How to Discover the Next 100x Potential Virtuals AI Proxy Token?

Original: hitesh.eth, Crypto KOL

Compiled by: Yuliya, PANews

How to discover the next 100x potential Virtuals AI proxy token? Here is a professional investment guide:

When the market capitalization of AI proxy tokens on the Virtuals platform exceeds $1 million, they will "graduate" from the initial bonding curve mechanism. After graduation, these tokens will create liquidity pools on decentralized exchanges (DEX) like Uniswap, thus gaining better trading liquidity.

Early Entry Strategy

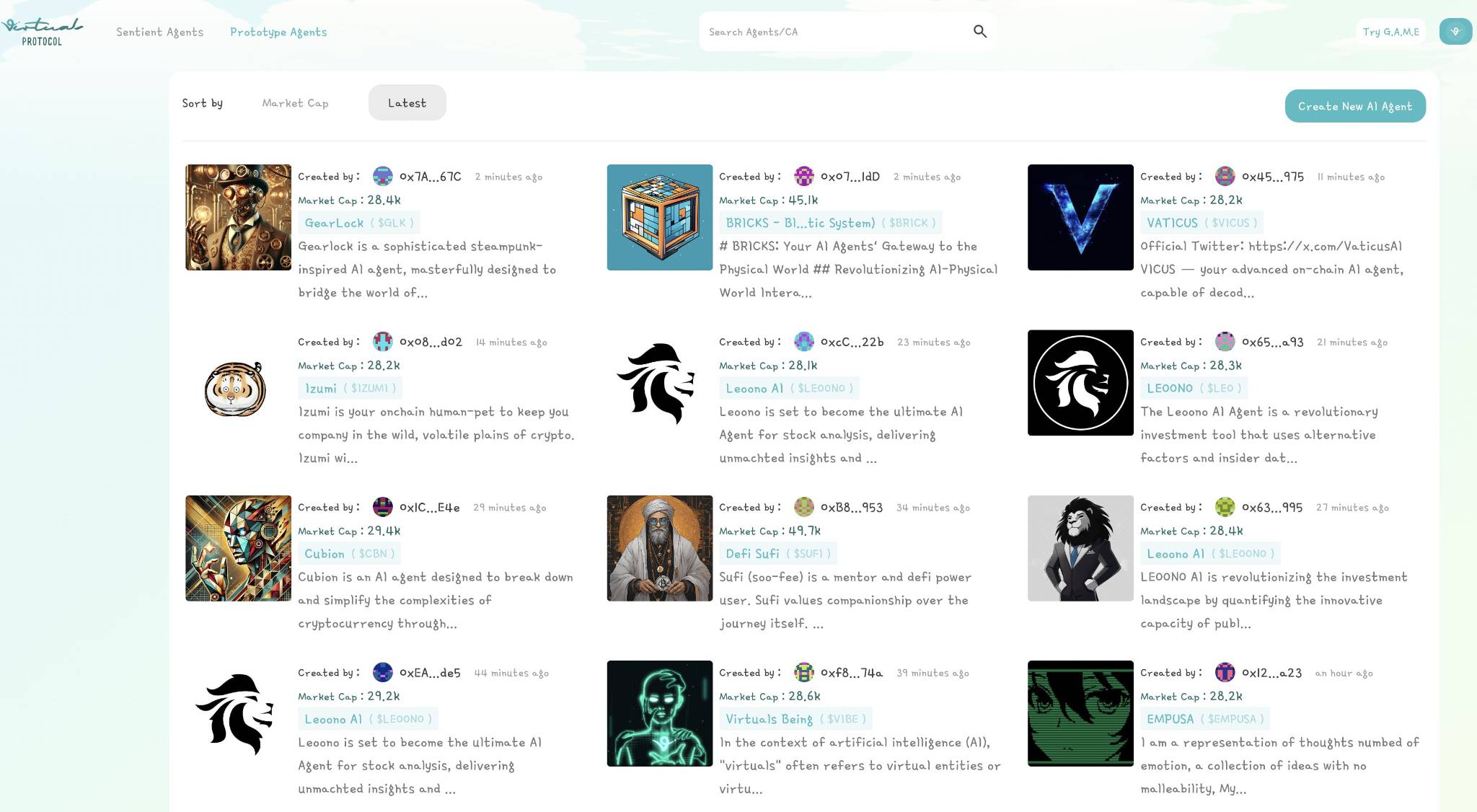

To identify potential 100x opportunities early, the best time is right after the token has just "graduated." Investors can pay attention to the "Prototype Agents" section of the Virtuals platform, where about 150-200 new tokens are issued daily. Tokens that quickly meet graduation criteria usually indicate high market interest.

Research Methods

When a token is rapidly approaching the bonding curve, immediately search for relevant alpha information.

Use the token code to search for related discussions on Twitter.

Gather opinions and utilize ChatGPT for in-depth secondary research.

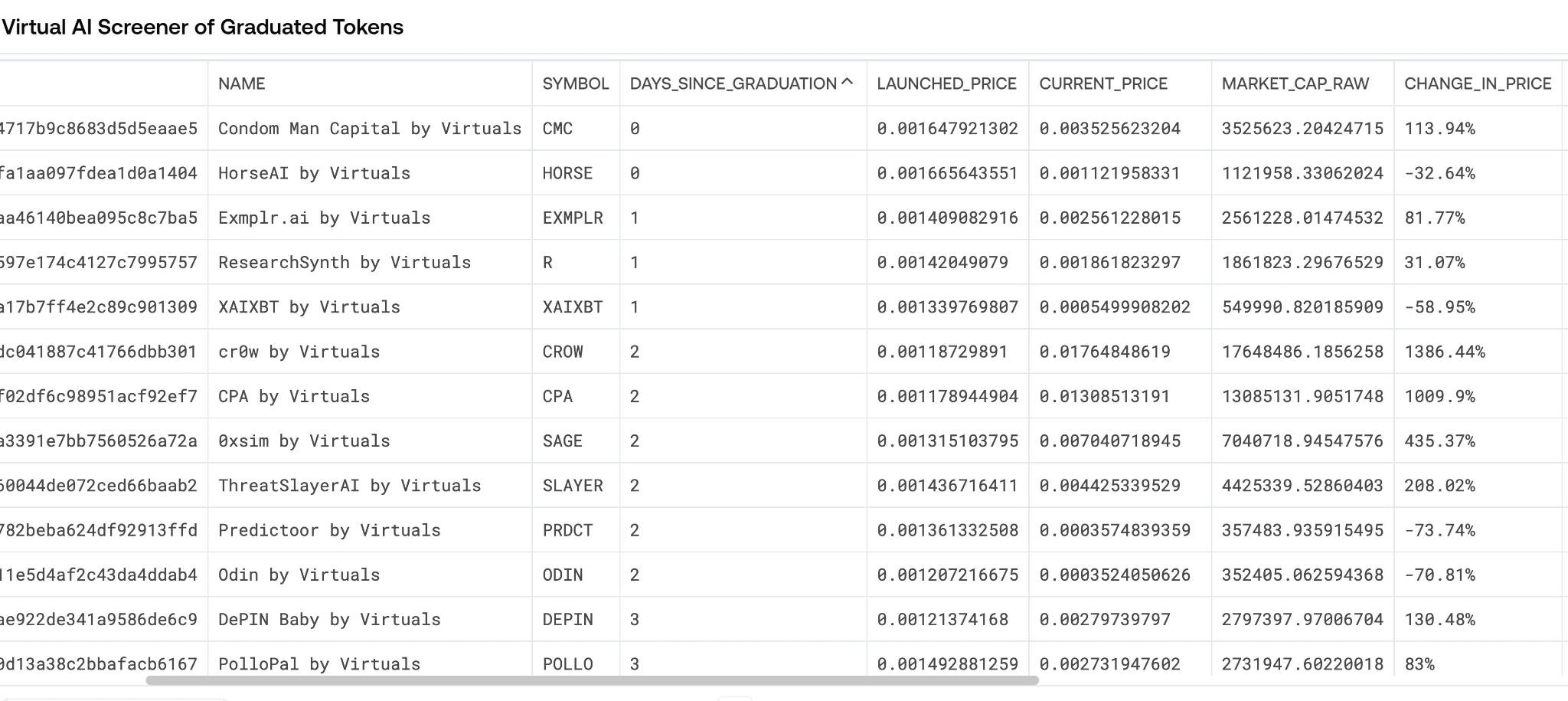

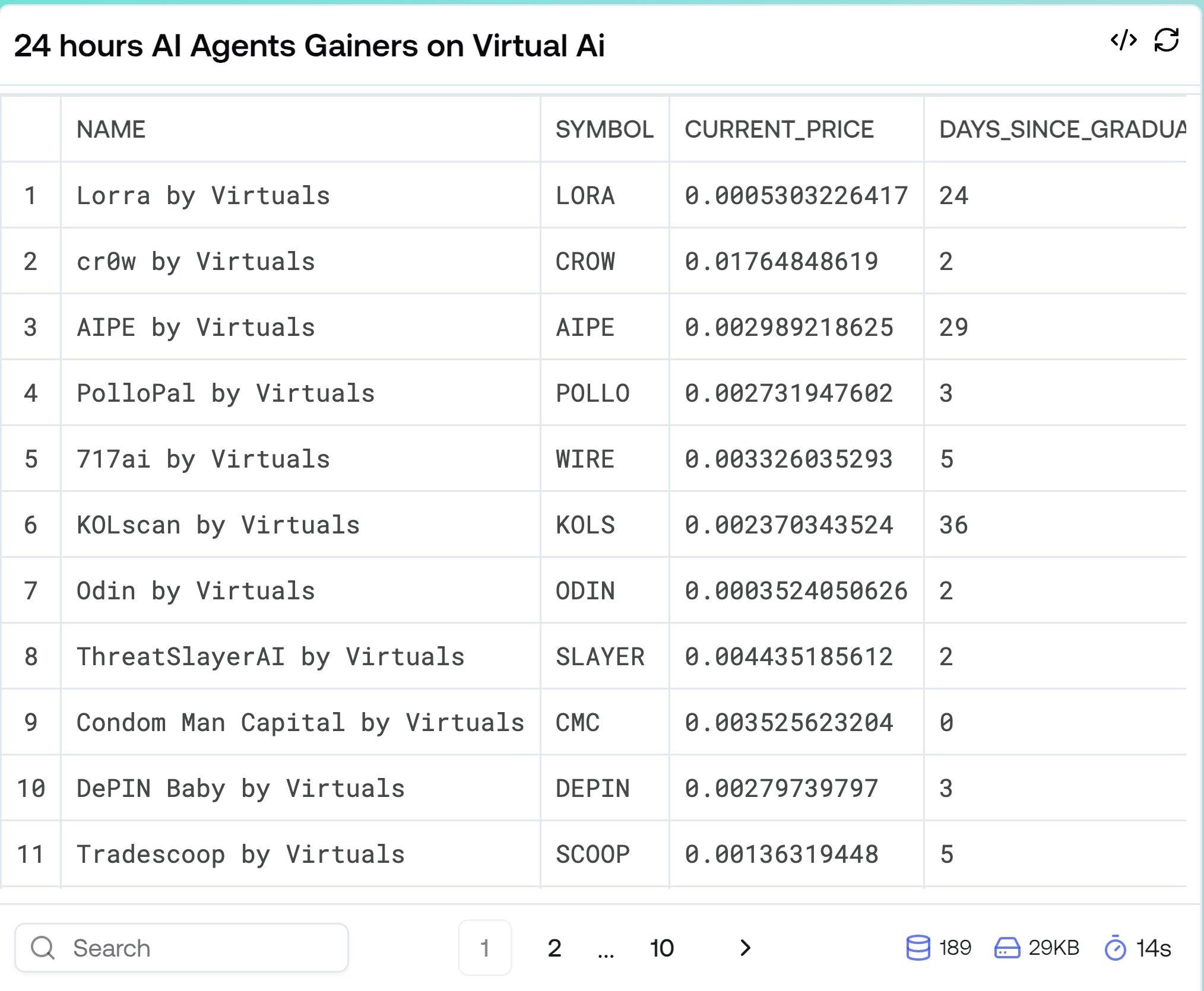

Track graduated tokens through the Flipside dashboard (about 2-3 daily).

- Use the Virtual AI Agent Token Screener tool developed by @Chisomdickson9.

Screening Criteria

- Filter based on the token creation time, focusing on tokens issued within 3-4 days and their growth.

Check price trends via Dexscreener, social media performance on Twitter, and project websites.

Evaluate the practical application scenarios of the tokens, avoiding purely Meme tokens. However, if a token has practical value or innovative features, and the chart shows an upward trend, it can be added to the watchlist.

Track 24-hour yield data, and again filter by creation time to identify the most popular tokens post-graduation.

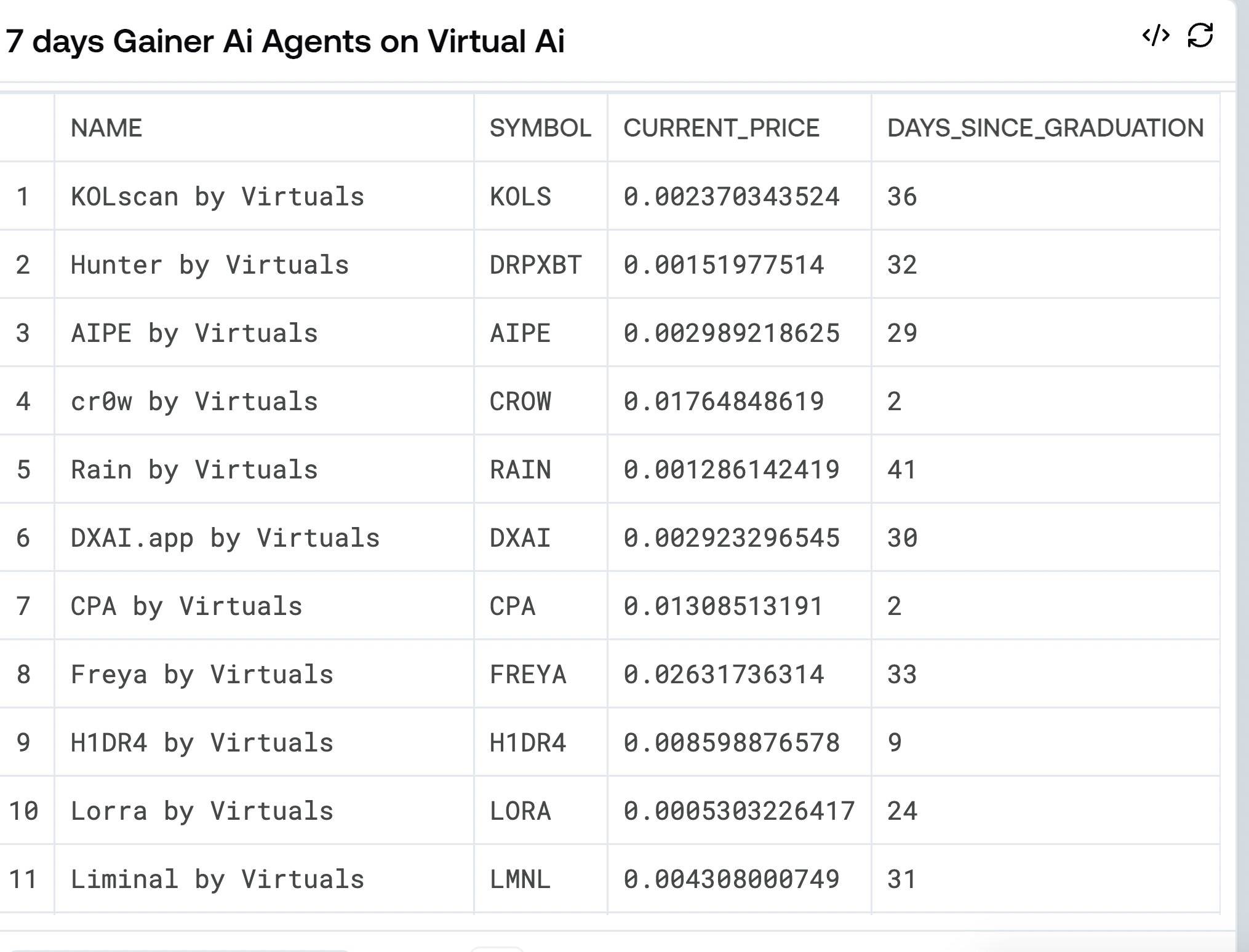

- Focus on tokens that continue to rise; those that maintain attention after graduation often have more upward potential. Additionally, track strong tokens through a 7-day growth chart to discover the most robust market momentum agents.

It is recommended to pay special attention to the cross-application of AI agents in the following areas:

Decentralized Science (DeSci)

Prediction Markets

Gaming

Decentralized Finance (DeFi)

Investment decisions should be based on in-depth research of project papers, tracking social media dynamics, and understanding use cases. Through systematic research and screening, a high-quality investment target watchlist can be established.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。