Comparing the Market Development Scale of Crypto AI and DeFi: Exploring the Similarities and Differences in the Development of These Two Fields

Author: Nancy, PANews

Every crypto cycle brings forth dominant narratives, and AI+ is undoubtedly one of the main themes of this bull market, especially as the AI Agent craze is capturing a significant portion of on-chain liquidity. Discussions in the market about crypto AI being in a similar cycle to DeFi Summer are increasing. This article by PANews will compare the market development scale of crypto AI and DeFi and explore the similarities and differences in the development of these two fields.

$48 Billion Market Cap Surpassing DeFi Summer Period: Can It Replicate DeFi's Success?

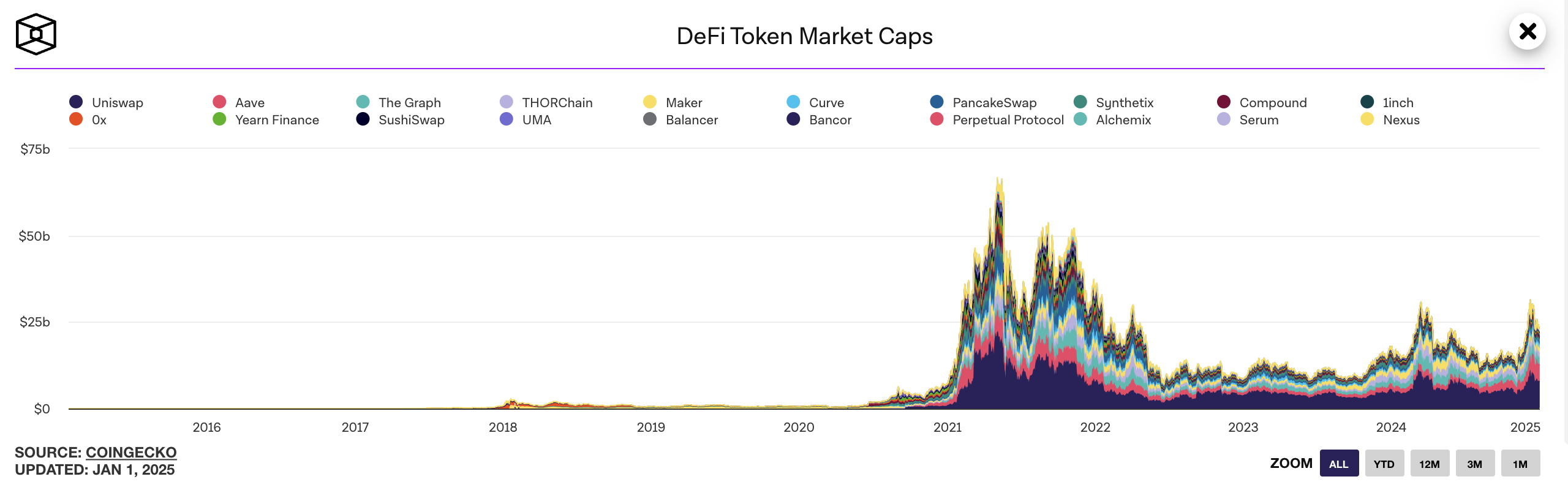

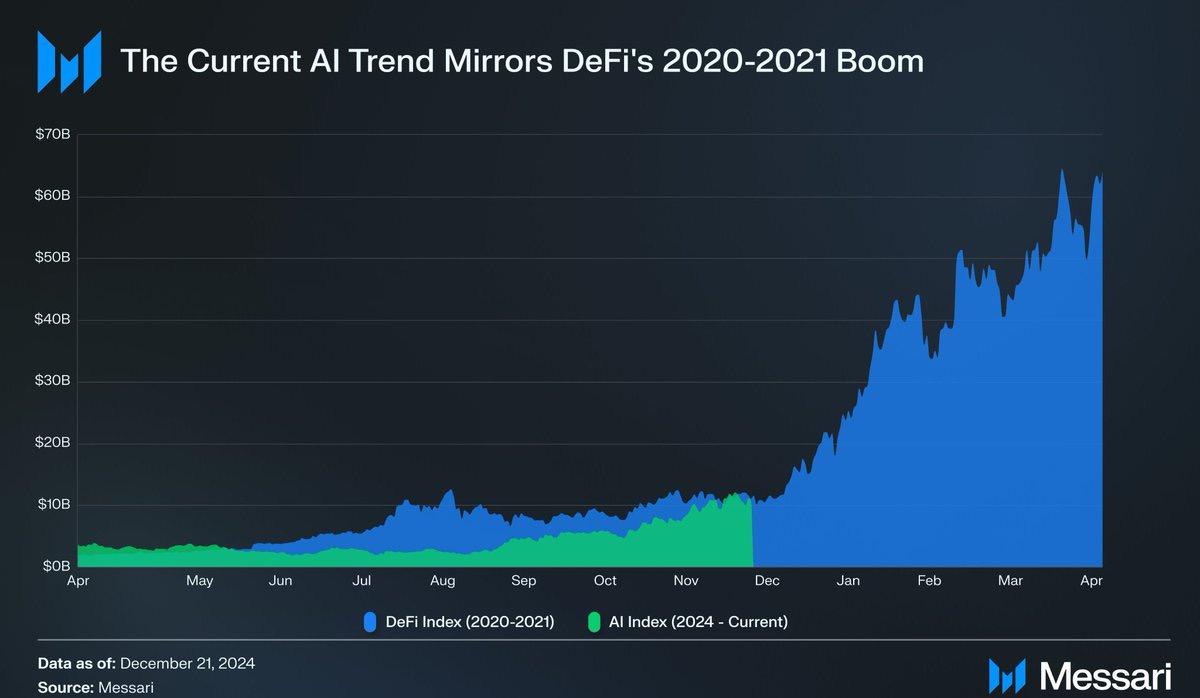

According to CoinGecko data, as of January 2, the market cap of the crypto AI sector has reached $48.8 billion, far exceeding the market cap during DeFi's "DeFi Summer" period. The Block data shows that after the explosive growth phase of DeFi in 2020, the market cap peaked at $6.04 billion, only breaking the $50 billion mark in mid-April 2021, when the market had gradually matured and diversified. This comparison indicates that the explosive power of crypto AI has surpassed the early development stage of DeFi, demonstrating a stronger advantage in market appeal and growth potential.

In particular, the AI Agent sub-sector has been continuously booming during this period. CoinGecko data shows that as of January 2, the market cap of AI Agents has reached $16.93 billion, accounting for 34.7% of the entire crypto AI sector, which is equivalent to the total market cap of DeFi protocols in January 2021. Taking leading projects like Virtuals Protocol ($5.02 billion) and ai16z ($2.7 billion) as examples, the combined market cap of these two has already surpassed the total market cap of all DeFi protocols at the end of 2020, further highlighting the rapid development of the AI sector. In contrast, leading DeFi projects Uniswap and Aave had peak circulating market caps of $22.05 billion and $6.58 billion, respectively, during the last bull market.

From the perspective of capital investment, DeFi attracted a large influx of venture capital after its rapid development, and crypto AI is currently in a similar stage, with increasing amounts of capital flowing into the AI sector, leading to a surge in investments around crypto AI. According to the 2024 financing report by PANews, the DeFi sector secured $1.69 billion in 296 financing events in 2024, while AI projects, as an emerging category, have seen rapid growth this year, with nearly 100 disclosed financing events, of which 15.2% received funding at the $10 million level, totaling around $600 million.

Despite the impressive data performance of the crypto AI sector, there are differing opinions on whether its development cycle can be similar to that of DeFi. For instance, Messari's latest report points out that AI Agents will peak in the first quarter of 2025 and will not recover. The reasons include: (1) AI Agent proxies have yet to prove their product adaptability to support market speculation; (2) The success of Alt-L1 is based on a clear demand for block space during the DeFi boom, but AI Agents lack both demand and a clear user base; (3) The launch of AI Agents relies on market speculation, but when the market realizes they will remain mere toys in the foreseeable future, this speculation cycle will collapse.

There are also viewpoints suggesting that AI possesses development potential similar to that of DeFi. For example, crypto KOL @0xWizard stated that 2020 could be called the "Cambrian Explosion of DeFi," and 2025 is likely to be the "Cambrian Explosion of AI Agents." Various Ai+Crypto play styles are expected to take shape next year. Researcher Haotian believes that the arrival of AI Agents is akin to the DeFi Summer of 2020, generating a massive new "bubble" narrative cycle of Build+Speculation. Although the AI Agent ecosystem does not yet have dedicated infrastructure conditions, the narrative opportunities brought by AI Agents are much grander than those of DeFi in terms of ecological plasticity.

Former Spartan Group member @0xJeff predicts that 2025 will be known as the Agentic era, with Agentic-type L1 reaching a market cap of $100 billion, similar to the L1 valuation cycle of 2020-21; DeFi, with the help of AI Agents, will reach a TVL peak of over $200 billion, similar to the previous cycle.

Regarding the valuation of AI MEME coin projects, crypto KOL @Rui stated that in the early MEME market, project valuations were closely related to whether they could be listed on exchanges, especially top exchanges. However, with the rise of AI Agents and market changes, the previous valuation system based on exchange logic for large-cap MEMEs has become ineffective. Expectations for project valuations are no longer based on which exchanges they will be listed on, but rather on what kind of ecosystem they will generate. For projects that already have an ecosystem, valuations can be determined based on their ecological share; for standalone projects or "wild system" projects, the key to valuation is whether they can break the $100 million market cap, as valuations below this rely more on dissemination, community, and early funding support.

Four Commonalities from Cultural Influence to Capital Efficiency

The combination of technology and capital is the core driving force behind the development of the crypto industry. In the last bull market, DeFi reshaped the crypto financial world through decentralized platforms and smart contracts. Now, crypto AI is changing the operation of the crypto market in a more intelligent and automated way. Currently, both fields share similarities in cultural influence, technological foundation, entry barriers, and capital efficiency.

Meme Culture

As one of the core narratives of the last crypto bull market, DeFi embodies a spirit of rebellion against traditional finance. Many DeFi projects attract attention through humorous and parody naming conventions (such as various food series) while providing genuine financial functions. Initially, the market even regarded DeFi more as a liquidity game rather than purely financial tools, but this culture of breaking the "seriousness" of traditional finance unexpectedly sparked reflection and discussion about the traditional financial system, quickly accumulating a large number of developers and user participation.

Similar to the meme culture in early DeFi narratives, the popularity of crypto AI also leverages the cultural power of MEME. The rise of AI Agents relies not only on technological innovation and application value but also on quickly gathering sentiment through humorous and playful MEME formats, thereby stimulating interest and participation from on-chain users, including attracting new groups such as external developers and researchers in a more relaxed and interactive manner.

Technological Foundation

With support in smart contracts, token standards, and developer ecosystems, Ethereum's flexibility provides a strong technological foundation for the rise of DeFi, allowing developers to innovate financial products based on demand. Its decentralized and open-source mechanisms also offer users a fair and transparent financial platform.

The rise and popularity of the current crypto AI narrative also began with explosive advancements in AI technology, particularly the emergence of large language models (such as ChatGPT), which revealed the immense potential of combining artificial intelligence technology with blockchain. At the same time, the rapid enhancement of AI large model capabilities has empowered more intelligent on-chain applications, such as trading strategies, market predictions, smart contract automation, and data analysis, providing new perspectives and momentum for innovation in crypto technology.

Entry Barriers

Compared to traditional financial systems that require complex procedures, bank accounts, and credit reviews, DeFi offers a way to provide financial services that are open, transparent, and do not require intermediaries through blockchain and smart contracts. Users can freely engage in lending, trading, and liquidity provision activities with just a crypto wallet and a small amount of crypto assets, regardless of regional and economic backgrounds.

In contrast to traditional crypto tools and platforms, AI Agents provide a more intelligent and automated operation method, allowing users to easily get started without needing to deeply understand complex technical details or possess professional trading knowledge and experience. Additionally, high-quality AI Agent projects break the high entry barriers of previous platforms like VC and centralized exchanges (CEX) through lower participation thresholds and convenient operational pathways, providing more opportunities for individual investors and opening up lower-cost and more decentralized innovation channels for developers and project parties.

Moreover, the combination of AI Agents with MEME culture has lowered the cognitive barriers for people regarding crypto AI technology, especially for users without a technical background, breaking the high barrier image of technical projects and making participation in this field more diverse, relaxed, and entertaining.

Capital Efficiency

In the DeFi narrative, capital efficiency has always been one of the core driving forces. DeFi significantly improves capital utilization efficiency through decentralized platforms, utilizing smart contracts and automated mechanisms. These platforms attract a large amount of institutional capital and retail users into the market by offering high APY and capital returns. Without the need for intermediaries and traditional banking processes, capital can flow in a shorter time and achieve higher returns, greatly enhancing the capital efficiency of the market.

AI Agents, through the automation and intelligent processing of artificial intelligence technology, can help users achieve more efficient capital operations in the crypto market. Unlike traditional manual intervention methods, AI Agents can automate tasks such as trading, asset management, and risk control based on real-time market data, helping users seize market opportunities and avoid emotional decision-making and human errors, thereby significantly improving capital operation efficiency. Furthermore, AI Agent projects provide more users with opportunities for profit redistribution through on-chain execution mechanisms, allowing participants to enjoy the growth dividends of projects with low entry barriers.

Four Key Differences from Technology-Driven to User Participation

Although DeFi and crypto AI exhibit similar dynamics and potential in driving innovation in the crypto market, they have significant differences on multiple key levels. These differences are reflected not only in the complexity of technology and the breadth of application scenarios but also in the different ways market driving forces and user participation manifest.

Application Scope

The main focus of DeFi is on on-chain finance, with innovations primarily concentrated on the construction of financial tools such as decentralized exchanges (DEX), automated market makers (AMM), and lending protocols. While these innovations have disrupted traditional financial systems, their application scenarios are relatively concentrated and clear. In contrast, the application scope of crypto AI is much broader, involving multiple fields such as on-chain finance, AI-generated content (AIGC), NFTs, smart contract automation, and data analysis. Although the complexity of technological integration in crypto AI is higher, it also allows for addressing a wider range of market and user needs. In the future, the technological development of large AI models will drive more cross-domain innovations and applications.

Technological Driving Force

The technological innovation of DeFi is primarily based on blockchain and smart contracts, driving the innovation of decentralized financial ecosystems. Its core motivation comes from decentralized trading, permissionless financial innovation, and the automatic execution of smart contracts. The narrative of crypto AI, on the other hand, has complex and diverse technological driving forces, ranging from trading strategies and risk management in the financial sector to content generation, personalized recommendations, and data analysis in broader application areas.

User Base

The main user group of DeFi consists of on-chain native users, who typically possess strong financial operation experience. In addition to attracting crypto natives, crypto AI can also engage a large number of users without technical backgrounds, including content creators, developers, and technical researchers, giving it a significant advantage in terms of popularity and market coverage.

Market Cap Driving Force

The market cap of DeFi projects is primarily determined by factors such as the amount of assets locked, listings on exchanges, and liquidity, relying more on the frequency of use of the platform's financial tools and the level of user participation, making market operations relatively direct and transparent. In contrast, the market cap logic of crypto AI projects is more complex and carries higher uncertainty; it not only depends on the depth and breadth of technological innovation but also needs to consider the ecological impact of the project and the development potential of actual application scenarios. This also means that the sustainability of the crypto AI narrative depends on the combination of technological advancement and user demand, presenting higher risks and potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。