Content & Review | Ethereum Chinese Weekly

Organization & Editing | Connie

Image Source: Internet

"Ethereum Chinese Weekly"

——Building an Information Bridge for Chinese Ethereum

Introduction to "Ethereum Chinese Weekly"

Every Monday at 2 PM (UTC+8), the Ethereum Chinese Weekly invites well-known project engineers, KOLs, and others from the Web3 industry to share insights on Ethereum industry topics, interpretations of reports from renowned institutions, analyses of new projects, and highlights of current trends.

The "Ethereum Chinese Weekly" (hereinafter referred to as "Weekly") gathers the exciting content from the "Ethereum Chinese Weekly Meeting," capturing the latest news and in-depth analyses, continuously delivering fresh and substantial content to you.

The Ethereum Chinese Weekly Meeting and the "Weekly" are jointly initiated by Web3BuidlerTech and ETHPanda, with support from communities like LXDAO.

Together with you, we are building an information bridge for Chinese Ethereum.

Ethereum Chinese Weekly Video

The exciting content of this issue can be accessed via the following link, or click the original text:

YouTube:

https://youtu.be/CAMw8YkqZEc

Materials for this issue:

https://www.notion.so/web3buidler/Web3BuidlerTech-702bd1ab80a7422586f1edac1917fa9c

Table of Contents

This issue of the "Weekly" consists of 2 parts, taking about 10 minutes to read.

- Overview of Industry Information from Last Week

Blockchain News

Data Trends

- In-Depth Content Analysis

Ethereum Pectra Upgrade Content Finalized

Review of 5 Important Developments in Ethereum for 2024

15 Key Insights on AI Agents Revealed by the Founder of ai16z

CoinGecko Releases: 2024 Cryptocurrency Narrative Popularity Rankings

Kyle Reviews His 2024 Cryptocurrency Market Predictions and Offers Predictions for Next Year

Overview of Industry Information from Last Week

(December 23 to December 29)

Blockchain News

- On December 23, Lido released the Lido Ethereum SDK—a TypeScript library that seamlessly integrates Lido's staking features into your off-chain applications.

The Lido Ethereum SDK is a production-grade toolkit for building Lido off-chain integrations (such as widgets, wallets, etc.) on the Ethereum protocol. It provides a set of tools, pre-built methods, and clear documentation to help users seamlessly integrate Lido's staking features into their projects.

The Lido Ethereum SDK is a core pillar of the Lido staking widget interface, used daily by thousands of stakers.

Learn more:

https://x.com/LidoFinance/status/1871111843176960167

- The DEX project Sushi announced the launch of Sonic Labs, which will provide users with token swapping capabilities and liquidity for v2 and v3 pools on Sonic.

Learn more:

https://www.sushi.com/blog/sushi-is-live-on-sonic

- Aave is considering integrating a new Chainlink oracle aimed at redistributing profits from front-running trades back to users of DeFi protocols.

On December 23, decentralized oracle provider Chainlink launched Smart Value Recovery (SVR), an oracle service specifically designed to extract profits from Maximal Extractable Value (MEV) for the benefit of DeFi protocols.

On the same day, Aave proposed to integrate SVR, "to reclaim MEV from Aave liquidations and return it to the Aave ecosystem." Aave estimates that SVR could capture about 40% of MEV profits, which could be redistributed to AaveDAO for the benefit of users.

Learn more:

https://cointelegraph.com/news/aave-mulls-chainlink-integration-return-mev-fees

- According to the PolkaWorld weekly report, Gavin Wood recently released a 2024 annual summary, stating that 2023/2024 is a watershed moment for Polkadot, with a significant shift in its core objectives.

Technically, many significant advancements are proposed and implemented in 2024; ecologically, projects represented by Mythical Game are pushing Polkadot's performance to its limits;

Additionally, Gavin proposed Proof-of-Personhood, a mechanism set to be rolled out in 2025, aimed at addressing the threats posed by generative AI to the free world.

Key advancements planned for Polkadot in 2025 include: Web3 gaming; Polkadot Hub; extreme performance testing; Proof of Personhood: an innovative verification method; on-chain payments and stablecoin solutions, etc.

Learn more:

https://mp.weixin.qq.com/s/C6np1DeUgBcEussSHtLmNw

Data Trends

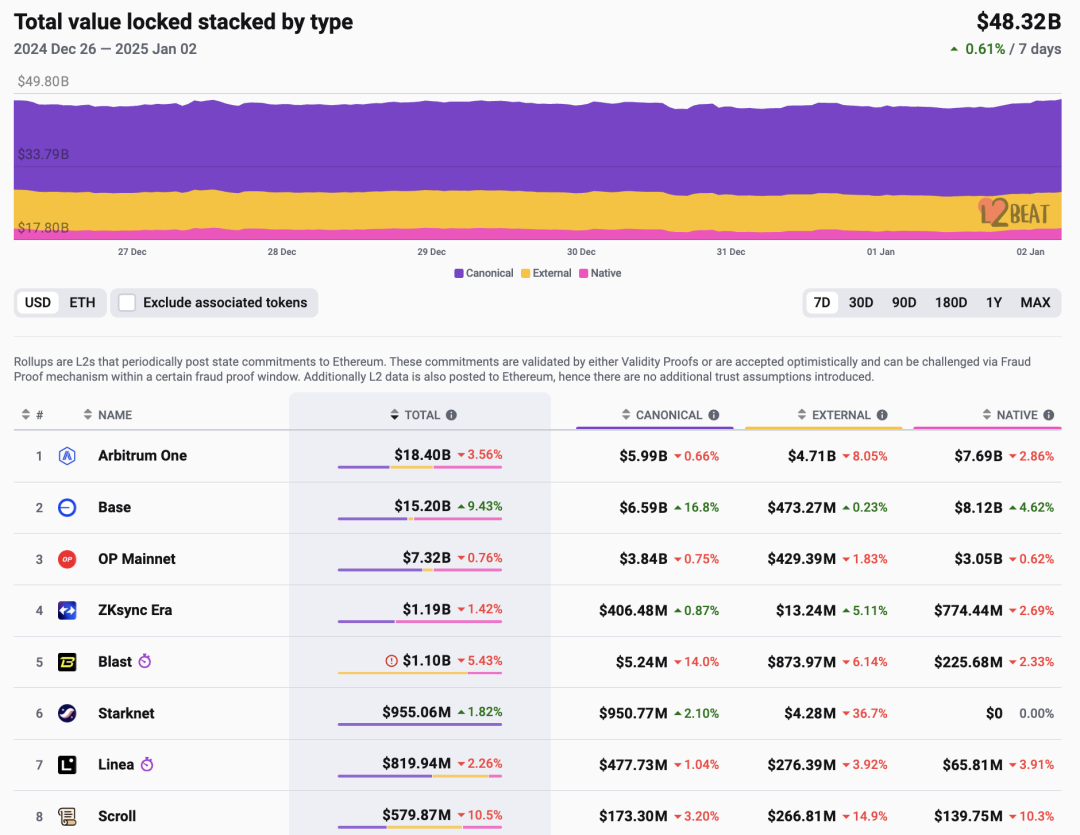

- L2BEAT Data (as of January 2, 2025):

Learn more:

https://l2beat.com/scaling/tvl

- Base's transaction volume maintained strong momentum throughout the fourth quarter, processing over 8 million transactions per day. Since March, the network has seen steady growth, with daily transactions increasing from about 500,000 to over 7.5 million in December. Additionally, Base's network TVL has grown to over $3.5 billion. The number of daily active addresses on the Base network has increased more than 40 times year-to-date.

Learn more:

https://www.theblock.co/post/332222/bases-transaction-count-maintains-momentum-through-q4?utm_source=twitter&utm_medium=social

- According to the official report from BNB Chain, the ecosystem saw significant growth in 2024, with total locked value (TVL) increasing by 58.2% year-on-year, from $3.5 billion at the beginning of the year to $5.5 billion by year-end, and the number of unique addresses increasing by 17.7% to 486 million.

opBNB's daily active users (DAU) reached 4.7 million, while BSC had 1.12 million. Additionally, opBNB's daily transaction volume reached 7.1 million, and BSC had 4 million, both showing significant year-on-year growth, with transaction fees remaining competitive at $0.001 and $0.03, respectively.

In terms of security, financial losses due to vulnerabilities on BNB Chain decreased by 67% in 2024, from $162 million in 2023 to $53 million, with the number of incidents dropping by 66%, from 416 to 138.

Learn more:

https://www.bnbchain.org/en/blog/2024-annual-report-on-bnb-chain

- PancakeSwap reported in a summary of DEX platform year-on-year performance that its global trading volume reached $310.6 billion in 2024. The protocol achieved this milestone across nine blockchains, representing a year-on-year increase of 179%. PancakeSwap's total trading volume in 2023 was $111.3 billion. According to PancakeSwap, the significant growth in its trading volume over the past 12 months was primarily driven by L2 networks Arbitrum and Base.

Learn more:

https://crypto.news/pancakeswap-hit-310b-in-trading-volume-up-179-yoy/

- According to the latest report from on-chain security company Cyvers, losses from cryptocurrency hacks in 2024 reached $2.3 billion, a 40% increase from 2023. The data shows that there were a total of 165 attack incidents throughout the year, with access control vulnerabilities causing losses of up to $1.9 billion, accounting for 81% of total losses;

Smart contract vulnerabilities caused losses of $456 million, while address fraud attacks resulted in approximately $68.7 million in losses.

Cyvers CEO Deddy Lavid stated that private key management vulnerabilities in centralized exchanges and cryptocurrency custodians are the main sources of risk, warning that North Korean hackers may target Bitcoin ETFs in 2025.

Learn more:

https://cointelegraph.com/news/crypto-hackers-2024-record-2-3-b-thefts

- According to the annual "Web3 Security Report" by blockchain security company Hacken, losses in the DeFi sector due to security incidents decreased by 40% from 2023 to 2024, thanks to protocol improvements, enhanced bridging, and more advanced encryption measures.

Meanwhile, as CEXs became primary targets for access control vulnerabilities and other significant security risks, CeFi security incidents more than doubled, with losses rising to $694 million.

The report indicates that financial losses in DeFi significantly decreased in 2024, dropping from $787 million in 2023 to $474 million this year. Losses related to bridging security incidents plummeted from $338 million in 2023 to $114 million in 2024.

Despite improvements in DeFi, such as multi-party computation and zero-knowledge proofs, challenges remain. In fact, access control vulnerabilities account for nearly half of all DeFi losses, including the $55 million hack of Radiant Capital.

Learn more:

https://cointelegraph.com/news/defi-security-improvements-vs-cefi-losses-2024

In-Depth Content Analysis

Ethereum Pectra Upgrade Content Finalized

This article reviews the planning process of the Ethereum Pectra upgrade, which integrates core improvements such as BLS12-381 precompilation (EIP-2537), an increase in validator reward limits (EIP-7251), and on-chain historical data optimization (EIP-2935), focusing on performance optimization and decentralization. Although attempts to merge EOF and PeerDAS were postponed to future upgrades due to complexity, Pectra is the largest upgrade in Ethereum's history. The development team will continue to validate security and stability in the test network, laying the foundation for ecological expansion.

Learn more:

https://tim.mirror.xyz/emiQJfRCb5sdnY018t-CeFDIye_Ehn4mieXI6kn5aXA

Review of 5 Important Developments in Ethereum for 2024

2024 is a milestone year for Ethereum. @VivekVentures tweeted that five major developments are noteworthy: Trump will use ETH as a store of value and launch Ethereum-based applications; ETH ETFs attract $3.5 billion in inflows, becoming one of the most successful ETFs; Deutsche Bank launches an Ethereum-based L2, achieving the first deep integration of traditional finance with public chains; Ethereum achieves secure and efficient scaling through L2 (Base demonstrates the sustainability of low-fee L2 scaling, while high-value assets remain on L1); the SEC withdraws its lawsuit against ETH, marking a new phase of positive development for Ethereum. These achievements solidify Ethereum's core position in the crypto ecosystem and pave the way for further breakthroughs in 2025.

Learn more:

https://x.com/VivekVentures/status/1871999295156887572

15 Key Insights on AI Agents Revealed by the Founder of ai16z

Shaw, a pioneer in the AI Agent space, founded ai16z and the Eliza framework, deeply integrating it with cryptocurrency and Web3 technologies. During his trip to Shanghai, he shared insights and market analysis on AI Agents with the community, covering various innovative projects and practical application cases, such as the Eliza framework supporting game interactions, the decentralized investment tool Marc AIndreessen, and the promotion of AI Agent payment integration and applications on the social media platform Farcaster. He pointed out that AI Agents have become one of the hottest narratives in the crypto industry, with greater potential in social media, virtual real estate, and decentralized governance, especially "collective AI Agents" that may lead new trends. However, ai16z faces the challenge of improving token economics models to match market value with actual project value while needing to find a balance between technological innovation and market hype. Shaw emphasized that the development of AI Agents relies not only on technological and product innovation but also on community-driven efforts and adherence to decentralization principles.

Learn more:

https://foresightnews.pro/article/detail/74896

Related Expansion: Comparative Analysis of G.A.M.E and ElizaOS—What Are Their Areas of Expertise?

https://x.com/jlwhoo7/status/1871191535188107336

CoinGecko Releases: 2024 Cryptocurrency Narrative Popularity Rankings

In 2024, the cryptocurrency industry narrative is dominated by meme coins and artificial intelligence (AI), attracting 30.67% and 15.67% of investor attention, respectively. Meme coins, represented by Solana and Base, have frequently entered the trending lists; the AI narrative focuses on the overall development of AI, AI meme coins, and AI agents. Additionally, RWA (real-world assets) and DePIN (decentralized physical infrastructure networks) are gaining traction as emerging focal points. In the blockchain ecosystem narrative, Solana and Base stand out, while Ethereum, Sui, and TON ecosystems also receive significant attention, reflecting a trend that balances speculation with technological innovation.

Learn more:

https://www.coingecko.com/research/publications/most-popular-blockchain-ecosystems?utm_campaign=Data Visualization&utm_source=x&utm_medium=social

Chinese Translation:

https://news.marsbit.co/20241224171515275779.html

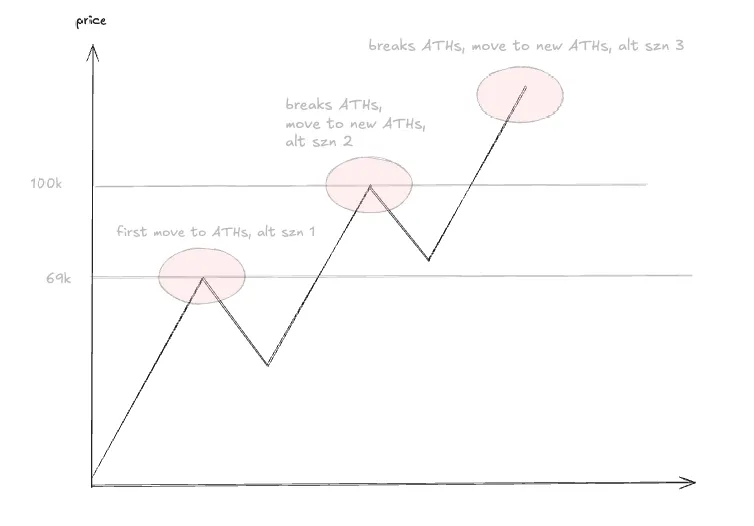

Kyle Reviews His 2024 Cryptocurrency Market Predictions and Offers Predictions for Next Year

This article reviews the author's predictions for the 2024 cryptocurrency market and actual performance, summarizing the successes and failures of key narratives and investment strategies while looking ahead to market trends in 2025. In the Ethereum space, it continues to solidify its industry position through technological innovation and ecological development, including growth in DeFi and L2 expansion, as well as integration with traditional financial institutions. Looking ahead to 2025, the author believes Ethereum will further benefit from clearer regulations and the introduction of institutional products (such as yield ETFs), enhancing its appeal as a mainstream asset. Meanwhile, the success of L2 expansion will continue to drive low-cost, high-efficiency trading experiences. DeFi, NFTs, and related tokens within the Ethereum ecosystem may become key investment themes, but investors need to pay attention to market tops and narrative turning points, maintaining flexibility. As a representative of innovation and decentralization, Ethereum's long-term potential should not be overlooked.

Learn more:

https://0xkyle.substack.com/p/the-2025-gameplan

Related Expansion: Delphi Digital's Views on the Development of Stablecoins in 2025

https://x.com/robbiepetersen_/status/1869807770406375765

This concludes the content of this issue of the Ethereum Chinese Weekly. Thank you for reading!

Next Monday at 2 PM (UTC + 8), we look forward to sharing the new issue with you! (Joining method at the end)

Image source: Internet, please delete if infringing.

Co-initiating Communities

Supporting Communities

LXDAO is a research DAO focused on sustainably supporting valuable Web3 public goods and open-source projects.

Join Us

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。