This article is from: Thor Hartvigsen

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Azuma (@azuma_eth)

Background

Since the launch of HYPE, Hyperliquid has seen a significant increase in trading volume and revenue.

HYPE officially went live on November 29, with an opening price of around $2, and experienced a substantial rise in December, only recently pulling back (down about 34% from its historical peak).

What are the next steps for HYPE and Hyperliquid?

This article will delve into the fundamentals of Hyperliquid and HYPE, explore the bullish expectations for HYPE, and analyze potential valuations in conjunction with the trading volume and revenue growth trends for 2025.

Trading Volume Data

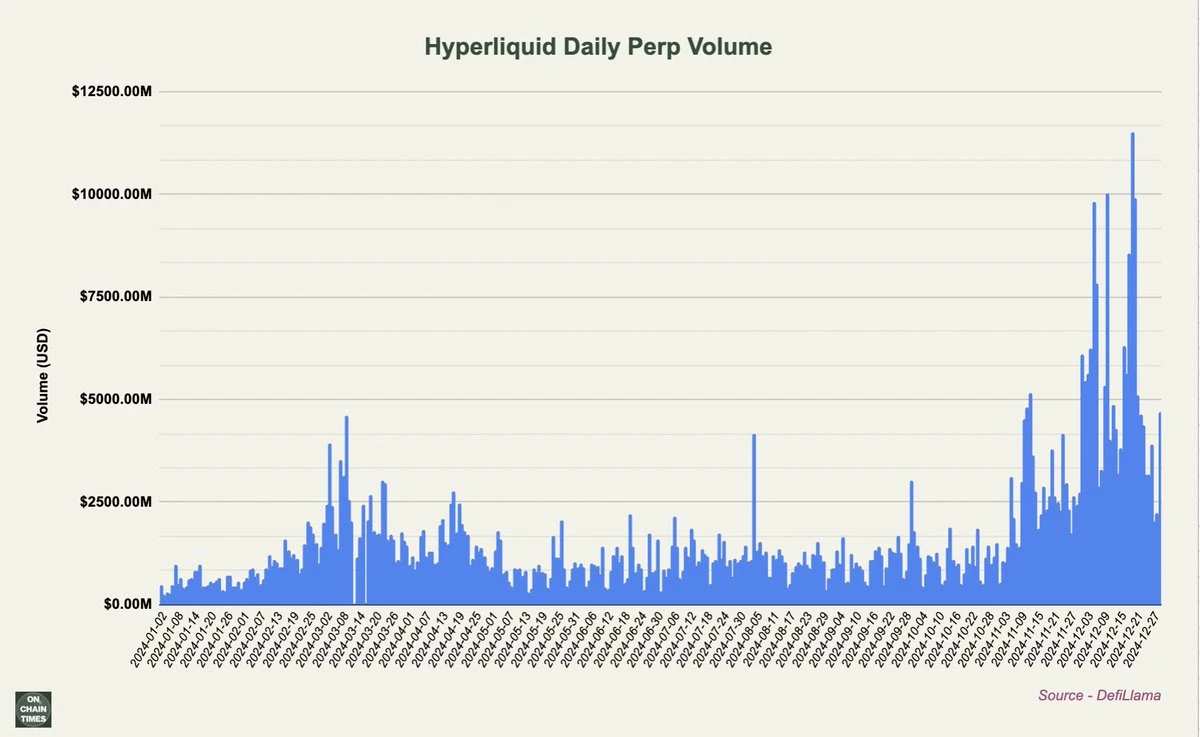

While some expected that trading volume on Hyperliquid would decline after the HYPE airdrop (as has happened historically with other derivative exchanges), the opposite has proven true. Since then, Hyperliquid's trading volume has surged, repeatedly setting new daily trading volume highs exceeding $10 billion.

The HYPE airdrop accounted for 31% of the total supply. An additional 42.81% of the supply is expected to be available for future distribution and community rewards. While it is anticipated that a portion of the remaining share will be used for staking incentives and HyperEVM Layer1 ecosystem incentives, the possibility of future traders and HYPE holders receiving some form of reward again, unbeknownst to them, is not zero.

At a price of $25, 42.81% of the HYPE supply equates to approximately $11 billion.

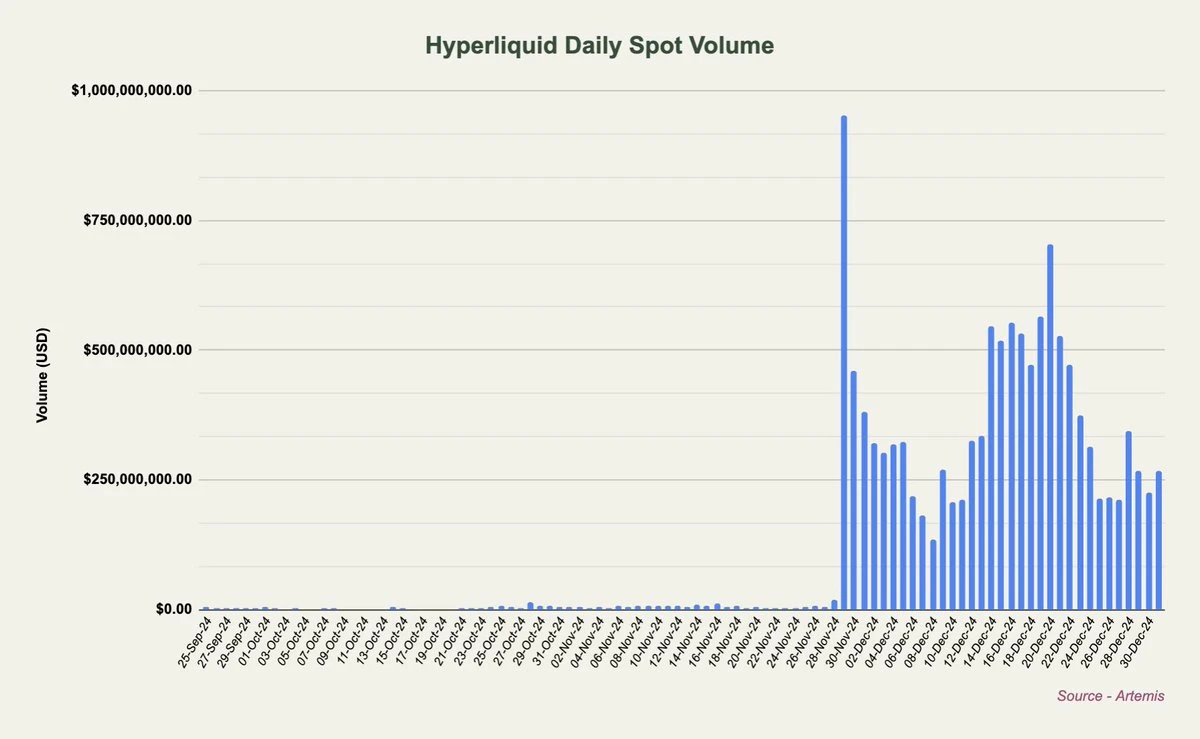

Since the launch of HYPE, Hyperliquid's spot trading volume has also significantly increased, with most trading days seeing volumes of $250 million to $500 million.

Hyperliquid vs CEX

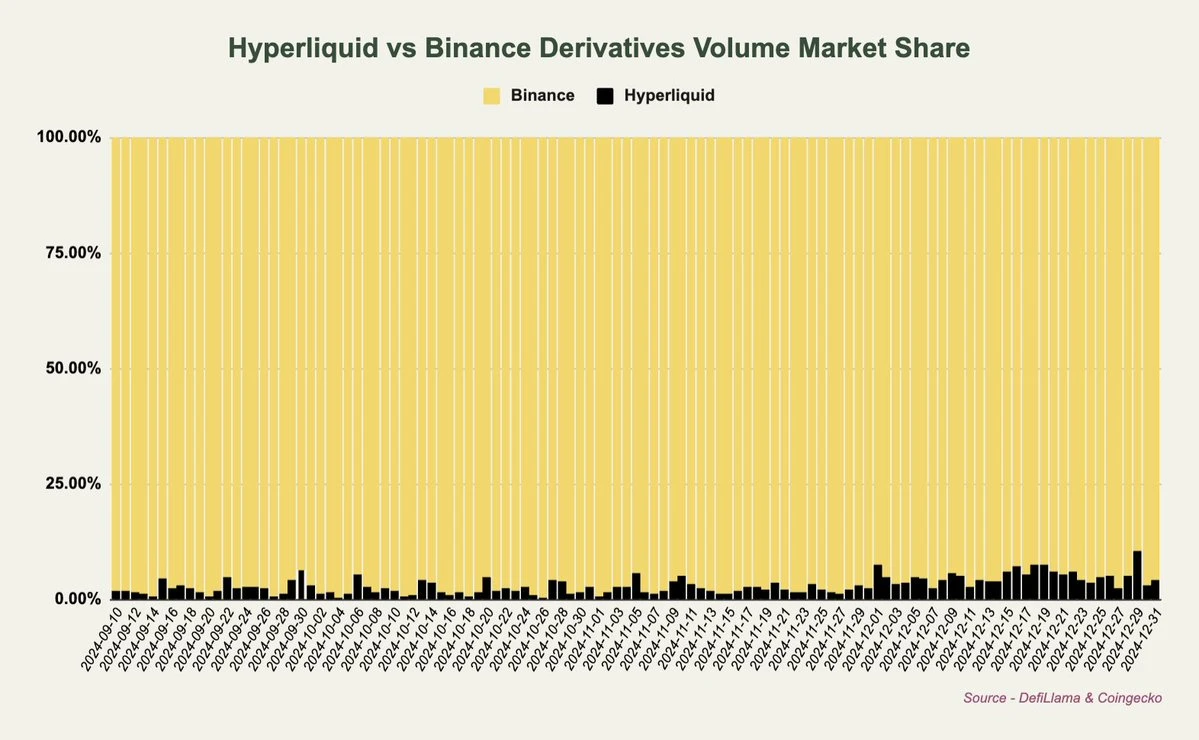

I have been tracking the trading volume comparison between Hyperliquid and centralized exchanges (CEX) like Binance for a long time.

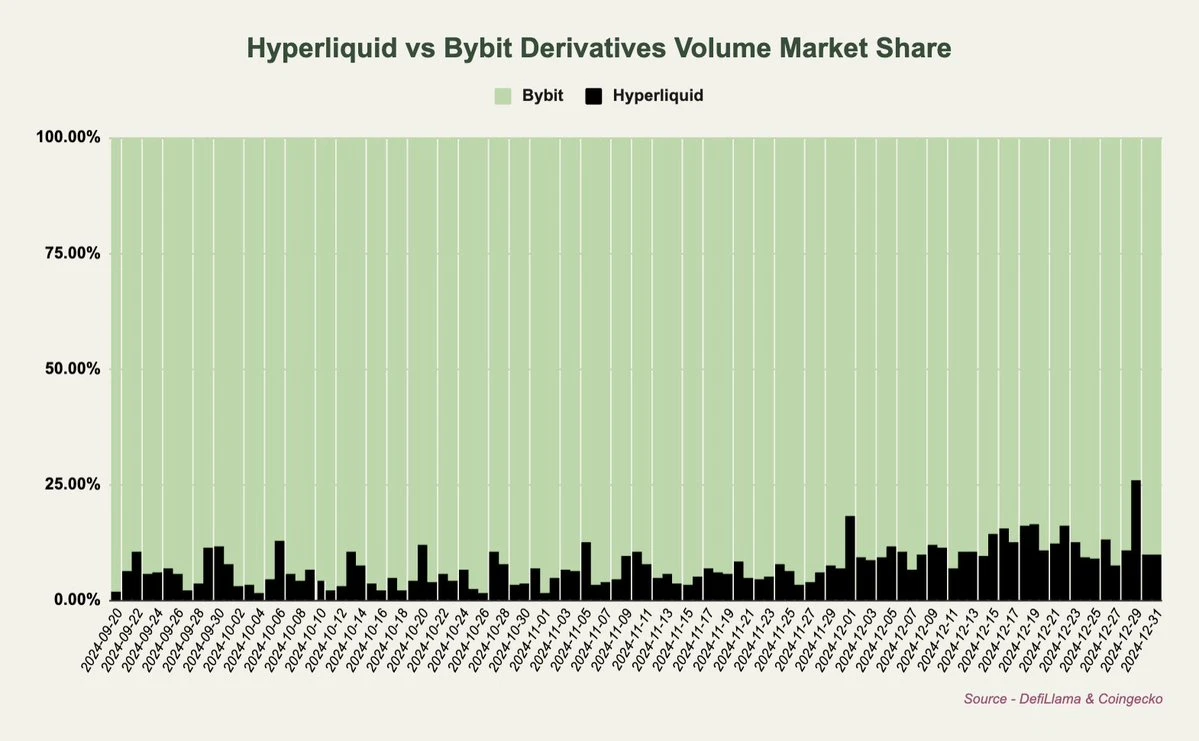

Over time, more users and trading volume have begun to shift on-chain, and the bullish expectations for Hyperliquid involve market share growth. Compared to Binance, Hyperliquid clearly has a long way to go. However, as shown in the chart below, Hyperliquid's market share has shown a noticeable upward trend in December. Over the past two weeks, Hyperliquid's relative market share has been around 5-8%.

According to Coingecko data, Binance's recent daily derivatives trading volume has ranged from $60 billion to $150 billion. However, these trading volume figures cannot be verified from the CEX side, so they should be taken with caution.

Relative to Bybit, Hyperliquid's market share recently reached as high as 25% of the latter (peak data).

Fees and Revenue

Derivative Trading

The fees on Hyperliquid are paid by trading users on the platform. Compared to other exchanges like Binance, Hyperliquid's fees are lower, aimed at incentivizing more trading activity. For perpetual contract trading, the fees for market orders are 0.035%, and for limit orders, the fees are 0.01%. The larger the trading volume, the lower the fees.

These fees are collected by the HLP market making vault, insurance fund, assistance fund (mainly responsible for buybacks), and some other miscellaneous addresses on Hyperliquid. The Hyperliquid team has not disclosed specific information on the distribution of platform trading fees, making it difficult to accurately estimate HYPE's buyback data.

Spot Trading

Users pay fees in the spot market to purchase and burn the specific tokens traded. Unsurprisingly, HYPE currently accounts for a large portion of Hyperliquid's spot trading volume. So far, HYPE's spot trading fees have exceeded 100,000 HYPE (over $2 million at current prices).

Overall, this has no substantial impact on HYPE's supply compared to the buybacks from the assistance fund (at least not yet).

Spot Auctions

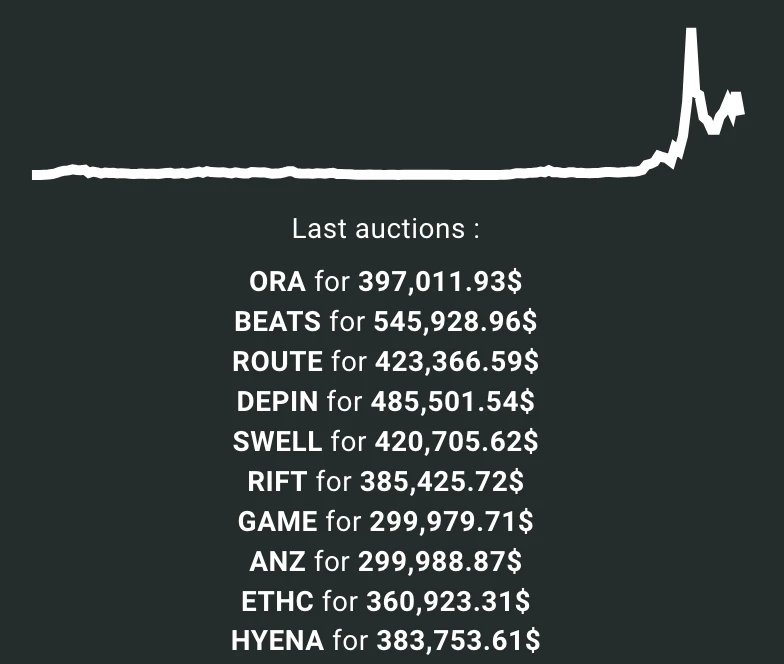

Hyperliquid has also generated considerable revenue from spot auctions. Assuming each auction is $500,000, Hyperliquid could generate an additional $141.29 million in revenue annually.

Assistance Fund and HYPE Buybacks

While the details of revenue distribution from spot auctions and derivative trading remain unclear, we can gauge daily HYPE buyback data through the assistance fund.

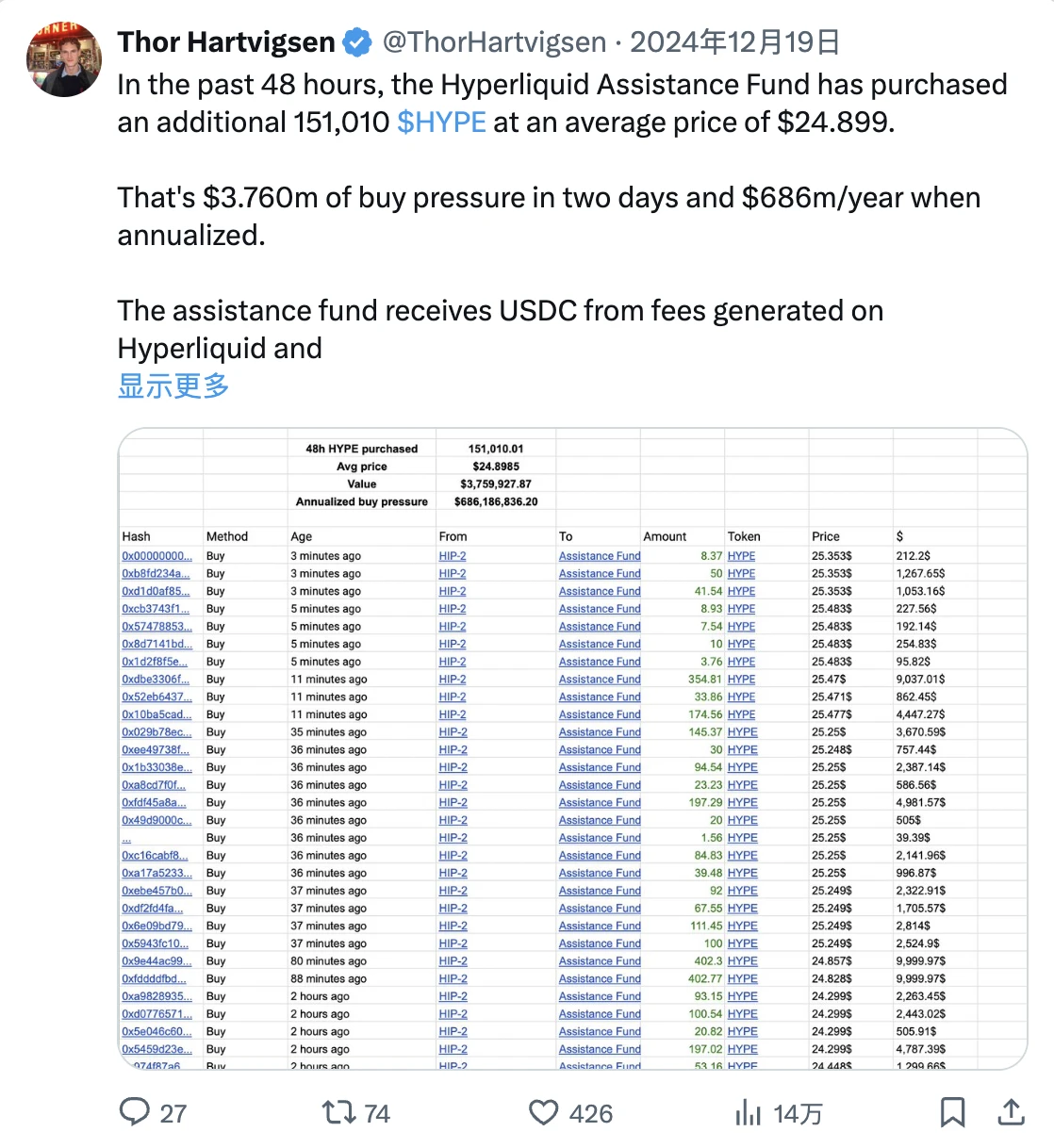

Two weeks ago, I published an analysis on X regarding the HYPE buyback situation from the assistance fund over a 48-hour period. During that time, approximately 151,000 HYPE were bought back, equivalent to an annual buyback strength of about $686 million.

During those two days, Hyperliquid's average daily trading volume reached $8 billion.

Valuation Framework

Entering 2025, the bullish expectations for HYPE are a bet on the continued growth of Hyperliquid's trading volume and the ongoing demand for spot auctions, as this will lead to increased revenue for Hyperliquid, thereby amplifying HYPE's buyback strength.

One key reason for the continuous growth in Hyperliquid's trading volume is that there are still billions of dollars available for future rewards, making Hyperliquid a very profitable trading venue. Other potential catalysts include the listing of spot markets on CEX and the launch of HyperEVM.

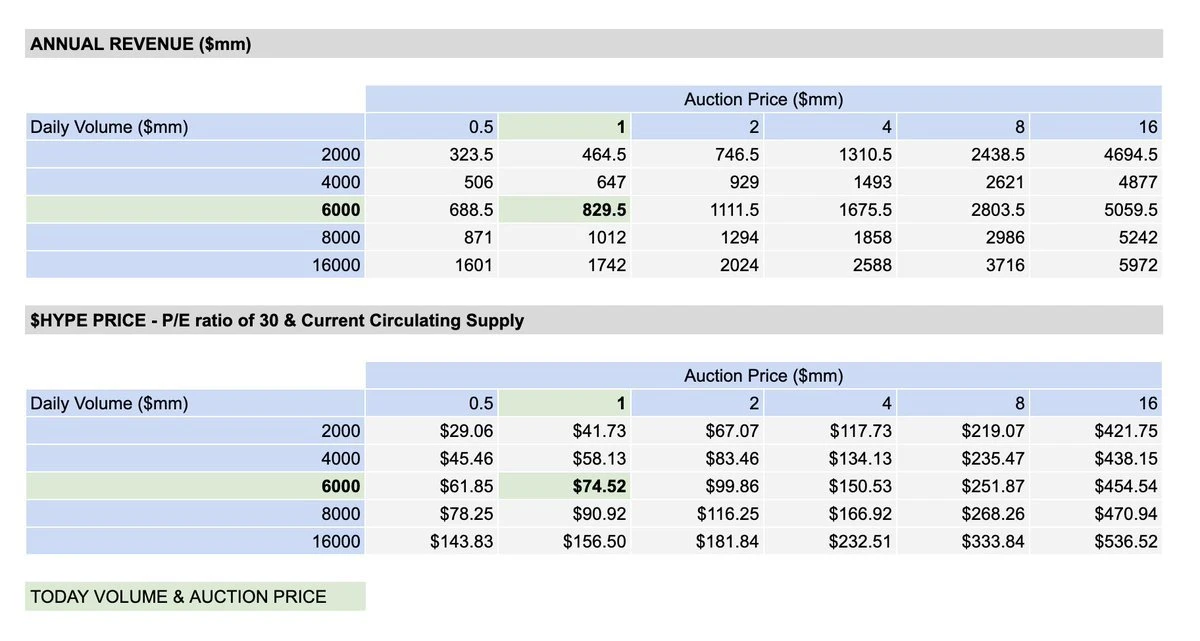

@fmoulin7 has done a great analysis of HYPE's potential valuation, assuming a price-to-earnings (P/E) ratio of 30, with corresponding HYPE price expectations under different scales of contract trading fee income and auction revenue.

Odaily Note: For further reading, see “In-depth Analysis of Hyperliquid: Potential Market Opportunities and the Bullish Logic of HYPE”.

Hyperliquid's average daily trading volume over the past 14 days has been approximately $4.89 billion, with auction prices around $500,000.

In light of this, we have derived an expected annual revenue for Hyperliquid of $587.5 million, assuming a P/E ratio of 30, which implies that HYPE could reach $52.78. Please note that this calculation is based on circulating market capitalization rather than FDV, as future unlocks are mostly related to community incentives rather than internal group unlocks.

Additionally, it is worth noting that to date, nearly all of this revenue will be used for HYPE buybacks; an increasing amount of HYPE has been staked (currently about 25%), effectively reducing the liquid supply.

In summary, if you believe that Hyperliquid's trading volume and adoption will continue to grow, there are many reasons to be bullish on HYPE over a longer time horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。