As the most direct embodiment of the attention value theory, the value of AI agent tokens will continue to grow.

Author: Robbie Petersen

Translation: Deep Tide TechFlow

Prediction #1: Frontend Will Dominate Value Capture

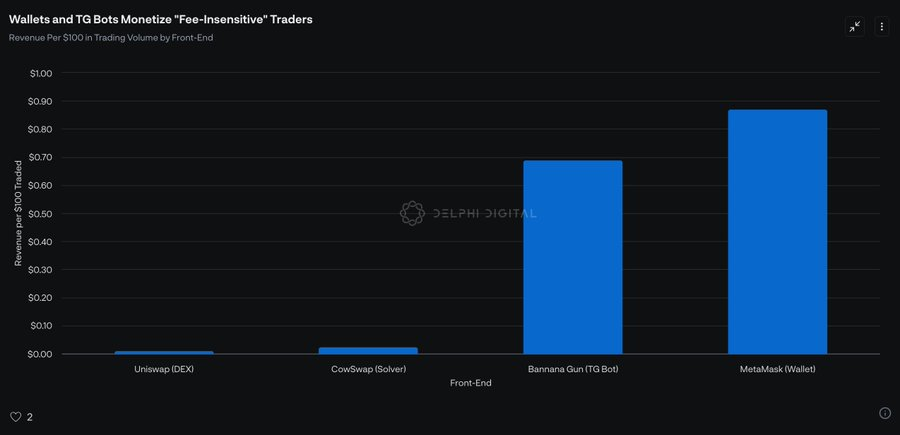

As the MEV supply chain matures, participants who control exclusive order flow will capture more value.

The reason is simple. Various participants downstream of the order flow—such as DEXs, seekers, builders, and validators—will face intensified competition. Meanwhile, the originators of the order flow (i.e., the frontend) will have a natural monopoly advantage in the MEV supply chain.

This means that the only role capable of increasing yield without significantly losing market share is the frontend, especially those frontends that control "fee-sensitive" order flow (e.g., digital wallets).

Additionally, emerging technologies like conditional liquidity (e.g., @DFlowProtocol) will further drive the development of this trend.

Prediction #2: DePIN Market Cap Will Grow 5 Times by 2025

Market leaders in decentralized physical infrastructure networks (DePIN), such as @Helium and @Hivemapper, will approach a tipping point in their network effects. Meanwhile, @dawninternet will emerge as the most groundbreaking application in the DePIN space due to significant technological improvements and crypto-economic incentives.

Prediction #3: Limited Application of Crypto Payment Rails in Agent Transactions

In the early stages, transactions between humans and agents will still rely on traditional payment rails. Stripe and PayPal will dominate the early agent payment infrastructure through "for benefit of" (FBO) account structures.

However, the high-fee model of traditional payment rails will only reveal its limitations once the autonomy of agents reaches a certain level. With the rise of microtransactions and usage-based pricing demands, traditional payment rails (approximately 3% fees) will become unsustainable.

Nevertheless, this situation will not occur by 2025, as most transactions will still be interactions between humans and agents. (Refer to tweet)

Prediction #4: Stablecoins Will Bridge the Application Gap in Fintech

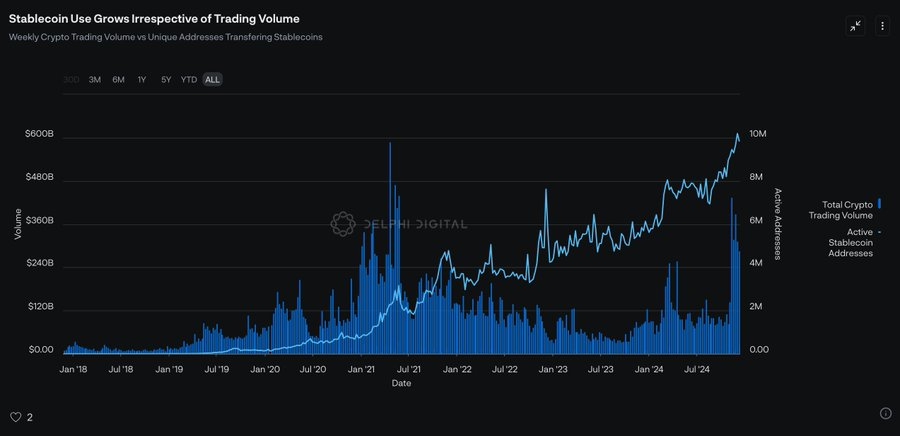

The role of stablecoins will shift from being the "lubricant" of DeFi (decentralized finance) to a true medium of exchange.

This transformation is driven by two main reasons for fintech companies adopting stablecoins: (1) enhancing profitability, and (2) strategically controlling more of the payment chain.

As the widespread adoption of stablecoins becomes a necessity for fintech companies' survival, the number of monthly active stablecoin addresses is expected to exceed 50 million.

Prediction #5: Visa Launches Stablecoin Initiative, Actively Adjusts Profit Structure

To address potential disruptive changes in the payment chain, Visa is proactively laying out a stablecoin initiative. While this may cut into the profits of its card network, this risk appears more manageable compared to being completely disrupted by the market. This logic also applies to other fintech companies and banks.

Prediction #6: Market Share of "Yield-Distribution" Stablecoins Will Grow 10 Times

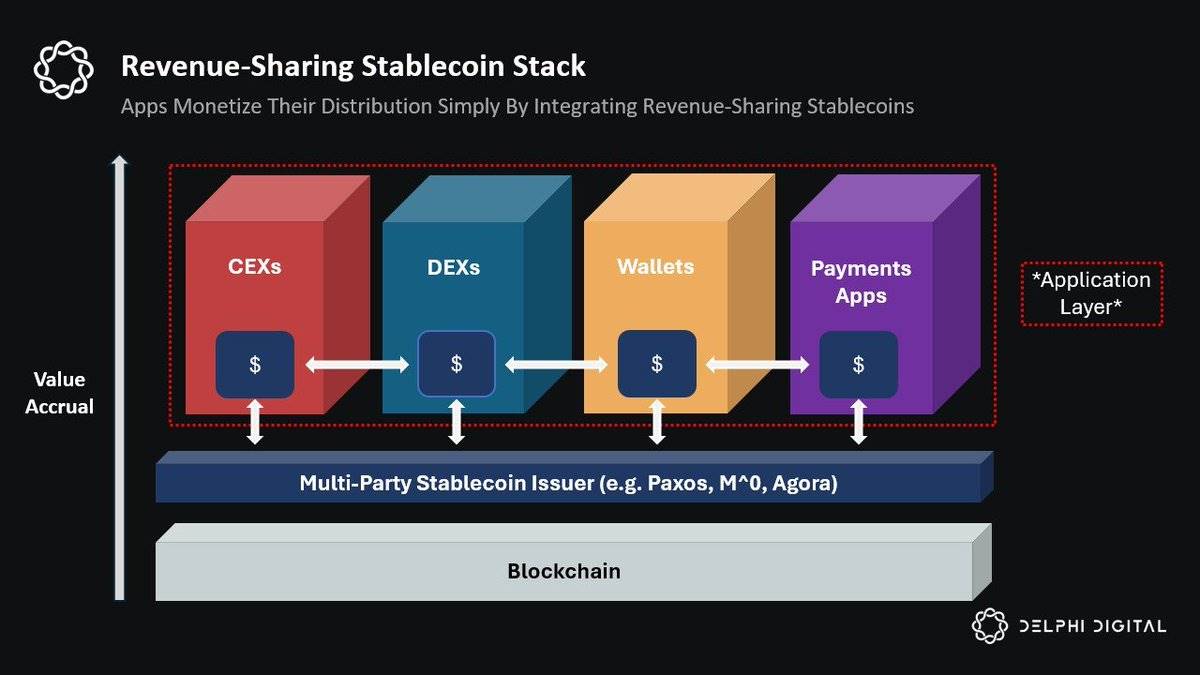

"Yield-distribution" stablecoins (such as USDG @Paxos, "M" @m0foundation, and AUSD @withAUSD) are changing the economic model of stablecoins by redistributing the profits traditionally earned by stablecoin issuers to applications that provide liquidity to the network.

Although Tether will still maintain its market dominance in 2025, the model of "yield-distribution" stablecoins is seen as the future direction for the following reasons:

(1) Importance of Distribution Channels: Unlike previous attempts to directly attract end-users with yield-generating stablecoins, "yield-distribution" stablecoins target applications with distribution channels. This model achieves the first alignment of incentives between distributors and issuers.

(2) Power of Network Effects: By incentivizing multiple applications to integrate simultaneously, "yield-distribution" stablecoins can fully leverage the network effects of the entire distributor ecosystem.

By 2025, with the collaboration of distributors (especially fintech companies) and market makers, the market share of these stablecoins will significantly increase as they create more direct benefits for distributors.

Prediction #7: The Boundary Between Wallets and Applications Will Blur

Wallets will gradually integrate application-like features, such as deposit yields (e.g., @fusewallet), credit accounts (e.g., @GearboxProtocol), native trading functions, and chatbot-like interfaces where users can express needs, executed by AI agents and backend solvers.

At the same time, applications will also attempt to maintain direct relationships with end-users by hiding the existence of wallets. For example, the mobile application launched by @JupiterExchange is an early case.

The biggest driving force behind the vision of wallet centralization comes from exchanges like @coinbase, which view wallet products as the primary means for on-chain user monetization. (Refer to tweet)

Prediction #8: Chain Abstraction Will Transition from Theory to Practice at the Wallet Level

Although discussions on chain abstraction have previously focused mainly on the chain and application layers, the optimal solution is to directly meet user needs. New technologies like @OneBalance_io resource locks, @NEARProtocol chain signatures, and @Safe SafeNet are driving a new paradigm that achieves chain abstraction at the wallet level.

Prediction #9: General-purpose L2 Will Gradually Lose Relevance

The trend of concentration in blockchain activity can be summarized by one question:

As an application, why should I choose to run on your chain?

For a few general-purpose chains with clear positioning (like Solana and Base) and vertically integrated chains (like HypeEVM and Unichain), the answer is clear.

However, for those long-tail general-purpose chains, the answer is not so clear. By 2025, blockchain activity will increasingly concentrate on a few chains that can provide clear value to applications.

Prediction #10: The Boundaries Between Attention and Value Will Gradually Disappear

As the most direct embodiment of the attention value theory, the value of AI agent tokens will continue to grow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。