This article can also be found on Ailurus's website

Life sciences and biotechnology have long driven transformative advances, from life-saving therapies to precision diagnostics, from detergent enzymes in laundry to bacteria that convert carbon into fabric. In a talk at Synbiobeta 2025, I shared a story about a species that could significantly lower the temperature of the entire planet.

The power of biology is miraculous. It is the technology of everything.

However, despite the bright prospects of the industry, traditional financing mechanisms often fail to support early disruptive ideas. On the other hand, it also hinders investors from capitalizing on these potential innovations to some extent.

Today, Bio Protocol (BIO) just launched on Binance and ETH, Solana, and Base through the Binance New Coin Pool. For those unfamiliar with the cryptocurrency world, Binance is currently the largest cryptocurrency trading platform globally, with daily trading volumes exceeding $11 billion.

Using Bio Protocol as an example, can a blockchain-based financing model provide an alternative? One that democratizes capital access, incentivizes collaboration, and drives more impactful discoveries?

The Challenge of Conservative Biotechnology Financing

The historical evolution of biotechnology financing, from post-World War II research funding to the venture capital boom driven by milestone successes like Genentech, has defined the financing model of biotechnology. Key milestones include:

Research Funding: Academic and startup labs receive funding to develop new technologies.

Venture Capital Partnerships: Venture capital helps scale lab innovations into intellectual property (IP) assets.

Pharmaceutical Collaborations: Strategic partnerships support large-scale manufacturing and distribution.

IPO: Companies seek public market financing to sustain long-term growth.

These achievements are largely credited to Genentech and its peers. Genentech's early success in human insulin and its famous collaboration withEli Lilly demonstrated the enormous financial return potential of the biotechnology industry. From founding to IPO, it took them about 4 years, which was the largest IPO at the time until Apple went public later in 1980. This marked the beginning of a revolution in biopharmaceuticals and therapeutics.

Historical image of Genentech and insulin production

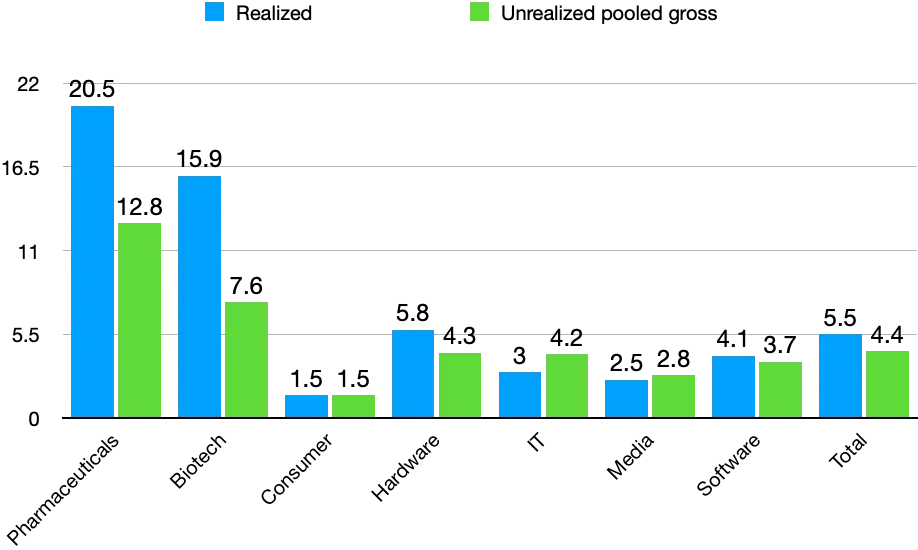

This model has been very effective because biotechnology is often incredibly powerful, capable of creating vast wealth. In the chart below, Bruce L Booth and Bijan Salehizadeh ina 2011 article published in Nature Biotechnology demonstrated that biotechnology investments significantly outperform those in the tech sector (IT, software, media, hardware, etc.).

Model remade based on Booth & Salehizadeh paper

Moreover, its performance has even surpassed that of the recent internet bubble.

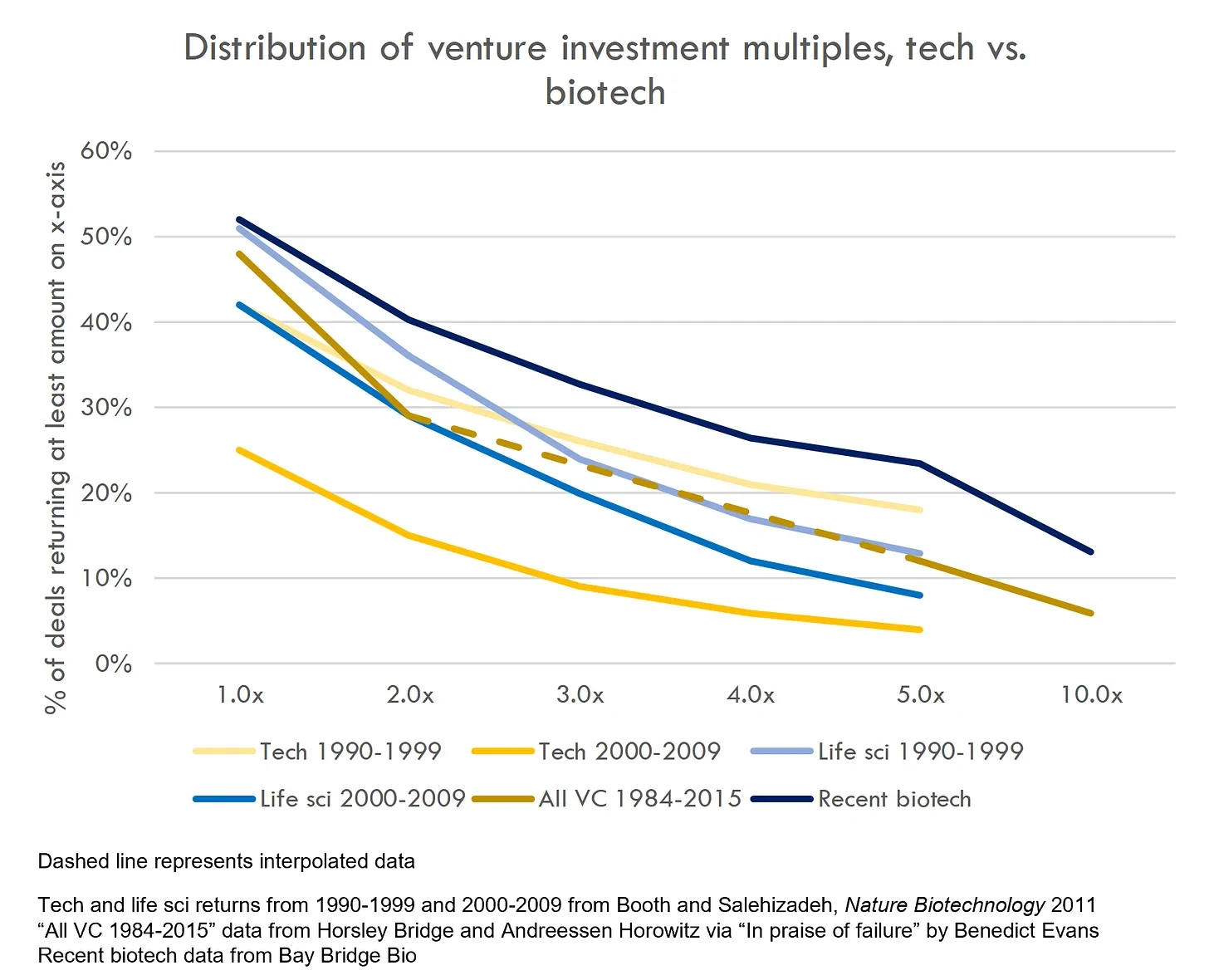

Image adapted from Bay Bridge Bio

However, despite the undeniable transformative and positive aspects of this model, it has turned into a dynamic attractor, a local minimum, and fostered conservatism throughout the industry.

The success of models similar to Genentech has led to an increasing phenomenon of prioritizing "blockbuster" therapies and established models targeting large markets. This rigidity has raised the barriers for unconventional biotech companies, marginalizing projects outside of therapeutics or with disruptive business models. Now, it is assumed that a "biotech company" is more or less a therapeutics development company. Anyone working in other fields must come up with new names for them, such as "techbio."

Even established giants cannot escape this gravity. In 2000, Novo Nordisk (the company behind the recently launched weight loss drugs Ozempic and Wegovy) had to spin off Novozyme, which produces over 50% of the detergent enzymes used in laundry detergents. In 2023, Johnson & Johnson (J&J) spun off its consumer products (including well-known brands like Band-Aid, Tylenol, and Johnson's Baby Powder) to form a new company called Kenvue.

Additionally, this emphasis on binary outcomes and non-recurring revenue challenges valuations, causing biotechnology to always be in cycles of boom and bust.

In the long run, this is detrimental to the development of the bio-related economy. Unlike the tech industry, no biotech company has reached a valuation of $1 trillion, and none founded after 1990 has reached a valuation of $100 billion, with only Moderna collapsing due to the COVID-19 pandemic.

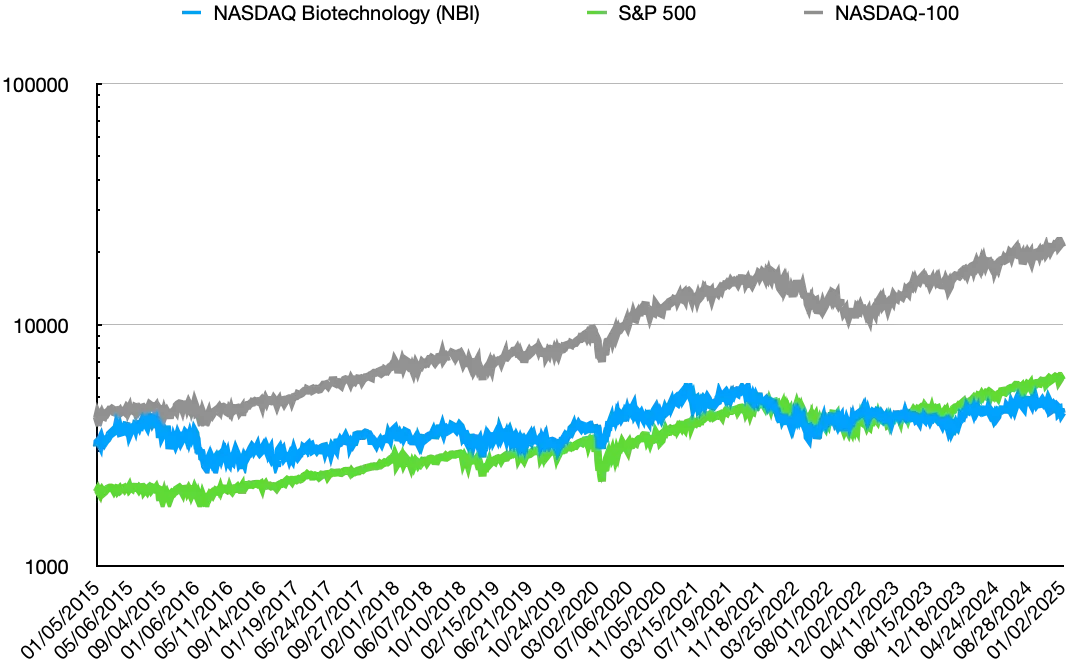

Over the past decade, the performance of the Nasdaq Biotechnology Index has significantly lagged behind the Nasdaq 100 Index, even worse than the S&P 500 Index.

Clearly, new models are needed!

Decentralized Financing: The Power of Blockchain

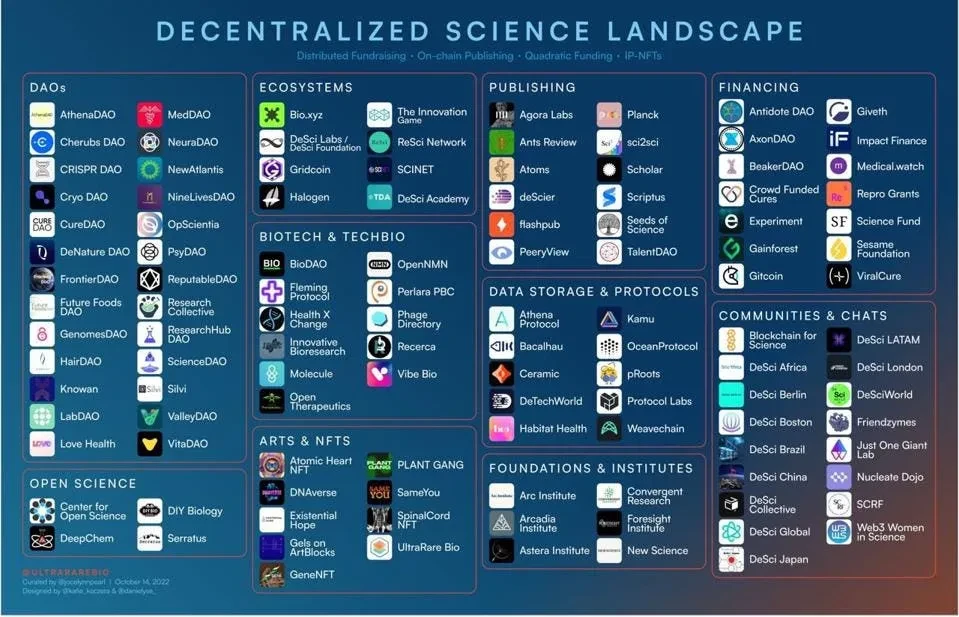

Blockchain and Web3 technologies introduce new paradigms for resource allocation and community engagement. Platforms like Bio Protocol (not a scientific journal, but a new web3 platform) leverage decentralized finance (DeFi) principles to create novel financing ecosystems. Here are some key elements:

Token-based Incentives: Participants can stake tokens (e.g., BIO) to fund specific research programs and receive rewards based on project outcomes.

Community Governance: Decentralized Autonomous Organizations (DAOs) do not solely rely on centralized entities, allowing stakeholders to vote on funding decisions.

Transparency and Security: The immutable ledger of blockchain ensures transparency and security of fund flows and research milestones.

Incentivizing Participation: By holding and staking BIO tokens, community members can participate in funding groundbreaking research and share in potential returns.

Collaboration with Institutions: BIO facilitates collaborations with research institutions, enabling labs to access decentralized funding without traditional bureaucratic barriers.

Excerpt from John Cumbers' column in Forbes

This approach not only democratizes funding but also aligns the interests of researchers, funders, and the broader community.

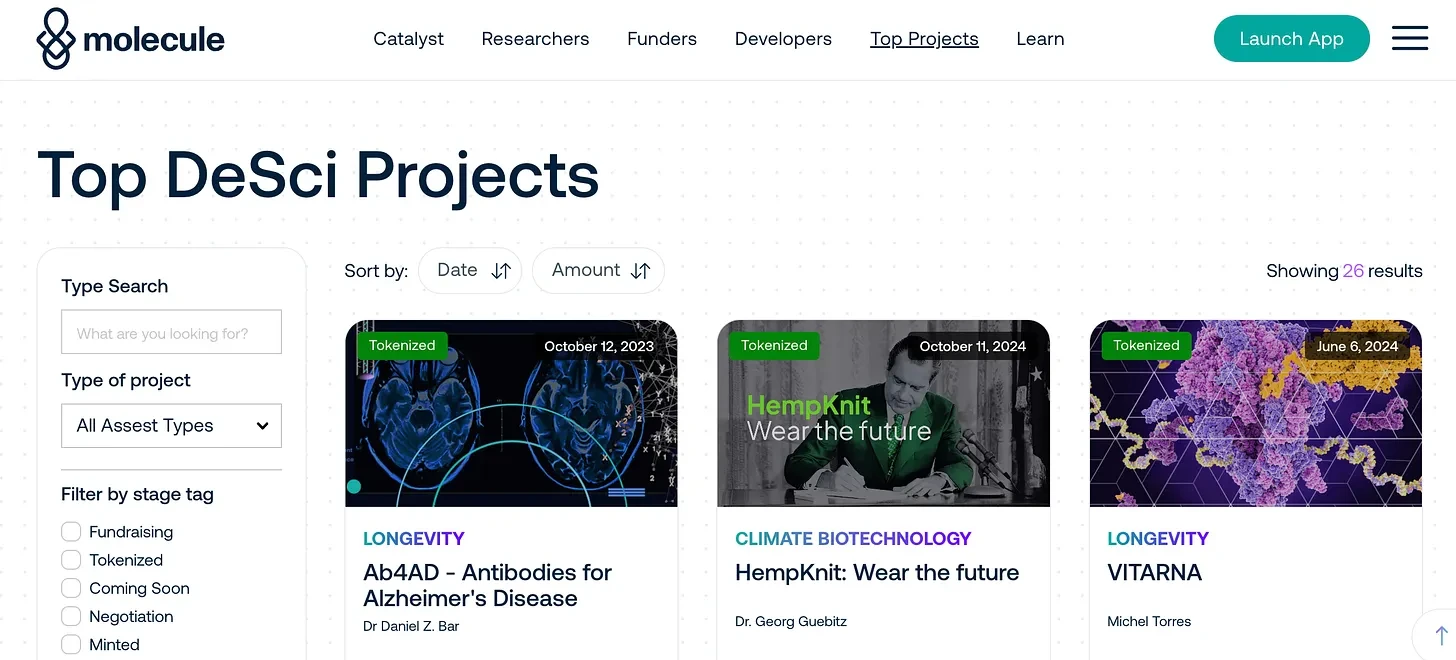

For example, early innovators in the decentralized science (DeSci) space, Molecule, have demonstrated how blockchain-based models can fund scientific projects. Their collaborations with researchers in fields like neurodegenerative diseases and synthetic biology have facilitated multiple funding projects that would have been difficult to support through traditional financing channels.

I know, this statement may not sound very serious or scientific at first glance. After all, cryptocurrency once had a notorious reputation.

Nevertheless, it may still have potential. The timing could be right. Cryptocurrency has evolved into a sufficiently large financial ecosystem, and it is currently on the rise; meanwhile, the biotechnology market is at a relatively low level globally, so people may be more open now.

This could at least provide some alternative liquidity for early innovations in biotechnology. In my view, the early stage is actually the most challenging time for any innovative drug asset. For example, if you don't have an ambitious idea focused on brain-computer interfaces, or something like our bio supercomputing, convincing traditional venture capital firms to invest enough funding may be more difficult than for traditional therapeutic biotech companies. And today, starting such a moonshot biotech company is still nearly impossible.

As long as you pass a key milestone and gain traction, considering how profitable biology can be historically, I believe there will be traditional venture capital and stock markets to take over later-stage funding.

This will also enable individual investors to participate in biotechnology innovation and potentially benefit early on. I mean, many publicly listed biotech companies are still in R&D. In principle, if they can be publicly traded, why can't any biotech company?

Before Robert Swanson, no one had a clear idea of how to commercialize genetic engineering. The model established today was also a crazy idea at the time. So why not use cryptocurrency?

Further Understanding Some Projects

At Molecule, we can see how it funds future life science projects. Here you will find some projects that are very serious, just like those you see in research funding applications.

Here are some notable examples that I personally like:

Ab4AD: Dr. Daniel Z. Bar from Tel Aviv University is developing antibodies for Alzheimer's disease. I would say this is a fairly mainstream research area, with the U.S. having approved two antibodies for early Alzheimer's patients targeting β-amyloid, and we certainly need more antibodies for treatment and diagnosis.

HempKnit: ValleyDAO and Georg Guebitz from the Austrian Center for Industrial Biotechnology are developing fibers that may last longer than existing fabrics made from industrial hemp. Like bamboo, hemp is one of the fastest-growing plants on Earth and one of the earliest plants used for fiber. With today's plant biology and synthetic biology technologies, hemp deserves a re-examination.

Cross-Fidelity Protein Stability Enhancement: Dr. Dimitri Scherbakov from the University of Zurich is developing drugs to prevent neurodegenerative diseases by improving the accuracy of protein synthesis, thereby reducing the formation of harmful protein aggregates.

I believe these are all very promising scientific projects that, if successful, will have a huge impact. Some might argue that some longevity companies backed by billionaires, venture capitalists, or Hollywood are more about hype than science.

Concerns About DeSci, Representing My Personal Views

While the prospects for decentralized financing are broad, there are still several key aspects worth discussing to maintain a balanced perspective.

Blockchain, web3, and cryptocurrency have clearly become an industry, just like all other industries, creating jargon and common patterns to facilitate internal efficiency, but also setting barriers to entry. While I have always been interested in its technology and even hold some investments myself, when I attended the 2023 Blockchain Meets Biology event, many things were still difficult for me to understand. I bet the reverse is also true; biotechnology will only have more jargon.

Secondly, will these efforts refocus on those common themes like drugs, climate change, etc.? After all, these themes are easier to understand, but at the same time, they limit imagination, and DeSci may not be much better than traditional models. In my view, the DeSci community should break out of conventional thinking patterns and not just fund another drug development.

Finally, I have heard a lot of discussions about IP innovation. Navigating the regulatory environment is crucial for ensuring compliance and avoiding legal hurdles. Therefore, is there a need for innovation here, or might compatibility be better?

Just a thought. Creating hybrid models (including new systems and existing systems) could help mitigate these risks: combining cryptocurrency and fiat currency, cloud labs and CROs, tokenization and traditional patents, etc.

Let’s Explore the Possibilities

For biotech founders, life science researchers, and Web3 enthusiasts, this is a key moment to rethink funding models for the future of life sciences.

The Bio Century has passed its lag phase and is now entering its exponential phase in the second quarter! The next wave of biotech innovation is forming. The question is: will you be a part of it?

Note: Guo Haotian is the founder and CEO of Ailurus Bio. Ailurus is a pioneering biocomputing company that programs biology into living intelligent devices, with products like PandaPure® that simplify protein expression and purification directly in cells. We envision a future where we can program reality through programming biology. Therefore, our mission is to make biology a universal technology—easy to use like modern computers—and to popularize it for the benefit of all humanity. For more information, please visit https://www.ailurus.bio

Disclaimer: Ailurus Bio and I currently have no affiliation with Bio Protocol or any other decentralized science (DeSci) projects. This article reflects an independent analysis of the trends and opportunities in decentralized financing models.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。