Original | Odaily Planet Daily (@OdailyChina)

On December 29, influential cryptocurrency trader Eugene Ng Ah Sio posted on X his outlook and expectations for the first quarter of 2025, predicting that ETH will be the best-performing mainstream token in the next quarter.

Eugene first mentioned three reasons for being bullish on ETH: technical trends; Trump's favor (especially WLF's significant purchases in the Ethereum ecosystem); and the development status of the Base ecosystem. He then reiterated that since Trump's election, the inflow of funds into Ethereum spot ETFs has undergone a 180-degree turnaround.

ETF Fund Trends: Is Ethereum More Promising?

Eugene did not exaggerate; SoSoValue data shows that since November 6, when Trump won the election, the inflow of funds into spot Ethereum ETFs has significantly increased, with the growth trend even surpassing that of Bitcoin spot ETFs during the same period.

Entering late December, this trend has become even more apparent.

SoSoValue data shows that in the last trading week (Eastern Time December 23 to December 27), the net inflow into Ethereum spot ETFs was $349 million; meanwhile, Bitcoin spot ETFs saw a net outflow of $388 million — this significant difference in fund movement may indicate a better outlook for ETH in the future.

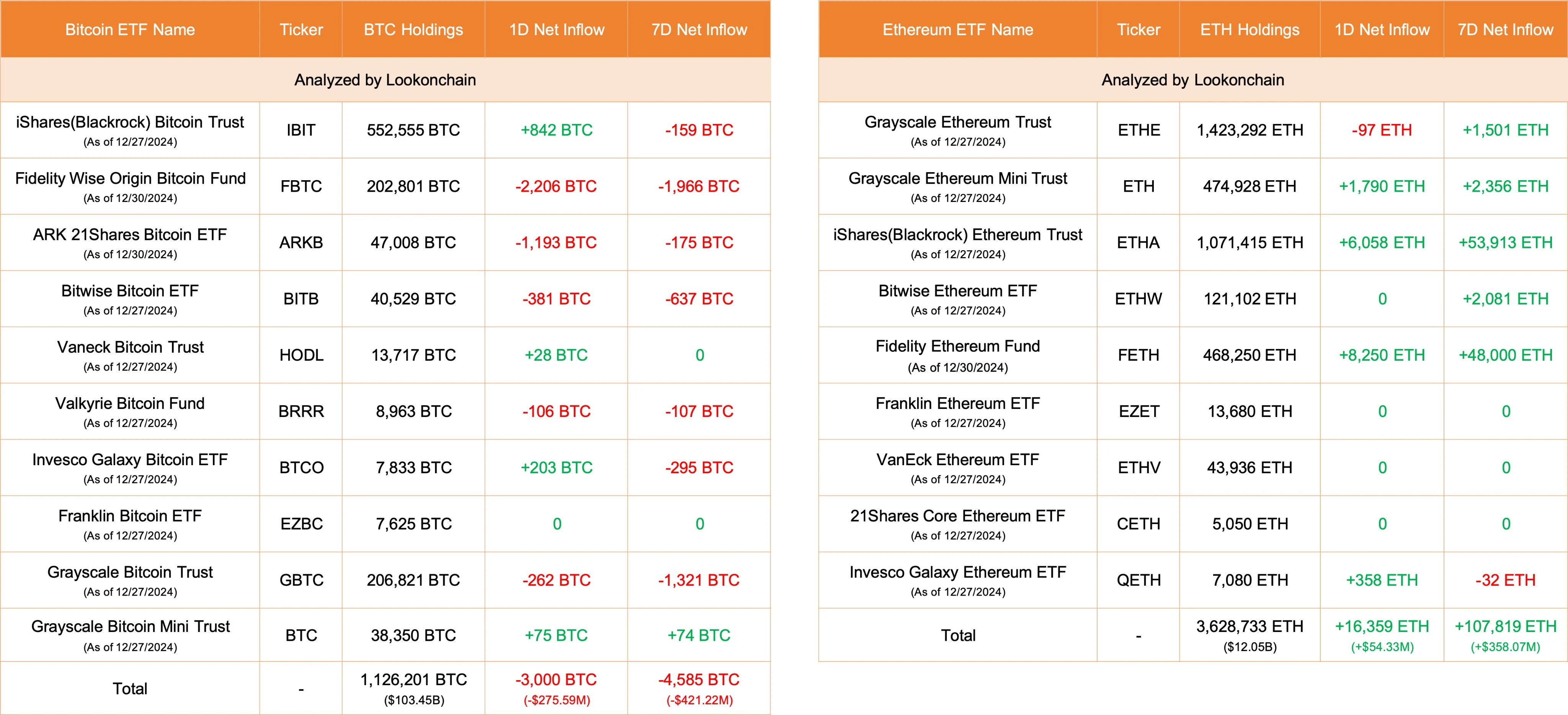

As of the time of writing, the official ETF inflow/outflow data for this Monday has not been fully released, but according to on-chain monitoring by Lookonchain, yesterday, ten U.S. Bitcoin ETFs had a net outflow of 3,000 BTC ($275.59 million); nine Ethereum ETFs had a net inflow of 16,359 ETH ($54.33 million), and the trend seems to remain unchanged.

Trump Concept Family Bundle

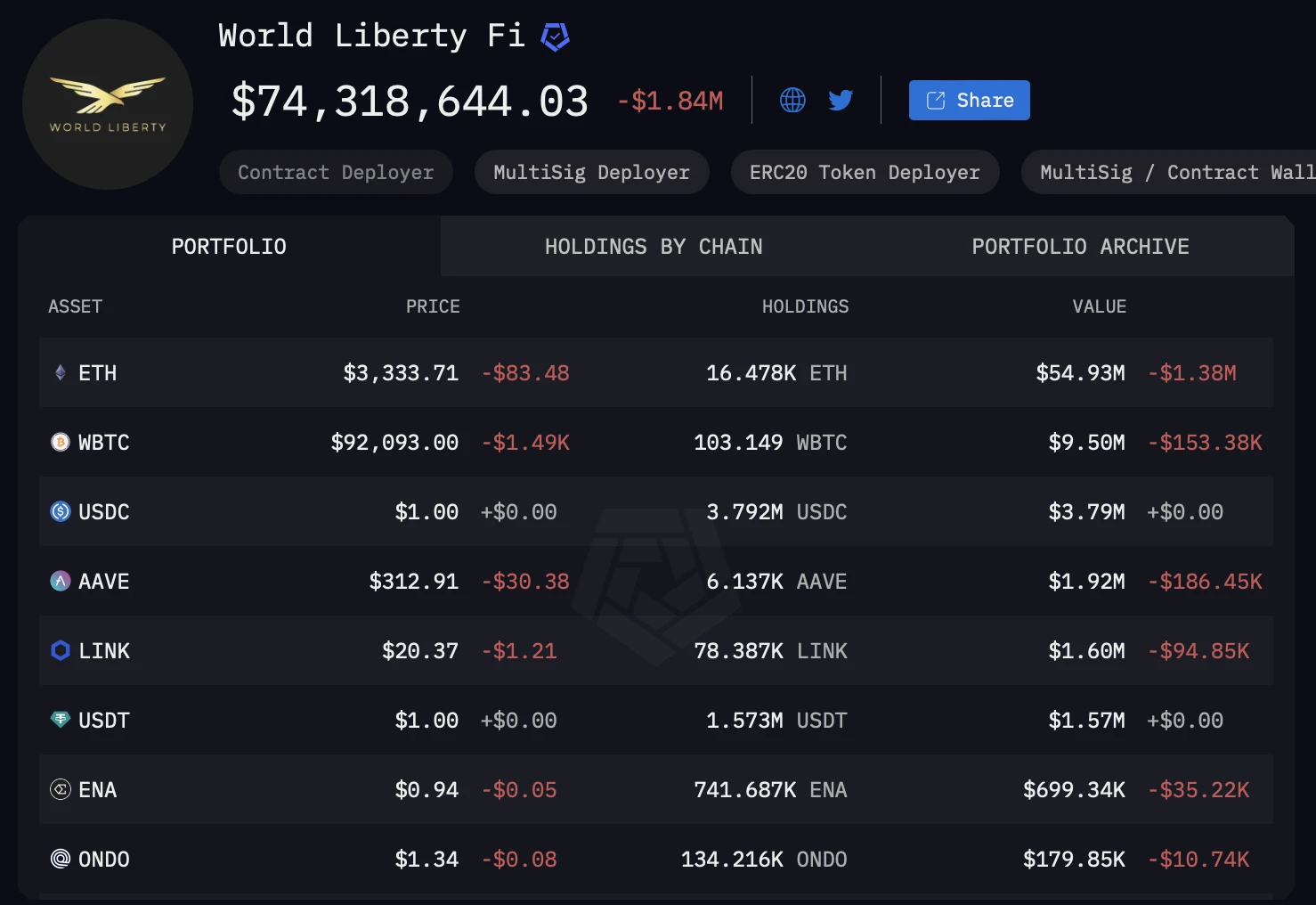

In addition to the ETF flow data, another reason supporting the bullish outlook for ETH is the continuous accumulation by the Trump family project WLFI.

Recently, WLFI has successively purchased several Ethereum ecosystem tokens such as AAVE, LINK, ENA, and ONDO, but the largest holding of the project remains ETH.

Although this is somewhat related to WIFI being deployed in the Ethereum ecosystem, the phrase "The president is on board, what are you hesitating for?" still has a strong FOMO effect.

Looking back at historical data, will the script repeat?

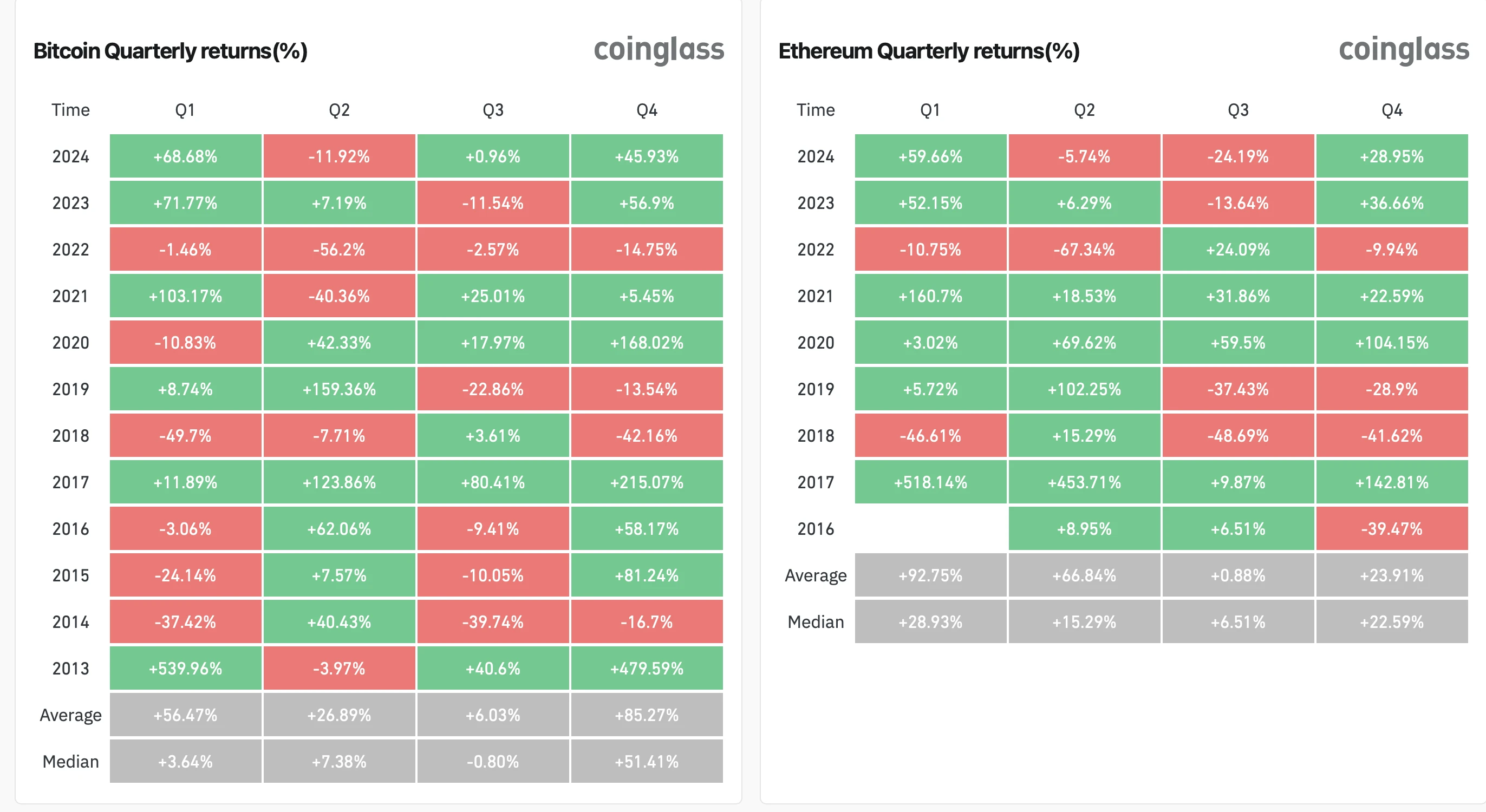

Coinglass data shows that in the first quarter following historical U.S. elections and Bitcoin halving cycles, ETH has performed the best, especially in the first quarters of 2017 and 2021, where ETH rose by 518% and 161%, respectively, even surpassing BTC's returns in those two quarters (11.9%, 103.2%).

If history repeats itself, ETH may see significant gains in Q1 of next year.

Potential Beta Choices

If ETH does rise as expected, some Ethereum ecosystem tokens may become higher-risk/higher-reward Beta choices, such as:

Trump concept token combination: AAVE, LINK, ENA, ONDO;

Grayscale Top 20 choices: LINK, UNI, AAVE, ENA, OP, LDO;

Potential benefits from ETF staking expectations: LDO, EIGEN, RPL, SSV;

Leading AI concepts in the Ethereum ecosystem: VIRTUAL, GAME, AIXBT;

Note from Odaily: The above tokens are only examples from specific sectors and concepts and do not constitute investment advice.

Counterarguments

Although many well-known investors/traders, including Eugene, have clearly expressed a bullish outlook on ETH, there are also voices that hold a pessimistic view on ETH's future performance.

Markus Thielen, founder of 10x Research, painted a more pessimistic scenario, predicting that ETH will continue to perform poorly and will not reach a new historical high in a "hawkish" macro environment in 2025: "We expect a more conservative outlook for ETH in 2025. Unlike previous years, the initial hawkish policies may be tested by weakening liquidity tailwinds.

During this period of extreme market volatility, the predictions made by various parties are merely "one-sided conclusions" based on their respective conditions and indicators; no one can predict the future, so remember to DYOR before making any moves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。