Original Author: Murphy, On-chain Data Analyst

On-chain Data Evaluation Model - Altcoin Season

One day, while I was in class, Xiao Chi @FC_0X0 sent me a WeChat message saying: "There is a piece of data, which is the gap between the total inflow of stablecoins into exchanges and the dollar value of BTC withdrawn, that is, the remaining potential purchasing power may have a direct relationship with the volatility of altcoins. Can we use this logic to look at the timing of the altcoin season?"

Coincidentally, my presentation also mentioned data observations regarding the potential conditions for "capital outflow," which corresponded to the timing of certain large-cap altcoins. However, at that time, it was just a rough outline, and I vaguely thought of some previously overlooked areas…

After returning, I organized the data and, inspired by Xiao Chi's thoughts, re-conceived a set of visual indicators that can effectively judge the "altcoin season." Here are my thoughts:

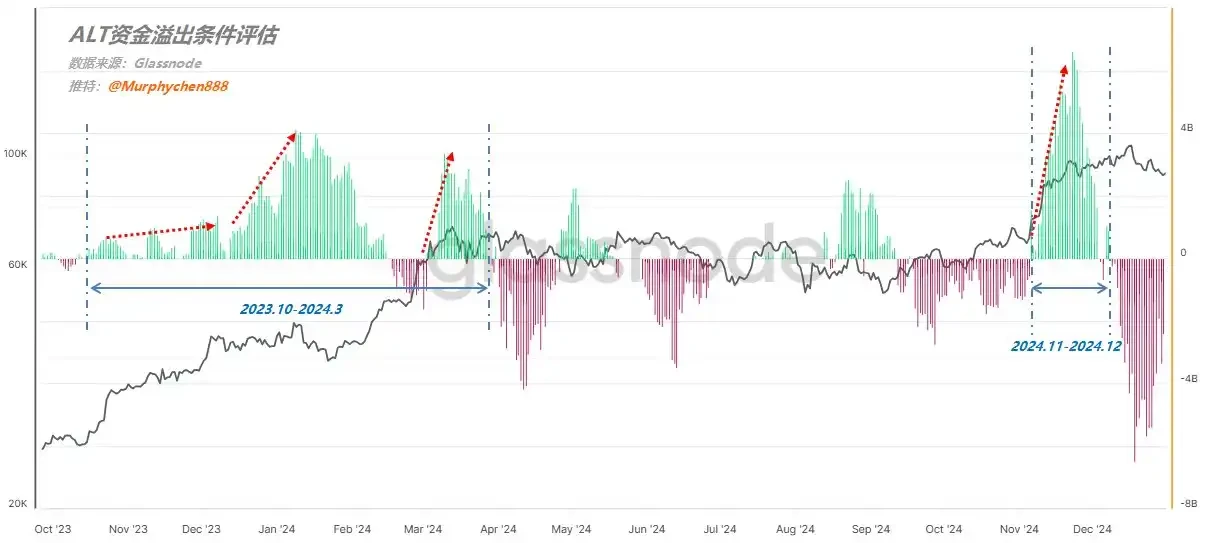

Altcoin Season Condition 1: Capital Outflow Condition Assessment

(Figure 1)

In Figure 1, the green indicates whether the total scale of stablecoins inflowing into exchanges within 30 days is greater than the dollar value of BTC withdrawn from exchanges. If so, it means that besides buying BTC, there is also the possibility of these funds spilling over into altcoins. The higher the green signal bar, the greater the theoretical outflow value, which means it has more preconditions for the start of the altcoin season.

From the data, it can be seen that during the periods of 2023.10-2024.3 and 2024.11-2024.12, the theoretical outflow value is the highest, indicating a greater possibility of generating an "altcoin season" during these two periods. Additionally, there is a small segment between August and September, but in terms of scale and duration, it is not as significant as the above two periods, thus having relatively weaker influence.

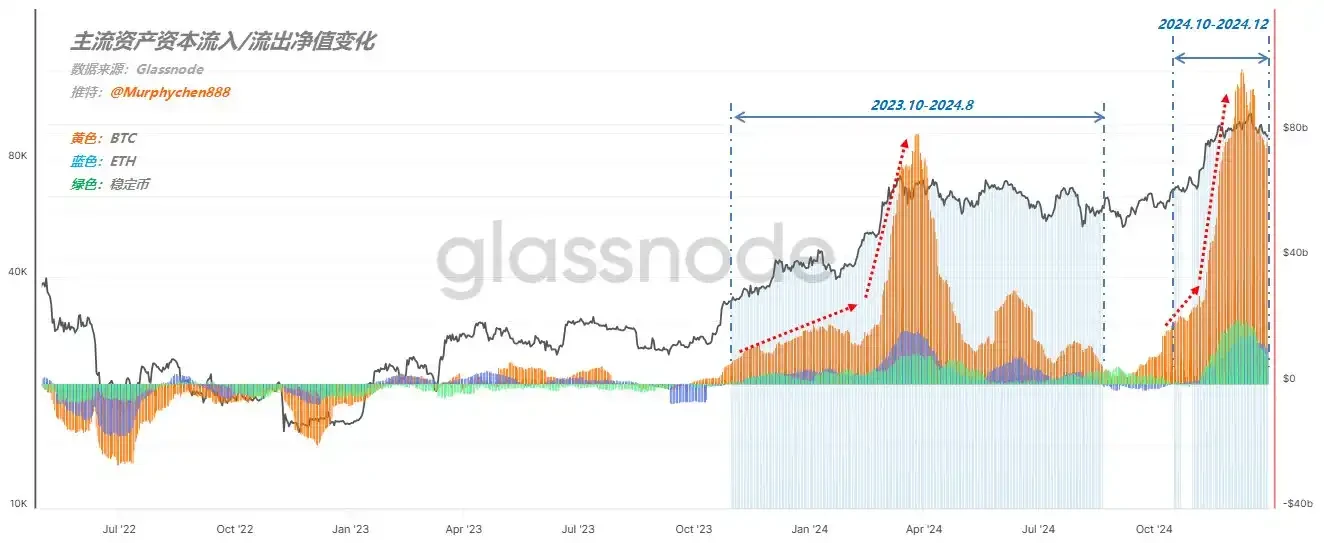

Altcoin Season Condition 2: Capital Inflow of Mainstream Assets

(Figure 2)

Historically, BTC often leads the overall sentiment in the crypto market, followed by market confidence flowing into other large-cap mainstream coins, and finally tilting further towards ALT. The tool to visualize this capital rotation is the 30-day change in the realized market cap of BTC and ETH, as well as the total supply of stablecoins (as shown in Figure 2). When all three major mainstream assets show net capital inflow, it indicates that market sentiment is starting to become exuberant, and overall risk appetite is rising, which is also one of the macro necessary conditions for the start of the altcoin season.

From the data, it can be seen that during the periods of 2023.10-2024.8 and 2024.10-2024.12, all three major mainstream assets simultaneously experienced net capital inflow, peaking in March and December 2024. This is also the time point of the highest FOMO in market sentiment so far in this cycle.

Altcoin Season Condition 3: Positive Momentum in Altcoin Market Cap Dispersal

(Figure 3)

The data basis for judging the start of the altcoin season also requires a third condition, which is to isolate positive momentum in the dispersion of total altcoin market cap. We need to look for periods when the total valuation of the 7D SMA within the altcoin range is greater than its 30D SMA total valuation. Because, this can represent that the valuation of altcoins is amplifying in the short term, and the liquidity flowing into altcoins is rapidly increasing.

In Figure 3, the red line represents the 7D average, and the blue line represents the 30D average; from the data, it can be seen that during the periods of 2023.10-2024.4 and 2024.11-2024.12, the red line crosses above the blue line, indicating that liquidity in the crypto space is starting to tilt towards altcoins, and the market cap of altcoins is entering a phase of positive momentum growth.

Summary

The above three conditions are considered from different angles: Condition 1 represents the possibility of capital outflow; Condition 2 represents overall sentiment and risk appetite; Condition 3 represents liquidity tilt. When all three are met, it is highly likely that the altcoin season is approaching.

Currently, Condition 2 is met, but Conditions 1 and 3 are not satisfied; thus, we can consider that the foundation for starting the altcoin season is present, but liquidity is still concentrated in mainstream assets (especially BTC), and there is not much outflow of funds into altcoins.

However, we can also see that the "negative outflow" in Condition 1 is slowly narrowing, which is a positive signal. Although friends may have to be patient for the anticipated altcoin season, what is meant to come will eventually arrive.

The content shared in this article is for communication and research purposes only and should not be considered as investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。