In the development history of the cryptocurrency industry, 2024 has left a significant mark. This year, we witnessed continuous breakthroughs in blockchain technology, a sustained surge in Bitcoin prices, and a gradually opening regulatory environment, leading to increasing mainstream recognition of cryptocurrency values. As 2024 comes to a close, the global leading digital asset trading platform Huobi HTX has released its latest report, “2024 Global Web3 Blockchain Ecosystem Review and 2025 Outlook”, which comprehensively summarizes the significant events that have had a huge impact on the cryptocurrency industry this year and provides a forward-looking analysis of the development prospects for 2025.

Review of 2024: The Top Ten Events Changing the Cryptocurrency Industry

In January, the U.S. Securities and Exchange Commission (SEC) made a historic decision to approve the listing of the first Bitcoin spot ETFs. This became a turning point for Bitcoin's approach to the mainstream investment market and reflected a loosening of the SEC's long-standing hardline stance on cryptocurrencies. The development tone of the cryptocurrency ecosystem for the entire year was thus established. Just six months later, the Ethereum spot ETF was officially approved by the SEC, marking a gradual shift towards a more open policy in the cryptocurrency field; globally, the Hong Kong Securities and Futures Commission (SFC) announced in April the approval of Asia's first spot Bitcoin and Ethereum ETFs, further solidifying Hong Kong's status as an international financial center.

Also in April, Bitcoin experienced its fourth halving in history. Unlike previous halvings, the market was not filled with optimism beforehand, with predictions of potential downturn risks following the halving. Ultimately, Bitcoin did not experience a significant drop after the halving but quickly rebounded after a period of volatility. This indicates that the long-term potential of Bitcoin is still widely recognized by the market, with more and more investors beginning to view Bitcoin as digital gold and a safe-haven asset.

Throughout 2024, Bitcoin's price experienced multiple large-scale fluctuations, many of which were related to actions taken by various governments. In July, the German government sold off all its Bitcoin holdings, missing out on over $2 billion in potential profits, sparking discussions in the market about digital currency management and strategy; in August, changes in the monetary policy of the Bank of Japan caused massive market turbulence, triggering circuit breakers in the Japanese and South Korean stock markets, leading investors to flee the stock market for safety, which resulted in severe price fluctuations for Bitcoin and other digital assets; in September, the Federal Reserve initiated a rate-cutting cycle, marking a shift in the global market. These events indicate that the correlation between cryptocurrencies and the global macroeconomy is strengthening.

Donald Trump was an unavoidable topic in 2024. At the Bitcoin 2024 conference in July, Trump promised that if he were to be re-elected as President of the United States, he would designate Bitcoin as a strategic reserve asset for the U.S. In November, Trump won the election, becoming the first U.S. president to openly support cryptocurrency. His re-election brought significant benefits to the cryptocurrency industry, and under his political influence, Bitcoin prices continued to soar. On December 5, Bitcoin first broke the $100,000 mark, setting a new high. This historic breakthrough not only highlighted Bitcoin's status as digital gold but also indicated that cryptocurrency, as a new asset class, is gradually changing the global financial landscape. Although Bitcoin's price has since corrected, Trump's re-election and the imminent appointment of a new SEC chairman may quickly lead to pro-crypto actions, and the market anticipates that the Federal Reserve will cut rates twice between February and May next year, potentially ushering in a peak period for the market. With policies becoming clearer and the market maturing, the future prospects for Bitcoin are increasingly bright, and more investors and institutions are expected to join this investment wave, fully unleashing the potential of the cryptocurrency market.

Huobi HTX pointed out that 2024 is a key year for cryptocurrency assets to truly move towards the mainstream. As the global economy gradually recovers and cryptocurrency regulatory policies loosen, the integration of traditional finance and the digital asset market is becoming increasingly close, marking the growing maturity of the cryptocurrency industry, with more institutions beginning to recognize and invest in this sector. Against this backdrop, Bitcoin's nearly 140% increase this year is no coincidence, and such growth has sparked enthusiasm among global investors, providing strong momentum to boost the cryptocurrency market and bringing unprecedented opportunities.

Outlook for 2025: Anticipating Bitcoin as a Strategic Reserve

The report suggests that as the global regulatory environment matures, innovations in blockchain technology will usher in a new round of explosive growth, with the rapid development of various infrastructures and innovative applications indicating that the cryptocurrency industry will encounter broader development opportunities. The next few years will be a critical period for the accelerated development of the cryptocurrency industry, continuous technological iteration, and widespread innovation.

Huobi HTX has focused on analyzing the pro-crypto policies that may emerge after Trump's re-election. Two important bills, the FIT21 Act and the Bitcoin Strategic Reserve Act, are expected to pass more quickly under Trump's influence. The former aims to provide a clear legal framework for token issuance and trading by classifying tokens into digital assets and digital commodities, shifting the regulation of many blockchain projects from the SEC to the CFTC, and introducing a safe harbor mechanism to promote the standardization and healthy development of the entire industry; the latter aligns with Trump's campaign promise, and if passed, would mark Bitcoin's transition from a niche asset to a nationally recognized reserve asset, greatly enhancing its legitimacy and recognition, and potentially prompting other countries to take similar measures, further promoting Bitcoin's recognition and application globally.

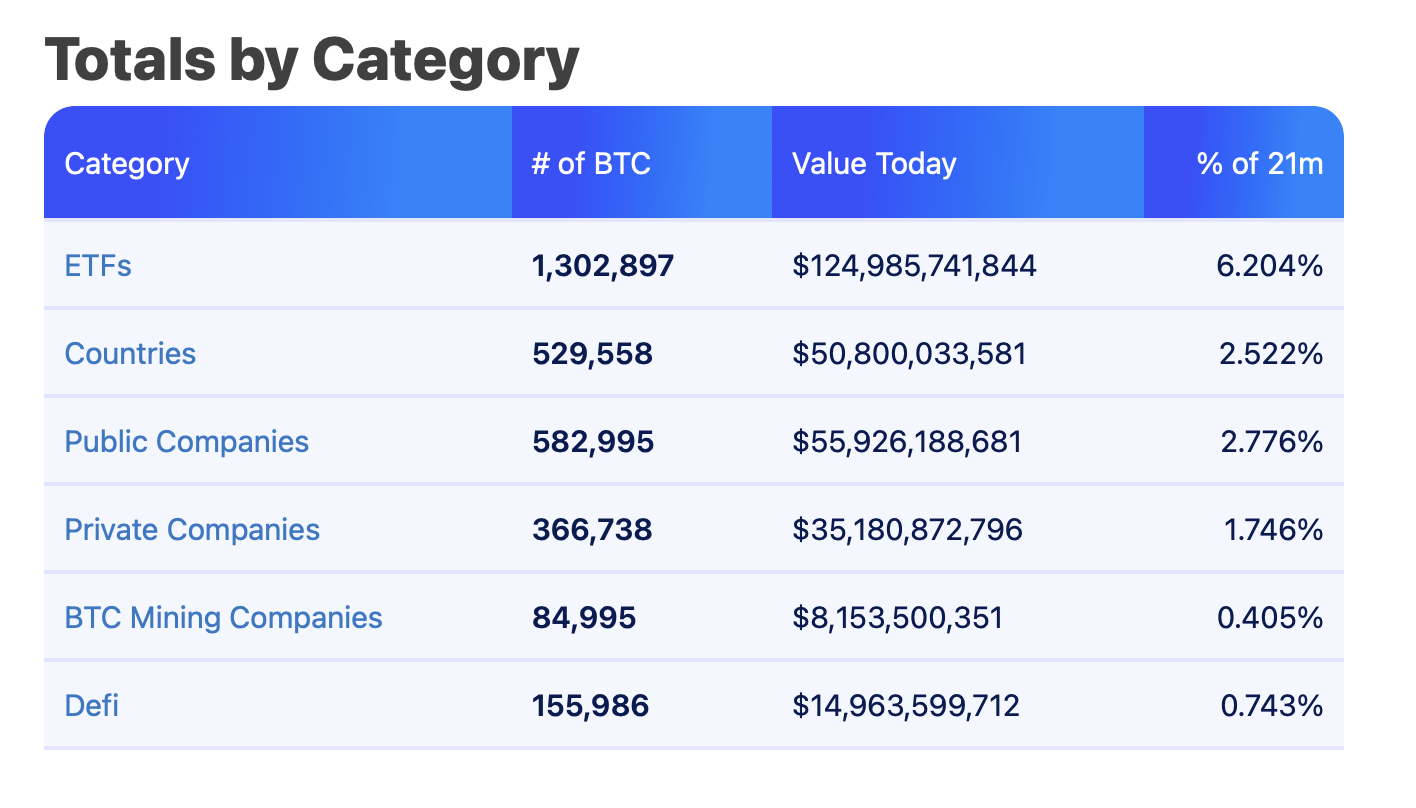

Source: BiTBO

The Bitcoin Strategic Reserve Act was submitted to Congress for review on August 4, 2024, and is under consideration by the Senate Banking Committee, while Trump has the conditions to push this bill through. Meanwhile, several U.S. states have also proposed their own Bitcoin Strategic Reserve Acts. Perhaps in 2025, Bitcoin as a strategic reserve will become a reality.

Additionally, after Trump's re-election, the SAB121 Act is likely to be repealed, allowing traditional financial institutions to hold cryptocurrencies on their balance sheets, further promoting the institutionalization of crypto assets and overall enhancing the maturity of the crypto market. The SEC's application standards for the Howey test are also likely to be relaxed, which will facilitate the approval of more cryptocurrency spot ETFs and allow more crypto companies to go public.

Huobi HTX Accelerates Global Compliance Strategy and Actively Expands Blockchain Ecosystem

For Huobi HTX, 2024 is a key year to walk alongside blockchain technology and an important moment to contribute to the decentralized economy. Over the past year, Huobi HTX has driven the development of the entire ecosystem through technological innovation, market expansion, and user growth on the platform, and has further promoted the prosperity of the Web3 ecosystem through strategic layout and investment.

In 2024, Huobi HTX experienced strong user growth, with cumulative registered users surpassing 49 million, including 3 million new users added in 2024 alone, and nearly 80 billion visits across both ends, showcasing the platform's strong appeal and user activity. In terms of trading volume, Huobi HTX's total trading volume for the year approached $2.4 trillion, a 100% increase compared to the previous year, with spot trading accounting for 62% and contract trading reaching $900 billion, demonstrating Huobi HTX's significant position in the market.

In seizing opportunities in emerging sectors, Huobi HTX has performed excellently, launching multiple high-quality assets and achieving outstanding results in areas such as MEME, RWA, and DeFi. Among the early launched projects, there are several that have seen dozens or even hundreds of times in price increases, including WIF, BOME, NEIROCTO, and SUNDOG.

In terms of compliance and internationalization, Huobi HTX continues to advance its global compliance strategy, actively collaborating with regulatory agencies in various countries to ensure the platform's legal operation in major markets. In 2024, Huobi HTX's compliance operations in the European market were further strengthened, and it is advancing its layout in the Middle East through Huobi Dubai.

Additionally, Huobi HTX's global investment arm, HTX Ventures, has increased its investment in cutting-edge crypto projects across multiple fields, including DeFi, ZK-rollups, Layer 1 and Layer 2 solutions, artificial intelligence, and GameFi. HTX Ventures has provided more resource support through partnerships with top venture capital firms, helping investment projects achieve market expansion and technological innovation. The successful launch of projects such as Babylon, Berachain, Monad, Avail, and Sophon demonstrates the strong innovative driving force of blockchain technology and its broad application prospects. The success of these projects has not only brought considerable returns to Huobi HTX but has also further promoted the development of the entire blockchain ecosystem.

Looking ahead to 2025, Huobi HTX will continue to deepen its efforts in the global market, strengthen compliance operations and technological innovation, and strive to provide users with more diversified digital asset services. As the global regulatory environment matures and industry technology continues to break through, the cryptocurrency industry will encounter more development opportunities in the coming years. Huobi HTX will continue to collaborate with major global institutions and communities to promote the widespread application of crypto assets and maintain a leading position in various sub-sectors. We believe that 2025 will be a key year for Huobi HTX to embrace new opportunities in the industry and a moment for the global blockchain ecosystem to experience a comprehensive explosion.

About Huobi HTX

Founded in 2013, Huobi HTX has evolved over 11 years from a cryptocurrency exchange into a comprehensive blockchain business ecosystem, covering digital asset trading, financial derivatives, research, investment, incubation, and other services. As a global leader in the Web3 portal, Huobi HTX adheres to a development strategy focused on global expansion, ecological prosperity, wealth effects, and security compliance, providing comprehensive, safe, and reliable value and services for virtual currency enthusiasts worldwide.

For more information about HTX, please visit HTX Square or https://www.htx.com/, and follow us on X, Telegram, and Discord. For further inquiries, please contact HTX@ruderfinn.com.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。