The implementation of MiCA will reshape the EU cryptocurrency market through strict compliance standards and a ban on algorithmic stablecoins.

Author: Cointelegraph

Translated by: Deep Tide TechFlow

Key Points

MiCA regulations classify stablecoins into two categories: Asset-Referenced Tokens (ARTs) and Electronic Money Tokens (EMTs). These tokens must be fully backed by liquid reserves at a 1:1 ratio and meet strict transparency and regulatory requirements to operate legally in the EU.

Algorithmic stablecoins, which lack physical backing and rely on market mechanisms to maintain value, are considered high-risk assets and are explicitly banned under MiCA regulations.

Stablecoin issuers must meet several stringent requirements, including registration as an Electronic Money Institution (EMI) or Credit Institution (CI), publishing a detailed white paper, storing reserve assets with EU-authorized third-party custodians, and integrating Digital Token Identifiers (DTIs).

It remains unclear whether Tether's USDT complies with MiCA requirements. Its use and availability in the EU may be subject to certain restrictions during the MiCA transition period.

If you follow the cryptocurrency space, you may have heard of the EU regulation known as “Markets in Crypto-Assets” (MiCA).

But what does MiCA mean for stablecoins like Tether USDT?

What is MiCA?

MiCA is a comprehensive set of cryptocurrency regulatory frameworks introduced by the EU, aimed at regulating crypto assets, including stablecoins. Its core objectives are to maintain the EU's dominant position in the monetary system, ensure financial stability, and protect consumer rights.

MiCA can be seen as the EU's statement of intent: “We welcome cryptocurrencies, but they must be conducted in a responsible and secure manner.”

Stablecoins under MiCA

Stablecoins are a special type of cryptocurrency designed to maintain a stable value by pegging to traditional assets such as fiat currencies (e.g., USD, EUR), commodities (e.g., gold), or even other cryptocurrencies.

According to MiCA, stablecoins are classified into the following two categories:

Asset-Referenced Tokens (ART): Tokens backed by multiple assets (such as various currencies or commodities).

Electronic Money Tokens (EMT): Tokens pegged to a single currency, similar to traditional electronic money.

To ensure the safety and stability of stablecoins, MiCA requires that all stablecoins be backed by sufficient liquid reserves and maintain a 1:1 ratio with their underlying assets.

Did You Know: MiCA stipulates that international stablecoin issuers must use EU-authorized custodians. For example, Circle's French subsidiary has issued USDC in Europe to comply with MiCA's regulatory requirements.

Ban on Algorithmic Stablecoins

An important provision of MiCA is the prohibition of algorithmic stablecoins across the EU. Unlike ARTs and EMTs, algorithmic stablecoins do not have explicit traditional asset backing and rely on complex algorithms and market mechanisms to maintain their value.

Due to the lack of clear and tangible asset support, MiCA does not classify algorithmic stablecoins as Asset-Referenced Tokens. Therefore, these types of tokens are effectively banned in the EU.

Compliance Requirements for Stablecoins under MiCA

If your company plans to issue stablecoins in the EU, you must meet the following compliance conditions:

Register as an Electronic Money Institution (EMI) or Credit Institution (CI): Issuers must obtain an EMI or CI license to ensure compliance with necessary financial and operational standards. For example, issuing or publicly trading EMTs requires an EMI license, while public issuance or application for EMT listing requires a CI license.

Publish a White Paper: You need to write a detailed document outlining the operational mechanism of the stablecoin, asset backing, potential risks, and operational structure.

Custody of Liquid Reserves: You must hold sufficient liquid reserves through trusted third-party custodians and ensure that each stablecoin has 1:1 actual asset backing.

Regular Reporting of Reserve Status: You are required to publish transparency reports regularly so that users and regulators can clearly understand the asset backing of the stablecoin.

Digital Token Identifier (DTI): The DTI is the "digital passport" of the stablecoin and must be clearly indicated in the white paper to provide information about the ledger where the token resides, helping regulators track relevant responsibilities.

Role of Digital Token Identifiers (DTI)

DTI is a unique number specifically used to identify digital tokens, established by the International Organization for Standardization (ISO) according to the ISO 24165 standard. It assigns a unique and permanent identifier to each digital asset.

Similar to how traditional securities use International Securities Identification Numbers (ISIN) to identify stocks, bonds, and other financial instruments, the introduction of DTI brings order to the cryptocurrency market. These identifiers use a combination of letters and numbers to ensure that each digital asset can be uniquely identified.

The DTI system is managed by the Digital Token Identifier Foundation (DTIF), with the primary goal of enhancing market transparency, supporting compliance requirements, and strengthening interoperability between different blockchain networks and traditional financial systems.

By simplifying the tracking and management of digital assets, DTI can bring the following benefits to the market:

More Efficient Risk Management: Helps businesses and regulators better monitor asset risks.

Optimized Reporting Processes: Streamlines the generation and submission of compliance reports.

More Reliable Market Data: Provides accurate asset information, enhancing market trust.

If you are a stablecoin issuer, you need to follow these steps to apply for a DTI:

Submit an Application: Visit the DTI official website, fill in the details of the token, and submit the application.

Technical Verification: The DTIF will review the technical foundation of the token.

Assign DTI: After verification, your stablecoin will receive a unique DTI number.

For detailed application processes, refer to the official MiCA guidelines and the DTI Quick Guide.

Is Tether (USDT) Compliant with MiCA?

MiCA regulations require that stablecoins (like USDT) classified as Electronic Money Tokens (EMT) must obtain a license from a Credit Institution or Electronic Money Institution and meet a series of compliance standards. However, Tether has not yet met these requirements, raising questions about the legal status of USDT in the EU.

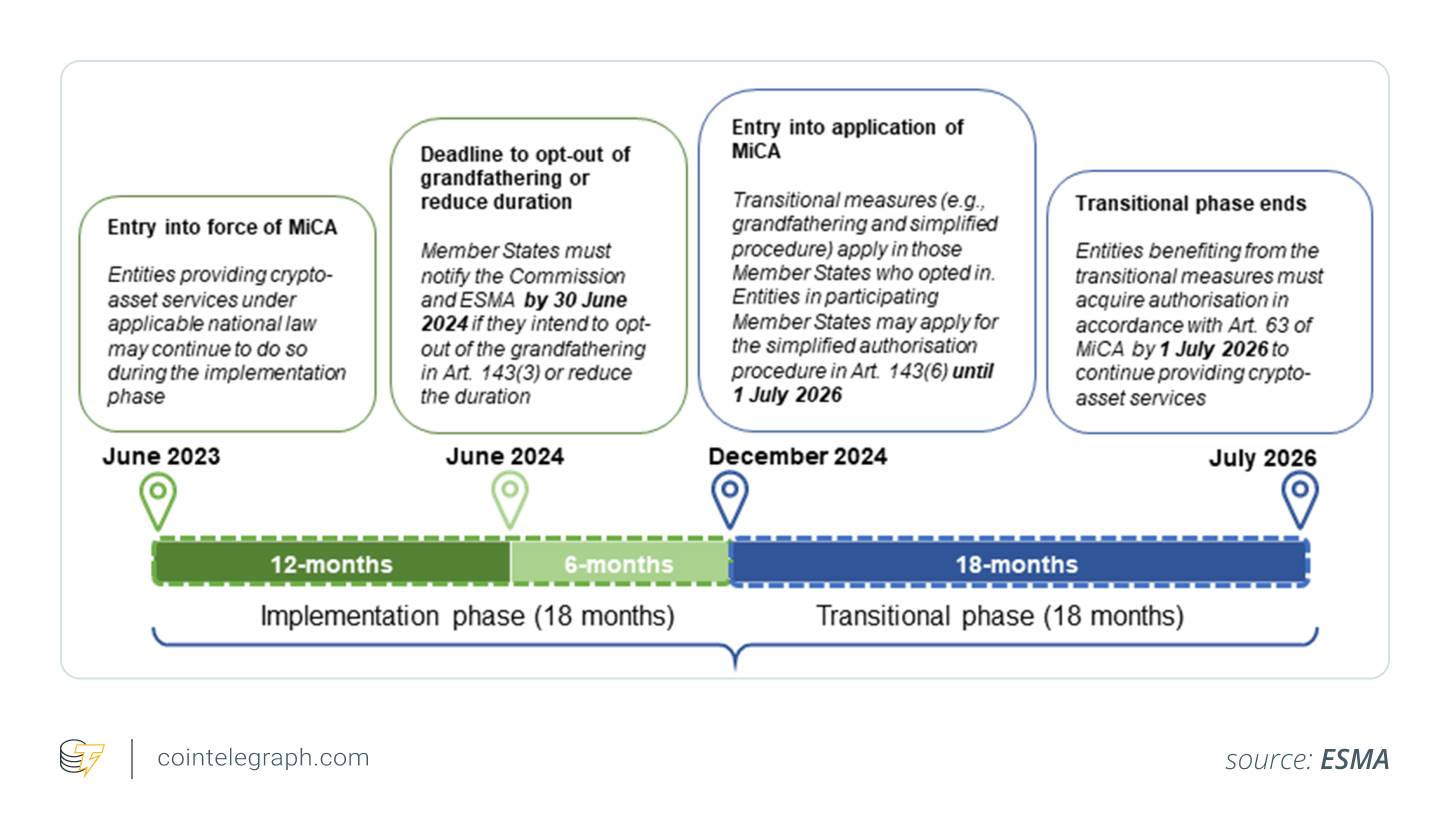

There are differing views in the market regarding the compliance of USDT. Some believe that USDT may face restrictions, while others think it may continue to operate during the transition period specified by MiCA.

Juan Ignacio Ibañez, a member of the MiCA Crypto Alliance Technical Committee, stated in an interview with Cointelegraph: “Although no regulatory body has explicitly stated that USDT is non-compliant, that does not mean it is compliant.”

He further pointed out that Coinbase's decision to delist USDT can be seen as a cautious strategy, but there are currently no clear regulatory directives requiring other exchanges like Binance or Crypto.com to take similar actions. He predicts that as MiCA regulations are fully implemented, the regulatory environment for stablecoins will become clearer, and other exchanges may also face similar delisting decisions.

Discussions on the status of USDT in the European market have garnered widespread attention on social media. Some believe that while USDT has not been banned immediately, MiCA requires it to achieve compliance during the transition period. This means that USDT may not necessarily exit the EU market entirely, but its liquidity and scope of use could be significantly affected by the implementation of MiCA.

There is a viewpoint suggesting that USDT may not be able to continue trading in Europe after December 30.

It is worth mentioning that Tether supports the Malta-based stablecoin company StablR, which focuses on two main projects: StablR Euro (EURR) pegged to the euro and StablR USD (USDR) pegged to the dollar. These tokens utilize Tether's tokenization platform Hadron, enhancing the flexibility and accessibility of stablecoin trading.

Despite this, there remains uncertainty about whether USDT meets MiCA's compliance requirements. Currently, relevant regulatory bodies have not explicitly stated whether USDT complies with MiCA or other legal requirements. Any claims regarding its compliance or potential bans lack solid evidence until an official announcement is made.

Did You Know: Tether CEO Paolo Ardoino revealed at the PlanB event in Switzerland that Tether's reserves include $100 billion in U.S. Treasury bonds, 82,000 bitcoins (valued at $5.5 billion at the time), and 48 tons of gold to support the value of its USDT stablecoin.

Will USDT Still Be Usable on DEX After December 30?

Decentralized exchanges (DEX) may not be directly affected by MiCA due to their decentralized nature. However, EU users will still need to comply with the new regulatory requirements. This means users need to verify whether USDT meets MiCA's compliance standards. Using non-compliant tokens may pose legal risks.

Which Stablecoins Comply with MiCA?

Compliant stablecoins adhere to the relevant laws, regulations, and standards set by authorities in various jurisdictions.

Compliance typically involves maintaining transparency, implementing strict anti-money laundering (AML) practices, and ensuring proper Know Your Customer (KYC) procedures. Additionally, compliant stablecoins must have verifiable reserve backing and undergo regular audits, which helps foster trust within the market.

Here are some stablecoins that comply with MiCA requirements:

EURI: Issued by Banking Circle, registered in Luxembourg as a Credit Institution (CI), with DTI number LGPZM7PJ9, supporting Ethereum and BNB Smart Chain.

EURe: Issued by Monerium, registered as an electronic money institution (EMI) with the Central Bank of Iceland, supporting Ethereum, Polygon, and Gnosis networks.

USDC and EURC: Issued by Circle Internet Financial Europe SAS (Circle SAS), registered as electronic money tokens, but as of December 26, their white paper did not provide DTI information.

EURCV: CoinVertible by SG Forge, registered as EMI in France, based on the Ethereum network, with DTI number 9W5C49FJV.

EURD: Issued by Quantoz Payments, registered in the Netherlands, with DTI number 3R9LGFRFP, based on the Algorand blockchain.

EUROe and eUSD: Issued by Membrane Finance Oy, registered in Finland, supporting multiple blockchain networks including Concordium, Solana, Arbitrum, Avalanche, Ethereum, Optimism, and Polygon.

EURQ and USDQ: Launched by Quantoz Payments, supported by Tether, Kraken, and Fabric Ventures. These stablecoins are fully backed by fiat reserves and have obtained electronic money token licenses from the Dutch Central Bank (DNB).

EURØP: A euro-backed stablecoin issued by Schuman Financial, fully supported by cash and cash equivalents. EURØP has obtained an electronic money token license from the French Prudential Supervision and Resolution Authority through its subsidiary Salvus SAS, planning to launch on Ethereum and Polygon, and expand to major centralized cryptocurrency exchanges in Europe. Notably, this token will be restricted in 107 high-risk jurisdictions including Iran, North Korea, and Venezuela.

Future Development Direction of EU Stablecoins

The implementation of MiCA will reshape the EU cryptocurrency market through strict compliance standards and a ban on algorithmic stablecoins.

While this poses challenges for established stablecoins like USDT, it also provides more development opportunities for compliant euro-denominated stablecoins. The EU is setting a regulatory example for the global cryptocurrency market, which may be emulated by other regions, promoting a more unified and secure development of the global market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。