DeFi tax regulations are a continuation of this model in the digital asset field, with the core focus on utilizing technological means and rules to enforce global capital transparency.

Written by: Aiying

Regulatory Document: https://public-inspection.federalregister.gov/2024-30496.pdf

The U.S. Department of the Treasury and the IRS recently released an important new regulation (RIN 1545-BR39) that expands the applicability of existing tax laws, incorporating DeFi front-end service providers into the definition of "brokers." These service providers, including any platforms that interact directly with users (such as the front-end interface of Uniswap), are required to collect user transaction data starting in 2026 and submit information to the IRS via Form 1099 beginning in 2027, including users' total earnings, transaction details, and taxpayer identification information.

We all know that Trump's political stage has never lacked drama, and his attitude towards cryptocurrency is no exception. From early criticisms of Bitcoin, calling it a "scam based on air," to later attempts through NFT projects and the issuance of the DeFi project WorldLibertyFinancial (WLF), he even boldly proposed incorporating Bitcoin into the national strategic reserve in the article "From Successful Strategic Land Purchases in American History to Bitcoin Reserves: A Forward-Looking Concept of the '2025 Bitcoin Strategic Reserve Draft'." His actions reflect a drive for personal interests and also imply the complex position of the cryptocurrency industry within the U.S. political system.

Although the new regulations are still a year or two away from taking effect, and there is considerable debate regarding the definition of "brokers," as the old regulatory policies cannot be rigidly applied to crypto projects, there is a possibility they could be overturned. However, Aiying wants to discuss the historical inevitability of the new regulations and how industry practitioners should make strategic choices from several dimensions.

Part One: The Logical Evolution from Traditional Colonialism to New Financial Colonialism

1.1 The Resource Logic of Traditional Colonialism

The core of traditional colonialism was to achieve resource plunder through military force and territorial possession. The British controlled India's cotton and tea through the East India Company, and Spain plundered gold from Latin America; these are typical cases of wealth transfer achieved through direct resource possession.

1.2 The Modern Model of Financial Colonialism

Modern colonialism centers on economic rules, achieving wealth transfer through capital flow and tax control. The U.S. Foreign Account Tax Compliance Act (FATCA) is an important embodiment of this logic, requiring global financial institutions to disclose asset information of U.S. citizens, forcing other countries to participate in U.S. tax governance. The DeFi tax regulations are a continuation of this model in the digital asset field, focusing on utilizing technological means and rules to enforce global capital transparency, allowing the U.S. to obtain more tax revenue while strengthening its control over the global economy.

Part Two: America's New Colonial Tools

2.1 Tax Rules: From FATCA to DeFi New Regulations

Tax rules are the foundation of America's new colonial model. FATCA forced global financial institutions to disclose asset information of U.S. citizens, setting a precedent for the weaponization of taxes. The DeFi tax regulations further extend this logic by requiring DeFi platforms to collect and report user transaction data, expanding America's control over the digital economy. With the implementation of this rule, the U.S. will gain more precise data on capital flows globally, further enhancing its control over the global economy.

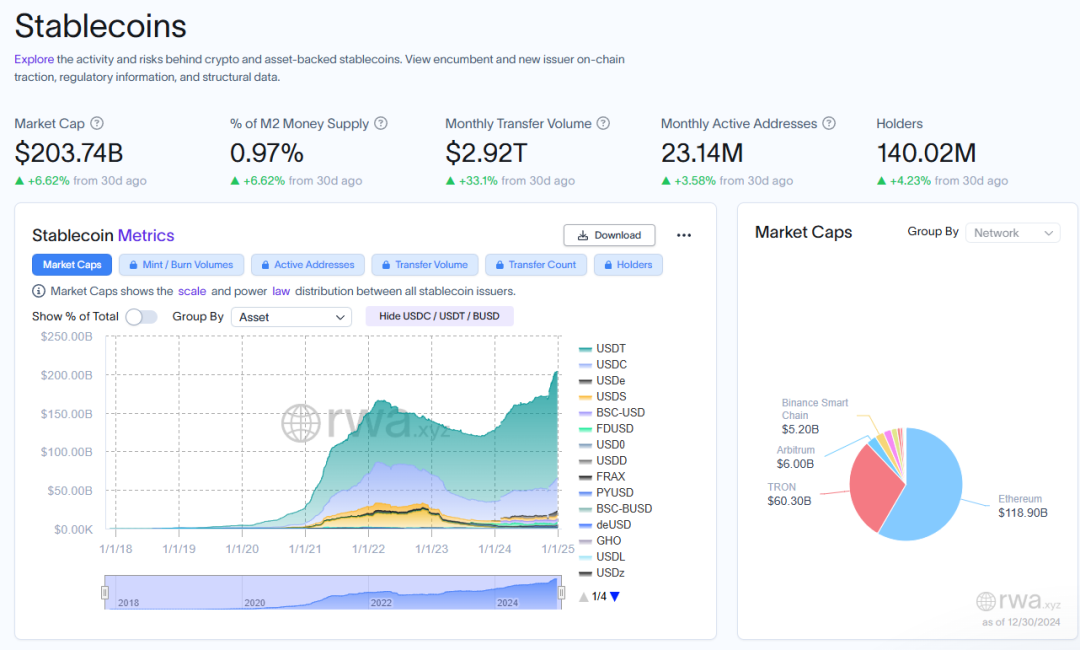

2.2 The Combination of Technology and the Dollar: The Dominance of Stablecoins

In the $200 billion stablecoin market, dollar-pegged stablecoins account for over 95%, with the underlying assets primarily being U.S. Treasury bonds and dollar reserves. Dollar stablecoins represented by USDT and USDC, through their application in the global payment system, not only solidify the dollar's global position but also lock more international capital within the U.S. financial system. This is a new form of dollar hegemony in the digital economy era.

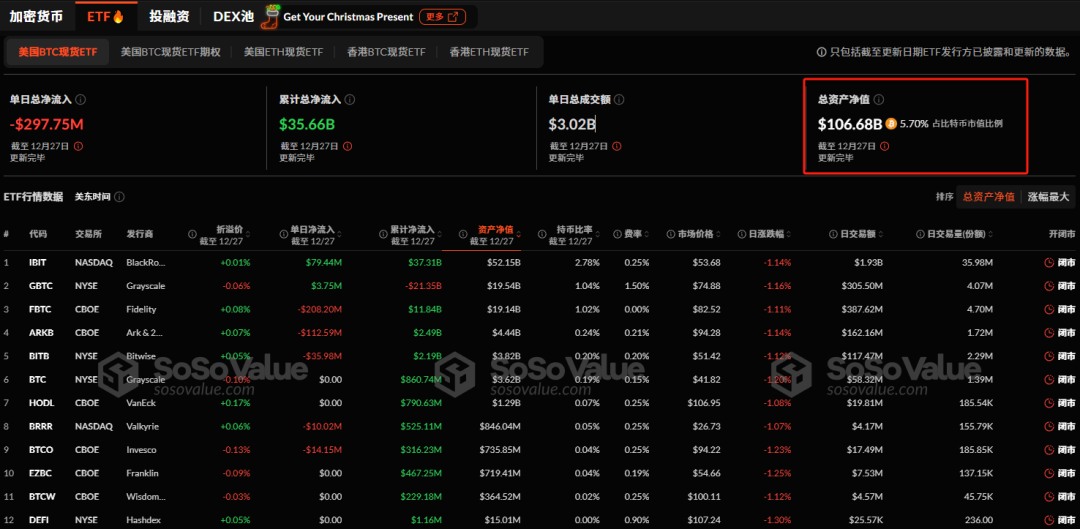

2.3 The Attractiveness of Financial Products: Bitcoin ETFs and Trust Products

Bitcoin ETFs and trust products launched by Wall Street giants like BlackRock have attracted a large influx of international capital into the U.S. market through legalization and institutionalization. These financial products not only provide greater enforcement space for U.S. tax rules but also further incorporate global investors into the U.S. economic ecosystem. The current market size is $100 billion.

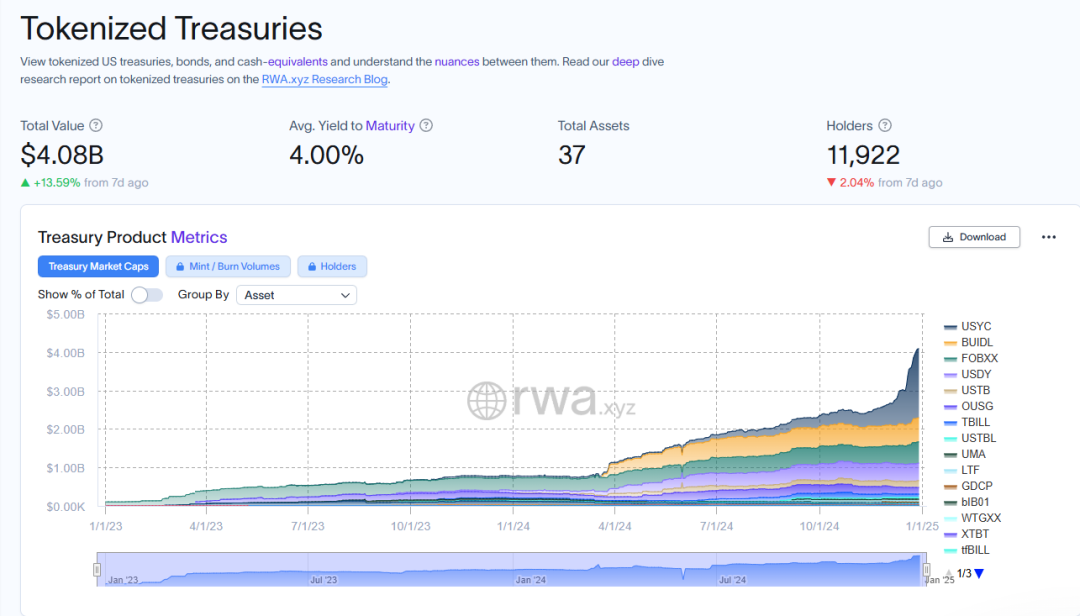

2.4 Tokenization of Real-World Assets (RWA)

The tokenization of real-world assets is becoming an important trend in the DeFi space. According to Aiying, the scale of U.S. Treasury bond tokenization has reached $4 billion. This model enhances the liquidity of traditional assets through blockchain technology while also creating new dominance for the U.S. in the global capital market. By controlling the RWA ecosystem, the U.S. can further promote the global circulation of Treasury bonds.

Part Three: Economy and Finance—Deficit Pressure and Tax Fairness

3.1 The U.S. Deficit Crisis and Tax Loopholes

The U.S. federal deficit has never been as concerning as it is now. In the fiscal year 2023, the deficit approached $1.7 trillion, exacerbated by post-pandemic fiscal stimulus and infrastructure investments. Meanwhile, the global market value of the cryptocurrency market once exceeded $3 trillion, yet most of it remained outside the tax system. This is clearly intolerable for a modern nation that relies on tax revenue.

Taxes are the cornerstone of national power. Historically, the U.S. has always sought to expand its tax base under deficit pressure. The hedge fund regulatory reforms of the 1980s are a prime example, filling fiscal gaps by broadening the coverage of capital gains taxes. Now, cryptocurrency has become the latest target.

3.2 Financial Sovereignty and the Defense of the Dollar

But this is not just a tax issue. The rise of DeFi and stablecoins challenges the dollar's dominant position in the global payment system. While stablecoins are an extension of the dollar, creating a parallel "private currency" system by pegging to the dollar, they also bypass the control of the Federal Reserve and traditional banks. The U.S. government realizes that this decentralized form of currency could pose a long-term threat to its financial sovereignty.

Through tax regulation, the U.S. aims not only to gain fiscal benefits but also to re-establish control over capital flows and defend the hegemony of the dollar.

Part Four: Industry Perspective—Choices and Trade-offs for Practitioners

4.1 Assessing the Importance of the U.S. Market

As practitioners of DeFi projects, the first step is to rationally assess the strategic value of the U.S. market for the business. If the platform's main trading volume and user base come from the U.S. market, then exiting the U.S. could mean significant losses. Conversely, if the U.S. market's share is low, a complete exit becomes a viable option.

4.2 Three Response Strategies

Partial Compliance: A Compromise Path

Establish a U.S. subsidiary (e.g., Uniswap.US) focused on meeting compliance needs for U.S. users.

Separate the protocol from the front end, reducing legal risks through DAO or other community management methods.

Introduce KYC mechanisms to report necessary information only for U.S. users.

Complete Exit: Focusing on Global Markets

Implement geographic blocking to restrict U.S. users' access through IP limitations.

Concentrate resources on more crypto-friendly markets in Asia-Pacific, the Middle East, and Europe.

Complete Decentralization: Upholding Technology and Ideals

Abandon front-end services and fully transition the platform to protocol autonomy.

Develop trustless compliance tools (e.g., on-chain tax reporting systems) to technically bypass regulation.

Refer to Aiying's previous articles for more insights:

Part Five: Deeper Reflections—The Future Game Between Regulation and Freedom

5.1 Evolution of Legislation and Long-Term Trends

In the short term, the industry may delay the implementation of rules through litigation. However, in the long run, the trend towards compliance is difficult to reverse. Regulation will lead to a polarization in the DeFi industry: on one end, there are fully compliant large platforms, and on the other, small decentralized projects that choose to operate in secrecy.

The U.S. may also adjust its policies under global competitive pressure. If other countries (such as Singapore and the UAE) adopt more lenient regulations for cryptocurrencies, the U.S. may relax certain restrictions to attract innovators.

5.2 Philosophical Reflection on Freedom and Control

The core of DeFi is freedom, while the core of government is control. This game has no endpoint. Perhaps the future of the cryptocurrency industry will exist in a form of "compliant decentralization": where technological innovation coexists with regulatory compromise, and privacy protection alternates with transparency.

Aiying's Conclusion: The Inevitability of History and Choices of the Industry

This legislation is not an isolated event but an inevitable result of the development of American political, economic, and cultural logic. For the DeFi industry, this presents both a challenge and an opportunity for transformation. At this historical juncture, how to balance compliance with innovation, protect freedom while bearing responsibility, is a question that every practitioner must answer.

The future of the cryptocurrency industry depends not only on technological advancements but also on how it finds its place between freedom and regulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。