

The chart created by Messari shows a more optimistic trend, indicating that AI Agents are approaching the midpoint, but the subsequent growth potential is even more considerable.

Reference document: https://x.com/Defi0xJeff/status/1873272066834841699;

So, where might the potential for future speculation lie?

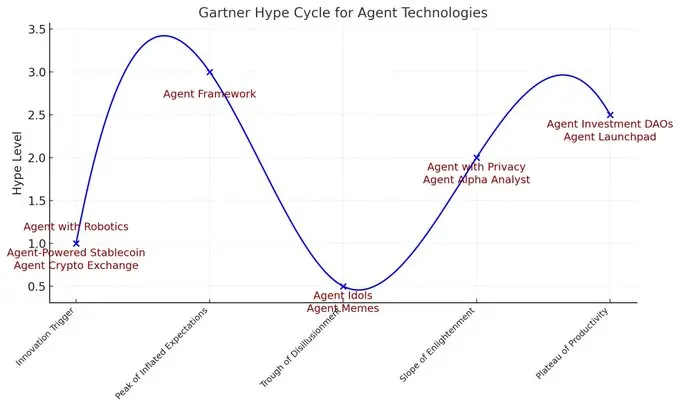

I analyzed the various types of Agent applications using the Gartner hype cycle, a favorite among IQ 100 individuals, with a chart created by ChatGPT:

In addition to the currently hottest Launchpad and Framework models, I personally see promising directions including: Agent-powered crypto exchanges: including intent trading, on-chain data analysis, and intelligent investment advisory-driven exchanges; fully decentralized listings, decentralized asset custody, and decentralized token issuance, all driven by Agents. Different types of Agent exchanges may vary in their level of participation in investment decisions, risk preferences, etc.

Agent-powered Stablecoins: an evolved version of stable coins, using AI to automatically rebase and maintain pegging;

Application Agentization, similar to tokenization, allowing different types of applications + agents to operate, such as games, NFTs, physical assets, etc.; all applications will eventually integrate Agent services into their core functionalities. (Excessive Agentization leading to bubbles can also be seen as a top indicator, such as when every chain starts creating AI Agents.)

In conclusion, the era of AgentFi has just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。