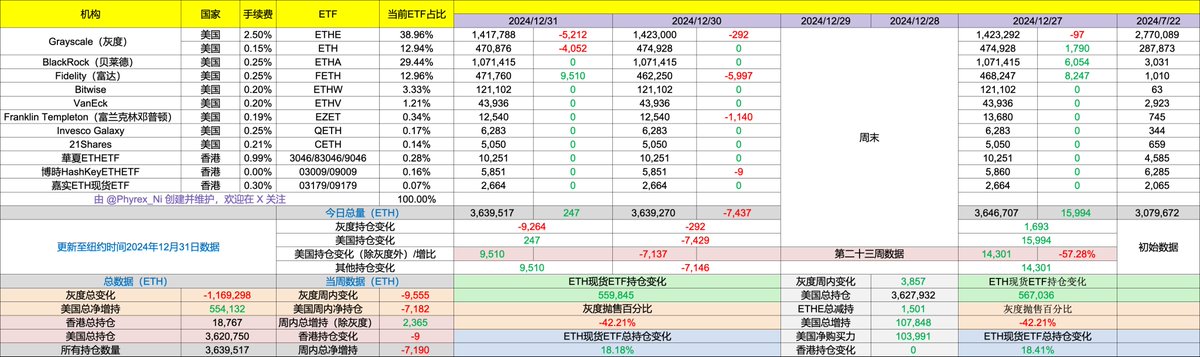

The data for the ETH spot ETF has come out relatively quickly, while there are too many institutions tracking BTC, so it is estimated to be available tomorrow. Yesterday was the last working day of 2024, and the ETH data is somewhat acceptable; it's not too good, for sure. The outflow from Grayscale after the market closed on Monday was included in yesterday's data, and BlackRock has not seen continued inflows for two consecutive days. The data from yesterday was mainly favorable due to Fidelity. If Fidelity hadn't bought over 9,500 #ETH, it would have ended the last day with a net outflow.

From a funding perspective, #BTC also saw a net inflow, but the net outflow from BlackRock over two working days was saved by Fidelity on the last day, allowing BTC and ETH to have a decent conclusion. Additionally, the amount of BTC and ETH purchased by Fidelity's investors is almost the same.

Therefore, we can see that although ETH's price has been criticized by many, the recent buying sentiment has been quite good. ETH still lacks a catalyst for a breakout. This opportunity, apart from a general rise in sentiment, either lies in RWA or in the staking of the ETH spot ETF.

Looking back at 2024, the ETH spot ETF has had its ups and downs. After BTC was approved, expectations for ETH were high, leading to its first surge. However, as time passed and the SEC tightened regulations on cryptocurrencies, more and more investors became pessimistic about the approval of the ETH spot ETF, with the lowest expected approval rate being less than 20%. It was only a week before the final date that the trend began to reverse, and after approval, it encountered a market downturn, causing ETH's price to lag behind.

From its debut on July 23 to today, it has been over five months, during which ETH experienced net outflows for more than four months in the ETF. Grayscale's $ETHE was the main seller, having sold nearly 1.2 million ETH by yesterday, accounting for 42% of the total. It wasn't until the end of November that ETH began to see net inflows, with BlackRock being the largest buyer, net purchasing 1,068,384 ETH, followed by Fidelity, which bought 470,750 ETH, while others were negligible.

On the last day of 2024, the total holdings of the U.S. spot ETF increased by nearly 560,000 ETH, and the three ETFs in Hong Kong also added 5,832 ETH during this period. Overall, there are indeed more investors optimistic about ETH's future development, especially with the new government taking office, compliant cryptocurrencies will be more favored by capital, given the lessons learned from BTC.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。