This article is really well written. I spent several hours reading it and went through it multiple times. There are no excessive conclusions or codes here, just pure data and papers. I highly recommend it for those doing research and exploring the correlation between macroeconomics and cryptocurrencies.

Excerpt:

"Due to the dynamism and stability of the cryptocurrency market, liquidity factors are particularly important in the cryptocurrency market. In a decentralized trading environment, it measures the ease of trading an asset without significant risk of price impact, using indicators such as token turnover or trading volume. High liquidity assets tend to have less volatility and are more attractive to investors, while illiquidity may offer higher return premiums but at the cost of greater price fluctuations and trading friction."

"The gap between different monetary policies. While performance in some cases aligns with the risk factors of cryptocurrencies and monetary policy regimes, in other cases, it deviates from expectations, highlighting unique dynamics. During periods of loose monetary policy, factors such as growth, momentum, and size show strong upward trends, coinciding with favorable liquidity conditions. However, the negative beta value during the downturn in 2018 indicates a continued sensitivity to downside beta risk even in a macroeconomic supportive environment. During periods of tight monetary policy, some factors decline or remain at lower levels due to reduced liquidity (liquidity and size or momentum and downside beta). However, indicators such as market, value, and growth continue to rise significantly, reflecting the resilience of a broader field independent of macro pressures on cryptocurrency adoption or speculative behavior. In a neutral regime, factors such as size and value exhibit contrasting behaviors, with value strengthening while size brings negative performance. These deviations emphasize the complexity of the digital asset market, where risk factors are influenced not only by monetary regimes but also by intrinsic factors."

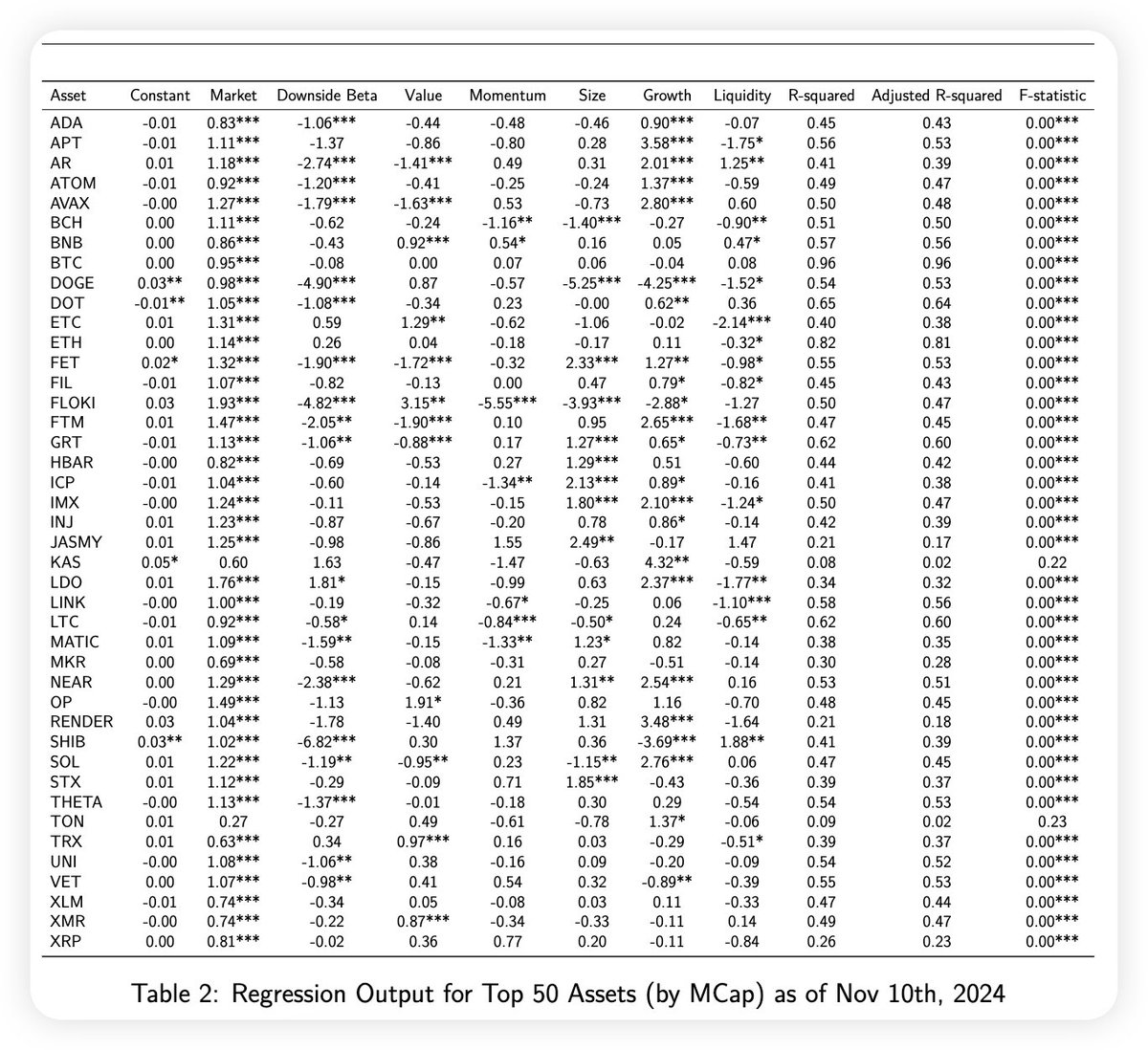

"Cryptocurrencies have increasingly become the focus of the financial world due to their rapid growth. This study aims to better understand the factors influencing their value and returns. To achieve this, we employed two effective financial models: the Fama-French and Fama-MacBeth models. Our analysis investigated seven different risk factors: market, size, value, momentum, growth, downside beta, and liquidity. The Fama-French model provides valuable insights into how these factors affect the returns of cryptocurrency assets or portfolios. However, the impact of these factors is not always the same as they change over time, reflecting the complexity and dynamism of the cryptocurrency market. This variability is part of what makes the digital asset market so interesting and challenging. On the other hand, the Fama-MacBeth model offers a dynamic perspective by analyzing how the cross-sectional risk premiums of cryptocurrencies evolve over time, reflecting the unpredictable and ever-changing nature of the market."

Original link: https://blog.cfbenchmarks.com/content/files/2024/12/A-Factor-Model-for-Digital-Assets---CF-Benchmarks.pdf

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。