Compiled by: Biscuit & Elvin, RootData

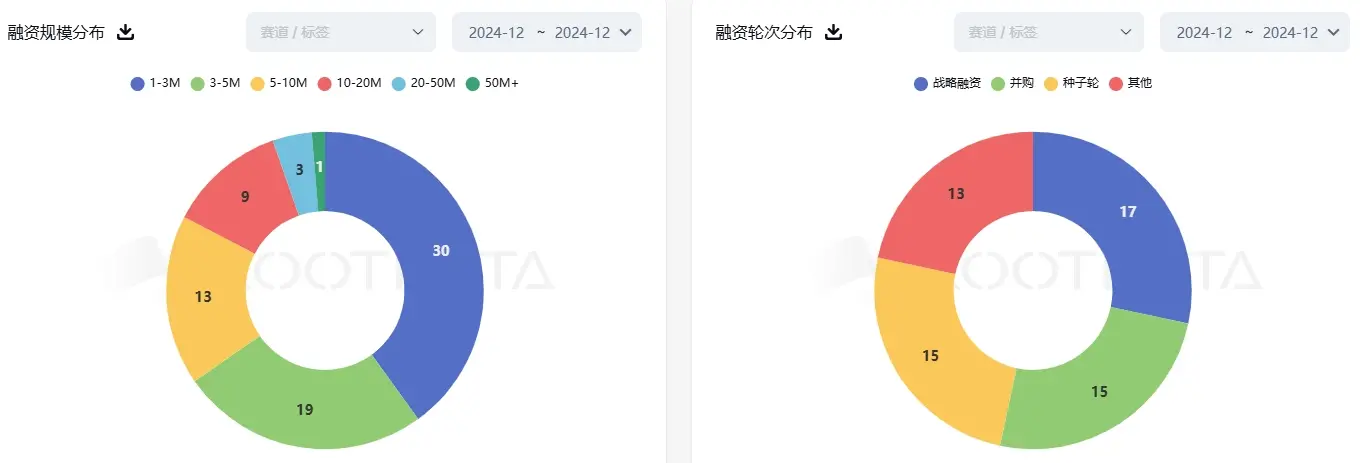

In December 2024, BTC reached a new high of $106,000, maintaining a high-level fluctuation between $92,000 and $100,000. The investment and financing data in the cryptocurrency sector showed signs of recovery, with total financing amounting to $741 million, a month-on-month increase of 62.8%. The number of financing events was 102, similar to the data from the previous two months. The average financing amount this month was $11.769 million, with a median financing amount of $4.1 million.

Trend of Financing in the Cryptocurrency Sector Over the Past Two Years

In this article, we will focus on specific financing data, active investors, trending projects, and other aspects to present the changing trends in the cryptocurrency market.

1. Financing Data

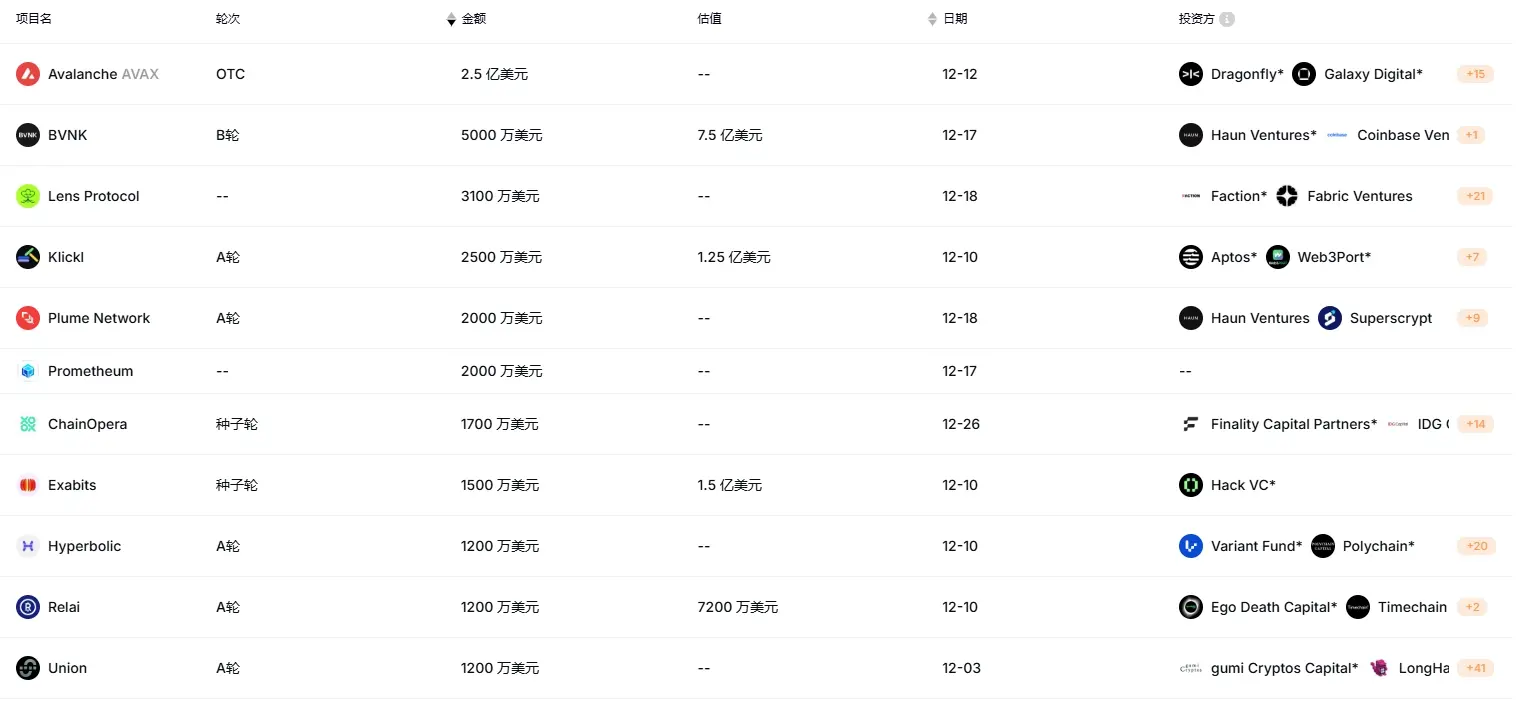

The largest financing event this month came from Avalanche, which completed $250 million in OTC financing, led by Dragonfly, Galaxy Digital, and ParaFi Capital. Other popular projects that completed financing include crypto banking services and payment solutions BVNK, decentralized open social graph Lens Protocol, global virtual asset service provider Klickl, modular public chain Plume Network, and blockchain asset securities company Prometheum.

In terms of financing amounts and rounds, the $1-3 million range accounted for the largest share of financing, and the seed round remains the most popular financing round, although its proportion has decreased, with 17 projects completing seed round financing. Notable projects include AI L1 blockchain ChainOpera AI ($17 million), decentralized AI infrastructure Exabits ($15 million), cryptocurrency credit card KAST ($10 million), and ZK verification network Fiamma ($4 million).

Additionally, there were 15 merger and acquisition events in December, which is above the monthly average (10 events), indicating that leaders in the cryptocurrency industry are accelerating integration and layout. Yuga Labs acquired the token proof protocol tokenproof; Synthetix acquired the leveraged token platform TLX; NFTGo acquired the crypto portfolio management project Mest; Gate.io announced the acquisition of the crypto asset exchange Coin Master, officially entering the Japanese market.

2. Active Investors

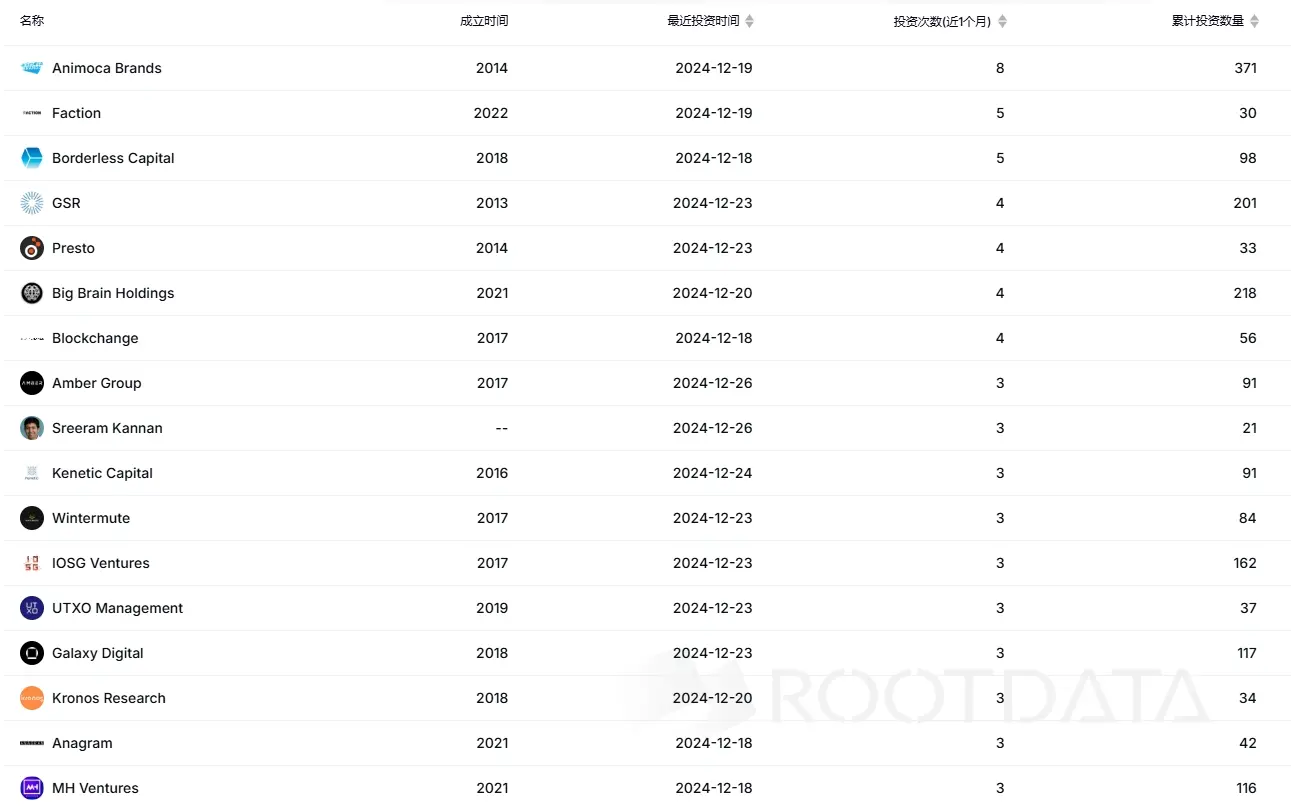

Animoca Brands has consecutively become the venture capital institution with the highest investment frequency in November and December, with 5 investments last month and 8 this month. Investment records include decentralized privacy protection solution FLock, social trading platform XYRO, Web3 native social marketing platform Bounty Bay, decentralized lending protocol Neptune, PoA blockchain Haven1, and AI computing economy layer GAIB.

Following closely are Faction, Borderless Capital, GSR, Presto, Big Brain Holdings, and Blockchange, each making more than 4 investments.

Additionally, Sreeram Kannan, Michael Heinrich, Zaki Manian, and Smokey were the most active Web3 angel investors in December, each investing in at least 3 projects.

In terms of fundraising for new crypto funds, December showed more positive signals, with MicroStrategy's model gaining market recognition. Specific events include:

Sora Ventures launched a $150 million fund, using Bitcoin as the primary reserve asset to optimize financial strategies and enhance shareholder value.

Bitcoin mining company MARA disclosed that it raised $1.925 billion through convertible notes in November and December, purchasing 15,574 BTC at an average price of $98,529.

Former Google engineer Casey Caruso founded the venture capital fund Topology Ventures, which has raised $75 million. The fund will invest in cutting-edge technologies, including artificial intelligence, decentralized networks, neural technology, aerospace, and robotics.

Semler Scientific raised an additional $50 million, having purchased 2,084 BTC at a price of $168.6 million, with an average price of approximately $81,000.

Venture capital fund Swish Ventures completed a $60 million fundraising round, targeting areas such as Web3 and AI. The fund plans to support 10 companies, with each investment ranging from $5 million to $7 million.

Nasdaq-listed Bitcoin mining company Riot Platforms announced plans to raise $500 million through the issuance of convertible preferred notes, with the net proceeds intended for purchasing additional BTC and general corporate purposes.

Crypto venture Dattice is raising funds for its third fund, although SEC filings did not specify the size of the fund.

Bitcoin mining company IREN announced plans to raise $400 million through the issuance of convertible bonds (with a coupon rate of 3.25% and a conversion premium of 30%).

3. Trending Projects

RootData's popularity score is calculated through normalized data from platform search volume, click volume, user votes, and Twitter popularity index. The projects with the highest popularity score in December include:

Fuel is an operating system built specifically for Ethereum Rollups. Fuel allows Rollups to solve the PSI (Parallelization, State Minimization Execution, Interoperability) problem without making any sacrifices.

Vana is an AI identity generation application that allows users to create a digital persona, which can be used across different applications while maintaining privacy, controlled only by the user who created it and their authorized accounts.

Plume is a fully integrated modular chain focused on RWAfi. They have built the first modular, composable EVM-compatible chain centered on RWA, aiming to simplify the onboarding of all types of assets through native infrastructure and unified RWAfi-specific features.

Nexus Network is a massively parallel proof mining network. It is a world-class instantiation of Nexus zkVM, designed to operate at a speed of one trillion CPU cycles per second, provided it connects sufficient computing power.

Magic Eden is a cross-chain NFT marketplace that has built a user-friendly platform supported by market-leading minting and trading solutions. Magic Eden brings dynamic cultural moments to the blockchain, enabling users to create, discover, and collect unique NFTs.

XION is a Layer 1 blockchain designed for consumer applications, providing a tailored seamless user experience for everyday users. Through its innovative Chain Abstraction infrastructure, XION simplifies complex crypto interactions and offers protocol-level account abstraction, gasless transactions, signature abstraction, cross-device usage, and fiat pricing.

Hyperliquid is a high-performance L1 platform. Its vision is a fully on-chain open financial system where user-built applications connect with high-performance native components, all without compromising the end-user experience.

Thena is an automated market maker based on BNB Chain, inspired by Solidly, creating a simpler liquidity acquisition process for new and existing protocols through capital-efficient liquidity guidance.

Movement is a modular framework for building and deploying Move-based infrastructure, applications, and blockchains in any distributed environment. The team is building a suite of products and services that enable non-Move protocols to leverage the powerful capabilities of the Move programming language without writing a line of Move code.

Virtuals Protocol is a decentralized factory that manufactures various AI characters for different virtual worlds (such as games or online spaces) that can respond through text, voice, and actions. Virtual Protocol provides incentives for the decentralized creation and monetization of AI characters for every virtual interaction (games, metaverse, online interactions, or others).

Blade Games is an on-chain gaming + AI agent ecosystem built around the zkVM stack, developing AI agents that run in games where users can play, train, and create their own on-chain economy.

BIO Protocol is the financial layer of DeSci, aimed at accelerating the flow of capital and talent into on-chain science. bioDAO can use the auction contracts of the BIO Protocol to raise funds and directly allocate them to research programs, IP assets, and other biotechnology organizations.

Balance is a Web3 experience infrastructure developed by the Epal team, aimed at providing a smooth transition experience from Web2 to Web3 for mass user adoption. Balance leverages its user traffic pool to bring transformation to multiple industries (especially social and gaming) by combining blockchain and AI technologies.

Nodepay is a network infrastructure providing decentralized bandwidth for AI training. By connecting to the Nodepay network, users will be able to sell unused internet to AI companies, enabling efficient transmission of public training data, labels, model sharing, and remote distributed training.

Usual is a stablecoin protocol that has launched USD, a permissionless and fully compliant stablecoin backed 1:1 by real-world assets (RWA). USUAL is a governance token that allows the community to guide the future development of the network. Usual addresses current stablecoin market issues by redistributing profits to the community and rewarding token holders with actual earnings generated from RWA.

Eclipse is a customizable rollup provider compatible with multiple Layer 1 blockchains. The platform enables developers to deploy their own rollups powered by the Solana operating system, using any chain for security or data storage.

Kaito is an AI-driven digital asset research platform that aims to revolutionize cryptocurrency research and investment through AI. Kaito's MetaSearch is designed to allow users to search the entire crypto space across platforms like Twitter, Discord, governance forums, Mirror, Medium, and more with a one-click product.

ChainOpera AI provides L1 blockchain and protocols for co-owning and co-creating decentralized AI apps and agents, supported by a Federated AI operating system and platform.

FLock aims to build a decentralized privacy protection solution for AI. FLock proposes a research initiative called Federated Learning Blocks (abbreviated as FLocks), which uses blockchain as a coordination platform among data holders for machine learning while keeping data local and private.

Berachain is a high-performance EVM-compatible blockchain built on liquidity proof consensus. Liquidity proof is a novel consensus mechanism designed to coordinate network incentives, establishing strong synergies between Berachain validators and the project ecosystem.

4. Project Updates

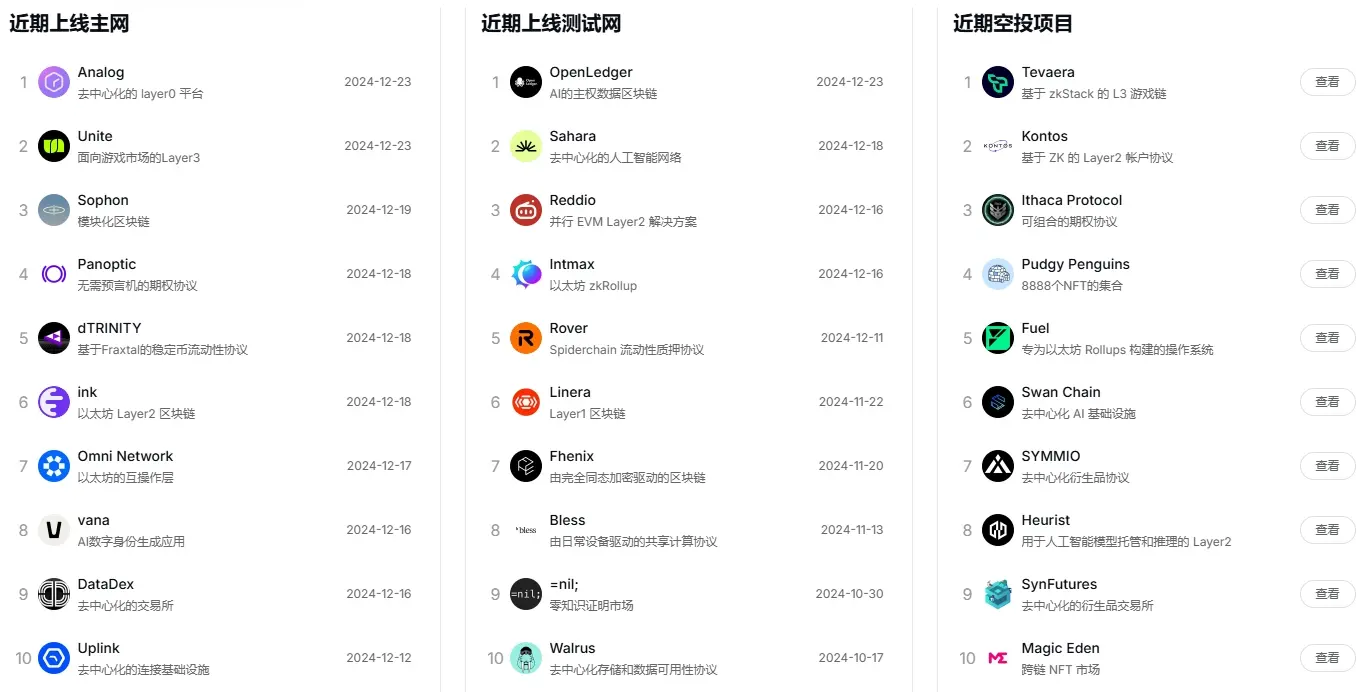

In December, RootData also recorded many events such as mainnet launches and new token issuances, helping users understand important project dynamics in the market and grasp earlier alpha opportunities.

Source: RootData Project Updates

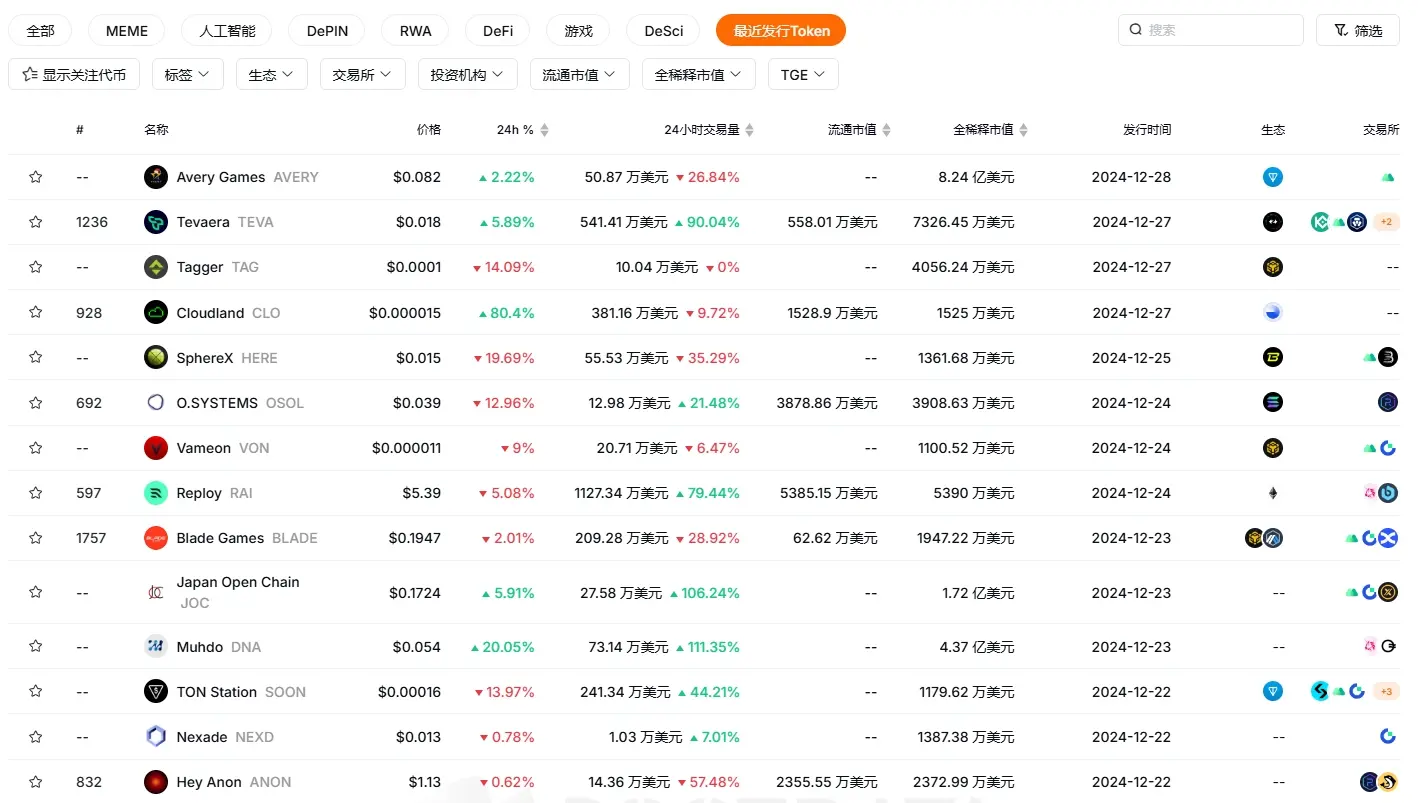

Projects with tokens launched in December include (sorted by date from recent to distant):

Source: RootData Market

Due to space limitations, the above is a partial list of mainnet and token information. For more complete and timely data, please visit the RootData official website (https://www.rootdata.com/zh/ ) for more information.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。