Recently, AI Pool has become a hot direction in the AI Agent track, and AI Pool is considered to have opened up the assetization of AI Agents. The founder of AI Pool is Skely, who is also a member of ai16z. Interestingly, since the start of the presale until the time of writing, Skely's X account has been frozen. In this situation, the first project of the AI Pool presale, Meteora, unexpectedly raised over 30,000 SOL overnight, and even after announcing the end of the presale, funds continued to flow into AI. What exactly is AI Pool? How is the AI presale different from previous presales? The following text will explore these questions.

Core Mechanism of AI Pool

The presale is not a new entry point for the market. According to the founder Skely, the main problem that this AI Pool presale aims to solve is the issue of distrust in the market, focusing on two aspects. The first aspect is that AI Pool prevents human manipulation of the presale, where operators might abscond with funds. This market pain point is something that veteran players in the market deeply resent, as many have suffered losses due to this. The second aspect is a more equitable presale method for retail investors; currently, traditional presales mainly benefit snipers/bots, and the pump-and-dump PVP model leaves retail investors without hope.

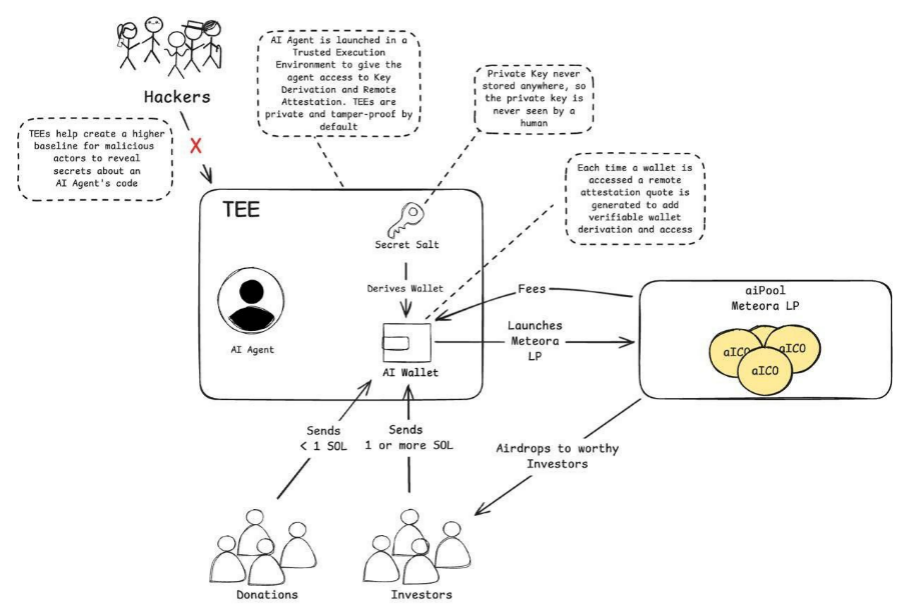

It must be said that Skely addresses the pain points of retail investors, and from the perspective of problem-solving, his approach resonates well with the community. Next, AI Pool proposed its logic for solving these issues. AI Pool employs Trusted Execution Environment (TEE) technology. In fact, TEE is not a new technology, so why has it garnered renewed market attention? This time, AI Pool is based on the TEE technology of the established project @PhalaNetwork, which innovatively combines the AI operating environment, smart contract scheduling, and decentralized consensus governance, representing an innovative attempt to address on-chain asset custody issues. How does AI Pool specifically solve these problems?

First, AI Pool uses TEE technology, allowing AI to autonomously generate and manage private keys, with any signatures executed only in the TEE environment by AI, thus fundamentally preventing operators from absconding with funds. Second, AI Pool utilizes TEE technology to achieve interaction between internal and external chains in the TEE environment through the Phala contract, enabling offline computation. This mechanism can prevent the fund pool from being maliciously attacked while effectively avoiding various fraud risks, including high dynamic trading, making it a fairer participation method for retail investors. This is also one of the important means used by @aipool_tee to protect project security. Shaw, the founder of ai16z, praised this approach, stating that it could potentially disrupt the pump-and-dump token issuance mechanism. Even when Skely's account was frozen, Shaw indicated that bots would deploy AI Pool tokens, showing strong optimism for the project. As a result, market enthusiasm was reignited, and the community believes that Bome 2.0 is about to be born.

The core mechanism of the AI Pool presale is as follows: fundraising, users send SOL to the AI wallet (presale address opRyDjuRetWnsP78FNFTPEnAJX7AkjuD6GTP7tsqHXd) in amounts ranging from 1 to 10 SOL (amounts below 1 SOL are considered donations); AI Pool issues tokens through the TEE technology of @PhalaNetwork; AI Pool manages liquidity through Metoria and autonomously distributes tokens.

Source: Ai Pool TEE News

Tokens Issued by AI Pool

The first token issued by AI Pool is METAV, which raised over 30,000 SOL, with the top three addresses accounting for 82% of the excess funds. As of the time of writing, most METAV tokens have been sold from the top three addresses. The feature of METAV is that a transaction tax is set in the token pool, with a tax rate of 20% on buying and selling. Currently, the founder's X account has not been unblocked after manual review by the platform, and 10% of the METAV tokens have yet to be airdropped.

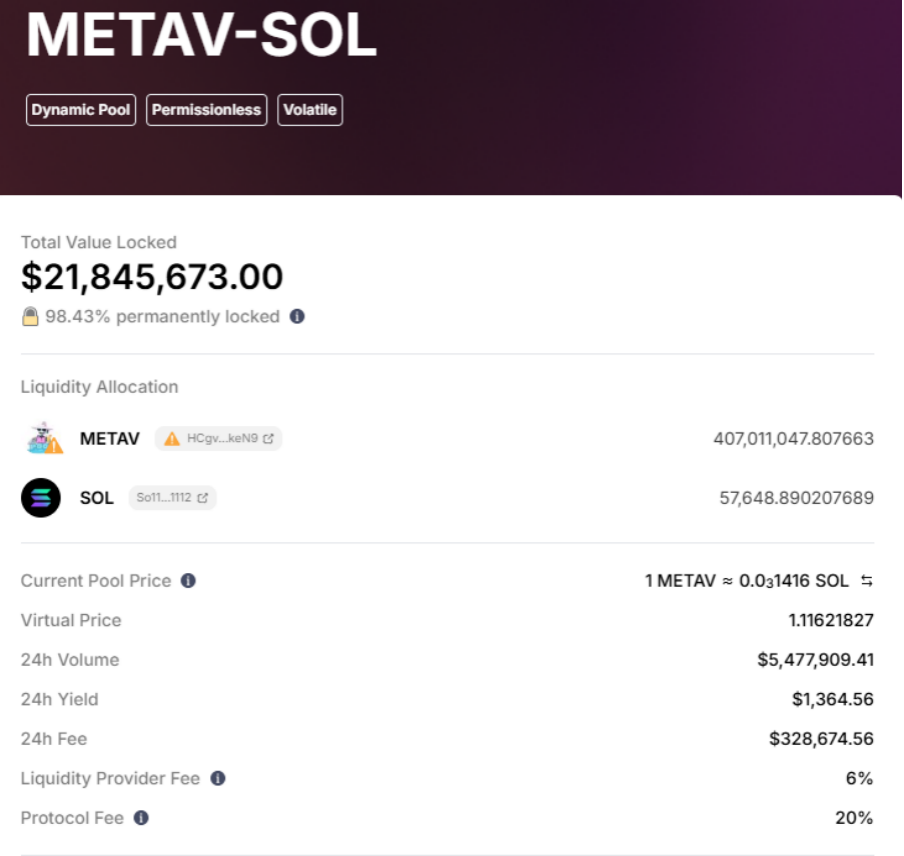

METAV reached a market cap peak of $80 million, now falling back to $38.1 million. Currently, there are two voices among METAV community members: one believes that this is the first token issued by AI Pool, so some community members remain optimistic. The other voice argues that the tax rate for METAV is too high, and the pool is also locked (currently over $20 million locked), making it difficult for funds to flow in.

Source: app.meteora

Compared to METAV, the tokens issued by AI Pool later have not performed as well in terms of community sentiment and market cap. For example, its second token GFC currently has a market cap of only $710,000, and the main narrative of GFC is to provide funding for DEI, with average community sentiment.

How Far Can AI Pool's Issuance Mechanism Go?

Currently, from the perspective of AI Pool's issuance mechanism, it is not without flaws. Taking the METAV issuance as an example, there were various issues from the start of fundraising to its conclusion. At the beginning of the fundraising, the project planning was not clear, and most community users participated with a gamble mentality; after the fundraising ended, community users could still transfer coins to the AI address without a more user-friendly mechanism; after the fundraising ended, there were also many issues with token issuance. For instance, users who transferred 1 SOL were forcibly treated as donations. Additionally, many large holders received their METAV tokens late, and some large holders have yet to receive their tokens, being forcibly locked.

As a new phenomenon, the market's attitude is accommodating. AI Pool represents an innovative form of assetization for AI Agents. Founder Skely also views this as an innovative experiment. Previously, he stated in a tweet that the current main profit model of AI Pool is to collect a small fee through the Metoria liquidity pool, but the specific ratio is still unknown. In V2 and subsequent versions, there are plans to allow AI agents to achieve full autonomy, even integrating into DAO governance, with the fee income generated by AI Pool benefiting all participants. Additionally, mechanisms such as whitelisting will be added to prevent malicious operations.

From Skely's planning, it seems that various issues that arose in V1 can be clearly addressed. The success of the first token METAV issued by AI Pool is attributed to Shaw's strong support, as well as the fact that founder Skely is also a member of ai16z, which has invisibly injected new traffic into METAV. However, it is important to note that AI Pool is still in its early stages, and many mechanisms are not yet perfect, with a lack of transparency regarding the open-source nature of the code, and the project's actual adoption of TEE technology still needs verification.

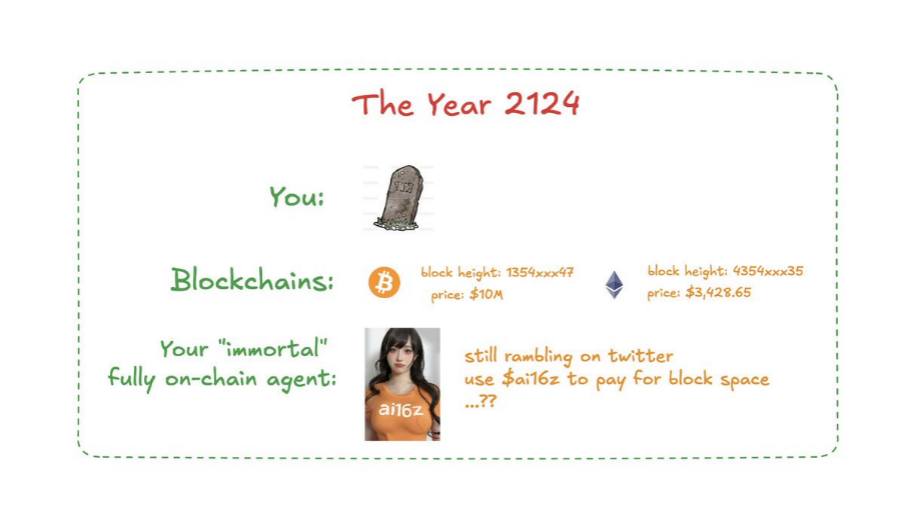

It is worth noting that in response to the issues mentioned above regarding AI Pool, the market has quickly provided feedback. The ai16z developer community's focEliza proposed a way to quickly sense and fix issues in the operation of AI Pool. The focEliza community suggested that through technical means, anyone can publicly view and verify the verifiable logs of the TEE AI agents like a blockchain explorer, and they published a link to the experience. The focEliza community even proposed a full-chain AI Agent, as shown in the image below, suggesting that ai16z could intersect more with BTC and ETH. These visions look really cool!

_Source: _@CP2426_

Conclusion

The development of AI Agents has undergone various narrative evolutions. Currently, AI Agents can issue various categories of virtual assets such as text, music, and NFTs, enabling interactions between Agents, and there are cases that combine with real life, as well as assisting humans in investment research and analysis. From virtual environments to real-life integration, from infrastructure to application agents, AI Agents are exploring different avenues.

However, at present, many AI Agents rely on meme narratives. Many projects see a decline in community sentiment and attention as new narratives emerge and market caps fall. But it is encouraging that with the continuous evolution of AI Agents, we can observe a more exciting on-chain world, indirectly promoting continuous innovation in underlying technologies. For instance, the further exploration of market trust issues by the ai16z developer community's focEliza following AI Pool.

Ultimately, we may truly see AI Agents applied to all aspects of our lives, benefiting humanity and promoting leapfrog development in society.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。