Organized by: Luan Peng, ChainCatcher

Important News:

- Zhao Changpeng: Not predicting trends, just trying to help more projects and observe their development

- Coinbase International's daily trading volume increased from $200 million to $12.6 billion in 2024

- Deng Chengbo's family sells 6.8% stake in Hong Kong virtual asset exchange for HKD 15 million

- Binance will conduct wallet maintenance on the Ethereum network

- Federal Reserve's Daly: Cryptocurrencies should not be confused with gold, still far from being "currency"

- Cardano founder responds to foundation governance controversy: The foundation has no direct connection with IOHK and Emurgo

- Bitget has completed the merger and token swap of BGB and BWB

- Musk changes X platform avatar and nickname to Kekius Maximus

“What important events have occurred in the past 24 hours”

Binance founder Zhao Changpeng (CZ) stated on X that he is often asked what the next hot topic in the crypto space will be. He admitted that he does not know and is just trying to help more projects and observe their development. He emphasized that they do not predict trends but rather follow and strive to contribute. He also asked the community, “What do you think the next hot topic in the crypto space will be?”

Coinbase International's daily trading volume increased from $200 million to $12.6 billion in 2024

Coinbase International posted on X reflecting on its growth, innovation, and market expansion in 2024. The daily trading volume increased from $200 million to $12.6 billion, a growth of 6200%. The nominal trading volume exceeded $380 billion on December 30. The exchange offers up to 20x leverage trading on 106 perpetual contracts.

Deng Chengbo's family sells 6.8% stake in Hong Kong virtual asset exchange for HKD 15 million

According to an announcement from the Hong Kong Stock Exchange, Deng Chengbo's family-owned listed company, Easy Communication, sold a 6.8% stake in the Hong Kong virtual asset exchange (HKVAX) for HKD 15 million. The buyers are Lean Group and businessman Leung Tak-fai, who purchased approximately 3.8% and 3% stakes in HKVAX for HKD 8.4 million and HKD 6.6 million, respectively.

According to the Hong Kong Securities and Futures Commission, HKVAX was granted a virtual asset trading platform license on October 3 of this year, allowing it to operate in Hong Kong or promote its services to Hong Kong investors.

Binance will conduct wallet maintenance on the Ethereum network

Binance will conduct wallet maintenance on the Ethereum network (ETH) on January 2, 2025, at 14:00 (UTC+8). To support this maintenance, Binance will suspend deposits and withdrawals for the Ethereum network (ETH) at 13:55 (UTC+8) on January 2, 2025. The maintenance is expected to take 1 hour, and deposits and withdrawals will automatically resume after the maintenance is completed.

According to Jinshi News, Mary Daly, president of the San Francisco Federal Reserve, believes that cryptocurrencies should be viewed as an independent asset class rather than being confused with gold as is often the case.

Daly stated, “I think cryptocurrencies are complex, and the service we need to provide for everyone is to truly interpret what it means. Once we do that, we can define it; it can be a currency, a medium of exchange, or a stock, an asset that retains value or sometimes depreciates. We just need to define these terms.”

Daly added, “So I don’t think it’s like gold; it sometimes has gold-like characteristics, but I don’t think it is an asset like gold.”

Cardano founder Charles Hoskinson responded to the controversy regarding the governance structure of the Cardano Foundation (CF), emphasizing the importance of decentralization principles and community oversight. The controversy originated from well-known Cardano community member Rick McCracken's questions about the foundation's leadership and transparency, arguing that there is a lack of effective community oversight.

Charles Hoskinson pointed out that the foundation has no direct connection with IOHK and Emurgo. The use of the Cardano Foundation's $600 million ADA treasury does not directly represent the community. In his view, the foundation's lack of enthusiasm for funding projects like Catalyst could hinder the ecosystem's development. This approach could lead to future sustainability issues for the ecosystem, especially considering that major contributors like IOHK work without proper incentives.

Charles Hoskinson's response to McCracken's statements was that these comments were quite “offensive” and “disappointing.” He noted that IOHK does face some issues, such as needing to lay off staff during a bear market, but remains focused on the ecosystem.

Bitget has completed the merger and token swap of BGB and BWB

According to official news, Bitget has completed the merger and token swap of Bitget Wallet Token (BWB) and Bitget Token (BGB). The distribution ratio for BGB is 1 BWB = 0.08563 BGB.

The merged BGB will become the sole ecological token for the Bitget exchange and Bitget wallet, expanding its use cases such as on-chain applications, further enhancing the ecosystem's synergy and user experience.

Musk changes X platform avatar and nickname to Kekius Maximus

Musk changed his X platform avatar and nickname to Kekius Maximus.

According to Coingecko data, PEPE is currently priced at $0.00001848, with a 24-hour increase of 2.3%. The Kekius Maximus token (KEKIUS) has seen a 24-hour increase of 107.0%, currently priced at $0.029.

The Jordanian Council of Ministers has approved the Jordan 2025 blockchain technology policy, aimed at enhancing government services, transparency, and digital security.

The main objectives of the policy include increasing confidence in government performance, ensuring the complete security and privacy of citizen data, reducing time and costs associated with government transactions, and supporting startups, building capacity, and developing professional skills in blockchain technology.

This policy aligns with Jordan's vision for economic modernization, aiming to achieve excellence in the service sector, support national development, and increase service exports. By leveraging blockchain technology, Jordan seeks to enhance citizen confidence in government services, improve transparency, combat fraud, and reduce operational costs.

Binance Labs stated on social media that as they transition to 2025, the Year of the Wood Snake, they expect the crypto industry to enter a vibrant phase. The wood element symbolizes growth and creativity, heralding a mature year of innovation and development. The incoming Trump administration's supportive stance on cryptocurrencies is expected to create a more favorable regulatory environment.

This shift may enhance institutional interest and investment in the crypto space, contributing to the industry's maturation and building a stronger foundation on solid ground. Binance Labs' main focus areas for 2025 are crypto/blockchain, artificial intelligence, and biotechnology, and they are excited to see innovations emerging at the intersection of these three fields.

It is anticipated that underperforming sectors such as gaming, ZK technology, and privacy solutions may make a comeback as they transition from development to production, thereby supporting new use cases. Additionally, existing narratives like DeSci, RWA/stablecoins, and AI agents are expected to continue performing well with strong momentum.

Binance Labs: Soon to be renamed, invested in 46 projects this year

According to official news, Binance Labs announced on social media that it is “soon to be renamed” while still focusing on fundamentals, aiming to create a long-term impact. As they enter 2025 and beyond, the organization will continue to support founders with a shared long-term vision for building.

In addition, it stated that this year it has invested in 46 projects, of which 14 are from the BNB chain-centered MVB program or unrelated laboratory incubation programs, and 32 are from direct investments. The allocation ratio between infrastructure and application trading is 50:50. Among these 46 transactions, 10 belong to DeFi, 7 to AI, 7 to the BTC ecosystem, 4 to Restake, 3 to gaming, 2 to ZK, 2 to RWA, and 2 to consumer applications. The remaining investments cover infrastructure (from security to wallets and chain abstraction) as well as emerging fields like Move. About 20% of the investments come from BNB ecosystem projects (its MVB program).

Binance founder Zhao Changpeng retweeted Errands Gotham's view, stating that Q1 2025 will be the most promising period for altcoins in the past 36 months, with a pattern similar to 2021 and 2017.

Errands Gotham predicts that the BNB chain will perform like Ethereum in Q1 2025, with a minimum target price of $1314 and an optimal target price of $1986.

According to The Block, Galaxy Ventures remains optimistic about the growth potential of stablecoins and tokenization in 2025. The firm's general partner, Will Nuelle, stated that stablecoins (especially in the payment sector) continue to show strong product-market fit and remain a key focus area for capital deployment.

Although tokenization still lags behind the adoption of stablecoins, Nuelle believes it has enormous potential. Galaxy Ventures plans to further explore these opportunities. However, Nuelle is less optimistic about metaverse-related projects, expecting funding in 2025 to lag due to a lack of clear adoption signs.

According to The Block, Blockchain Capital general partner Kinjal Shah expects that financing in the crypto market will rise as the market strengthens in 2025, but it will not return to the historical highs influenced by macroeconomic factors in 2021-2022. The firm will continue to seize market opportunities, focusing on areas such as stablecoin infrastructure, innovative distribution models, and DeFi platforms connecting institutions and retail users.

According to The Block, Multicoin Capital co-founder and managing partner Kyle Samani stated in an interview with The Block that Multicoin Capital is actively expanding its investments in DeFi applications, particularly within the Solana ecosystem, which has outperformed Ethereum and second-layer ecosystems in key chain metrics this year. “We expect this trend to continue, as more users, capital, issuance, and activity migrate to the Solana ecosystem, Solana-based applications and protocols will become big winners in the next cycle.”

Samani also pointed out that Ethereum will face ongoing challenges and may “even fall into a long-term decline” due to fierce competition from Solana and other faster, cheaper blockchains. He added, “Unless Ethereum can enhance its competitiveness, developers, users, and capital will turn to other chains that better meet their needs.”

Additionally, Multicoin is optimistic about stablecoins, with Samani viewing them as “potentially one of the greatest technological and financial innovations of our lifetime.” He stated, “Stablecoins have the opportunity to become giants in 2025, as everyone in the world craves dollars, and stablecoins are the most efficient way to obtain dollars. The design space is vast, and we are still in the early stages of the adoption curve.”

“What are the exciting articles worth reading in the past 24 hours”

As of December 31, ai16z's market value has approached the $2 billion mark, with a more than 40% increase in the past 24 hours. Notably, the ai16z token has rapidly grown into a project with a market value close to $2 billion in less than two months since its launch on October 26, and its market popularity continues to rise.

As the “first AI-driven decentralized autonomous organization (DAO) for investment,” ai16z is a standout project in the AI Agent wave, with its launched AI Agent construction framework Eliza successfully supporting the issuance of hundreds of AI Agent projects, including the popular AI Agent token project aiPool, and collaborating with Treasure DAO and Loot Realms to develop mini-games like Smolworl and Eternum.

According to GitHub data from December 31, the autonomous agent framework Eliza developed by the ai16z team topped the GitHub trend chart in December.

With the dual driving force of “investment + Eliza development framework technology,” ai16z has become a center for the incubation and production of AI Agent projects. So, what AI Agent projects has ai16z participated in and supported as an AI Agent incubation center?

A review of the major crypto events of 2024: Bitcoin shines, the crypto market is full of potential

The year 2024 was a tumultuous year for the crypto industry. During this year, cryptocurrencies entered a path of mainstream elevation, with institutionalization, compliance, and politicization becoming core narratives. Bitcoin hitting $100,000 marked the end of the crypto market's stigmatization, with digital gold shining brightly, and a new cycle slowly unfolding.

However, crypto is far more than just Bitcoin, and the market is not solely about institutions. The shift in the spotlight recorded the changes of the year, with Bitcoin performing brilliantly on stage, but not always being the main character. Each month of the year brought new topics and headlines to the crypto market, with technologies, projects, communities, and figures emerging one after another, weaving through the ups and downs of 2024, and writing vivid footnotes for the arrival of 2025.

Looking back at the old year and welcoming the new year, the crypto market remains full of potential, with limitless future possibilities.

As 2025 approaches, let's see how crypto VCs view market dynamics and potential opportunities

As the New Year’s bell is about to ring, the crypto industry is entering a new development node. In the recently concluded year of 2024, the market experienced recovery, innovation, and adjustment, with leading projects continuously solidifying their positions and emerging tracks quietly rising, laying the foundation for the future. Throughout the year’s ups and downs, VCs, as barometers of industry development, not only witnessed market changes but also shaped the direction of the industry at the intersection of capital, community, and technology.

Standing at the starting point of 2025, PANews invited over a dozen top VCs to share their observations and thoughts on the crypto industry. They reviewed the highlights of the past year, analyzed current market opportunities and challenges, and made predictions about future development trends. In this rapidly changing field, which projects and tracks are becoming the focus of VCs? Let’s step into the VCs' perspective and explore the “yesterday, today, and tomorrow” of the crypto industry.

How to seize opportunities early in the AI Agent cycle?

What are the criteria for choosing Agents? What narratives and practicalities are currently most valued in CT?

ETF fund flows may indicate future market scenarios; is ETH finally set to take over BTC?

On December 29, influential trader Eugene Ng Ah Sio in the cryptocurrency community posted on X his outlook and expectations for Q1 2025, predicting that ETH will become the best-performing mainstream token in the next quarter.

Eugene first mentioned three reasons for being bullish on ETH: technical trends; Trump's favor (especially WLF's significant purchases in the Ethereum ecosystem); and the development status of the Base ecosystem. He then emphasized again that since Trump's election, the inflow of funds into Ethereum spot ETFs has undergone a 180-degree turnaround.

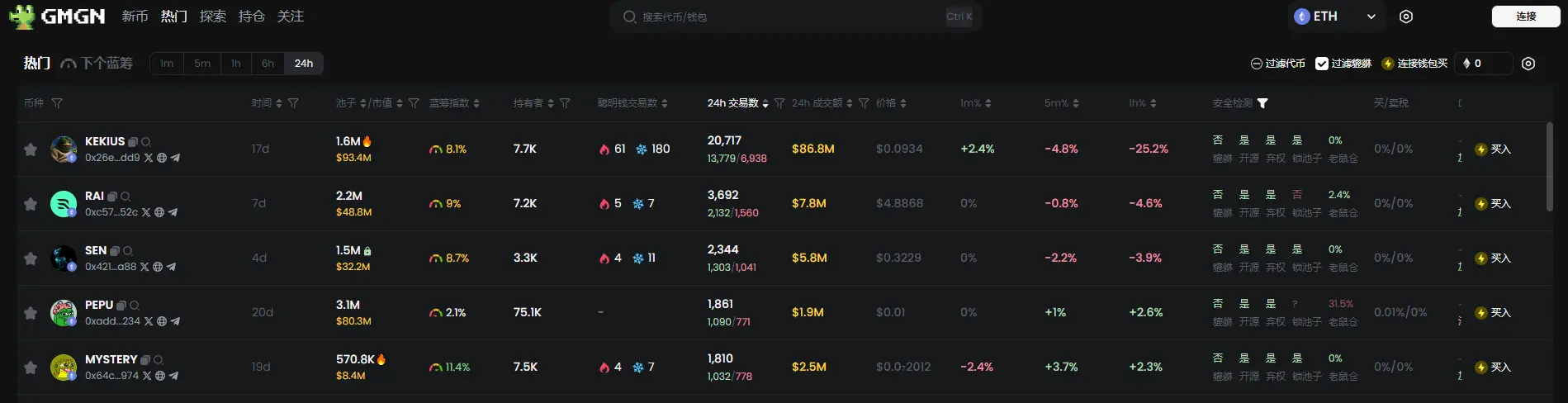

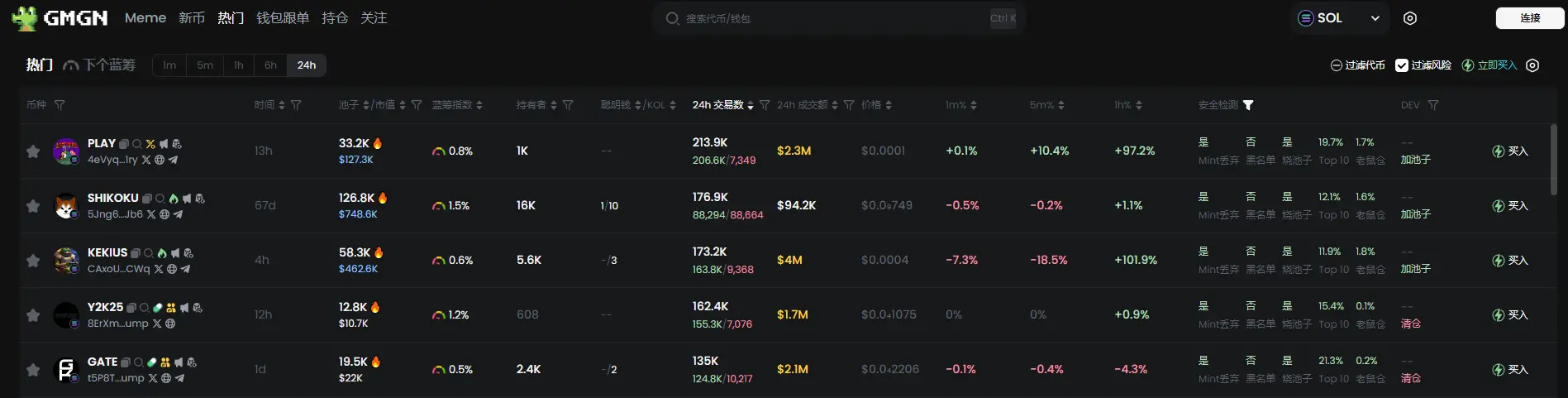

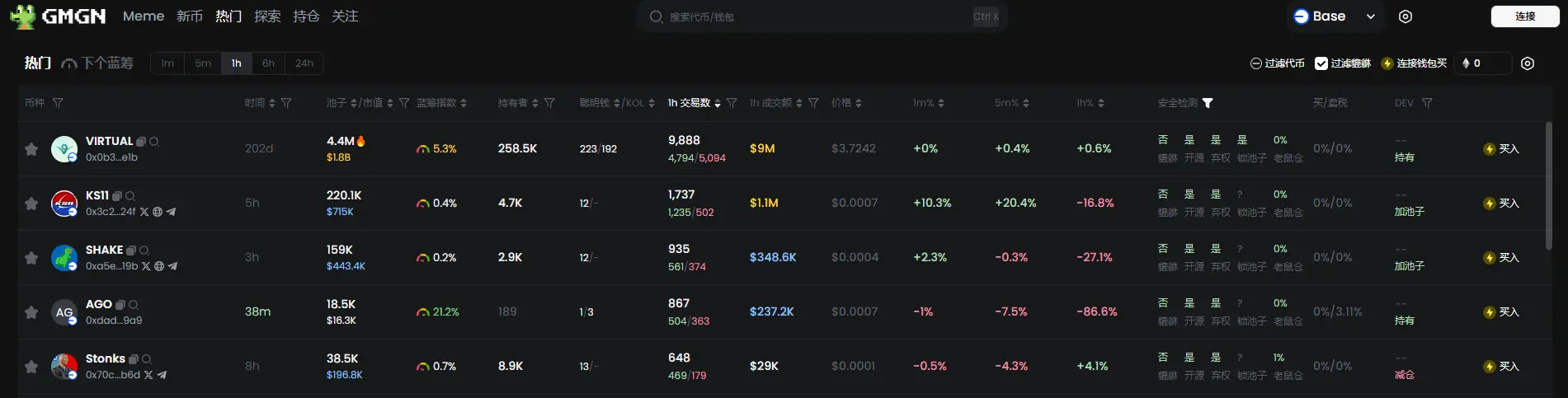

Meme Popularity Rankings

According to the meme token tracking and analysis platform GMGN, as of December 31 at 19:30:

In the past 24 hours, the top five popular tokens on Ethereum are: KEKIUS, RAI, SEN, ULTPEPU, MYSTERY

In the past 24 hours, the top five popular tokens on Solana are: PLAY, SHIKOKU, CLKEKIUS, Y2K25, GATE

In the past 24 hours, the top five popular tokens on Base are: VIRTUAL, KS11, SHAKE, AGO, Stonks

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。