Bedrock is committed to integrating the three most promising asset classes in the blockchain field: BTC, ETH, and DePIN (IOTEX), releasing their intrinsic value through an innovative liquid staking mechanism.

Written by: Deep Tide TechFlow

Recently, the top crypto research institution Messari released the annual report "The Crypto Theses 2025," conveying a positive attitude towards Bitcoin's prospects in 2025: BTC will mature as a global asset.

BTCFi has become a hot narrative for 2025.

When discussing the current BTCFi landscape, the liquid staking mechanism aimed at providing BTC holders with more capital-efficient native yields is an important sector that cannot be overlooked.

With the recent launch of the latest BTC LRT product brBTC and the upcoming token TGE, the multi-chain, multi-asset liquid staking protocol Bedrock has further entered the public eye.

It is reported that in the latest round of financing conducted in May this year, Bedrock attracted support from well-known institutions and industry leaders, including OKX Ventures, LongHash Ventures, Comma3 Ventures, and Babylon co-founder Fisher Yu.

On this important occasion, we had an in-depth conversation with Bedrock core contributor Zhuling.

In the conversation, Zhuling, who excels at unraveling complexities from a global perspective, introduced us to Bedrock's overall product planning in the BTCFi field:

uniBTC is the pioneering BTC LRT asset of the BTCFi 1.0 era based on the Babylon narrative; the uniBTC Vaults, which provide users with a simple and intuitive yield acquisition channel, represent our strategic upgrade to BTCFi 1.0; the newly launched brBTC, as a pioneering product of the BTCFi 2.0 era, reflects our deep thinking about the future of finance.

When discussing expectations for 2025, Zhuling did not hide his optimism about BTCFi:

After witnessing Bitcoin break the $100,000 mark together, we believe this is an important signal that the bull market is truly beginning. BTCFi will soon enter a new phase, which we define as BTCFi 2.0.

Regarding brBTC, Zhuling also detailed its important position in Bedrock's overall planning for BTCFi 2.0:

The core advantage of brBTC is true yield diversification. Through intelligent dynamic asset allocation strategies, it not only brings users higher quality yields but also lowers the participation threshold, helping BTCFi achieve scalable development.

Read the full article to learn more about the exciting content of the conversation.

The Acceleration of BTCFi 2.0 Arrival: The Core Advantages of Liquid Staking Leader Bedrock

TechFlow: We are pleased to have the opportunity for an in-depth exchange with you. First, could you please introduce yourself (you can share some of your past educational experiences, work/startup experiences, and how you got involved with Bedrock)?

Zhuling:

Hello everyone, I am Zhuling, a core contributor at Bedrock. I am very happy to have this opportunity for an in-depth exchange with you all.

As a technical expert with an overseas engineering background, I have deeply participated as a consulting advisor in several innovative projects for central banks and financial institutions. Driven by a strong interest in cutting-edge technology and innovative business opportunities, I joined an overseas blockchain startup team and continued to participate in the design and development of a hardcore public chain.

My first encounter with staking yields originated during the birth of the first generation of PoS public chains, where I saw a unique and innovative yield model in blockchain. The staking yield model is similar to government bonds and is the most native yield of blockchain.

In the past five years, I have been deeply involved in staking services for mainstream public chains like Ethereum, witnessing Ethereum's historic transition from PoW to PoS. I believe that in the current blockchain ecosystem, financial applications dominate, and staking yields, as pure on-chain native yields, have become a core pillar of DeFi.

Therefore, at the beginning of this year, I joined the Bedrock project as an early contributor. This project aims to integrate the three most promising asset classes in the blockchain field: Bitcoin (BTC), Ethereum (ETH), and DePIN (IOTEX), releasing their intrinsic value through an innovative liquid staking mechanism.

TechFlow: The liquid staking space is crowded, but Bedrock still stands out. Could you share some of Bedrock's impressive achievements and key data from the past?

Zhuling:

Overall, Bedrock currently has a TVL of approximately $508 million, with over 114,000 staking users. Specifically, as a multi-chain, multi-asset liquid staking protocol, Bedrock's past achievements can be organized from different ecological dimensions.

First, in the Ethereum ecosystem, Bedrock launched uniETH a year ago. As an institutional-grade liquid re-staking token based on EigenLayer, uniETH is the only protocol in ETH that supports only native ETH and implements a full-process smart contract. From the first day of its launch, uniETH supported unstaking, and all smart contracts underwent multiple security audits, aiming to help users choose the best validation nodes and obtain the best yields. Currently, the staking volume of uniETH exceeds 29,010 ETH, with nearly 10,000 staking users.

Subsequently, Bedrock launched uniIOTX, which quickly became the largest staking entry on IOTX, with a current staking volume of nearly 450 million IOTX and nearly 15,000 staking users.

This summer, Babylon's emergence allowed us to see the value of BTCFi, and the liquid staking Bitcoin uniBTC, launched in collaboration with Babylon's technology, is Bedrock's key layout for the Bitcoin ecosystem.

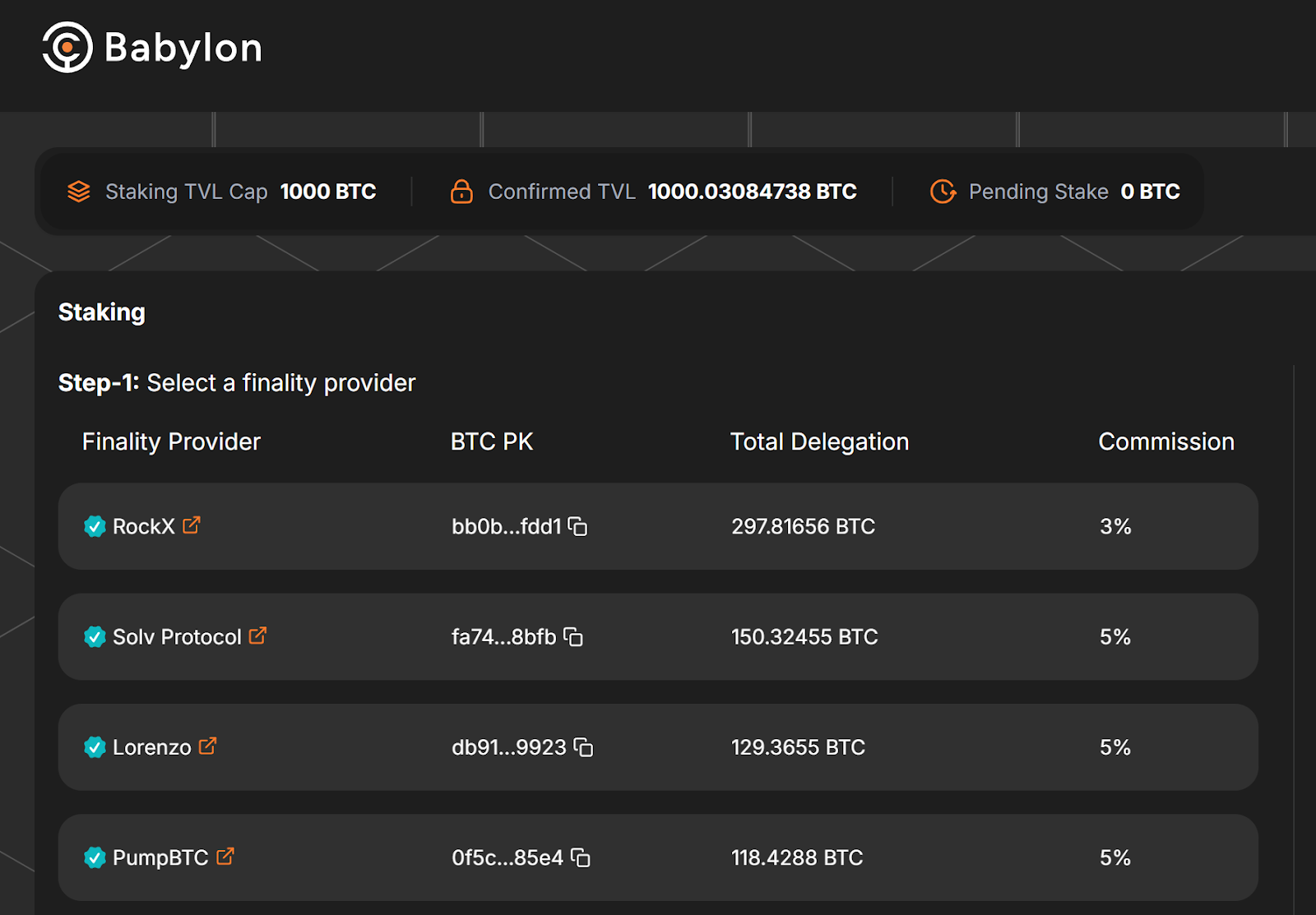

When discussing Bedrock's impressive data, the deep cooperation with the Babylon ecosystem is an unavoidable topic. Currently, Babylon staking has gone through three phases. In the Babylon Staking Cap-1 phase, Bedrock (ROCKX) emerged as a dark horse in this quota competition, staking the most BTC and accounting for nearly 30% of the total initial staking amount in Babylon.

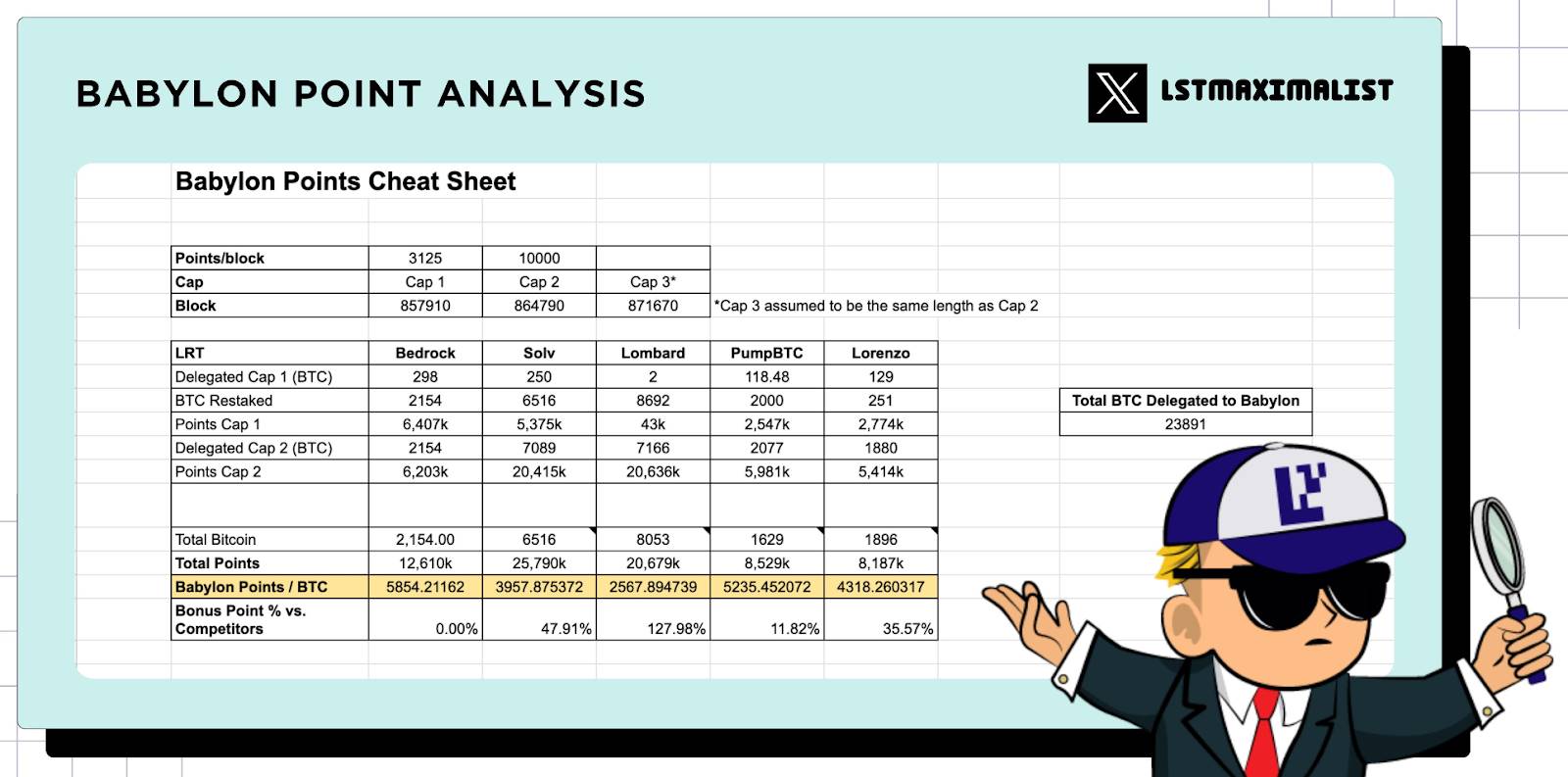

The success of Cap-1 did not stop our thinking; instead, we observed many user-level pain points, such as the severe compression of participation rewards for Babylon staking users. Therefore, in the Babylon Staking Cap-2 phase, Bedrock did a lot of work to ensure that BTC stakers received the highest Babylon points. Ultimately, we achieved very good results, with Bedrock stakers receiving and distributing a total of 5,854 Babylon points in this phase, ranking first among various Bitcoin staking protocols. This strategy, which starts from maintaining users' interests, has also received widespread positive feedback from the community.

In the recently concluded Babylon Staking Cap-3 phase, Bedrock still performed strongly in both TVL and Holder data. However, with the development of the Bitcoin ecosystem, we gradually realized that BTCFi should have more deep development possibilities beyond Babylon. With a series of market catalysts, such as Bitcoin breaking the $100,000 mark, we sense that BTCFi 2.0 is accelerating its arrival. There is still much we can do, so while participating in Cap-3 staking, Bedrock's focus has shifted more towards the new LRT product brBTC, aiming to provide BTC users with better yield strategies.

TechFlow: What unique advantages do you think Bedrock has compared to other competitors in the space that have contributed to its success?

Zhuling:

First, I believe Bedrock's biggest differentiating advantage compared to other liquid staking projects lies in its unique positioning. As an industry-leading multi-asset Restaking Protocol, Bedrock is dedicated to providing users with comprehensive staking solutions, aiming to redefine the future of digital asset staking.

Secondly, the impressive data Bedrock has achieved so far is inseparable from the resource support brought by our project background, including in-depth cooperation with ROCKX and Babylon.

As we all know, Bedrock originated from RockX. As a blockchain platform that has been deeply involved in the staking space since 2019, RockX has a total staking value of over $2 billion and more than 150,000 registered users.

As one of the first projects to enter the BTC Restaking space and a pioneer in the Babylon ecosystem, Bedrock has excellent backing and resource support. In May of this year, Bedrock received investment support from well-known institutions and industry leaders, including OKX Ventures, LongHash Ventures, Comma3 Ventures, and Babylon co-founder Fisher Yu, and subsequently reached a technical cooperation with Babylon, rapidly developing within the Babylon ecosystem.

Positioning and resource support are important, but the hard power of the product itself is also crucial. The core design philosophy of Bedrock's products is to put users first, understanding user needs to iteratively refine products, and continuously exploring product and technology development. We oppose the notion that BTCFi is solely a game for large holders; we have always been committed to bringing more users into BTCFi, promoting its widespread adoption, and providing them with more convenient access, diverse use cases, and simplified optimized yield strategies. For example, uniBTC is the BTC LRT with the most extensive and comprehensive DeFi user scenarios, supporting 13 chains and over 30 DeFi scenarios, while providing users with APY yields of up to three digits, and has also received high praise from the community in the market.

Last but very importantly, Bedrock is committed to building a complete ecosystem through a diversified product portfolio, including uniETH, uniIOTX, uniBTC, uniBTC vaults, and brBTC, continuously constructing a more open and efficient digital asset staking ecosystem, providing users with higher quality staking services and richer application scenarios.

From uniBTC to brBTC, a panoramic view of Bedrock's BTCFi planning

TechFlow: In 2023, when the narrative around the Bitcoin ecosystem was just heating up, Bedrock had already begun to focus on BTCFi. How did you and your team keenly perceive this trend? How do you personally view the current state and future prospects of BTCFi?

Zhuling:

Although the narrative around the Bitcoin ecosystem just emerged in 2023, we believe that 2024 will be the true inaugural year for BTCFi, where we will see many concepts of the Bitcoin ecosystem truly take shape, such as the Ordinal and Rune craze.

Moving into the second half of 2024, the market will witness the full bloom of BTCFi, with sub-narratives like Restaking, Lending, BTC L2, and BTC Stables all on the rise. The Babylon ecosystem will lead everyone to achieve success in the first phase of BTCFi. At this stage, I believe no one will say that Bitcoin does not need an ecosystem anymore.

We also believe that after witnessing Bitcoin break the $100,000 mark together, we see this as an important signal that the bull market is truly beginning, and BTCFi will soon enter a new phase, which we define as BTCFi 2.0.

Entering 2025, BTCFi will have even more surprising performances, and based on our observations, the trends related to BTCFi are becoming evident:

On one hand, BTC holders will have more sustainable, stable, and diverse yield strategies;

On the other hand, the entry barriers for BTCFi will be lower, with not only a simplified participation process but also greater flexibility for user participation;

Most importantly, the competition in the BTCFi space will no longer be dominated by a single player; instead, it will involve closer cooperation and resource integration among all parties while further optimizing development.

This is our judgment regarding the market, and in the future, Bedrock will continue to work around these aspects.

TechFlow: Based on your deep engagement in the staking space and observations of the Bitcoin ecosystem, what is Bedrock's overall vision and product planning for BTCFi?

Zhuling:

In the current market environment, we observe that user demands for BTCFi products are undergoing profound changes, shifting from an initial pursuit of simple yields to a comprehensive consideration of sustainability, innovation, and ecological value in BTCFi products. This shift marks the entire industry moving towards a more mature development stage.

BTCFi is not just an emerging track; it is an inevitable choice for the evolution of the Bitcoin ecosystem. It will become an important link connecting traditional Bitcoin holders with the next generation of financial innovation, opening a new era of Bitcoin value release.

Looking ahead to 2025, we firmly believe that BTCFi will experience a qualitative leap, officially entering the 2.0 era. This will not only redefine the development trajectory of BTC L2 but also inject revolutionary innovative power into the stablecoin system and staking economy, ultimately building a more inclusive and scalable Bitcoin financial ecosystem.

As a pioneer and trailblazer in the BTCFi field, Bedrock always adheres to the core philosophy of "connecting, innovating, and empowering," dedicated to building a bridge that connects Bitcoin's native value with future financial innovations. We must not only accurately grasp user needs but also stand at the high point of industry development to lead the future direction of BTCFi.

Based on this vision, we have constructed a comprehensive product matrix:

uniBTC: As a pioneering BTC LRT asset based on the Babylon narrative, uniBTC redefines the Bitcoin yield ecosystem. This is not only a milestone product for Bedrock in the BTCFi 1.0 era but also a perfect answer we deliver in the Babylon era, gaining widespread recognition and trust from users.

uniBTC Vaults: This is our strategic upgrade to BTCFi 1.0, creating a one-stop yield aggregation platform that achieves intelligent liquidity optimization across ecosystems. This product disrupts the complex operational model of traditional DeFi, providing users with a simple and intuitive yield acquisition channel.

brBTC: As a pioneering product of the BTCFi 2.0 era, brBTC represents our deep thinking about the future of finance. It not only integrates diversified Bitcoin derivative assets and re-staking protocols but also builds a truly cross-chain value network through innovative economic model design. With dynamically optimized asset allocation strategies and diverse financial application scenarios, brBTC is reshaping the future landscape of Bitcoin finance.

It can be said that our strategic layout for BTCFi is already very clear, and what we need to do next is to present higher quality products and continuously optimize them based on community feedback.

TechFlow: Based on your introduction, brBTC is a key focus of Bedrock's BTCFi 2.0 phase. Could you provide us with more detailed information and plans for brBTC? What are its unique advantages? How will brBTC interact with uniBTC and the broader ecosystem within Bedrock's BTCFi overall planning?

Zhuling:

From the perspective of product evolution, uniBTC and uniBTC Vaults, as our core products in the BTCFi 1.0 era, successfully created the first bridge for users to enter the Bitcoin financial world. The launch of brBTC marks our official entry into the BTCFi 2.0 era. In the first phase, brBTC will be launched on Ethereum and BNB Chain. In the second phase, it will support more chains to further expand the coverage and accessibility of brBTC.

True yield diversification is the core advantage of brBTC. Through intelligent dynamic asset allocation strategies, it not only brings users higher quality yields but also lowers the participation threshold, helping BTCFi achieve scalable development.

Specifically, the yield structure of brBTC mainly includes two core components.

First is the diversified re-staking yield system:

The most distinctive yield source of brBTC is its innovative multi-protocol re-staking mechanism. We have established strategic partnerships with the industry's most powerful re-staking protocols, including Babylon, Kernel, Symbiotic, Mellow, Pell, and SatLayer. This not only ensures the diversity and stability of yields but also lays a solid foundation for introducing more high-quality re-staking protocols in the future, allowing brBTC holders to continuously enjoy the yield dividends brought by ecosystem expansion.

Secondly, brBTC's diversified yield comes from innovative DeFi yield strategies:

brBTC has innovatively adopted flexible combination strategies for on-chain DeFi yields. Continuing the mature yield logic of uniTokens, we have built a comprehensive DeFi ecosystem. Users can freely combine various DeFi protocols (such as DEX, lending, etc.) according to their personal risk preferences, achieving personalized yield customization. This innovative strategy design not only guarantees basic yields but also provides more possibilities for users pursuing high yields.

Looking ahead, we are actively laying out the off-chain yield landscape, including collaborations with traditional financial institutions and the development of innovative yield models. These groundbreaking plans will be announced to the community at the appropriate time, further enriching the yield sources of brBTC.

Of course, from a global perspective, brBTC is not a standalone product; it can effectively interact with various segments of Bedrock's BTCFi product matrix to form an ecological effect: brBTC will work with uniBTC and uniBTC Vaults to form a complete product matrix that meets different users' investment needs. Users can use uniBTC as the deposit asset for brBTC, and the intelligent interaction among the three products will create the most comprehensive Bitcoin financial application scenarios for users. This innovative ecological interaction mechanism not only enhances the liquidity of the entire decentralized Bitcoin ecosystem but also provides a solid guarantee for ecological security.

TechFlow: From the user's perspective, the security of funds is fundamental. How does Bedrock ensure fund security and protect user rights?

Zhuling:

Bedrock has multiple measures in place to effectively protect user asset security, providing users with a trustworthy blockchain ecosystem. In today's complex blockchain environment, security is always one of our most valued core elements, so we have built a comprehensive security assurance system from multiple levels, striving to provide maximum protection for user assets.

First, contract audit reports are one of the foundational measures for ensuring security. Bedrock has established partnerships with several well-known auditing firms in the industry, and has passed comprehensive audits from authoritative security auditing institutions, including Peckshield and Blocksec, aiming to safeguard fund security from the most fundamental level of code.

Additionally, Bedrock has successfully integrated Chainlink, further ensuring the security and reliability of data, enhancing the platform's risk resistance capabilities. Furthermore, we have implemented a series of stringent security measures, including a 24/7 real-time monitoring mechanism to respond to potential threats at any time, a bug bounty program to incentivize global security experts to identify and fix possible security vulnerabilities, and we have also established a dedicated security fund for rapid response and resolution of sudden security issues.

Through these multi-layered security assurance measures, Bedrock not only provides users with a feature-rich blockchain platform but also builds a solid defense for the security of user assets. In the future, we will continue to invest resources and continuously optimize security strategies to ensure that users can participate in the innovation and development of the blockchain ecosystem on the Bedrock platform with peace of mind.

TGE is approaching, and now is the golden period to participate in Bedrock and accumulate tokens

TechFlow: The community is currently buzzing with discussions about Bedrock's TGE. Could you share more details with us?

Zhuling:

First of all, I would like to thank the community for their continued attention to Bedrock's TGE. The current discussion around our Diamonds and TGE is indeed very high.

Although more information about the TGE has not yet been announced, we can confirm that the Diamonds accumulated by users will be converted into future BR tokens according to a specific mechanism. Community-centric operation is the fundamental principle of Bedrock, and we will never overlook the contributions of early supporters.

The design of Bedrock's TGE will fully reflect the long-term value of the project. Our goal is to establish a sustainable token economic model. In the future, the BR token will not only serve as a value carrier but will also become an important governance tool within the ecosystem, allowing token holders to participate in significant project decisions and jointly promote the healthy development of the ecosystem.

The specific conversion ratio and details will be announced to the community at the appropriate time, so please stay tuned.

TechFlow: For current users, how can they participate in Bedrock more effectively?

Zhuling:

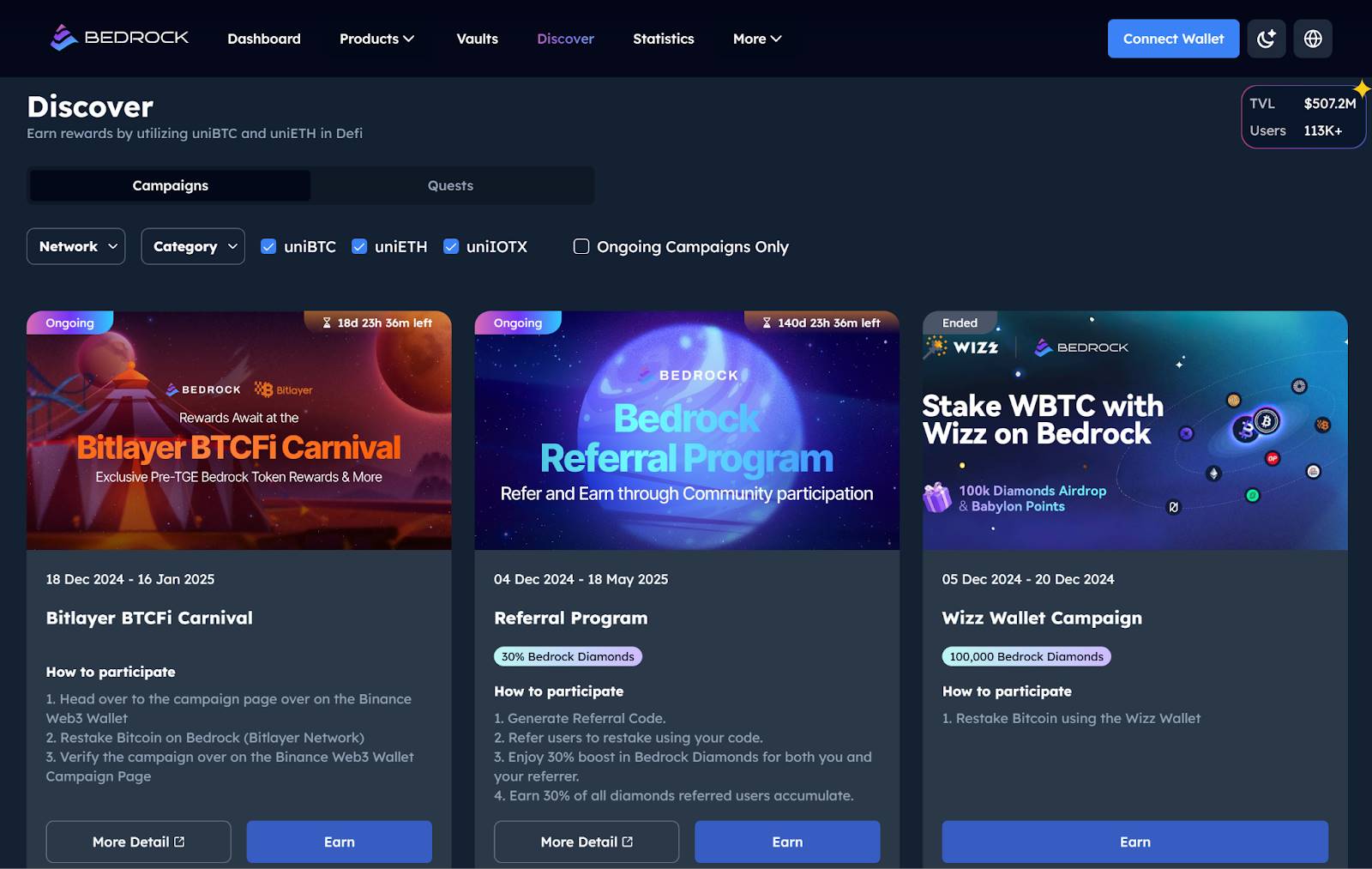

As mentioned in the TGE commitment earlier: the Diamonds accumulated by users will be converted into BR tokens in the future, so this is a golden period for users to interact with Bedrock and accumulate Diamonds through participation in unitoken activities.

Since our product planning is very clear, the ways for users to participate in our ecosystem are also very straightforward:

First, users can participate in staking to mint uniBTC and receive multiple Diamonds rewards. Bedrock supports the minting of uniBTC with assets from ecosystems such as Ethereum (wBTC/FBTC/cbBTC), Optimism (wBTC), Merlin (BTC/MBTC), Bitlayer (BTC/wBTC), and B² Network (BTC/wBTC). In the future, as we accelerate ecosystem collaborations, Bedrock will continue to support a wider range of assets. Meanwhile, users can visit the Bedrock official website Discover page to participate in various yield activities to earn Diamonds bonuses. Participating in the minting of uniBTC will yield multiple rewards, including Bedrock Diamonds rewards, Babylon staking yields, Babylon points, and DeFi ecosystem participation yields.

Secondly, participating in uniBTC Vaults is also an efficient choice for accumulating Diamonds and optimizing yields: Currently, Bedrock has partnered with DeFi protocols CIAN and Veda to launch two Vault products: uniBTC Corn Vault and Cian uniBTC Yield Layer. Users only need to deposit assets such as uniBTC, FBTC, cbBTC, or WBTC to participate in yield optimization strategies with one click, while also earning points from multiple platforms including CORN, BABYLON, CIAN, VEDA, and FBTC.

Of course, as a recently launched core product focusing on BTCFi 2.0, participating in the minting of brBTC will also yield considerable Diamonds rewards. To further integrate BTC liquidity across different DeFi platforms, brBTC currently accepts WBTC, FBTC, mBTC, cbBTC, BTCB, and uniBTC as collateral, and more assets will be introduced as the ecosystem expands. We welcome everyone to participate and experience it.

TechFlow: One last question, as the market becomes active again, more people are looking forward to innovations in the staking and re-staking space. What do you think the next trend in liquid staking will be? In light of this trend, could you share Bedrock's key focus areas for 2025?

Zhuling:

We believe that 2025 will be a year of vigorous development for the cryptocurrency industry, and innovations in liquid staking will also usher in a new round of breakthrough developments.

From a trend perspective, the next phase of liquid staking may exhibit the following characteristics:

Further integration of multi-chain ecosystems: As more blockchain interoperability is achieved, liquid staking assets (such as uniBTC and brBTC) will play a greater role in cross-chain ecosystems, helping users maximize yields across multiple networks.

Diversification of yield models: In addition to traditional on-chain staking yields, the exploration of combining DeFi strategies, off-chain yields, and more innovative yield scenarios will become a mainstream trend.

Strengthening of security and transparency: The demand for fund security and transparency from users will continue to drive the evolution of protocol design and operational models.

In response to these trends, Bedrock's key focus areas for 2025 will revolve around the following points.

First, Bedrock will continue to deepen the ecosystem of core staking products:

In 2024, we will help users earn yields in leading re-staking protocols such as Eigenlayer and Babylon through our two core products, uniETH and uniBTC, while maintaining asset liquidity. Building on this foundation, in 2025, we will continue to enhance the uniTokens series, providing users with more high-quality staking and liquidity management solutions.

Second, Bedrock will focus on BTCFi 2.0 and strive to lead this narrative trend.

brBTC will serve as the core tool of the BTCFi 2.0 narrative, bringing users safe, efficient, and sustainable yields. We will work to expand the ecological application scenarios of brBTC, promoting the release of Bitcoin's value in DeFi and re-staking fields while ensuring that brBTC holders can freely interact across multiple chains and protocols.

Most importantly, Bedrock will continue to explore new yield scenarios.

In addition to on-chain yields, we will explore the possibilities of off-chain yields, further expanding users' yield space through collaborations with traditional finance, institutional investors, and other innovative yield models.

Finally, Bedrock will promote the industry towards standardization and security.

In the face of the rapidly developing industry trends, Bedrock will continue to focus on protocol security, yield transparency, and user education, setting new standards for the industry while promoting the healthy development of the liquid staking space.

In summary, Bedrock will continue to maintain its leading position in industry innovation in 2025, creating more value for users through the optimization of core products, expansion of multi-chain ecosystems, and the construction of the BTCFi 2.0 narrative, helping the liquid staking space reach new heights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。