Last night, Michael Saylor, the founder of MicroStrategy, tweeted that last week MicroStrategy increased its holdings by 2,138 BTC, worth $209 million, continuing its record of purchasing for eight consecutive weeks.

It is reported that Michael Saylor has publicly stated that the company will continue to buy Bitcoin at any price, even if the price skyrockets to $1 million. According to official reports, MicroStrategy has spent a total of $22 billion this year to acquire 257,250 Bitcoin. As of December 30, the company holds 446,440 BTC, with a market value of up to $4.15 billion, a quarterly return of 47.8%, and an annual return of 74.1%, which to some extent reflects the success of its strategy.

Despite MicroStrategy's significant success in Bitcoin investment, its stock (MSTR) has recently underperformed. After MSTR was included in the Nasdaq-100 index, the stock price fell by 30% in just two weeks and has retraced over 40% from its peak of $542 in November. This price volatility has sparked speculation in the market about MicroStrategy's future performance. Joe Burnett, head of market research at Unchained, stated that MicroStrategy's current strategy is "hyper-Bitcoinization." Felix Hartmann, founder of Hartmann Capital, noted that MicroStrategy's stock price "will eventually crash, but most short sellers will time it wrong, leading to failed bets on shorting BTC and MSTR."

However, even though MSTR's stock price has seen a significant pullback in the past 30 days, it has gained over 330% compared to the beginning of the year, far exceeding most market performances.

According to AICoin (aicoin.com) data, in the past, after MicroStrategy's acquisition news was disclosed, Bitcoin usually experienced a period of significant volatility, but it often fell more than it rose.

The above screenshot is from AICoin's multi-screen multi-window feature.

According to AICoin's editor, to capture this type of news-driven market, you can use the PRO tool—Large Transactions.

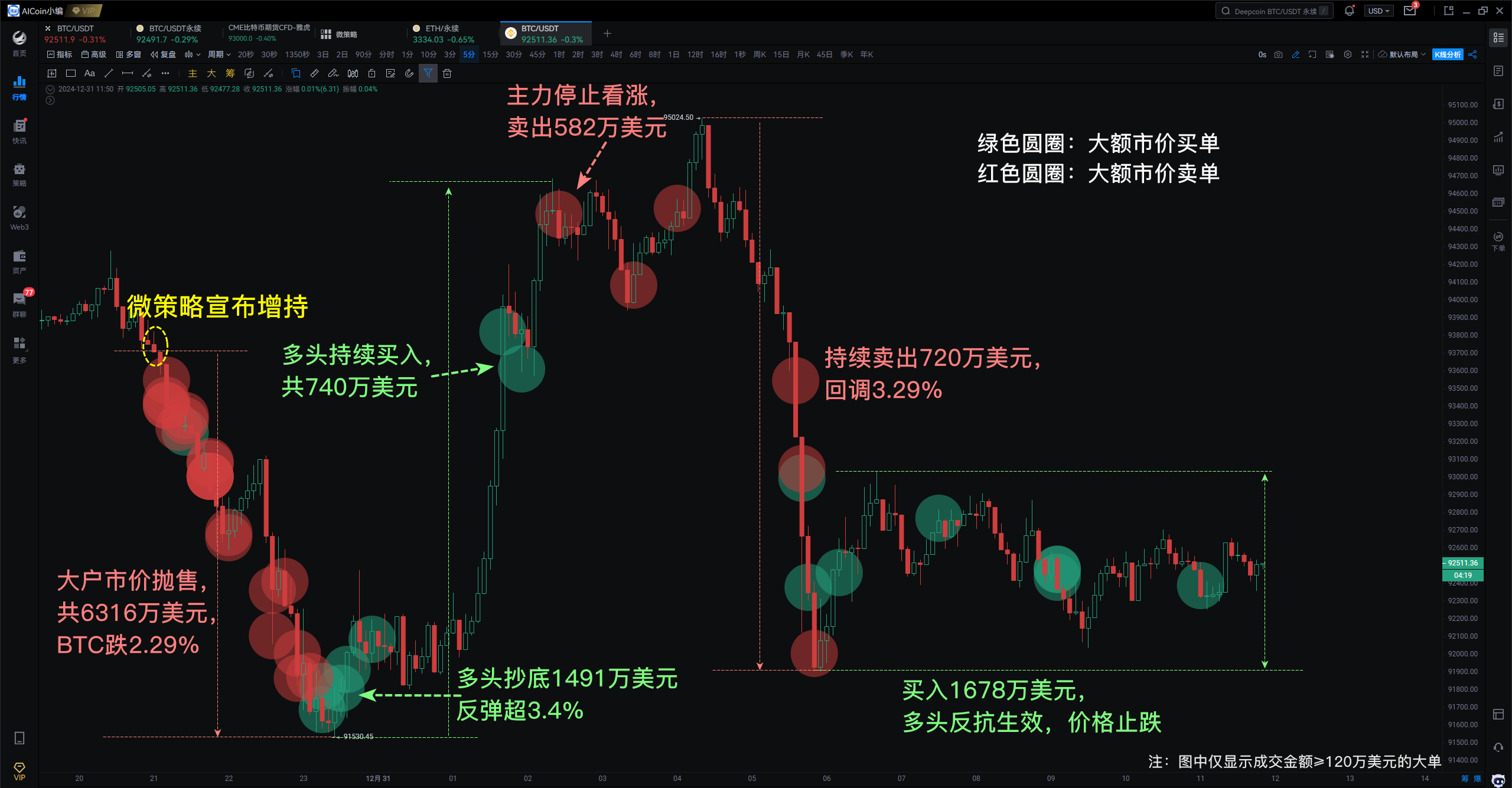

Taking last night's MicroStrategy acquisition as an example:

On December 30 at 21:02, after the news of MicroStrategy's acquisition was disclosed, large holders on Binance urgently sold, executing a market order of $63.16 million, putting pressure on BTC, which fell by 2.29%.

According to large transaction statistics, after BTC broke below the $92,000 support, large holders began to buy the dip, and after intensively buying $14.91 million, the price rebounded, rising over 3.4%. During the rebound, the main force continued to buy until the price entered a pressure zone, at which point they turned bearish and sold $5.82 million, causing BTC to pull back again by 3.28%. When Bitcoin retested the key support, bulls intervened, buying $16.78 million at market price, preventing further price declines.

In summary, when positive news appears, do not blindly go long; first, assess the behavior of the main players. If large holders are selling, there is a high probability of a panic sell-off; conversely, if large holders are entering, the market may experience a rally. In short, follow the actions of large holders.

Additionally, news-driven market responses are very rapid. To capture first-hand information, it is recommended to lock onto the PC or APP terminal [News - Twitter] section to get ahead of market trends!

Editor’s Science Popularization:

• Multi-screen Multi-window: You can choose from various layout styles, supporting up to 18 windows on the same page, with each small window in the layout supporting independent indicator settings, with no limit on the number of indicators, facilitating multi-period and multi-dimensional analysis. In addition to the default layout, you can also create new layouts based on your needs, flexibly using various tools to create a personalized analysis template library.

• Large Transactions: A PRO feature tool that can track main force market transaction conditions in real-time. Experience it now: https://www.aicoin.com/vip

Recommended reading: “Market Crash or Limit Order Conspiracy? Unveiling the Truth Behind BTC's Main Force Manipulation”

The content is for sharing only and for reference, not constituting any investment advice!

If you have any questions, feel free to join the 【PRO CLUB】 group to discuss with the editor~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。