Author: Pzai, Foresight News

As a company with a core strategy centered around Bitcoin reserves, MicroStrategy (MSTR) has garnered significant attention from U.S. stock investors in recent years due to its steadfast support for Bitcoin, combined with the fervent market environment surrounding the cryptocurrency.

However, since reaching an all-time high of $589 on November 21, MSTR's stock price has fallen over 44% to $300, with its market capitalization dropping by 34% in just the past two weeks. As a standout cryptocurrency asset in the U.S. stock market, subtle changes in the market environment have led to dramatic fluctuations in its stock price. Ultimately, can the narrative of the "crypto Federal Reserve" continue to maintain its former glory?

Decline from Peak

Due to its business model, MicroStrategy's stock price is highly correlated with Bitcoin prices. In December 2024, Bitcoin's price fell approximately 10% from a high of $108,000 to around $97,000. This pullback directly impacted the value of MicroStrategy's balance sheet, dragging down its stock performance. For a long time, MicroStrategy's stock price has traded at a premium relative to its Bitcoin holdings. In November 2024, this premium reached as high as 3.5 times, but by early 2025, it had shrunk to 1.6 times. The contraction of the premium indicates that investor confidence in its "leveraged Bitcoin investment" narrative is waning.

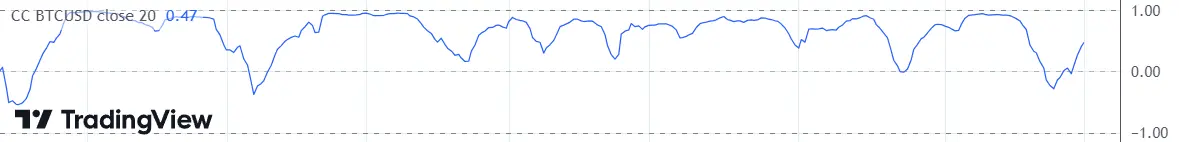

Correlation of MSTR stock price with Bitcoin trends (anchored to Binance BTCUSD pair)

As of December 2024, MicroStrategy holds approximately 446,000 Bitcoins, valued at around $43 billion, making it the largest corporate holder of Bitcoin globally. This massive holding positions it significantly in the cryptocurrency market, and it was included in the Nasdaq index that same month, becoming one of the few crypto assets listed.

However, outside of MSTR, global corporations remain relatively cautious about Bitcoin as an emerging asset. Although the potential returns and diversification benefits of Bitcoin have attracted some corporate interest, its high volatility, regulatory uncertainties, and compatibility issues with traditional corporate financial strategies have led most companies to adopt a wait-and-see approach or to experiment only to a limited extent. For example, Microsoft shareholders voted down a Bitcoin investment proposal in December 2024, primarily due to Bitcoin's high volatility conflicting with the company's pursuit of stable investments. Markus Thielen, founder of 10x Research, stated in a report to clients: "As MicroStrategy's stock price has fallen 44% from its peak, while other companies are adopting Bitcoin as a reserve asset strategy on a smaller scale, the narrative of traditional companies flooding into Bitcoin seems to be losing momentum."

Pressure on Leverage Strategy

MicroStrategy has financed its continued Bitcoin purchases through issuing stocks and convertible bonds. This strategy was seen as a "flywheel converting fiat currency into Bitcoin" during the Bitcoin bull market, attracting a large number of investors. The company's founder and CEO, Michael Saylor, has repeatedly stated that Bitcoin is "digital gold" and the best tool for hedging against inflation. He has also been actively lobbying U.S. corporations and the government to embrace Bitcoin.

However, because MicroStrategy's business model is highly dependent on Bitcoin prices, any fluctuations in Bitcoin prices significantly impact its stock price. After Bitcoin reached an all-time high, some investors chose to take profits, putting pressure on MicroStrategy's stock price. On the policy front, related assets also faced certain headwinds. The Federal Reserve signaled a hawkish stance during its December 2024 meeting, suggesting potential further interest rate hikes to curb inflation. This policy shift dampened the attractiveness of related assets, and MicroStrategy, as a leveraged Bitcoin investment tool, was particularly affected.

MicroStrategy's leveraged strategy amplified gains during upward trends but also increased risks during downturns. Concerns about its debt burden and refinancing capabilities have intensified, especially in the context of falling Bitcoin prices, which could place greater financial pressure on the company. Against the backdrop of Bitcoin price corrections and weakening market sentiment, MicroStrategy's narrative is indeed facing challenges in the short term. Investor concerns about its high premium and leverage risks have led to a significant stock price decline.

Outlook

It is evident that MicroStrategy's stock performance will continue to be highly dependent on Bitcoin prices. Its status as the "crypto Federal Reserve" is challenged in the short term due to Bitcoin price corrections and shifts in market sentiment, but its long-term potential still hinges on Bitcoin's price trajectory and the company's capital management capabilities. If Bitcoin prices return to an upward trend, MicroStrategy's narrative may regain support. Especially with the expectation that Bitcoin will be widely accepted as a store of value during Trump's term, its ongoing strategy of accumulating Bitcoin may still attract investors in the long run.

As investors' valuations of MicroStrategy become more rational, its stock price's deleveraging may bring it closer to the value of its Bitcoin holdings rather than maintaining a high premium. This rationalization process may lead to further adjustments in stock prices but also provide better entry opportunities for long-term investors.

Moreover, the new accounting rules effective in 2025 will allow MicroStrategy to report the value of its Bitcoin holdings at fair value, which could significantly enhance its net income and attract more institutional investors, potentially even leading to inclusion in the S&P 500 index (though this possibility is relatively low). Although MicroStrategy's stock performance may continue to face pressure in the short term, its solid position as the largest corporate holder of Bitcoin still holds strategic significance in the market.

As of the time of publication, MSTR's stock price is $300.01. As the Bitcoin market gradually warms up, market sentiment is also expected to reflect in its price. If the Bitcoin market returns to an upward trend, MicroStrategy may once again become a focal point for investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。