Source: Forbes

Translation and Compilation: BitpushNews

Bitcoin halving, historical highs, and the arrival of altcoin season—Is this the classic formula for a bull market? Or is it not?

First, the BTC halving reduces its issuance rate, leading to a supply shortage. After that, BTC will rise to historical highs, followed by altcoin speculation, as investors tend to seek higher returns, triggering a full-blown altcoin season. Shortly after the last Bitcoin halving, it broke the $100,000 mark—a historic milestone. However, the altcoin market has not seen a surge so far.

Where is the usual rebound? Has the classic narrative been disrupted? The surge of institutional capital and liquidity tightening due to high interest rates, combined with Trump's proactive and bold views on cryptocurrency, have confirmed one thing: this cycle will be different from any we have seen before.

How is this cycle different?

Every cycle has four stages: accumulation, uptrend, distribution, and downtrend. Although the mechanisms behind these stages are well-known, timing the market is one of the most recognized skills. You try to predict when we enter a specific stage to formulate trading strategies. However, while cycles follow predictable patterns, we must not forget the broader market context—cryptocurrency has undergone many changes over the past year.

Institutional Capital

The increasing presence of institutional investors in the Bitcoin market is reshaping its dynamics. With the emergence and growth of cryptocurrency ETFs, Bitcoin has become the seventh-largest asset globally, becoming a new choice for institutional investors. Increased participation from institutional investors typically brings greater price stability. However, this may not be good news for altcoins. After all, volatility and significant corrections can redirect capital flows back into altcoins. Reduced volatility means that potential returns flowing back into the altcoin market may decrease.

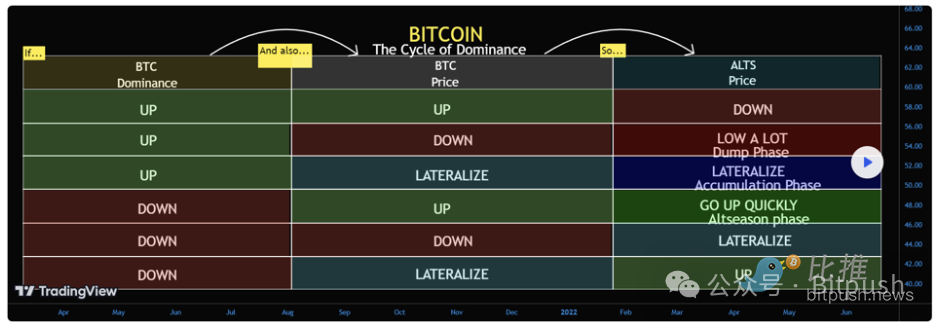

This year is special. The launch of Bitcoin spot ETFs has brought a significant influx of traditional financial capital into the cryptocurrency market. Institutional funds flowing into these ETFs have triggered a supply shock for Bitcoin, enhancing its dominance. The demand for Bitcoin driven by ETFs directly impacts its dominance, which currently stands at about 56%, an important metric often overlooked by novice traders. It measures BTC's market share relative to altcoins and can provide insight into whether we are in Bitcoin season (BTC performing well) or altcoin season (altcoins performing well). What does a strong BTC dominance combined with a stable Bitcoin price mean? Altcoin sell-off. In this cycle, Bitcoin spot ETFs have extended Bitcoin's dominance. This new variable was absent in previous bull markets, making the 2025 altcoin season undoubtedly unique.

Macro: Liquidity and Regulation

If you ask any CFO what the most important financial metric is, they will tell you it is liquidity.

In 2023 and 2024, U.S. interest rates rose to one of the highest levels in a long time. Although it has decreased from 5.25% a year ago to 4.19% now, it is still a relatively attractive yield for risk-free assets. On the other hand, interest rate cuts often fuel cryptocurrency bull markets for a simple reason—they create a favorable environment for the prosperity of higher-risk assets. After all, risk-free government bonds yielding 0.11% like in 2021 are as attractive as losing capital due to inflation. Low interest rates equal cheaper borrowing and higher liquidity, which in turn encourages investors to place funds where they can achieve higher returns. Where? Yes, you guessed it. Cryptocurrency.

Trump's victory undoubtedly shook the crypto world. The "Bitcoin Bill" sparked intense debate in both crypto and non-crypto circles. If passed, the Senate legislation would require the Treasury and the Federal Reserve to purchase 200,000 Bitcoins annually over five years to accumulate 1 million Bitcoins. In other words, about 5% of the global supply. Undoubtedly, supportive regulations for crypto are a significant step toward the widespread adoption of crypto assets, and Trump's stance has proven to inspire positive sentiment. Shortly after the future president confirmed the creation of a BTC Federal Reserve plan, BTC reached a historic high.

With BTC maintaining its dominance, high interest rates, and U.S. support for cryptocurrency regulations, should we expect a full-blown altcoin super cycle in 2025? That is a billion-dollar question.

When Will Altcoin Season Arrive?

If history has taught us anything, it is that altcoin surges typically follow significant movements in Bitcoin. However, estimating how much these price fluctuations will be—or how long after Bitcoin sets a historical high altcoins will surge—is impossible.

David Siemer, CEO of Wave Digital Assets, stated, "I don't think we will see a dramatic altcoin season like in 2021 in the near future, which means BTC's dominance will fall below 40%. But as BTC continues to rise, we will see significant increases in altcoin values."

Siemer further added, "For altcoins to break out relative to BTC like in 2021, their usage (adoption) and value (revenue generation) need to increase by several orders of magnitude," emphasizing that this may take at least three years. But once it starts, the altcoin season itself is easy to identify, as there are some quite bullish signals:

Altcoin prices rise rapidly and outperform Bitcoin, especially large-cap altcoins. This means that not only are altcoins overall rising, but their gains are larger than Bitcoin's.

Altcoin dominance skyrockets, similar to the altcoin season in May 2021. These tokens dominate the market, with the total market cap of the top 100 altcoins reaching 1.3 times that of Bitcoin.

FOMO-driven sentiment, high trading volumes, and venture capitalists are intensifying buying pressure and price momentum.

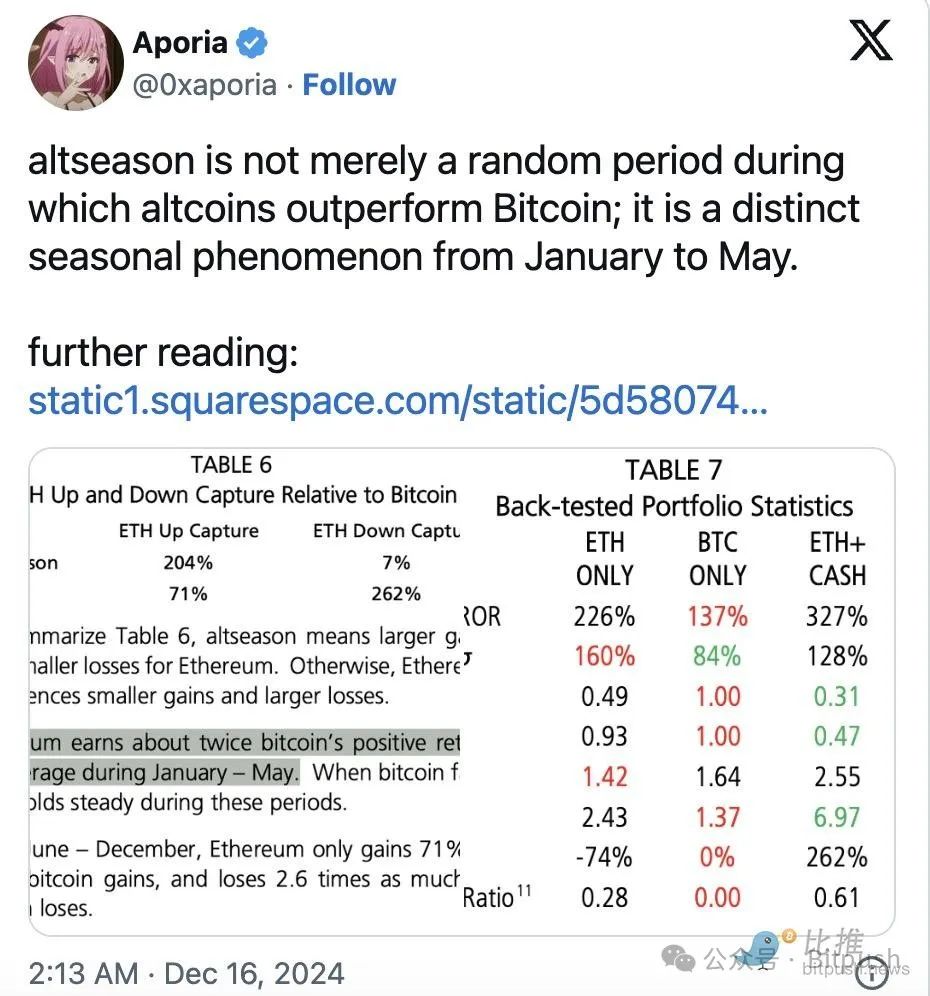

Cane Island Digital Research shared findings on the seasonality of altcoin rebounds in its "Altcoin Boom Proof," indicating that ETH represents altcoins experiencing bull markets. Additionally, it mentioned the recurring pattern of altcoin booms from January to May.

Narrative Dominance

Although the upcoming altcoin season may differ significantly from the seasons we are accustomed to, certain niche tracks have already carved out a place in the cryptocurrency space. After the VIRTUAL token experienced a surge of 24,908.4% (i.e., 249 times), it is safe to say we have entered a new level of narrative dominance.

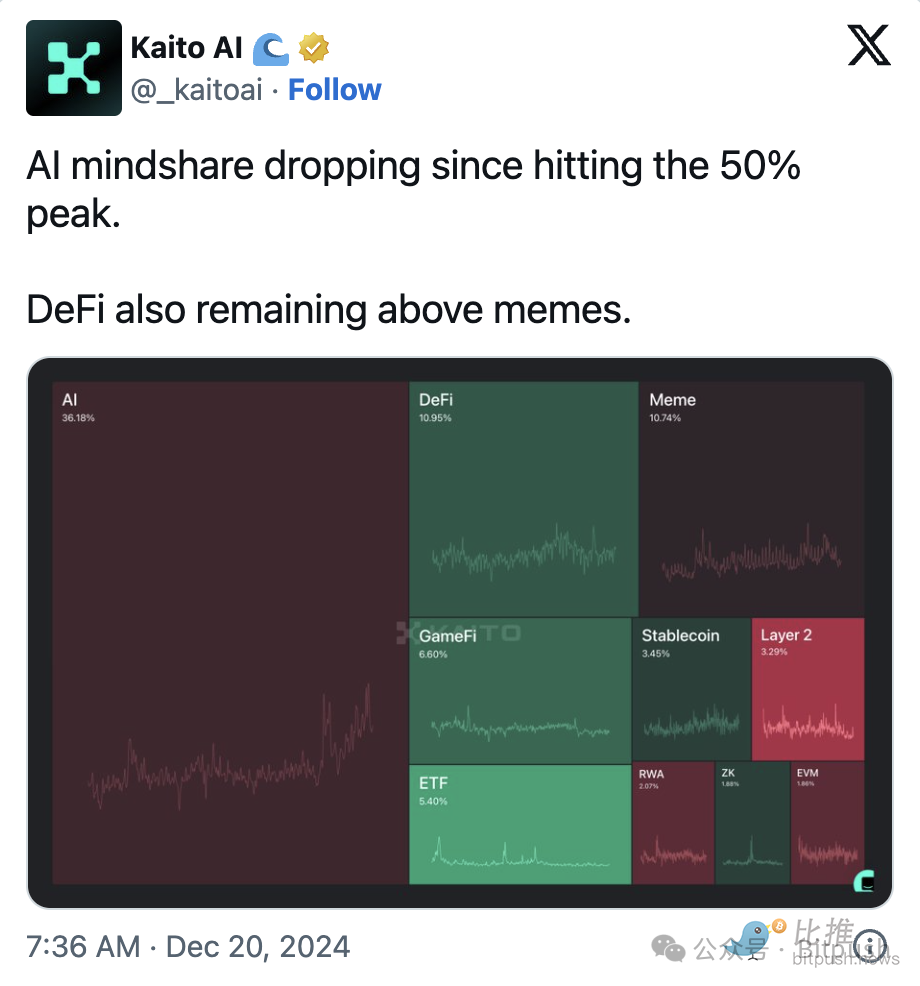

While memecoins may surpass real-world assets or fields like AI, AI agents stand out as a unique force, often seen as the driving force behind the next super cycle. Artificial intelligence remains at its peak, and with advancements in AI agents, the on-chain AI economy has captured a significant market share, which, according to Kaito AI, is expected to peak at 50% in 2024. Driven by unprecedented demand for AI services, this trend is likely to continue into 2025.

Institutional adoption driven by large companies like BlackRock is also influencing areas like real-world assets, making tokenization a fundamental component of the crypto world. While much attention is focused on artificial intelligence and AI agents, traditional finance is exploring tokenization as a viable business option, with major banks like JPMorgan and Goldman Sachs attempting to disrupt financial markets.

How to Prepare for Altcoin Season?

As we enter 2025, here are a few points to keep in mind before the arrival of altcoin season.

Bitcoin dominance is a classic reference indicator; make good use of it to time your trades. Websites like BlockchainCenter.net can help assess whether the market is currently in altcoin season or Bitcoin season. It is important to note:

The cryptocurrency market is largely driven by sentiment, so pay attention to regulatory measures, macroeconomic trends, or crypto-native narratives (DeFi, AI agents, meme coins).

Not all altcoins will follow the dynamic changes in Bitcoin prices. Historically, projects with strong fundamentals or aligned with emerging narratives (such as AI projects) tend to perform better. However, prioritize quality over quantity and focus on projects with strong fundamentals, active teams, and ideally, a product-market fit that can inspire large communities.

Pullbacks are a healthy phenomenon. They indicate that the market is consolidating and allow investors to enter positions before the next upswing. Altcoin seasons typically occur in the later stages of a bull market. Please be patient.

Conclusion

The cryptocurrency market is maturing. Each cycle is a stepping stone and should be viewed as a learning lesson. While memecoins continue to reap rewards, new narratives are becoming increasingly influential. But the most interesting aspect is that current popular narratives, such as AI agents, are not just a passing trend. Most importantly, compared to any previous bull market, we will now face greater impacts from macro factors and institutional adoption. Does this mean we should expect different altcoin dynamics this time? To some extent, yes. We should also not blindly follow the patterns of the past few years. The question is not whether an altcoin season will happen, but when it will happen and how it will differ from the past few years.

Get ready for the challenge!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。