Master's Discussion on Hot Topics:

Yesterday, Bitcoin took a sharp dive, breaking below the low of 92,200 on the 20th. Initially, it seemed like a bottoming rebound scenario, but the plot is not yet finished. From my personal perspective, if Bitcoin can drop to 84K, that would be an excellent opportunity for a mid-term bottom fishing. At this stage, we can only continue to wait for the market to provide a deeper lesson.

Now, let's talk about Ethereum, which has recently been a bit out of sync. It had already made a premature recovery from the oversold condition earlier, so it hasn't really followed Bitcoin's decline in the past couple of days. The support at 3000-3100 appears to be quite strong. That said, Ethereum tends to be particularly active in the first quarter of each year.

This is also a historical issue, and I hope that from January to March next year, we can see a decent rally, especially since institutions have bought so much, just waiting for a pump. However, the data tells a different story: yesterday, 3,000 Bitcoin ETFs flowed out of the U.S., while Ethereum ETFs saw a net inflow of 16,359, showing a stark contrast.

Even more astonishing, early this morning, 450 million USDC were minted on the Ethereum chain, indicating a continuous influx of buying power. If Ethereum breaks through 3,400 and holds, the likelihood is high that it could trigger some exciting moves.

Looking back at Bitcoin, it remains closely tied to the U.S. stock market, both struggling together. When the stock market falls, Bitcoin falls; when the stock market rebounds, Bitcoin follows suit. Unfortunately, with the holidays approaching, the market lacks significant news stimuli, and overall liquidity remains low, causing Bitcoin to drift along, with fluctuations becoming the norm.

However, one phenomenon is worth noting: although the turnover rate increased on the workday yesterday, the trading volume did not see a significant rise, remaining almost flat compared to the previous workday. This suggests that either a large amount of turnover is happening off-market, or that this turnover is not closely related to price movements.

From the data, it appears that the dominant turnover is mainly from losing positions, meaning many people are cutting their losses and exiting. The downward pressure on support has been anticipated for some time.

After all, during periods of liquidity scarcity, support tends to be more slippery than expected, as we cannot be too strict right now. It would be wise to wait until liquidity recovers next week to observe more closely.

Master's Trend Analysis:

Resistance Levels:

First Resistance Level: 92,750

Second Resistance Level: 94,100

Support Levels:

First Support Level: 91,500

Second Support Level: 90,000

Today's Recommendations:

Currently, the upward momentum of Bitcoin has passed. It is recommended to take a bearish perspective and consider short-term entries. If the lows continue to be broken, rebounds will become more difficult. In the absence of new capital inflows, please be aware that prices will likely trend downwards slowly, and avoid prematurely judging the current level as a bottom.

In the short term, there is significant resistance around 93K, so it is advisable to closely monitor price fluctuations along the descending trend line. Until the price recovers to 95K, a bearish perspective should be maintained. There are currently no favorable conditions for a rebound; a technical rebound may occur due to some short-term profit-taking, but be cautious of further downside risks.

The current price is in the low range after an increase, near an important support level. If this support is broken, it could trigger panic selling, so it is recommended to set support levels in phases and prepare corresponding response measures.

Although a rebound occurred after touching the first support, the rebound has completely retraced. Similar situations indicate strong selling pressure; unless a trend reversal occurs in a certain rebound area, it is advisable to maintain a bearish perspective.

If the price breaks through the descending trend line, the viewpoint needs to be reassessed. In the current situation, upward divergence is merely a signal for a short-term technical rebound and should not be prematurely judged as a bottom.

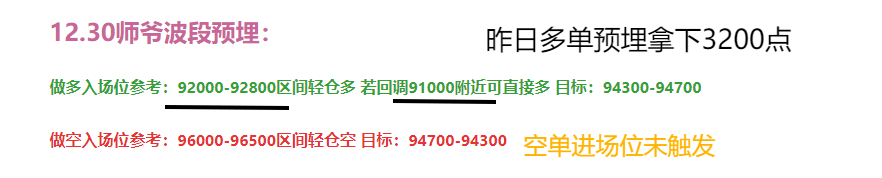

12.31 Master's Band Trading Setup:

Long Entry Reference: Not currently applicable

Short Entry Reference: Light short in the range of 93,300-94,100. If it rises near the 4-hour 60MA (95,500), short directly. Target: 91,500-90,000.

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, liquidation, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above). Other advertisements at the end of the article and in the comments section are unrelated to the author! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。