On December 16th at 16:00, the AICoin editor conducted a graphic and text sharing session on the "Fibonacci Measurement Method." Below is a summary of the live broadcast content.

In this session, the research institute will continue to focus on market trends, tools for profit, bottom-fishing during price increases, and the strongest auxiliary indicator: Fibonacci!

1. Assignments

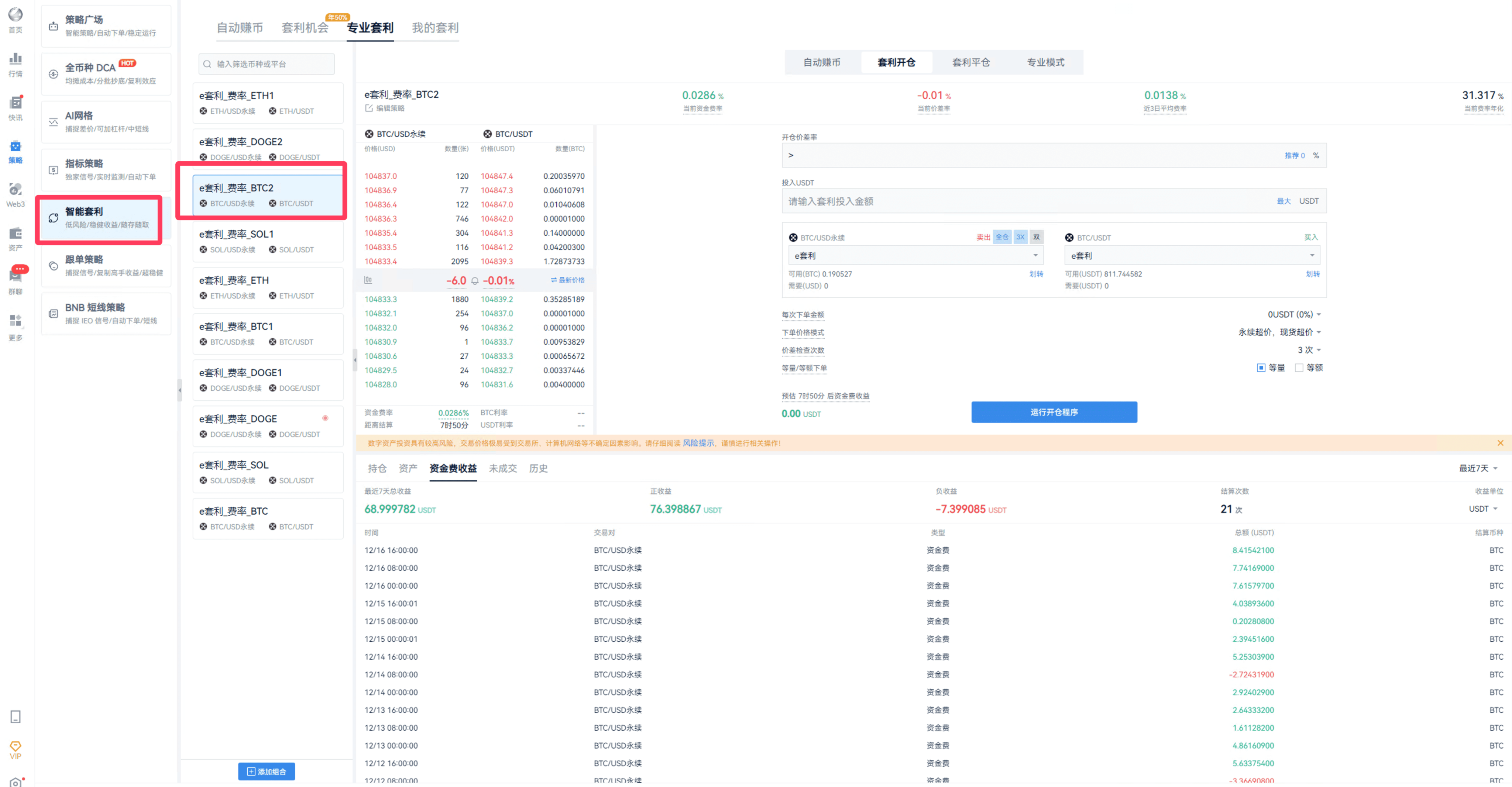

First, the host assigned last week's homework: arbitrage and AI grid, along with the corresponding grid parameters.

1. Arbitrage

The host's 30,000 U funds this week continue to be placed in the arbitrage sector.

This week's arbitrage positive funding rate still accounts for the majority, so the host's earnings continue to rise.

If you have large funds, you can continue to pay attention to the arbitrage sector, as the positive returns from arbitrage are evident.

Cross-exchange arbitrage can also be played, but currently, the price difference between exchanges is not very large, making it difficult to earn. If you have good opportunities, feel free to share them on the AICoin forum!

The host recommends that everyone study funding fee arbitrage and inter-period arbitrage. Those with the conditions can also explore on-chain and off-chain arbitrage!

2. AI Grid

The host previously mentioned that after breaking through 100,000, the grid was adjusted to between 96,000 and 106,000.

It has been running for 20 days now; let's see the results.

This AI grid is also very high-frequency, and the profit curve is steadily rising.

The AI grid is also worth getting your idle money moving!

Of course, the two assignments mentioned above are test funds, aimed at exploring for everyone in the live broadcast room!

3. Summary

First test fund: 30,000 U, running arbitrage, funding fee arbitrage.

Second test fund: 700 U, running AI grid.

Both assignments are currently performing well, having helped students explore these two tools, both of which can make money.

If the second AI grid breaks, the host will adjust the grid's upper and lower limits again and will continue to guide everyone, giving assignments.

Currently, it is highly recommended that everyone use the PC client’s arbitrage sector and AI grid!

From the host's fund allocation, it can also be seen that the arbitrage sector is more suitable for large funds, providing stable profits and ensuring the stability and growth of one's funds. The grid tool shows more obvious returns but requires more effort to study the grid; adjustments are needed if it breaks. Both are excellent tools for making profits!

2. Fibonacci

Does everyone know about Fibonacci?

Let's start with a definition: What is Fibonacci?

The Fibonacci sequence, also known as the golden ratio sequence, was introduced by the mathematician Leonardo Fibonacci using rabbit reproduction as an example, hence it is also called the "rabbit sequence." It refers to the following sequence: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, ….

In the investment world, Fibonacci is considered mystical because of the wonders of nature—everything has intricate relationships with the golden ratio.

For Fibonacci tools, we only need to remember these numbers to use the Fibonacci tools effectively.

Common numbers: 0.236, 0.382, 0.5, 0.618, 0.786.

Key points: 0.382, 0.5, 0.618.

Do you know how to use Fibonacci retracement?

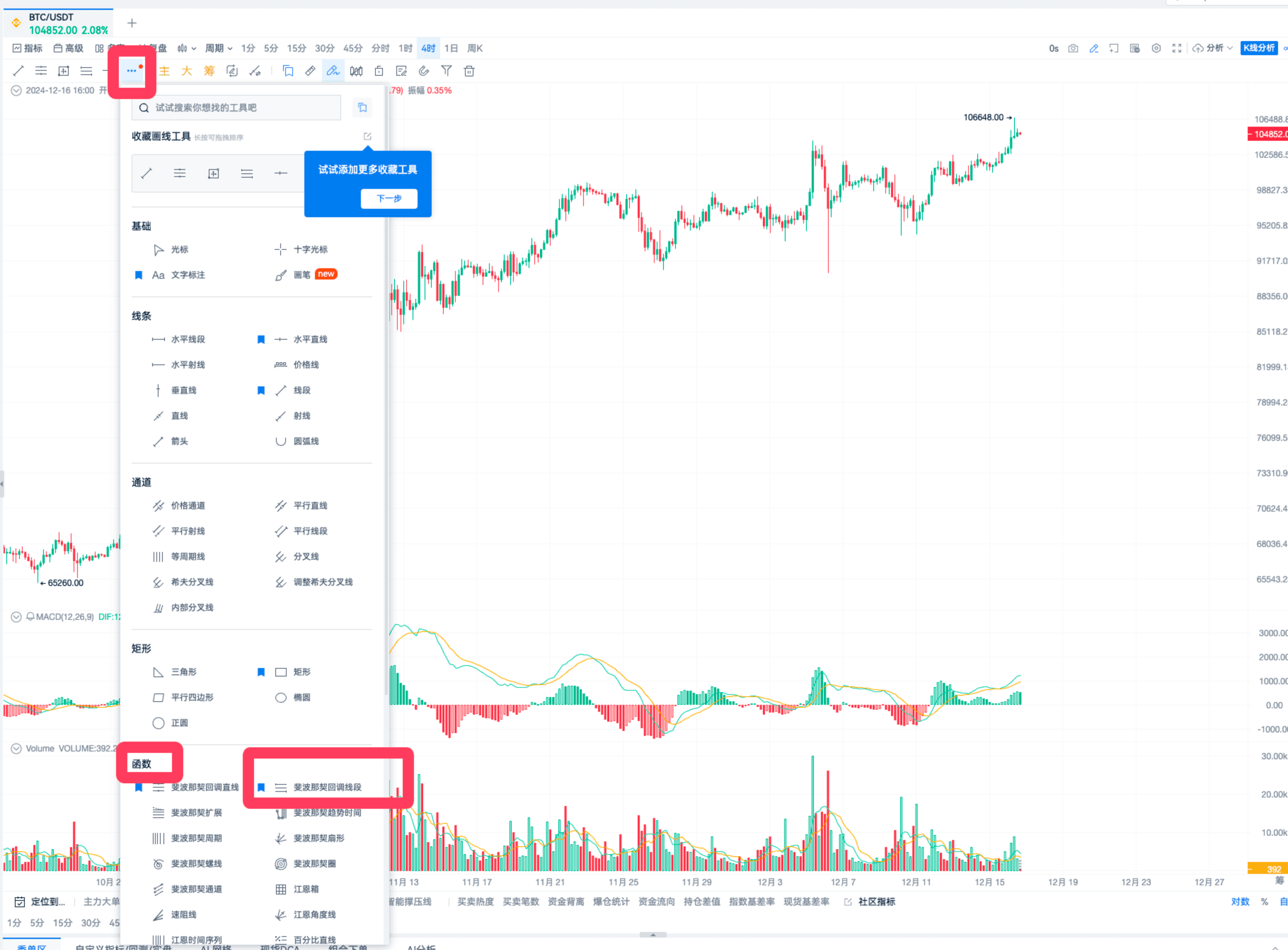

The Fibonacci indicator commonly used by the host is the Fibonacci retracement line segment.

To learn how to analyze market trends using Fibonacci, we first need to master its drawing method, which involves several steps.

First, find a segment of the market and determine the starting point; this starting point can be dynamic.

In simple terms: choose the highest and lowest points of a market segment and connect them!

Many students may ask how to choose high and low points.

There are techniques for this.

The technique here is: choose a trend from a larger cycle, then find the low and high points in the next lower cycle, and identify the retracement support levels. If there are signals at the corresponding key retracement support levels, such as 0.382, 0.5, or 0.618, then it is a good time to enter the market.

Additionally, there are two schools of thought regarding drawing: one that includes only the body of the candlestick and one that includes shadows; just stick to what you prefer. The host belongs to the shadow school.

Let's select a few market pairs and analyze them using Fibonacci together.

The Fibonacci drawing method: determine the trend, find highs and lows, connect the lines, seek support, wait for signals, enter the market - profit, freedom 👍.

Let's take a look at BTC's Fibonacci and see how we should draw it.

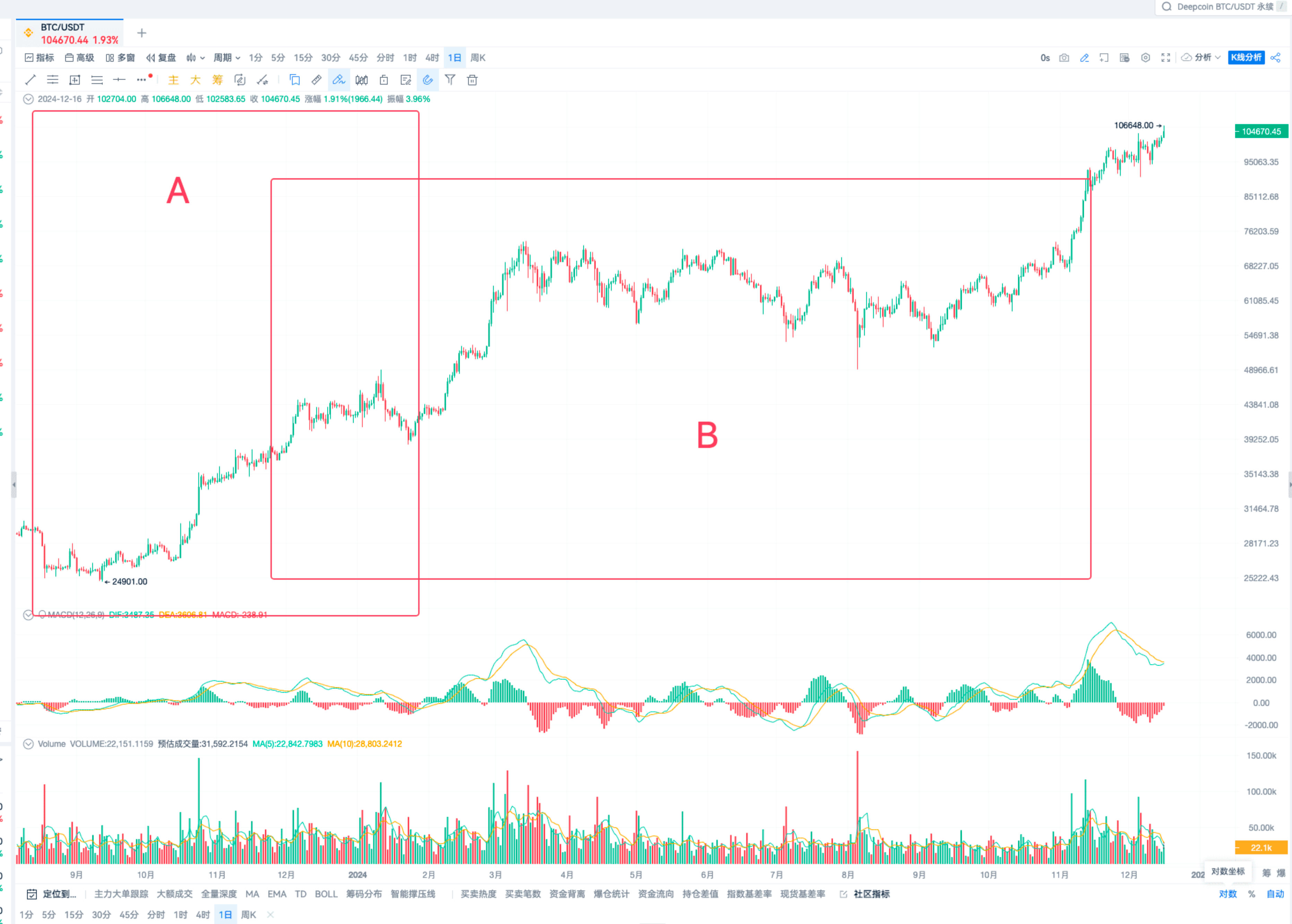

We start from the daily level, drawing from large to small, trying each cycle.

Everyone, open BTC's candlestick chart with me. Let's look at the weekly chart. What trend do you see?

If you are unsure about the price movement, you can refer to last Monday's live broadcast, which provided a good judgment indicator: the DIF line.

Around this time, we can confirm that the weekly chart is confirming an upward trend.

Because its DIF line crosses above the zero axis.

Since the larger level is a bullish trend, what should we do in its next lower level, which is the daily chart?

The answer is: we should connect the line from the low point to the high point, find the retracement support level, and enter long!

Especially during the early and mid-stage upward trends of the larger level.

There are actually many such opportunities in its next lower level.

Because prices do not move in a straight line, there will be many fluctuations in the next lower level. If we have Fibonacci tools to measure, we can pick up many quality price levels.

Let's return to the daily chart and find the highs and lows together.

From the daily perspective, we have two obvious areas.

Since the weekly chart established an upward trend in February 2023, these two segments in the daily chart are actually retracement fluctuations within the upward trend.

Now, let's directly find the corresponding highs and lows.

Let's first look at Area A on the daily chart.

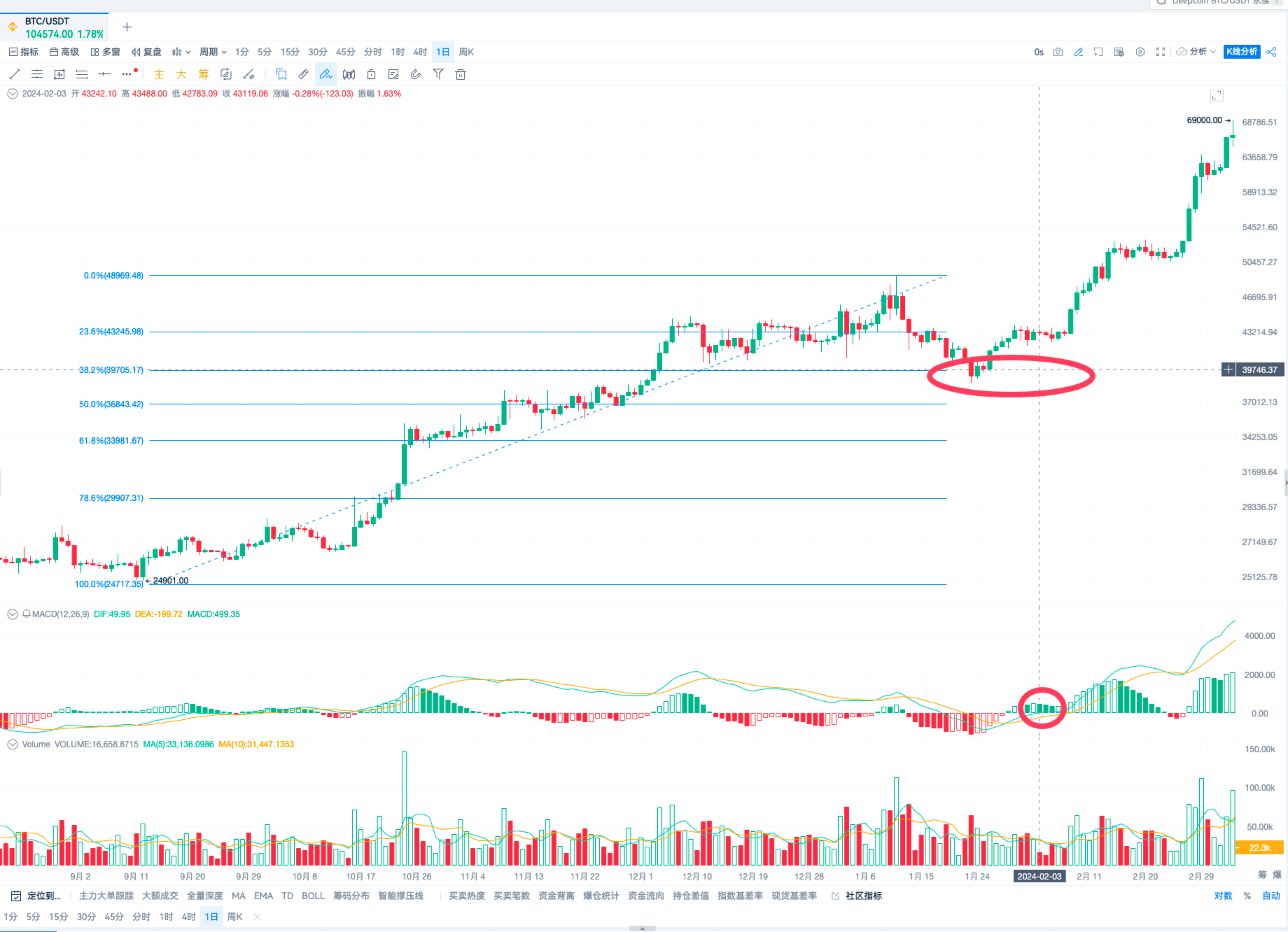

Let's assume today is January 15, 2024.

At this time, we see that the daily chart is in a retracement.

Note: When drawing during the drawing cycle, it must be during a retracement; otherwise, the Fibonacci retracement line drawn will be ineffective.

Let's connect this.

This way, we have drawn the retracement line segment.

After a while, the daily DIF line broke through the zero axis.

Here is near the 0.382 support level, a good entry point!

Some students may ask how to distinguish areas and how to identify retracements.

You can set your own reasonable retracement standards, for example, after creating a new high in this segment, if it retraces 3 candlesticks.

This can also be tried for drawing.

Because it also created a new high and retraced.

Let's draw it and see.

Let's push the time forward to the first circle here.

The effect of connecting the lines.

It didn't return to 0.236 and continued to rise.

This drawing method is correct, but there are no trading opportunities. If it were given to the host, they would also miss the trading opportunity at the first circle.

Now let's look at the second high point.

The price reaches here, which also meets the criteria of creating a new high and retracing several candlesticks.

Moreover, there is a very good retracement point here: MACD shows divergence.

So its retracement is likely to be more significant.

Let's erase the previous drawing and create a new one.

Draw it well.

Now let's look at the effect, the subsequent effect.

Again, near 0.382, the DIF broke through the zero axis, a good point.

Here, the DIF is an example of a signal point.

In fact, there are many other signals, such as EMA, MACD divergence, TD…

This is the drawing method.

In the discussion area, some students asked, "Which position has stronger support?"

It is recommended to focus on: 0.5, 0.382, 0.618. In a bull market phase, 0.382 will be more prominent. Of course, 0.382 is a support level, but whether to enter also depends on the signals. The host has repeatedly mentioned in previous broadcasts that there should be clear signals near this support level.

Fibonacci is suitable for any cycle; it is a magical law of nature. It involves determining the trend in a larger cycle and finding points in the next lower level. Fibonacci expansion is used for profit-taking planning, which we can explain later.

It is recommended that everyone try drawing to analyze the market. If you don't understand, feel free to reach out to our editors for communication, or join as a pro member to learn from each other!

Conclusion: The Fibonacci retracement line segment is very suitable for analyzing retracement support levels. If signals appear near the support level, it is worth entering the market. Pay attention to the key Fibonacci levels: 0.382, 0.5, 0.618.

Drawing tips:

1) Include shadows.

2) Determine the bullish or bearish trend of the larger level (using the DIF line crossing the zero axis as a trend judgment).

3) For the next lower level trend, determine the low and high points, connect the line from low to high, and look for signals at key points.

That concludes all the content of the live broadcast!

Thank you all for your attention, and stay tuned to our live broadcast room.

In a bull market, let's explore the market together and find trading opportunities! Use AICoin well to earn a free life.

Recommended Reading

For more valuable live broadcast content, please follow AICoin's "AICoin - Leading Data Market, Intelligent Tool Platform" section, and feel free to download AICoin - Leading Data Market, Intelligent Tool Platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。