“Change is inevitable; adapting to change is the key to success.”

—— Ray Dalio, Founder of Bridgewater Associates - "Principles"

After experiencing a significant increase of 117% in 2014, Bitcoin became the focus of global investors. Although the market is currently undergoing a short-term adjustment, from a long-term development perspective, Bitcoin is still expected to continue its upward trend in 2025, potentially reaching new historical highs. Below, we will elaborate on the current state and future prospects of the Bitcoin market from several dimensions!

As 2025 approaches, the Bitcoin market is showing a clear adjustment trend. The price of Bitcoin briefly fell below $92,000 at the end of December 2024, with a monthly decline of 4%, marking the worst monthly performance since 2021. This downward trend is primarily due to several factors: First, there is a noticeable pressure from profit-taking. After a 117% increase throughout the year, some retail investors and long-term holders chose to realize their profits at the end of the year, leading to significant selling pressure in the market; Second, there has been an outflow of funds from Bitcoin ETFs. From December 19 to December 31, there was a cumulative net outflow of over $1.5 billion; Additionally, the yield on 10-year U.S. Treasury bonds has continued to soar. With the strengthening of the dollar, this trend is expected to continue in the short term, adding pressure to the market.

Despite the short-term adjustment pressure in the market, there are still many positive factors for the Bitcoin market in the medium to long term in 2025:

Institutional investors, represented by MicroStrategy, continue to increase their holdings. In the last week of December 2024 alone, MicroStrategy added 2,138 Bitcoins, demonstrating the confidence of professional investors in the long-term value of Bitcoin.

According to a research report by Galaxy Research, it is expected that in 2025, five companies from the NASDAQ 100 index and five sovereign nations will announce the inclusion of Bitcoin in their balance sheets or sovereign wealth funds. This adoption at the institutional, corporate, and national levels will bring new demand dynamics for Bitcoin; on the policy front, the rise of the Trump administration and its friendly attitude towards cryptocurrencies will regulate the development of the crypto space, potentially leading it to become a mature financial system, which will be a positive signal for Bitcoin's development prospects; furthermore, mining companies are transitioning to high-performance computing. It is expected that more than half of the 20 largest publicly listed Bitcoin mining companies will announce partnerships with AI companies or large-scale computing enterprises by 2025. Based on these factors, Bitcoin is expected to undergo a historic transformation in 2025!

However, investors also need to be aware of related risk factors: the crypto market is highly volatile, with significant short-term price fluctuations, market sentiment affected by changes in regulatory policies, and uncertainties in the macroeconomic environment.

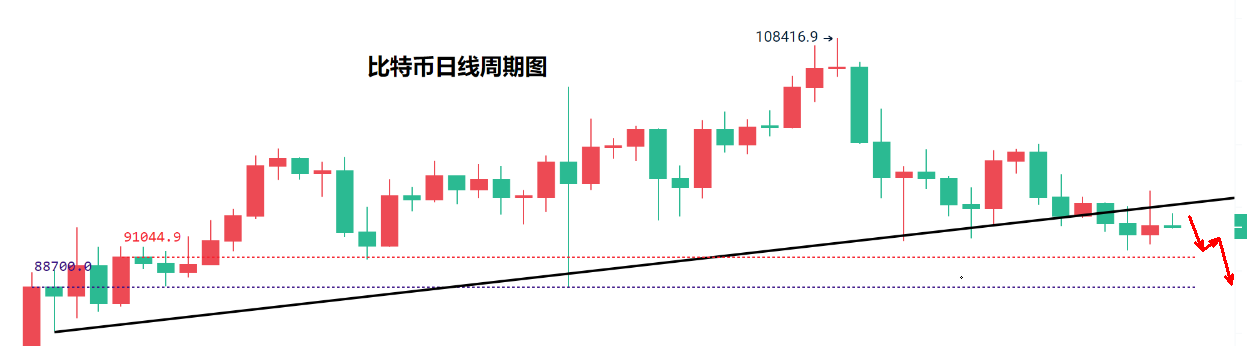

In terms of Bitcoin's technical analysis:

After a quick rebound following the opening of the U.S. stock market yesterday, Bitcoin faced pressure at the MA50, resulting in a "liquidation leverage" market. However, the daily close was at $93,600, still under pressure below the upward trend line, currently operating below the daily MA5, with the MACD indicator showing bearish momentum. Therefore, the short-term outlook remains weak, with resistance in the $93,700-$95,000 range above and support at $91,000-$88,700 below.

The above represents only the author's logic and views. Discussion and exchange are welcome. Creating content is not easy; please indicate the source if reprinted. Thank you for following the WeChat public account: Trader Sean

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。