The bell for 2025 has just rung, and the global economy is entering a critical turning point that could have far-reaching effects on the cryptocurrency market.

After a year of economic ups and downs and interest rate fluctuations, traders are looking forward to clearer direction from the upcoming economic data. In particular, the market will focus on whether the U.S. Federal Reserve will continue its cautious monetary policy. Any unexpected results from employment and inflation data could trigger market volatility and affect capital flows, including choices related to investments in digital assets.

Economic Situation at the Beginning of 2025: Key Trend Interpretations

Central Bank Policy: Tighten First, Then Observe

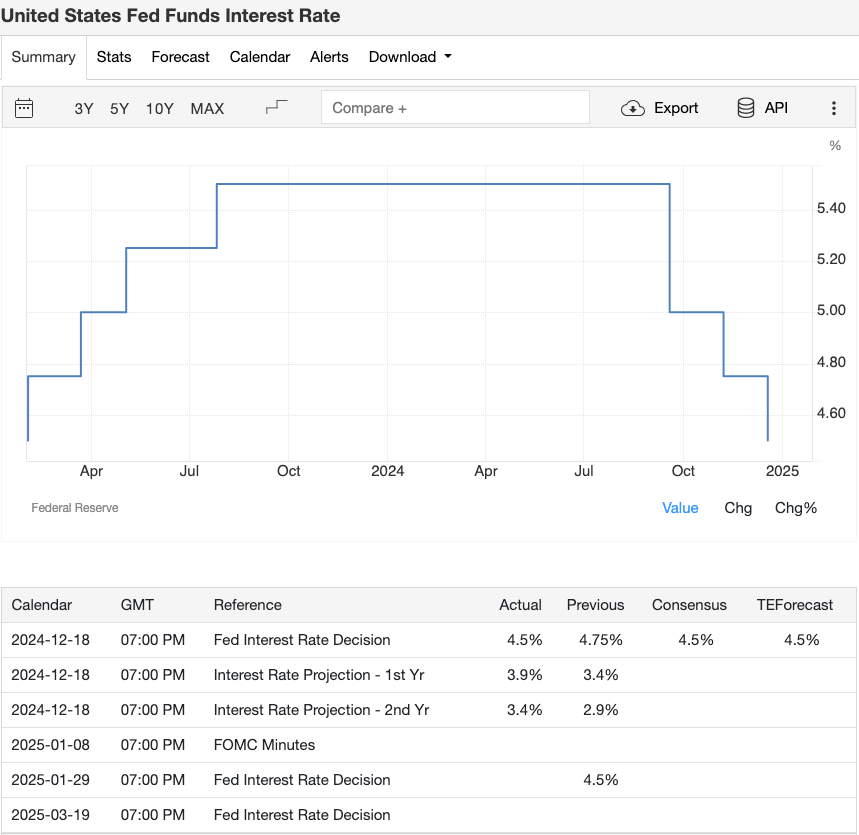

Federal Reserve Dynamics|In 2024, the Federal Reserve cut interest rates multiple times, with the latest adjustment bringing rates to a range of 4.25%-4.5%. Although inflation levels have retreated from peak levels, they remain above the 2% target. According to the latest forecasts, the Federal Reserve may cut rates two more times in 2025, totaling 50 basis points. Impact on cryptocurrency: High interest rates increase borrowing costs, potentially reducing market interest in high-risk assets, including cryptocurrencies. However, if future data continues to show declining inflation, the market may welcome a more accommodative environment.

Image Credit: Yahoo Finance

European Central Bank Dynamics|In 2024, the European Central Bank maintained a tough stance, continuing high interest rate policies to address stubborn inflation issues. If future inflation data does not show significant improvement, the European Central Bank is likely to continue tightening policies, putting pressure on risk assets, including cryptocurrencies.

Inflation: Still the Focus

Global inflation shows signs of easing but remains above the target levels of major central banks. United States|Core inflation remains stubborn, driven by wage growth and housing costs. Europe|The pace of inflation decline is slower than expected, raising market concerns about the possibility of further rate hikes by the European Central Bank. Impact on cryptocurrency: High inflation may lead more people to view cryptocurrencies as a "store of value," especially assets like Bitcoin. On the other hand, tightening policies implemented to combat inflation may reduce market liquidity, potentially limiting the upside for the crypto market.

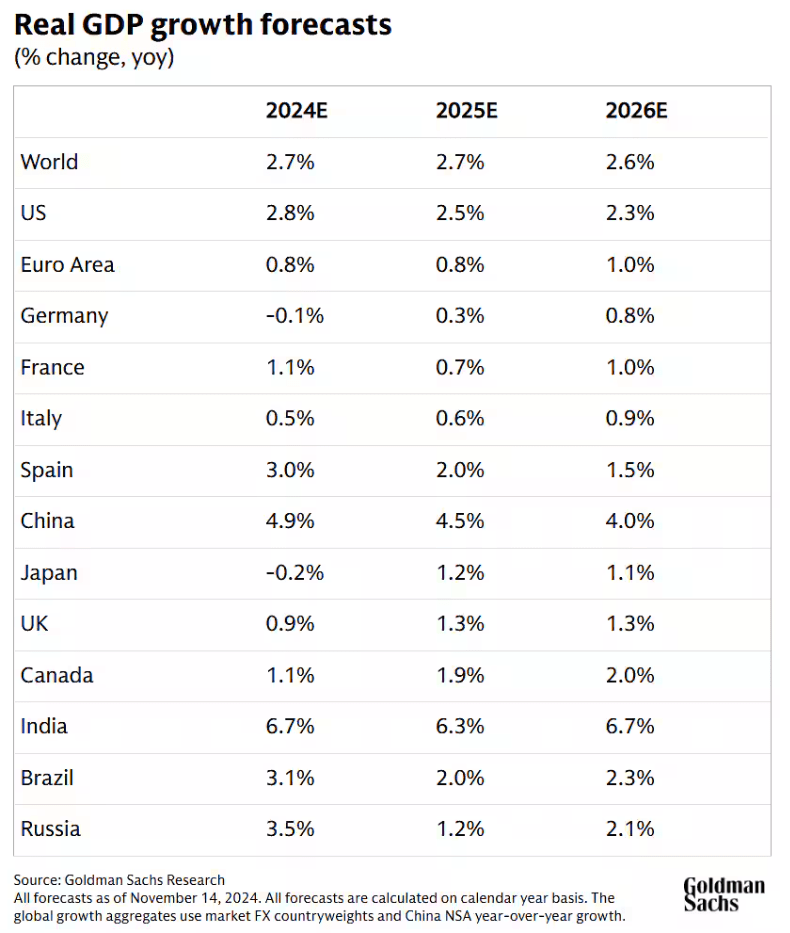

Global Economic Growth: Moderate but Steady

United States|Latest data predicts that the U.S. economy will grow at about 2.1% in 2025, slightly above the previous estimate of 2%. This growth rate, while robust, is insufficient to drive a broad market rebound. Europe|The economic outlook in Europe remains weak due to high inflation and geopolitical risks. China|China is implementing targeted policies to stimulate the economy, which helps support global demand. However, the speed of recovery still carries some uncertainty.

Image Credit: Goldman Sachs

Geopolitical Risks: An Unignorable Variable

Current Situation|Tensions between the U.S. and China in trade and technology remain high. The war in Ukraine and conflicts in the Middle East continue to exert pressure on energy markets and global supply chains. Impact on the crypto market: During heightened tensions, cryptocurrencies like Bitcoin are sometimes viewed as safe-haven assets. However, in the short term, the performance of the cryptocurrency market often fluctuates in sync with other risk assets.

Image Credit: Visual Capitalist

Unique Drivers of the Crypto Market

Technological Breakthroughs|Upgrades to Ethereum, new DeFi trends, and the integration of artificial intelligence with blockchain could serve as catalysts for the market. Institutional Participation|As regulations become clearer, traditional financial institutions are increasingly interested in cryptocurrencies, which will provide long-term growth momentum for the market. Central Bank Digital Currencies (CBDCs)|Many central banks are accelerating the launch of digital currencies, which may promote the adoption of cryptocurrencies but could also pose competition to existing crypto assets.

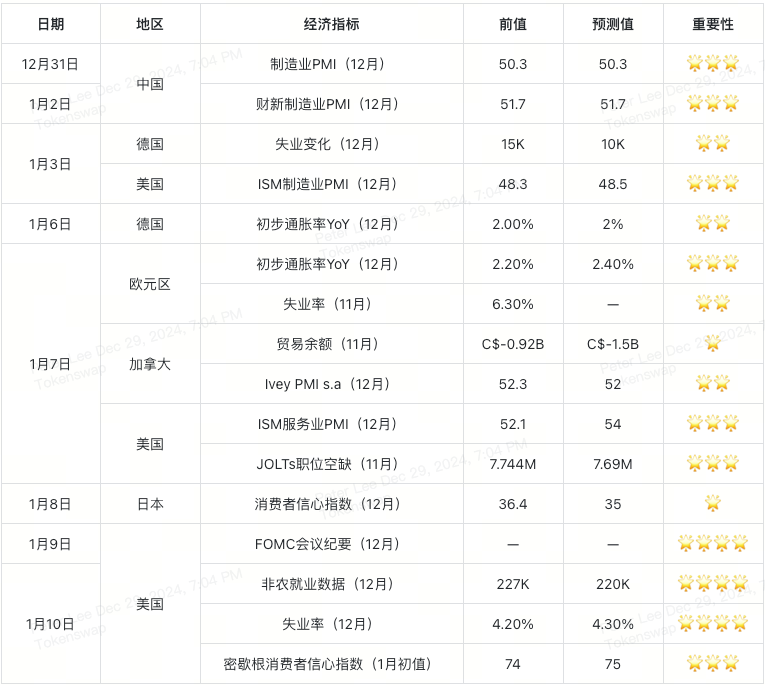

Key Data Releases (December 31, 2024 – January 10, 2025)

Week 1: December 31, 2024 – January 3, 2025

China Manufacturing PMI

Forecast: 51.8

Why It Matters: PMI is an important indicator of manufacturing activity; a reading above 50 indicates expansion, while below 50 indicates contraction. The Caixin PMI focuses more on the performance of private enterprises and is one of the barometers of the Chinese economy.

Potential Impact: If the data performs strongly, it may boost market confidence in the global economy, and this optimism could also spill over into the cryptocurrency market.

Germany Unemployment Change

Forecast: +10K

Why It Matters: Germany is the "backbone" of the European economy, and the stability of the labor market directly affects economic confidence in the Eurozone.

Potential Impact: If unemployment numbers are lower than expected, it may enhance investor confidence in the European market, thereby boosting risk appetite in the crypto market.

U.S. ISM Manufacturing PMI

Forecast: 48.5

Why It Matters: A reading below 50 indicates a contraction in manufacturing activity, which is typically seen as a signal of economic weakness.

Potential Impact: If the data is weaker than expected, the market may worry about a slowdown in the U.S. economy, which could put pressure on risk assets, including cryptocurrencies.

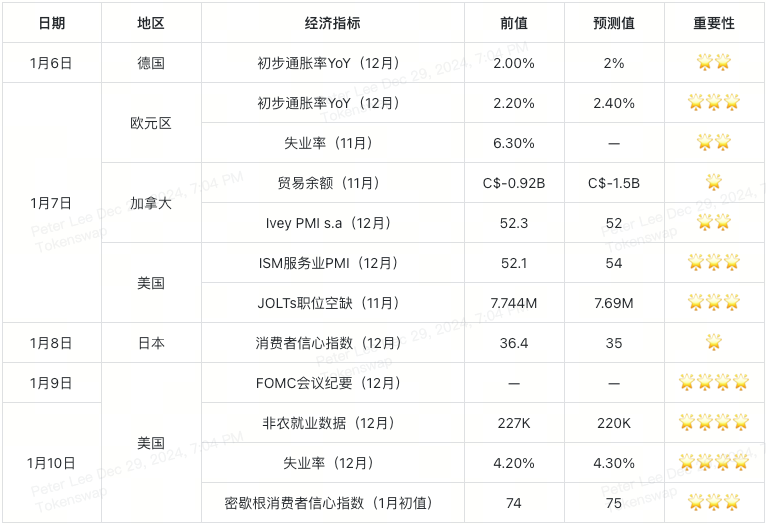

Week 2: January 6, 2025 – January 10, 2025

Germany Inflation Rate (December)

Forecast: 2.0% YoY

Why It Matters: Germany's inflation data will confirm whether the European Central Bank faces further rate hike pressures. Lower inflation may support a more dovish policy stance, benefiting risk assets, including cryptocurrencies.

Potential Impact: The market will watch for signs of cooling inflation.

France and Italy Inflation (December), Eurozone Unemployment Rate (November)

Forecast: France 1.6%, Italy 2.3%

Eurozone Unemployment Rate: 6.3%

Why It Matters: Declining inflation in core countries indicates easing price pressures, while a stable unemployment rate shows economic resilience. These factors collectively shape expectations for the European Central Bank's policies.

Potential Impact: If inflation rates decline, it may boost investor confidence; however, data exceeding expectations could raise concerns about tightening policies.

U.S. FOMC Meeting Minutes (December)

Why It Matters: Traders will closely analyze the minutes to understand the Federal Reserve's policy outlook for 2025, particularly the likelihood of interest rate adjustments.

Potential Impact: Any changes in the policy tone could trigger short-term volatility.

Image Credit: Trading Economics

Trade Balance and Labor Market Data

Trade Data

Australia: Forecast A$5.953B

Germany: Forecast €13.4B

Why It Matters: A strong trade surplus indicates a healthy economy, which could positively influence sentiment in the cryptocurrency market.

Potential Impact: Positive trade data may boost market risk sentiment, driving up cryptocurrency prices.

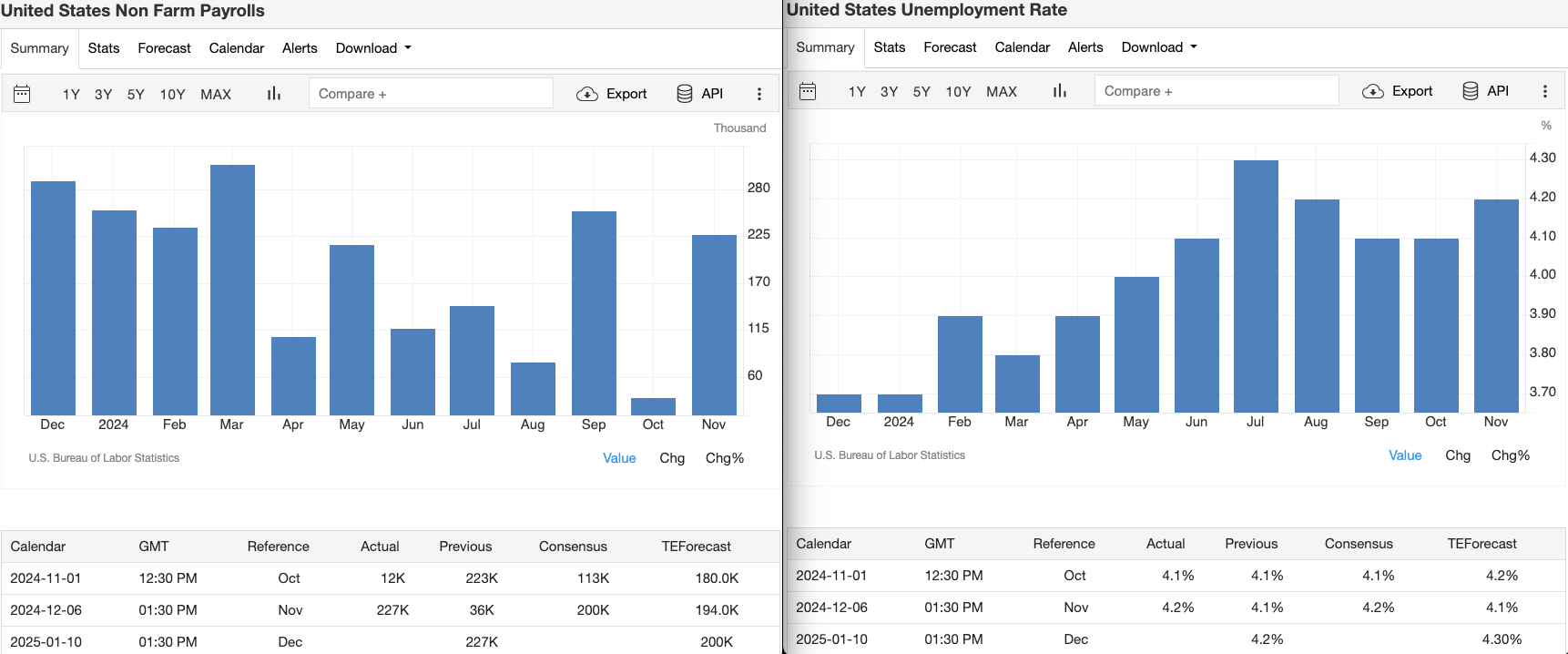

Labor Market Data

Canada Unemployment Rate (December): Forecast 6.8%

U.S. Non-Farm Payroll Data (December): Forecast 220K

U.S. Unemployment Rate (December): Forecast 4.3%

Why It Matters: Employment data directly impacts central bank decisions. If the data is weak, it may reinforce market expectations for accommodative policies, benefiting the cryptocurrency market.

Potential Impact: Non-farm payrolls exceeding expectations may temporarily boost the dollar, but weak data could enhance market expectations for easing, thereby driving up cryptocurrency prices.

Image Credit: Trading Economics

Michigan Consumer Confidence Index (Early January)

Forecast: 75

Why It Matters: Consumer confidence reflects expectations for the economy. Higher confidence may encourage more risk-taking, while weaker confidence may lead to more cautious market sentiment.

Potential Impact: The consistency of consumer confidence with employment data will be a focal point for investors.

Strategies for Crypto Traders

Focus on China's Economic Trends

If China's manufacturing PMI data exceeds expectations, it may boost global market sentiment and bring inflows into the cryptocurrency market.

However, if the data performs poorly, it may weaken market risk appetite and put pressure on crypto assets.

Keep an Eye on Eurozone Economic Indicators

Germany's employment data and the inflation rates of Germany, France, and Italy will influence the European Central Bank's policy direction.

Dovish policy signals may boost market risk sentiment, benefiting risk assets including cryptocurrencies.

Focus on Federal Reserve Signals

The Federal Reserve's FOMC meeting minutes, along with ISM PMI and non-farm payroll data, will be the focal points for the market.

If the Federal Reserve hints at rate cuts, it could present an opportunity for the cryptocurrency market to rise; whereas hawkish signals may trigger short-term market volatility.

Interpreting Trade Data

Positive trade data from Germany and Australia typically reflects strong global economic demand.

This rising risk appetite market environment may inject more confidence into the cryptocurrency market.

Consumer and Labor Market Confidence

Strong North American labor data and consumer confidence help boost market sentiment, supporting the performance of crypto assets.

If the data is weak, it may trigger market adjustments in the short term, but could pave the way for future accommodative policies, creating long-term benefits for the crypto market.

Managing Market Volatility

A dense release of data may lead to significant market volatility.

It is advisable to use stop-loss orders to control risk, diversify portfolios to reduce exposure to single assets, and closely monitor changes in market liquidity to ensure robust trading.

Global Risks and Market Sentiment Analysis

Geopolitical Risks

Current Hotspots: The ongoing U.S.-China trade and technology conflicts, the war in Ukraine, and tensions in the Middle East remain major uncertainties, particularly affecting the energy market.

Impact on the Crypto Market: During heightened geopolitical tensions, cryptocurrencies like Bitcoin are sometimes viewed as safe-haven assets. However, when general risk aversion rises, cryptocurrencies may decline alongside other high-risk assets.

Consumer Behavior

Why It Matters: Consumer confidence and holiday spending data are important indicators of economic vitality. If consumer confidence is low, it may dampen retail investors' willingness to enter the crypto market.

Key Indicators to Watch: The Michigan Consumer Confidence Index and its alignment with employment and inflation trends.

Regulation and Central Bank Digital Currencies (CBDCs)

Current Situation: Major economies are accelerating the development of regulatory frameworks for cryptocurrencies, which may enhance institutional investors' trust in crypto assets. At the same time, several countries are testing or launching CBDCs.

Impact on the Crypto Market: Clearer regulatory policies may attract more funds into the market, while vague or overly strict regulations could undermine market confidence.

Market Liquidity

Influencing Factors: Central bank policies and specific events within the crypto market (such as token unlocks and blockchain protocol upgrades).

Importance: Insufficient liquidity can exacerbate market volatility, while ample liquidity can support the market and help prices rise.

Energy and Commodities

- Why It Matters: Fluctuations in oil and gas prices directly affect costs for consumers and businesses, thereby influencing inflation and interest rate trends. Additionally, higher energy prices may impact the profitability of Bitcoin mining.

Market Expectations for Early 2025

Next Steps for the Federal Reserve

Current Status: After multiple rate cuts in 2024, the Federal Reserve is expected to cut rates only twice in 2025, totaling 50 basis points. The December FOMC meeting minutes will further clarify its policy direction.

Impact on the Crypto Market: If the Federal Reserve releases dovish signals, it may boost market risk appetite, leading to potential gains in crypto assets. However, if the minutes lean hawkish, it could trigger short-term sell-offs.

Inflation Trends

Current Status: Inflation data from Germany and the Eurozone will reveal whether price pressures have eased.

Impact on the Crypto Market: If inflation declines more than expected, market expectations for accommodative monetary policy may strengthen, benefiting risk assets including cryptocurrencies.

Resilience of the Labor Market

Current Status: U.S. non-farm payroll data and unemployment rates will reveal the state of the labor market, while Canadian data will provide a supplementary perspective on the North American economy.

Impact on the Crypto Market: Strong employment data may temporarily boost the dollar, putting pressure on cryptocurrencies. However, if the data is weak, it may increase market expectations for accommodative policies, providing long-term benefits for crypto assets.

Economic Recovery in China

Current Status: China's PMI data will reflect whether fiscal policies have effectively stimulated economic growth.

Impact on the Crypto Market: If China's economy performs strongly, it will boost global market confidence and commodity demand, and this optimism may also extend to the crypto market.

Internal Drivers of the Crypto Market

Current Status: Technological advancements, increased institutional adoption, and clearer regulatory environments are shaping the future of the crypto market.

Impact on the Crypto Market: Even if the macroeconomic environment faces challenges, developments such as Ethereum upgrades, DeFi resurgence, and AI-driven project growth may still provide growth opportunities for the market independent of traditional economic cycles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。