In the past few days, the BTC price has been constrained by 96,000, briefly retracing to the 92,000 support level. Meanwhile, the long-short position ratio has been high, peaking at 2.45, indicating a relatively strong market risk aversion. Additionally, due to the New Year's holiday, stock markets in many regions/countries are closed, leading to relatively insufficient liquidity in the crypto market. Currently, the market needs news to stimulate it, with the main events being the MicroStrategy's increased holdings announcement on Monday night and the non-farm payroll data on Friday night.

According to AICoin (aicoin.com) data, the current Fear & Greed Index is approaching the extreme greed level at 74, but Coinbase BTC continues to show a negative premium. The main players in the US market have not yet made a move. However, as the days until Trump’s presidency draw closer, it is likely that there will be another wave of speculation, making the next two weeks very important.

Key data to pay attention to:

1. Coinbase BTC Premium

As of the time of writing, it remains a negative premium but has reached a near one-week high. If it returns to a positive premium, it indicates that demand in the US market is starting to increase, leading to main player purchases, which would make BTC's rise more stable.

2. CME Gaps

Pay attention to Monday's gap: upward gap, bullish; downward gap, bearish. However, gaps are not always fully filled, and mainly serve as support and resistance references.

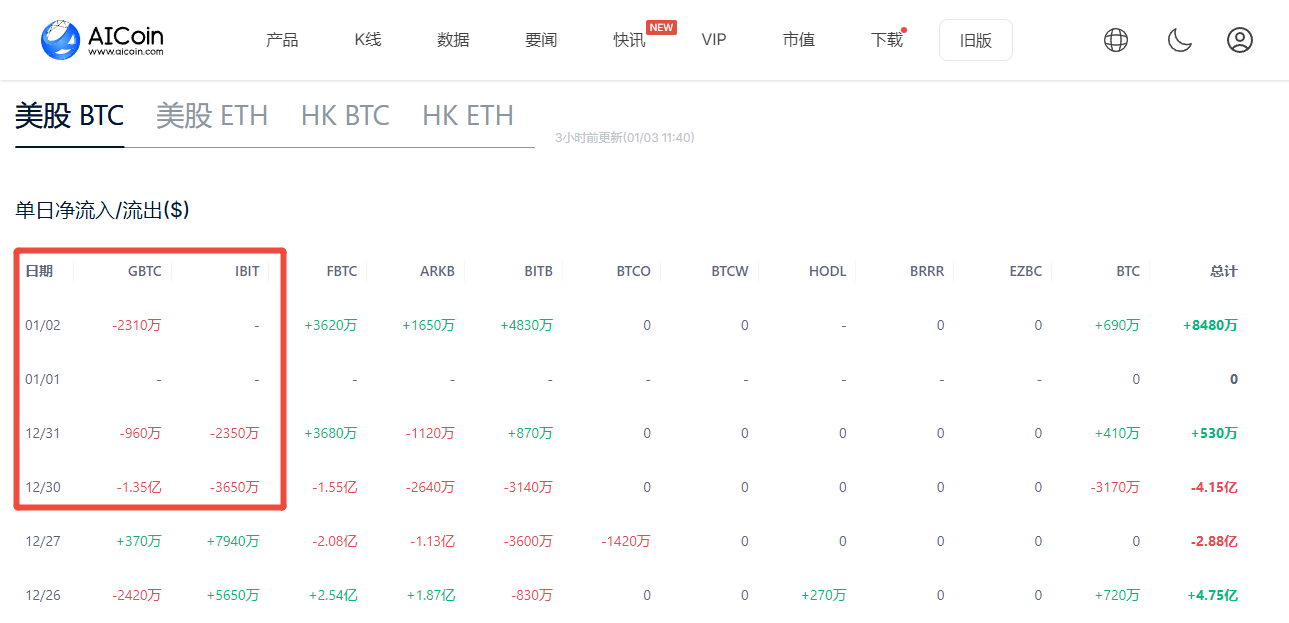

3. ETF Data

The total asset size of the US Bitcoin spot ETF has reached 110 billion USD, with net inflows nearing 35 billion USD. However, the previous major inflow, IBIT, has seen an outflow of 393 million USD in the last three trading days. Meanwhile, Grayscale continues to sell GBTC, and the inflow amounts of other ETF funds have significantly shrunk compared to October and November. If purchasing power recovers subsequently, it can be seen as a signal of increased confidence among US institutions.

The relationship between US spot BTC ETF fund flows and Bitcoin: net inflow, bullish; net outflow, bearish.

ETF data tracking: https://www.aicoin.com/zh-Hans/web3-etf/us-btc?lang=cn

4. ETH/BTC Exchange Rate

Ethereum will undergo the Pectra upgrade in the first quarter of this year, and the market is sure to speculate on it. Currently, some KOLs are bullish up to 10,000 USD. Pay attention to ETH/BTC, which is forming a descending channel on the weekly level but is supported at the lower Bollinger Band, with hopes of forming a W bottom and rebounding to 0.04574. If the ETH/BTC exchange rate warms up, ETH will be strong.

The content is for sharing only and for reference, not constituting any investment advice!

If you have any questions, feel free to join the 【PRO CLUB】 group to discuss with the editor~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。