Master Discusses Hot Topics:

In the past few days, with New Year's Day and the U.S. stock market closed, the market has been quite calm. As Master mentioned before, the market continues to follow its predetermined trajectory, with no sudden fluctuations.

With the pricing power of Bitcoin being handed over to the U.S., we retail investors in the crypto space are slowly adapting to the rhythm of U.S. holidays, living a laid-back life during Christmas and New Year's.

Currently, Bitcoin is still oscillating within the current range, even though tonight is a working day and the U.S. stock market is open. However, Master personally senses that there won't be any major movements; during this low liquidity period, we haven't seen any wild fluctuations, allowing everyone to pass through this week steadily.

As for next week, with more institutions and investors returning to work, market liquidity will gradually recover. At that time, as Master mentioned in yesterday's article, the market will start preparing for Trump's transition in two weeks.

Next week, there may also be more information flowing out, so friends engaged in short-term and medium-to-long-term trading need to pay close attention. So far, Master’s view remains unchanged: it’s possible to be bearish, but don’t short easily. Because if a certain piece of news suddenly emerges next week, it could change the entire market trend.

Returning to the data aspect, trading volume remains very low, but turnover is still active. In recent days, the turnover has mainly been driven by those investors who are at a loss reducing their holdings, while those who recently bought the dip are trading frequently.

At the same time, support levels are changing. Master previously mentioned that although it is a short-term chip, the support level may be adjusted down to 92k to 88k. If this situation continues next week, the support level may be further lowered, so we will observe for a while and not make adjustments for now.

Now, let's talk about the data of the Ethereum spot ETF in the past few days; the overall performance is still good. However, due to the outflow from Grayscale and the lack of inflow from BlackRock over the past two days, it ultimately relied on Fidelity's funding support to avoid a net outflow situation.

Although Ethereum's price is often criticized and questioned, buying sentiment has remained strong, mainly due to the lack of a breakout opportunity. This opportunity, besides a general rise in sentiment, may focus on the staking of real assets or Ethereum spot ETFs.

Looking back at 2024, Ethereum's spot ETF has gone through quite a few ups and downs. Although the approval of the Bitcoin ETF triggered a surge in Ethereum, increased regulation led to a decline in market sentiment, with the highest approval rate expectation being less than 20%.

It wasn't until November that a turning point began to appear, with BlackRock and Fidelity becoming the main buyers, and Ethereum finally started to see net inflows. By the last day of 2024, the holdings of U.S. ETFs had increased by about 560,000 Ethereum.

The three ETFs in Hong Kong also increased their holdings by 5,832 Ethereum, indicating a market optimism towards Ethereum's future, especially after Trump's transition, where the capital preference for compliant cryptocurrencies is gradually rising, making Ethereum's prospects even more promising. For now, everyone just needs to be patient and wait to see Bitcoin and Ethereum reach new ATHs again!

Master Looks at Trends:

Resistance Level Reference:

First Resistance Level: 95800

Second Resistance Level: 95400

Support Level Reference:

First Support Level: 94600

Second Support Level: 94100

Today's Suggestions:

Currently, Bitcoin has risen to 95K. If it oscillates between 94.8K and 95K in the short term, we can expect further rebounds. The high and low points of the previously formed bearish flag pattern have been established, and these areas can be used as important support and resistance levels for reference.

Currently, around 95.4K is the area where the highs and lows of the past bearish flag pattern overlap, which is an important resistance level that must be broken to continue the upward trend. If the psychological support level of 95K is broken, it does not necessarily mean an immediate shift to a bearish outlook. Instead, we can look for ultra-short-term entry opportunities in the range of 94.5K to 94.6K. At the same time, we can pay attention to the movement of the 20-day moving average.

Currently, the 20-day, 60-day, and 120-day moving averages have formed a positive arrangement. During the adjustment phase, these three moving averages can serve as support levels, allowing for gradual buying. (Aggressive entry - near the 20-day moving average) (Conservative entry - near the 60-day and 120-day moving averages)

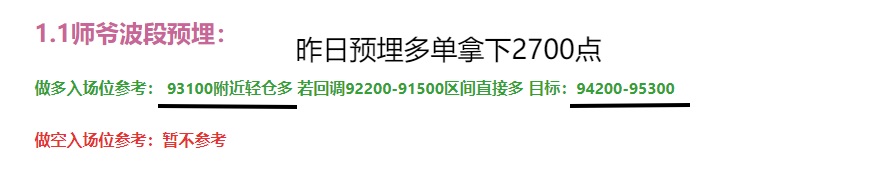

1.2 Master’s Wave Strategy:

Long Entry Reference: Light long near 94100; if it retraces to around 93200, go long directly. Target: 95000-95400-95800

Short Entry Reference: Light short in the range of 95800-96500; if it rebounds near 97500, go short directly. Target: 94600-94100

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official public account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。