Author: IOSG Ventures

Introduction

AI development has made significant breakthroughs in recent years due to advancements in data, computing power, and algorithm research, particularly with the emergence of OpenAI's GPT-4, which represents the arrival of foundational LLM (Large Language Model) architectures, driving productivity improvements and transforming social efficiency.

However, the drawbacks of closed-source large models, as represented by GPT-4, have also become apparent. Centralized models often face limitations in third-party integrations, hindering the scalability and interoperability of AI agents based on centralized models.

As a result, open-source large models, such as the Llama series, have gained increasing popularity among researchers. However, open source does not necessarily equate to transparency, and it faces many challenges.

The main dilemma is that open-source AI development offers little economic incentive for most contributors. Even though some competitions provide rewards, these are usually one-time incentives, and subsequent improvement and development work still require passion, unless a significant scale is reached with a large community of followers, which could lead to more revenue opportunities and encourage more contributors to continue improving.

Therefore, the AI project Bittensor attempts to utilize web3 token mining to make open-source AI development more sustainable, verifiable, and efficient. Through Yuma Consensus, it aligns resources with research parties (Miners), validators (Validators), and AI project parties (Subnet Creators), making AI research more transparent and decentralized, allowing anyone to contribute to AI and earn deserved rewards.

The performance of tokens in the secondary market also reflects people's expectations, with prices rising from over $50 in September 2023 to over $500 in December 2024, achieving a tenfold increase!

Recently, an investor in Bittensor and the founder of Digital Currency Group established an accelerator named Yuma, dedicated to incubating subnet projects within the Bittensor ecosystem, and took on the role of CEO, demonstrating confidence in the potential of the Bittensor project.

Source: Coindesk

Of course, no project's success is without skepticism. Since its inception, Bittensor has faced considerable FUD (Fear, Uncertainty, Doubt). In this article, we summarize many unanswered questions and attempt to understand Bittensor's future positioning and potential in the decentralized AI space through research and analysis.

What is Bittensor?

Bittensor was founded in 2021 by a team from Toronto, Canada, including Jacob Robert Steeves, Ala Shaabana, and Garrett Oetken.

Bittensor is a decentralized AI infrastructure used by AI developers to build and deploy machine learning models or other AI-related developments. Many Web3 AI projects, regardless of whether they have their own blockchain, can connect to Bittensor's blockchain "subtensor" and become part of a subnet.

What is a Subnet?

Subnets form the core of the Bittensor ecosystem. Each subnet in Bittensor is an independent incentive-based competitive market. Anyone can create a subnet, customize the tasks it will perform, and design an incentive mechanism (in machine learning terms, the incentive mechanism can be understood as the target loss function, guiding the model training towards ideal outcomes). By paying a registration fee (priced in TAO), one can create a subnet and obtain a netuid for that subnet. Note that a subnet creator does not need to undertake the operational tasks within the subnet but can delegate the rights to operate those tasks to others.

Operating tasks within the subnet provides another way for others to participate, namely by joining an existing subnet. If joining an existing subnet, there are two ways to participate: as a subnet miner or a subnet validator. Besides paying the registration fee (priced in TAO) and, if a validator, staking TAO, one only needs to provide a computer with sufficient computing resources and register that computer and their wallet to a subnet, while running the subnet creator's provided miner module or validator module (both modules are Python code within the Bittensor API).

How Does the Competitive Market of Subnets Work?

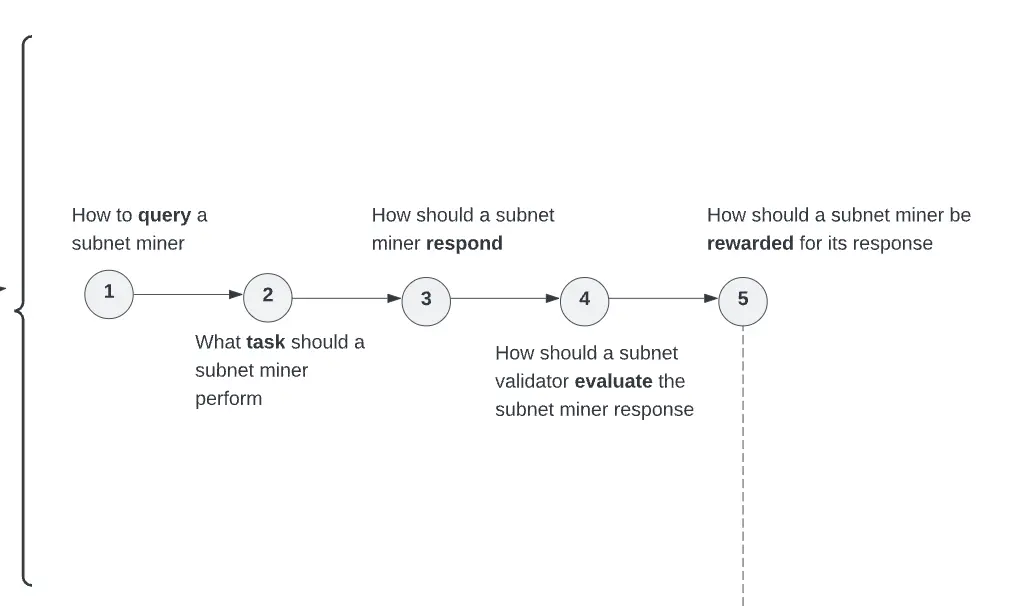

The operation of subnet competition works as follows: suppose you decide to become a subnet miner. Subnet validators will assign tasks for you to complete. Other miners in the subnet will also receive the same type of tasks. Once all subnet miners complete their tasks, they submit the results to the subnet validators.

Subsequently, subnet validators will evaluate and rank the quality of the tasks submitted by subnet miners. As a subnet miner, you will receive rewards (priced in TAO) based on the quality of your work. Similarly, other subnet miners will receive corresponding rewards based on their performance. At the same time, subnet validators will also receive rewards for ensuring that high-quality subnet miners receive better rewards, thus promoting the continuous improvement of the overall quality of the subnet. All these competitive processes are automated based on the incentive mechanisms coded by the subnet creators.

Source: Steps on how Subnet Creator defines Incentive Mechanism

The incentive mechanism ultimately judges the performance of subnet miners. When the incentive mechanism is well-calibrated, it can create a virtuous cycle where subnet miners continuously improve the tasks required in competition.

Conversely, poorly designed incentive mechanisms may lead to exploitation and shortcuts, adversely affecting the overall quality of the subnet and hindering the motivation of fair miners.

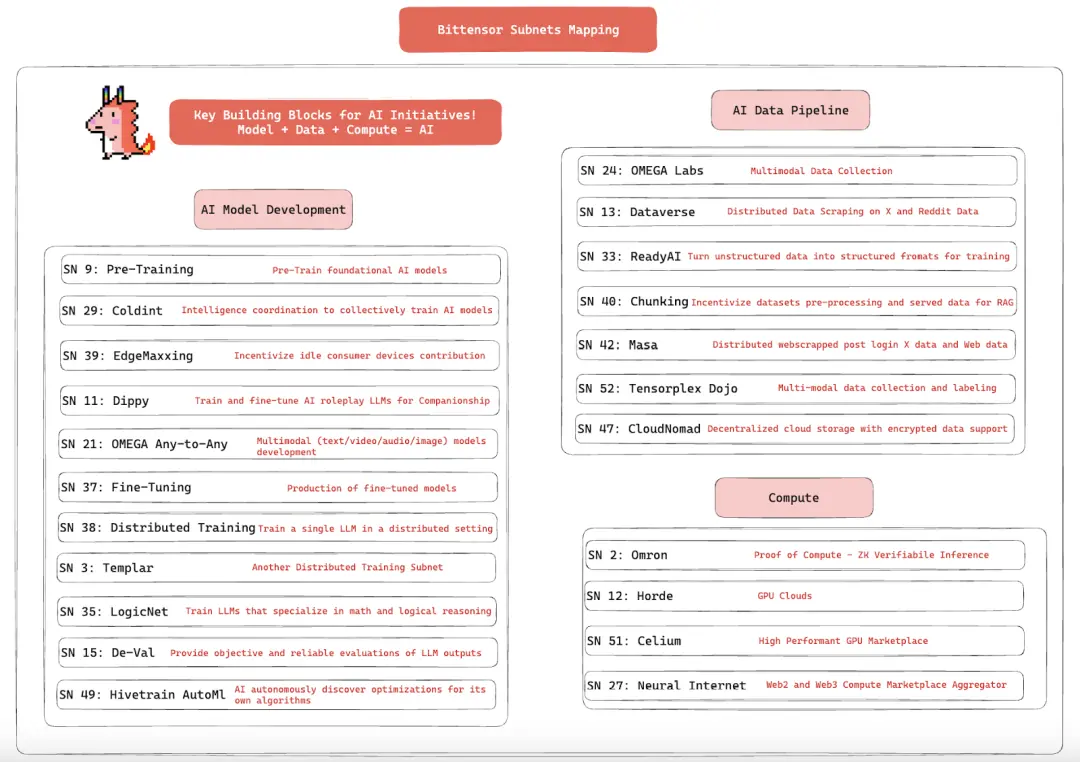

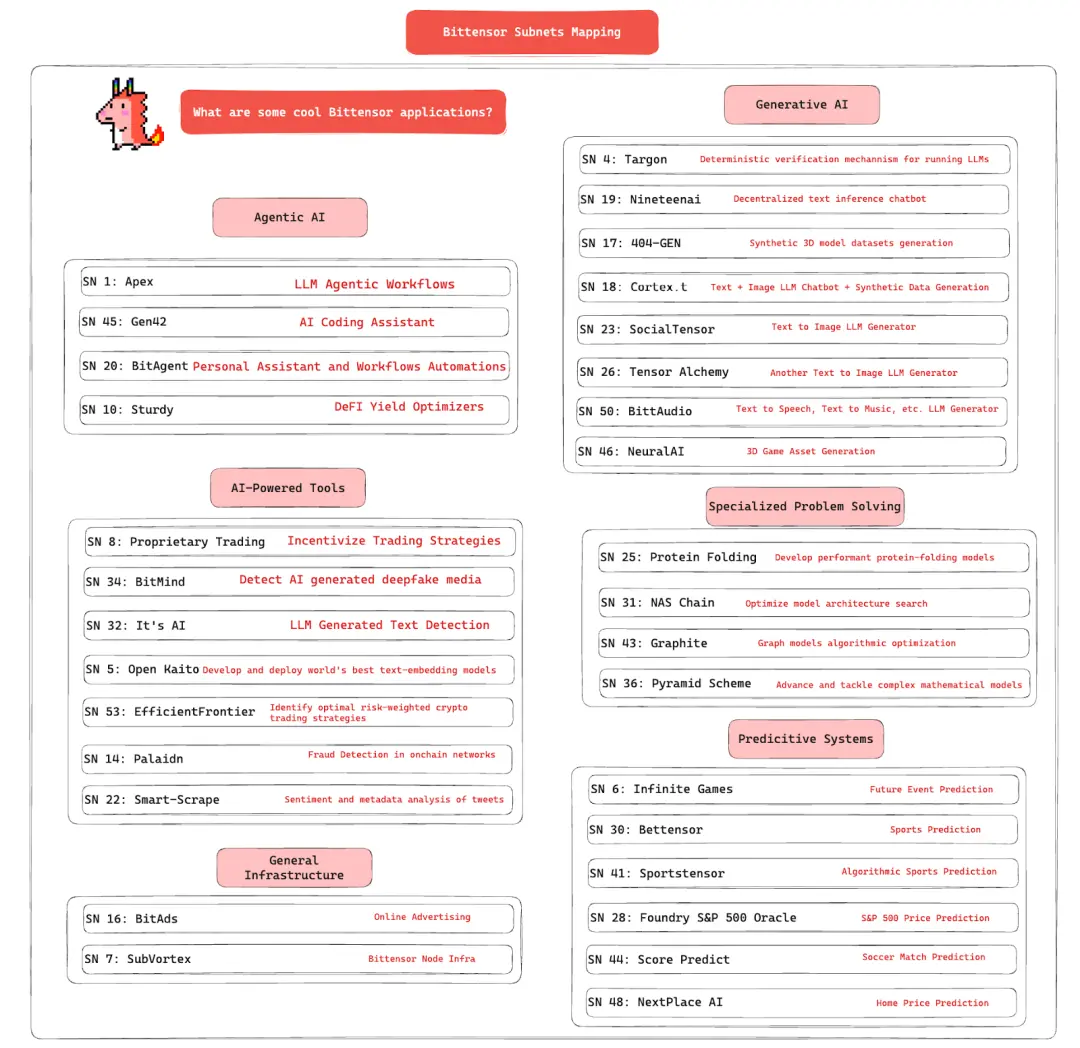

The specific work of each subnet miner depends on the original purpose for which the subnet creator established the subnet, which can be quite variable or specific. For example, the task of miners in subnet 1 is to respond to text prompts sent by subnet validators and provide the best completion results, while the task of miners in subnet 47 may be to provide storage.

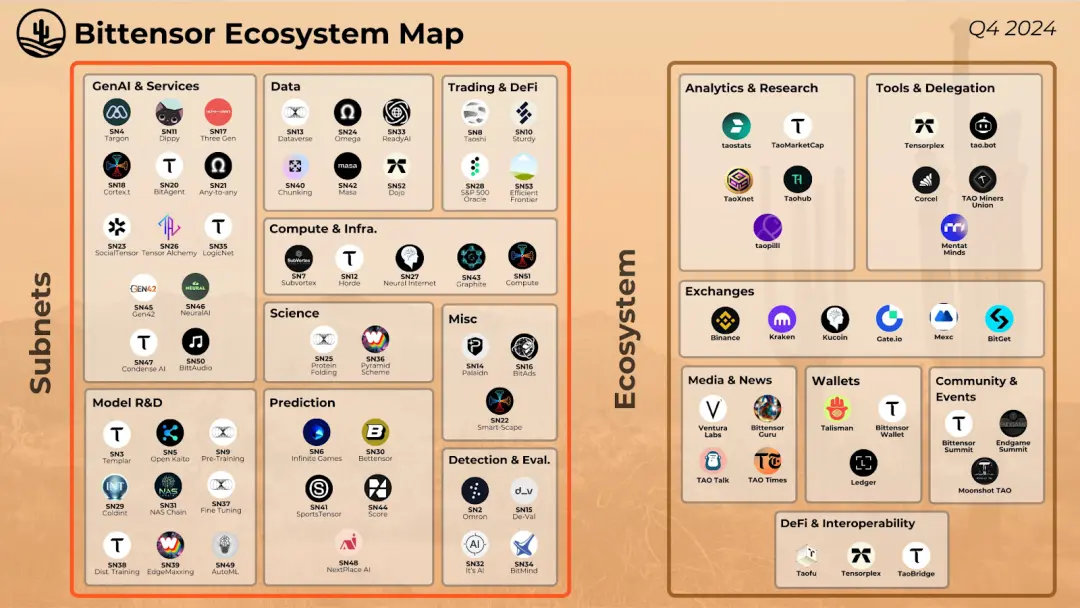

Each subnet also has its unique research and commercialization direction, such as attempting to tackle technical challenges in a specific AI field, like decentralized AI training or verifiable reasoning, or providing essential infrastructure and resources needed for AI, such as GPU trading markets or data labeling services, or helping users identify AIGC deepfake technologies, like Subnet 34 - BitMind.

Currently, Bittensor has over 55 subnets, and this number continues to grow!

Source: IOSG Ventures

The Role of the Subtensor Blockchain

Clearly, the blockchain and the project token TAO play a significant role in this series of competitions.

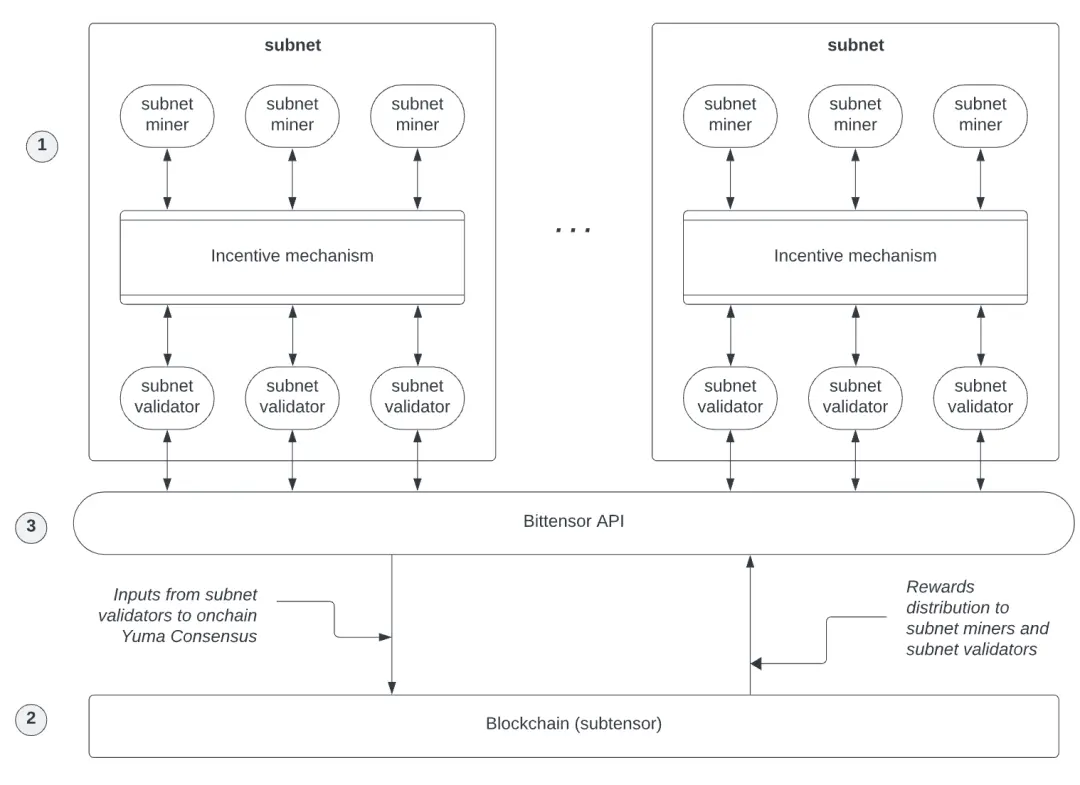

First, the Subtensor blockchain records all key activities of the subnets in its ledger. More importantly, the Subtensor blockchain is responsible for determining the reward distribution for subnet miners and validators. An algorithm called Yuma Consensus (YC) continuously runs on the Subtensor blockchain. Each subnet validator ranks the work quality of all subnet miners, and the rankings from all subnet validators are collectively submitted as input to the YC algorithm. Generally, the rankings from different subnet validators arrive at Subtensor at different times, but the YC algorithm on Subtensor waits for all rankings to arrive, typically every 12 seconds, to calculate rewards based on the input from all validators' rankings. These rewards (priced in TAO) are deposited into the wallets of subnet miners and validators. The Subtensor blockchain continuously runs the YC algorithm independently for each subnet.

The YC consensus algorithm mainly considers two factors: first, a weight vector maintained by each subnet validator, where each element of the vector represents the weight assigned to the subnet miners based on their historical performance. Each subnet validator ranks all subnet miners using this weight vector. The second factor is the amount staked by each validator and miner. The Yuma consensus on-chain uses this weight vector and staked amounts to calculate rewards and distribute them among subnet validators and miners.

The Bittensor API serves to transmit and connect the opinions of validators within the subnet and the Yuma consensus on the Subtensor blockchain. Additionally, validators within the same subnet will only connect to miners within that subnet; validators and miners from different subnets will not communicate or connect with each other.

Source: Bittenso

Source: Bittenso

Game Theory of Validators

To participate as a subnet validator or miner, one must first register and stake. Registration means registering a key in the desired subnet to obtain a UID slot within that subnet, which represents the right to validate within that subnet. Note that subnet validators can simultaneously hold multiple UID slots and validate for multiple subnets, but do not need to increase their staked amounts; staking a single amount of TAO allows them to choose multiple UID slots for validation across multiple subnets (similar to the concept of restaking).

Therefore, to obtain the maximum rewards, staking validators tend to choose to provide validation services for all subnets. However, not all staked validators have the right to truly provide staking services. Only the top 64 validators ranked by staking amount in a subnet are considered to have the legitimate validation permission for that subnet. This reduces the risk of malicious behavior by validators, as the staking amount becomes a high barrier and increases the cost of wrongdoing (at least 1000 TAO must be staked to set weights in a subnet). Each validator will try to build a good reputation and performance record to attract more TAO for delegated staking to increase their staking amount and become one of the top 64 validators in that subnet.

Once subnet validators and subnet miners (who do not need to stake to run miners) register their keys to the subnet, they can start mining.

Unique Token Incentive Economy

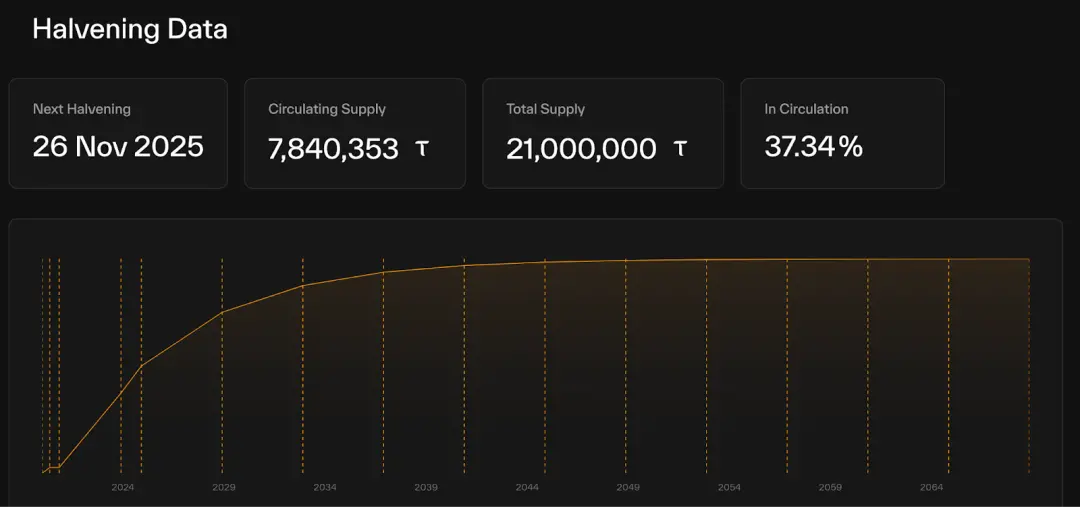

All TAO token rewards are newly minted, similar to Bitcoin. Bittensor's $TAO has the same token economics and issuance curve as Bitcoin. TAO Supply: The total cap is 21 million, halving every 4 years.

Bittensor started with a fair launch, with no pre-mined TAO tokens or ICO. Currently, the network generates 7,200 TAO daily, with 1 TAO generated per block, approximately every 12 seconds. The total supply cap is set at 21 million, following a programmatic issuance plan similar to Bitcoin.

However, Bittensor introduces a unique mechanism where once half of the total supply is distributed, the issuance rate is halved. This halving occurs approximately every 4 years and continues at each half boundary of the remaining tokens until all 21 million TAO tokens are in circulation.

Although TAO adopts Bitcoin's issuance curve and philosophy, this curve is dynamically positive due to its recycling mechanism, unlike Bitcoin's completely fixed nature.

Recycling Mechanism:

The daily token issuance for the current cycle is 7,200 TAO (the same as Bitcoin's issuance during its first cycle from January 2009 to November 2012).

However, a certain number of dynamic TAO are recycled daily through key (re)registration.

To become a miner or validator, one must register a key in the network and meet other GPU and computing power requirements. Registration requires recycling TAO, meaning a certain amount of TAO must be paid to re-enter the network.

Each time a key is (re)registered, that TAO is removed from the circulating supply and re-entered into the protocol's issuance pool, where it can be mined again in the future.

This mechanism delays the planned 4-year halving time because the recycled TAO is dynamic. As more keys are (re)registered, the cost of recycling TAO increases, or as other subnets are launched, the amount of recycled TAO may significantly increase.

Moreover, registration applies not only to newcomers but also to users who have been deregistered for the following reasons:

For miners, their models and reasoning are not competitive enough among other miners;

For validators, they fail to continuously set the correct weights, maintain issuance, or do not have enough TAO in their keys (self-delegation + shares from other delegators).

These factors themselves will also exacerbate the growth in registration demand.

The number of recycled TAO = Total number of registered (or re-registered) keys across subnets * Average registration (or re-registration) cost.

Therefore, the first halving, originally planned for 4 years after launch, may be delayed to 5 or 6 years, or even longer. This entirely depends on the balance between the issuance and recycling of TAO.

The Bittensor network went live on January 3, 2021. According to token recycling data from taostats, the planned halving date is expected to be delayed to November 2025.

Source: https://taostats.io/tokenomics

What is dTAO?

dTAO is an innovative incentive mechanism proposed by the Opentensor/Bittensor network, aimed at addressing the inefficiencies in resource allocation within decentralized networks. Unlike traditional methods where validators manually vote on resource allocation, dTAO introduces a market-based dynamic adjustment mechanism that directly links resource allocation to subnet network performance, thereby optimizing the fairness and efficiency of reward distribution.

Core Mechanisms

Market-Based Dynamic Resource Allocation

The dynamic TAO allocation mechanism is based on the market performance of subnet tokens. Each subnet in the network has its own independent token, and its relative price determines the distribution ratio of TAO issuance among subnets. As market information changes, this distribution ratio is dynamically adjusted to ensure resources flow to efficient and high-potential subnets.Embedded Liquidity Pool Design

Each subnet is configured with a liquidity pool consisting of TAO and subnet tokens (subnet/TAO token pair). Users can exchange TAO for subnet tokens by staking TAO in the liquidity pool. This design incentivizes users to invest in high-performing subnets and indirectly supports the overall development of the network.Fair Token Distribution Mechanism

Subnet tokens are gradually distributed through a "Fair Launch" model, ensuring that teams need to earn their token shares through long-term contributions and development. This mechanism avoids the risk of tokens being quickly sold off while encouraging teams to focus on technological improvements and ecosystem building.Balancing Roles of Users and Validators

The resource allocation of dynamic TAO is influenced not only by the market but also by the joint impact of validators and users. Validators must evaluate the technical capabilities, market potential, and actual performance of teams rigorously, similar to venture capitalists (VCs). Users further drive the market value formation of subnets by staking TAO and participating in market transactions.

Economic Model Analysis

Current Funding Support

Data shows that the subnets in the network currently receive an average of about $47,000 in rewards daily, corresponding to an annual support of about $17 million. This funding scale is significantly higher than the median seed round (about $3 million) and Series A funding (about $14 million) for traditional AI startups, providing strong support for the rapid development of subnets.Future Potential

The current annual budget for Bittensor is expected to reach $1.3 billion, comparable to centralized AI research institutions like OpenAI and Anthropic. With the introduction of dynamic TAO, future new issuances of TAO will primarily flow into the liquidity pools of subnet tokens, further promoting the circulation of capital and value within the ecosystem.Long-Term Incentives

The design of dTAO greatly incentivizes teams to continuously improve their technology and applications by linking issuance to market performance. This mechanism also suppresses short-term behaviors that seek quick cash-outs through over-the-counter (OTC) transactions, laying the foundation for the long-term sustainable development of the network.

Impact and Significance

Optimized Resource Allocation

dTAO optimizes resource allocation through market-driven dynamic adjustments, ensuring that high-efficiency and high-growth potential subnets receive more resources. This mechanism not only improves the overall efficiency of the network but also promotes competition and innovation.

Decentralized AI Ecosystem Construction

Bittensor is not only a decentralized AI network but also serves as an incubation platform for AI networks through dynamic TAO. The competition and collaboration among subnets further drive the development of the decentralized AI ecosystem.

Incentives for Ecosystem Participants

Dynamic TAO balances the interests of users, validators, and teams, ensuring that all participants can contribute to the growth of the network through economic incentive mechanisms.

Enhanced Role of Validators

Validators need to play a more important role in the network. They must evaluate the value and potential of subnets rigorously, ensuring the scientific and rational allocation of network resources.

The introduction of dTAO marks a significant advancement in the resource allocation mechanism of decentralized networks. Through market-based dynamic adjustments, embedded liquidity pool designs, and fair issuance models, dTAO achieves efficient and equitable resource distribution. Additionally, as an AI network incubation platform, it not only empowers the development of subnets but also provides new development paths for the future of decentralized AI networks.

Applications of Agents on Bittensor

Many people say that Bittensor represents the AI coin of VC elites and has fallen behind the flourishing application era of various agent developer frameworks today. With the recent surge in AI Agents and the total market capitalization of AI Agent-related tokens surpassing $10 billion, especially with projects represented by the Virtuals ecosystem dominating the total market cap with a valuation of $5 billion (including various utility investment and research analysis-type Agents, such as $AIXBT, $VADER, $SEKOIA, etc.), Bittensor seems to be left behind in the eyes of many.

However, in reality, Bittensor still possesses many "Alphas." What many do not realize is that the success of Virtuals/ai16z in the consumer AI Agent field complements the efforts of Bittensor subnets in decentralized AI infrastructure.

As the TVL (Total Value Locked) and influence of Agents expand, robust training and reasoning infrastructure become increasingly important.

Currently, Virtuals and Bittensor have collaborated extensively within the ecosystem.

Many consumer-facing virtuals protocol agents are supported by Bittensor subnets, leveraging the computational power and data ecosystem of TAO to create new possibilities, such as

$TAOCAT.

- TAOCAT is an AI agent created by Masa within the Virtuals ecosystem, primarily serving as a steadfast defender of TAO, actively participating in discussions on X and voicing the influence of TAO.

- TAOCAT utilizes the real-time data infrastructure of subnet 42 Masa and the advanced LLM provided by Bittensor subnet 19 to compete for TAO token allocation in the Agent Arena on Bittensor subnet 59, creating a new paradigm for tokenized AI value capture, where any user interaction on X will become training data for TAO Cat.

Other projects supported by Bittensor subnets include:

- $AION: The first agent capable of predicting outcomes and participating in prediction market betting, with copy-trading functionality set to launch soon.

- $SERAPH: The first project focused on validating infrastructure, aimed at certifying the upcoming wave of AI agents that will sweep through our digital world.

The collaboration between Virtuals and Bittensor demonstrates the immense practical value that can be created on the Bittensor infrastructure. With the official launch of AgenTAO (SN62), this will mark an important milestone for automated software engineering agents on Bittensor, as all Bittensor subnets will gradually be developed by agents on Bittensor. In the future, we will see more application-side AI agents emerging from the Bittensor ecosystem!

Source: taogod

Conclusion

The future of Bittensor is exciting, with many research and investment institutions emerging specifically around the Bittensor ecosystem, similar to the Ethereum network. This includes shout-outs from the founder of DCG, podcasts, blogs, and OSS Capital, which focuses on investing in Bittensor while also being a research organization for subnets. A network of connections similar to the PayPal mafia has formed around Bittensor, with recent gatherings involving Contango, Canonical, Delphi Labs, and DCG, where many experts from the Crypto x AI space have begun to align with and support Bittensor. Therefore, it is not without reason that Bittensor was able to surpass Virtuals in Kaito's mindshare recently.

Source: BitMind Bittensor Subnet 34

In April 2025, Bittensor will host a The Endgame Summit conference and hackathon in Austin, Texas, with over 300 participants, specifically focused on bringing more subnets, validators, and miners into the Bittensor ecosystem and expanding its territory.

Endgame Summit

Endgame Summit

Of course, whether centralized AI projects or decentralized AI projects, the ultimate standard will return to the product itself. Currently, the Bittensor ecosystem has emerged and is flourishing.

Source: Outpost AI Research

Source: Outpost AI Research

Recently, the founder of Bittensor summarized the major achievements of various subnets over the past year on his personal X:

Source: https://x.com/constreborn/status/1873359385373909008_

Therefore, let us continue to look forward to Bittensor and see what products and use cases will emerge from Bittensor in the future, becoming the go-to place for people seeking specific AI problem-solving solutions!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。