Key Points

● The total market capitalization of cryptocurrencies is $3.42 trillion, up from $3.4 trillion last week, with a weekly increase of 0.5%. As of December 30, 2024, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $35.66 billion, with a net outflow of $388 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $2.68 billion, with a net inflow of $350 million this week.

● The total market capitalization of stablecoins is $211 billion, accounting for 6.17% of the total cryptocurrency market capitalization, with a weekly increase of 0.47%. Among them, USDT has a market capitalization of $138.7 billion, accounting for 65.7% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $43.6 billion, accounting for 20.7%; and DAI with a market capitalization of $5.4 billion, accounting for 2.6%.

● This week, the total TVL of DeFi is $121.5 billion, with a weekly increase of 2.2%. By public chain classification, the top three public chains by TVL are Ethereum with a share of 56%; Solana with a share of 7.01%; and Tron with a share of 6%. The overall share remains stable, with Ethereum still being the leader in the DeFi space.

● From on-chain data, this week, the Layer 1 public chains with the most significant fluctuations in daily trading volume are BNB and SUI, both exceeding a 50% increase compared to last week. In terms of transaction fees, overall fluctuations are minor, with ETH fees showing a downward trend, decreasing by 33.3% compared to last week. In terms of daily active addresses, SOL active addresses have rebounded, with a 10.9% increase compared to last week; this week, the total TVL of Ethereum Layer 2 reached $46.99 billion, with a 2.4% increase compared to last week. Among them, Arbitrum One and Optimism occupy the top positions with market shares of 39.09% and 24.31%, respectively, but both have seen slight declines.

● Innovative projects to watch: DeTrading: DeTrading is a trustless cross-chain platform for atomic swaps across all chains; stMOVE: The first liquid staking solution of the Movement network. Earn stMOVE protocol rewards through secure, transparent, and hassle-free non-custodial Liquid staking services; Resupply: A decentralized stablecoin protocol, Resupply allows users to borrow stablecoins through Curve Lend or Fraxlend and re-collateralize for mining.

Table of Contents

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Share 3

3. ETF Inflow and Outflow Data 5

4. ETH/BTC and ETH/USD Exchange Rates 6

5. Decentralized Finance (DeFi) 7

7. Stablecoin Market Capitalization and Issuance 12

II. This Week's Hot Money Trends 14

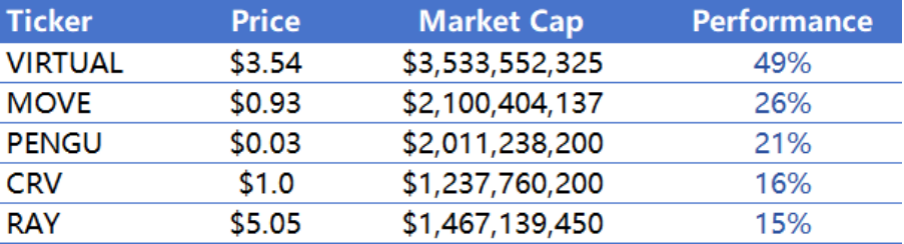

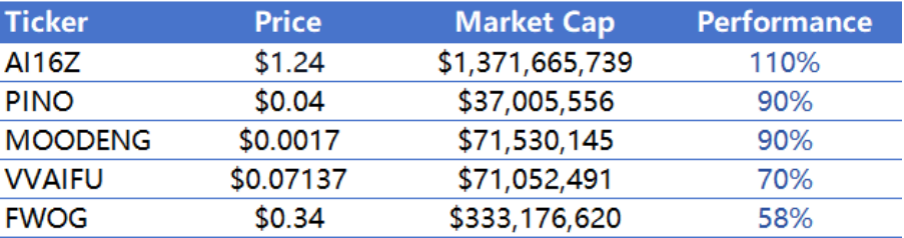

1. Top Five VC Coins and Meme Coins by Increase This Week 14

1. Major Industry Events This Week 16

2. Major Upcoming Events Next Week 17

3. Important Financing and Investment from Last Week 18

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Share

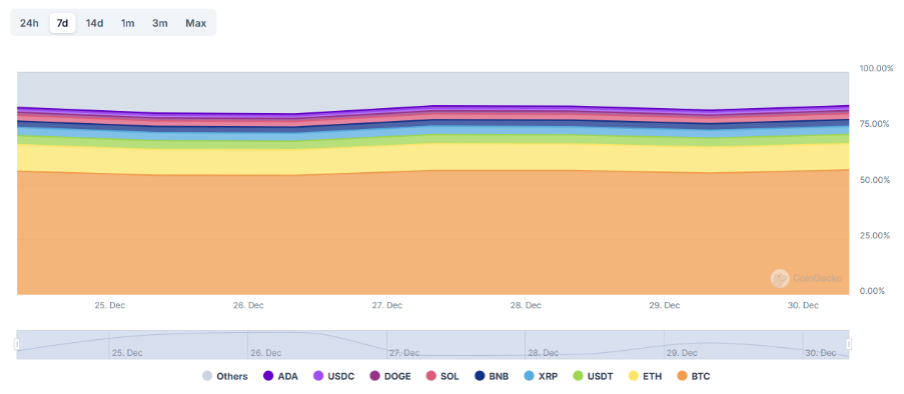

The total market capitalization of cryptocurrencies is $3.42 trillion, up from $3.4 trillion last week, with a weekly increase of 0.5%.

Data Source: cryptorank

As of the time of writing, the market capitalization of Bitcoin (BTC) is $1.85 trillion, accounting for 54.14% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $211 billion, accounting for 6.17% of the total cryptocurrency market capitalization.

Data Source: coingeck

Source: coingeck

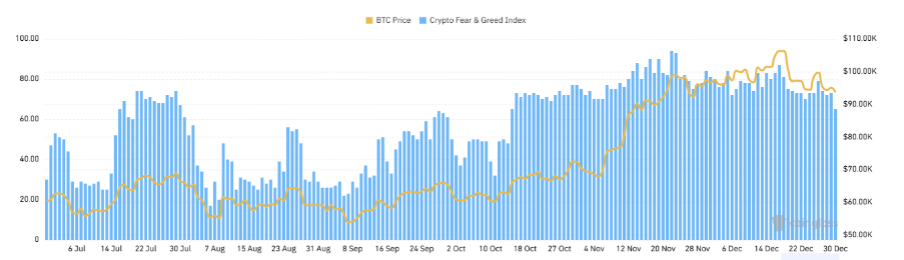

2. Fear Index

The cryptocurrency fear index is 65, indicating greed.

Data Source: coinglass

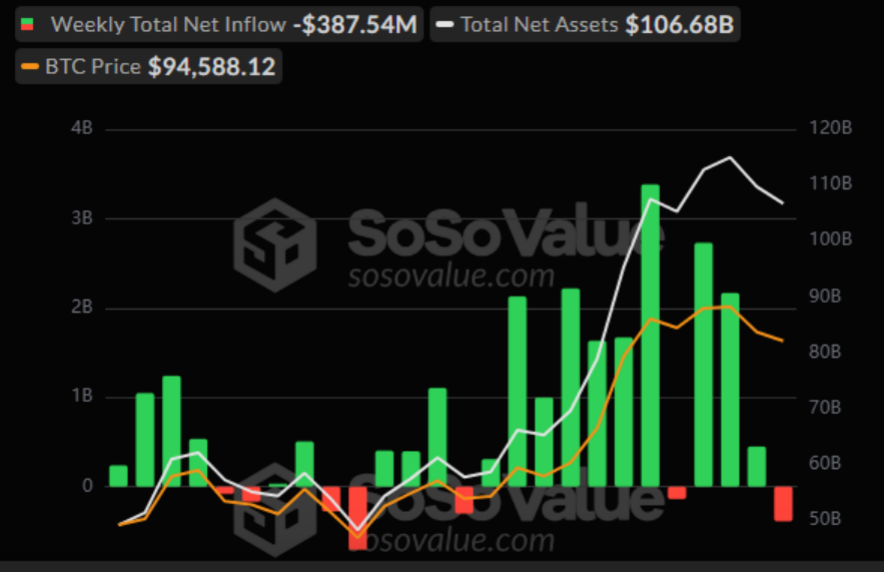

3. ETF Inflow and Outflow Data

As of December 30, 2024, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $35.66 billion, with a net outflow of $388 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $2.68 billion, with a net inflow of $350 million this week.

Data Source: sosovalue

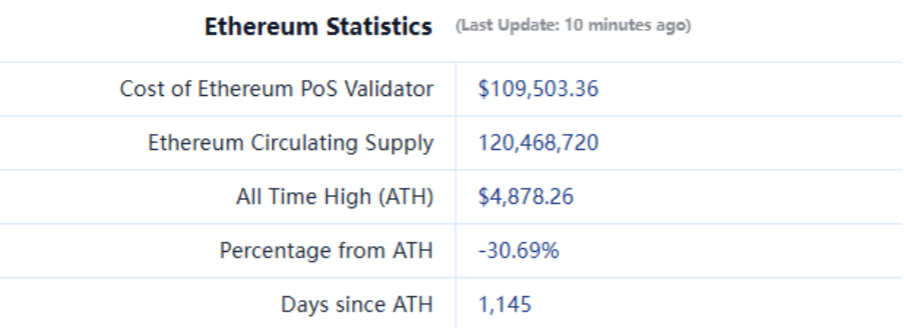

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $3,422, historical highest price $4,878, down approximately 30.69% from the highest price.

ETHBTC: Currently at 0.036536, historical highest at 0.1238.

Data Source: ratiogang

5. Decentralized Finance (DeFi)

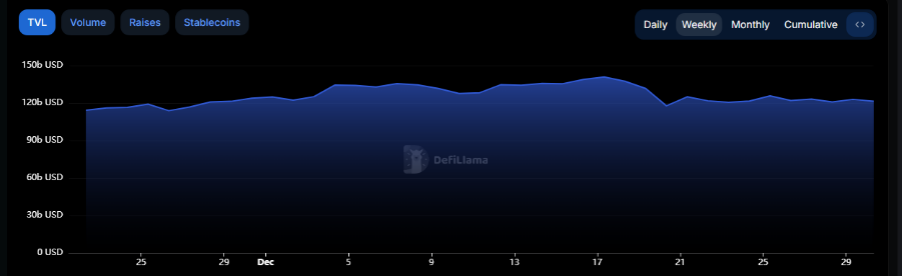

According to DeFiLlama, the total TVL of DeFi this week is $121.5 billion, with a weekly increase of 2.2%.

Data Source: defillama

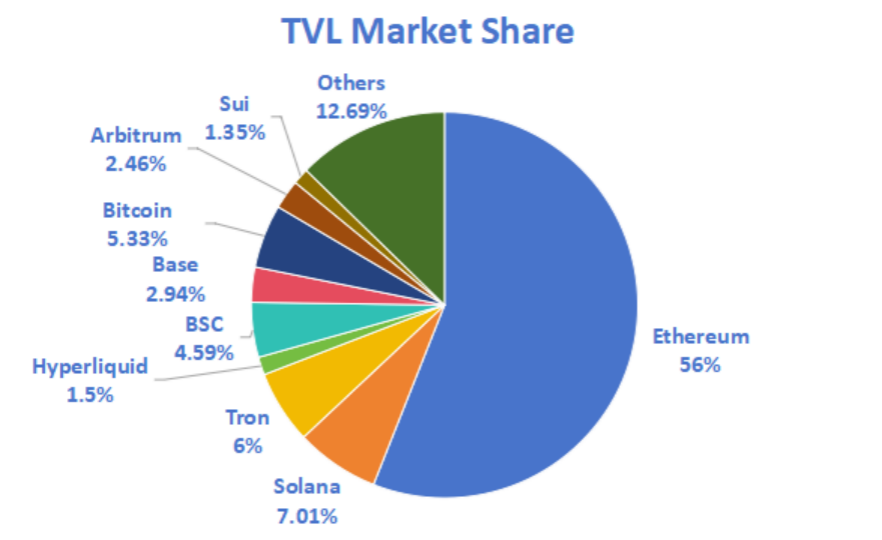

By public chain classification, the top three public chains by TVL are Ethereum with a share of 56%; Solana with a share of 7.01%; and Tron with a share of 6%. The overall share remains stable, with Ethereum still being the leader in the DeFi space.

Data Source: CoinW Research Institute, defillama

Data as of December 30, 2024

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of December 30, 2024

Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In daily trading volume, this week BNB and SUI have shown significant fluctuations, both exceeding a 50% increase compared to last week. In terms of transaction fees, overall fluctuations are minor, with ETH fees showing a downward trend, decreasing by 33.3% compared to last week.

● Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, while TVL reflects the level of user trust in the platform. In terms of daily active addresses, SOL active addresses have rebounded, with a 10.9% increase compared to last week. In terms of TVL, ETH remains a leader among public chains.

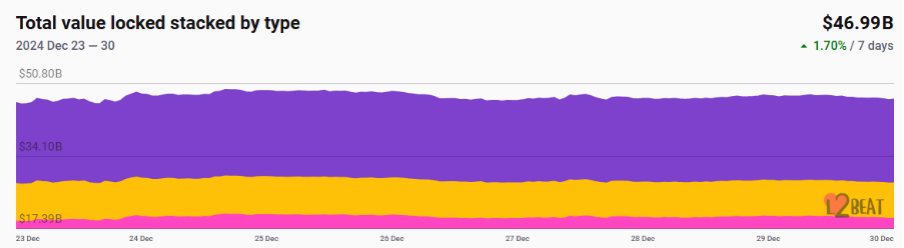

Layer 2 Related Data

● According to L2Beat, the total TVL of Ethereum Layer 2 reached $46.99 billion, with an overall increase of 2.4% compared to last week.

Data Source: L2Beat

Data as of December 30, 2024

Arbitrum One and Optimism occupy the top positions with market shares of 39.09% and 24.31%, respectively, but both have seen slight declines.

Data Source: footprint

Data as of December 30, 2024

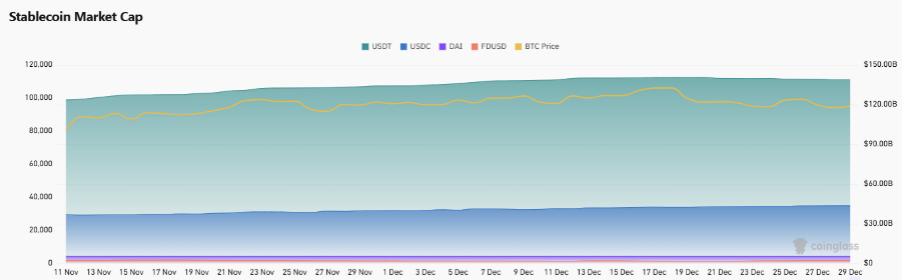

7. Stablecoin Market Capitalization and Issuance

According to Coinglass data, the total market capitalization of stablecoins is currently reported at $211 billion, continuing to set a historical high, with a weekly increase of 0.47%. Among them, USDT has a market capitalization of $138.7 billion, accounting for 65.7% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $43.6 billion, accounting for 20.7%; and DAI with a market capitalization of $5.4 billion, accounting for 2.6%.

Data Source: CoinW Research Institute, Coinglass

Data as of December 30, 2024

According to Whale Alert data, a total of 550 million USDC was minted this week, representing a 175% increase in the total issuance of stablecoins compared to last week.

Data Source: Whale Alert

Data as of December 30, 2024

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Increase This Week

The top five VC coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of December 30, 2024

The top five Meme coins by increase over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of December 30, 2024

2. New Project Insights

● DeTrading: DeTrading is a trustless cross-chain platform for atomic swaps across all chains.

● stMOVE: The first liquid staking solution of the Movement network. Earn stMOVE protocol rewards through secure, transparent, and hassle-free non-custodial Liquid staking services.

● Resupply: A decentralized stablecoin protocol, Resupply allows users to borrow stablecoins through Curve Lend or Fraxlend and re-collateralize for mining.

III. New Industry Dynamics

1. Major Industry Events This Week

● Network3 launched a Pre-TGE airdrop campaign, where early node users can bind their wallets to qualify for the airdrop. The airdrop has opened wallet binding functionality, and new users and early node users need to complete wallet binding before the TGE to ensure eligibility for claiming the airdrop. The total airdrop amount is 50 million N3 tokens, which can be obtained by downloading the node, binding the wallet, running node mining, completing task activities, and inviting new users for bonus rewards. Additionally, according to the Network3 team, Network3 plans to launch on exchanges in January next year.

● Eliza will announce a new tokenomics proposal around January 1. According to a member of the Eliza team at a community meeting, the project team plans to release two important announcements. First, the project team will officially announce the list of all partners to enhance project transparency and help the community better understand the cooperation relationships and their specific scope. Regarding tokenomics, the team will unveil a new tokenomics proposal around January 1, designed by professionals from multiple teams, which will include LP pairing mechanisms, DeFi functionality integration, and more. Furthermore, the project team revealed that they have acquired a Launchpad company, which will be used for official releases in the future.

● REVOX announced the end of the S1 airdrop and launched the Stake to AI token economy. The AI Agent infrastructure REVOX announced the end of the S1 airdrop, with over 9 million wallets claiming, of which more than 1.22 million users passed Human Verification. According to the white paper, REVOX plans to launch the Stake to AI token economy. Users can stake REX tokens for sREX tokens to earn AI points, which can be used to pay for AI services within the REVOX ecosystem. Additionally, sREX holders can participate in early projects within the REVOX ecosystem and have the opportunity to receive future airdrops based on their participation level and token holdings.

● Public company KULR purchased 217.18 Bitcoins at an average price of $96,556. The U.S. publicly traded company KULR has initiated its Bitcoin reserve strategy, purchasing 217.18 Bitcoins for $21 million, with an average price of $96,556 per Bitcoin. Custody and wallet management are conducted through the Coinbase Prime platform, and KULR plans to allocate up to 90% of its surplus cash to Bitcoin.

● Trump's administration creates ideal conditions for DeFi, with new policies allowing more protocols to distribute dividends to token holders. ETHDenver founder John Paller stated in an interview that Trump's focus on deregulation and economic growth could create ideal conditions for the flourishing of DeFi.

2. Major Upcoming Events Next Week

● The first airdrop season of the Ethereum liquidity re-staking platform Kelp DAO (10% of total supply) has a snapshot date of December 31, 2024.

● The deadline for claiming the airdrop token PRCL from the Solana ecosystem real estate trading protocol Parcl is December 31.

● The re-staking protocol Swell Network will distribute 1.25 million SWELL tokens to users who cross-chain and hold assets on Swellchain within the first two weeks, with users needing to complete the cross-chain by December 31 to receive their share.

● The second airdrop season of the Ethereum liquidity re-staking platform Kelp DAO (5% of total supply) will run from January 1, 2025, to April 30, 2025, with an additional 15% loyalty reward for re-staking before January 15, 2025; the remaining 5% of the airdrop plan is pending.

● The deadline for the second wave of ZK token claims from ZK Nation is January 3, 2025, and members of the Protocol Guild, contributors from external projects, or users nominated by ZKsync native ecosystem projects can claim.

3. Important Financing and Investment from Last Week

● Usual, Series A, raised $10 million, with investors including Binance Labs, Kraken Ventures, Galaxy Digital, OKX Ventures, IOSG Ventures, Wintermute, Amber Group, GSR, and others. Usual is a stablecoin protocol that launched USD, a permissionless and fully compliant stablecoin backed 1:1 by real-world assets (RWA). USUAL is a governance token that allows the community to guide the future development of the network. Usual addresses current stablecoin market issues by redistributing profits to the community and rewarding token holders with actual earnings generated from RWA. (December 23)

● Avalon Labs, Series A, raised $10 million, with investors including Framework Ventures, Kenetic Capital, SNZ Holding, and others. Avalon Finance is a BTCFi protocol that allows users to use their held Bitcoins as collateral to obtain USDa, unlocking the value they hold and increasing the use of Bitcoin within their platform. Avalon Labs also offers financial products such as Bitcoin-backed loans, interest-bearing savings accounts, and credit cards. (December 23)

● ChainOpera, seed round, raised $17 million, with investors including Finality Capital Partners, IDG Capital, Road Capital, and others. ChainOpera AI is a truly decentralized, open AI platform dedicated to achieving a simple, scalable, and trustworthy collaborative AI economy, as well as an accessible and democratized AI application ecosystem. (December 26)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。