In 2024, the cryptocurrency market experienced a resurgence and structural transformation, with a total market capitalization exceeding $3.8 trillion, a year-on-year increase of 110%. During this year, the price of BTC broke the $100,000 mark, setting a new historical high. This not only marks an important milestone in the development of the crypto market but also signifies a year of comprehensive rise for the derivatives market.

These "milestone" figures stem from multiple favorable factors within the industry. In January, the SEC approved the listing of 11 Bitcoin spot ETFs, including products from asset management giants like BlackRock and Fidelity Investments. In July of the same year, the approval of Ethereum spot ETFs further enriched investors' choices and injected more liquidity into the market. Meanwhile, Tesla CEO Elon Musk's public support at the "Bitcoin 2024 Conference" boosted market confidence. He referred to Bitcoin as "the gold of the digital age" and reaffirmed his long-term belief in DeFi. This statement further solidified the position of crypto assets as a mainstream investment category.

Driven by macroeconomic benefits, the derivatives market became another important growth engine for the crypto industry in 2024. According to Coinglass data, the global crypto derivatives market saw a significant increase in trading volume in 2024, with the total open interest reaching a historical high, indicating a strong interest from investors in leveraged products and market price fluctuations. Major exchanges demonstrated unique competitiveness in both derivatives and spot markets, including:

- Binance led the market with an average daily trading volume of $40 billion in mainstream contracts, consolidating its industry leadership with strong liquidity and a broad user base.

- OKX secured second place with an average daily trading volume of $19 billion in mainstream contracts, establishing a solid foundation for the platform's sustainable development through its leading asset reserve proof mechanism.

- Bybit maintained its position as the second-largest exchange in the global spot market with an average daily trading volume of $2.3 billion, while also seeing over $8 billion in capital inflow in 2024.

- Crypto.com found breakthroughs in specific areas, winning market share through innovative features and user experience.

- Deribit dominated the options sector, holding a 2% market share in Bitcoin options, establishing its leadership in the professional derivatives field.

- Hyperliqud, as a leading on-chain exchange, promoted the industry's development towards transparency and efficiency with decentralized perpetual contracts and margin trading.

These platforms not only drove the growth of trading volume but also provided valuable observational samples for the global crypto market. As an industry-leading contract data analysis platform, Coinglass will deeply analyze how major exchanges gain advantages in the global landscape through data on the derivatives market, spot trading volume, asset transparency, and trading fees, exploring the core driving forces of the crypto market in 2024, and providing forward-looking insights and reflections for investors and the industry.

Derivatives Market

In 2024, the cryptocurrency derivatives market experienced historic growth, becoming an important component of the cryptocurrency market. The global crypto derivatives market set new records, with an average daily trading volume exceeding $100 billion and monthly trading volume surpassing $3 trillion, far exceeding the trading volume of the spot market. This significant growth reflects an increased demand for leveraged products from investors, especially during periods of high market volatility. As the market matures and regulatory frameworks improve, more institutional investors—such as hedge funds and asset management companies—are entering the derivatives market, further driving its development. Additionally, retail investor participation is also rapidly increasing, as user-friendly trading platforms lower the entry barriers, while the high leverage characteristics of derivatives attract a large number of retail users seeking short-term gains.

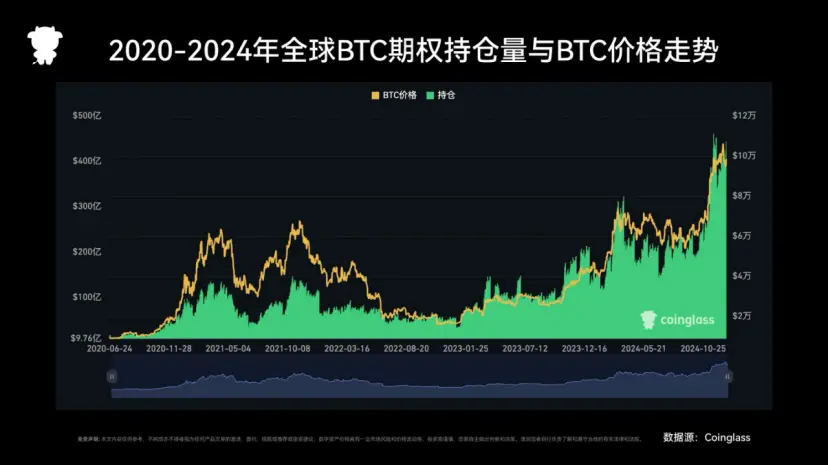

By the end of 2024, the total open interest in BTC contracts in the global crypto derivatives market exceeded $60 billion, indicating a sustained demand for risk management tools and leveraged products. The impact of derivatives trading on the market cannot be ignored. Firstly, it significantly enhances market liquidity, allowing traders to leverage larger market sizes with less capital, reducing the impact of large trades on spot prices, thus making market operations more efficient. Secondly, the derivatives market plays an important role in price discovery, especially during periods of market volatility, where the prices of futures and perpetual contracts often guide the price trends of the spot market. Furthermore, derivatives provide institutional investors with hedging tools, reducing the volatility of asset portfolios and attracting more long-term capital inflows. Ultimately, the trading behavior in the derivatives market promotes the efficiency of market pricing, reduces the volatility of cryptocurrency assets, and enhances the overall stability of the market, laying the foundation for the maturity and healthy development of the cryptocurrency market.

In 2024, the trading volume of the cryptocurrency derivatives market accounted for a significant share of the total trading volume, with noticeable differences in market distribution among major exchanges. According to Coinglass's contract trading volume data, Binance continued to lead the market, with the total trading volume of the top ten contract cryptocurrencies reaching $14.6855 trillion, far surpassing other competitors, showcasing its unmatched advantage in the crypto derivatives trading field. OKX ranked second globally with a trading volume of $7.0648 trillion, also demonstrating its core position in the global derivatives market. The user base of OKX is primarily concentrated in the top five cryptocurrencies: BTC, ETH, SOL, DOGE, and PEPE, further solidifying its market dominance in these high-demand cryptocurrencies.

Although Bitget and Bybit ranked third and fourth respectively, showing impressive performance, there remains a significant gap in trading volume between them and Binance and OKX, indicating that the global market competition remains relatively concentrated.

The competitive landscape among different exchanges has shown noticeable differentiation. Platforms like OKX and Binance have solidified their leading positions in the global market by optimizing trading products and enhancing user experience, while Bitget and Bybit have demonstrated unique competitiveness in specific areas or cryptocurrencies.

In 2024, the price of BTC broke the $100,000 mark, driving significant growth in the BTC options market. As the price of Bitcoin rose, the activity in options trading surged, with total open interest reaching $41.127 billion, further solidifying its core position in the global market.

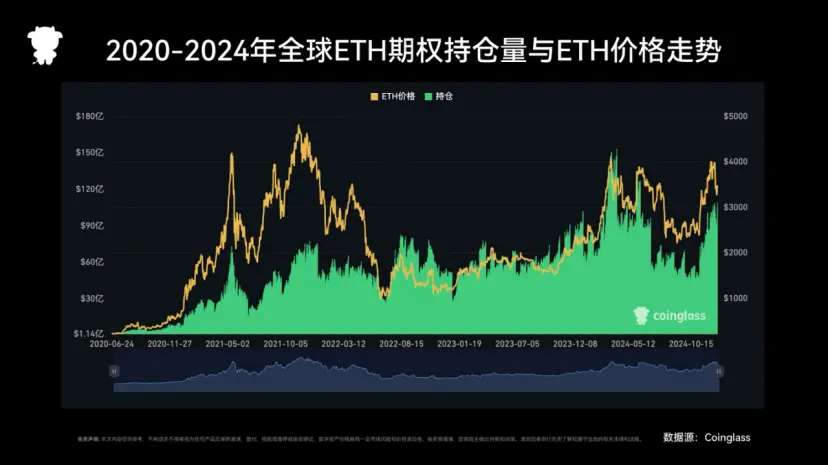

As of December 19, 2024, the total open interest in the BTC options market was $41.127 billion, while ETH stood at $10.072 billion. The market size of BTC is four times that of ETH, reflecting BTC's status as the core asset of liquidity in the crypto market.

In the competitive landscape of the BTC options market, Deribit continues to dominate, holding 82.2% of the global market share. Meanwhile, OKX performed excellently with a flexible product strategy and strong liquidity, ranking third with a position volume of $2.927 billion, accounting for 7.1% of the global market share. This performance highlights OKX's rapid rise in the options market and its potential for continued growth.

In 2024, the Ethereum (ETH) options market continued to grow, with total open interest reaching $10.072 billion. With the further development of the smart contract ecosystem and the promotion of staking activities, the ETH options market exhibited a robust growth trend.

The price of ETH broke the $4,000 high in 2024, driving an expansion in market demand. In the market landscape, Deribit continued to hold a dominant position, while other platforms gradually expanded their shares through their respective market strategies. Data shows that among the leading platforms, some exchanges have market shares exceeding 10%, indicating active layouts by competitors in this field.

Spot Trading Volume

In 2024, the cryptocurrency spot trading market exhibited a trend of centralization, with the market share gap among major exchanges further widening. In 2024, Binance maintained its leading position with over $2.15 trillion in mainstream spot trading volume, occupying an absolute dominant position in the market. Following closely were Bybit and Crypto.com, with mainstream spot trading volumes of $858 billion and $810 billion respectively, forming a second tier, indicating their competitive advantages in the mid-sized market.

Coinbase and OKX ranked fifth with trading volumes of $635 billion and $606 billion respectively, solidifying their stable positions in the market. In contrast, Kraken's trading volume was $133 billion, Bitstamp's was $67 billion, and Bitfinex's was $58 billion, with these exchanges having relatively smaller market sizes, and their user bases more concentrated in specific regions or among professional investors. Gemini's trading volume was only $18 billion, ranking low among major exchanges, reflecting its focus on serving institutional clients and long-term investors.

Asset Holding Transparency

Transparency is gradually becoming a key factor for centralized exchanges to gain user trust. The collapse of FTX in 2022 exposed deep-seated issues in the industry regarding asset transparency and risk management, directly leading to a crisis of trust in the market. Users found it difficult to verify the true financial status of exchanges, and internal governance flaws exacerbated the risk of asset loss, severely damaging the industry's credibility and significantly increasing market uncertainty, posing a serious challenge to the long-term development of the cryptocurrency industry.

After the FTX incident, the market's demand for transparency rapidly increased, prompting CEX to rebuild trust through asset disclosure and technological upgrades. Leading exchanges, including OKX, were the first to introduce Proof of Reserves (POR) and adopted advanced cryptographic technologies like zk-STARK, allowing users to independently verify asset conditions, balancing transparency with privacy protection. This trend not only reshaped the foundation of industry trust but also established new development standards for CEX, laying an important cornerstone for the future of the crypto market.

Moreover, the transparency of exchanges is inseparable from a clear and quantifiable indicator system. According to DefiLlama data, "Assets" and "Clean Assets" have become key metrics for assessing the health of exchanges:

The first is Assets, which includes all assets held by the exchange but excludes IOU assets that have already been accounted for on other chains. For example, the anchored BTC on the Binance Smart Chain (BSC) has already been recorded on the Bitcoin chain, so it will not be counted again.

The second is Clean Assets: reflecting the total locked value (TVL) of the exchange, excluding proprietary assets issued by the exchange (such as platform tokens), providing a more accurate measure of the asset quality and liquidity of the exchange.

Through these two indicators, users can more clearly assess the robustness and transparency of the platform.

Binance ranks first in the industry with total assets of $165.29 billion. In the face of increasing regulatory pressure, Binance's transparency and asset quality issues have garnered widespread attention from the market.

In 2024, OKX's capital inflow and transparency performance became important data points in the crypto industry. According to DefiLlama data: OKX ranked among the industry leaders with a net inflow of $4.602 billion, reaching total assets of $28.86 billion, of which $28.72 billion are clean assets, resulting in a clean asset ratio of 99.5%. The net inflow data indicates that OKX is at a leading level among similar exchanges, showing a significant increase in user trading activity and capital flow. The clean asset ratio indicates that the vast majority of the assets held by the platform are unencumbered or unborrowed, reflecting a high level of capital safety and liquidity.

Bybit's net capital inflow reached $8 billion, showing rapid growth. Crypto.com and Bitfinex faced net outflows of $220 million and $2.3 billion, respectively, reflecting a further decline in their market shares.

Trading Fee Indicators

(1) Spot Trading Fees

As competition in the spot trading market intensifies, major exchanges are attracting users by optimizing fees, adjusting user thresholds, and implementing differentiated strategies, resulting in a clear stratification trend in the market.

At the ordinary user level, the fee strategies of major exchanges remain consistent, all adopting a 0.1% maker and taker fee.

At the VIP user level, the competitive landscape is more intense. OKX offers a highly competitive fee structure for the highest-level VIP users: a negative maker fee of -0.01% and a taker fee of 0.02%. This is better than Binance's offering of a 0.011% maker and 0.023% taker fee for top users. Bybit's fee structure in this area is relatively conservative, with a taker fee of 0.015% and a maker fee of 0.005%. Although the overall fees are higher than the other two exchanges, it still maintains a certain level of market competitiveness.

In terms of the trading volume thresholds required to achieve these favorable fees, OKX has the highest requirement, needing a trading volume of over $5 billion within 30 days. Binance's requirement is over $4 billion, while Bybit has the lowest threshold, requiring only $1 billion. This differentiation in thresholds reflects the different strategies and market positioning of each exchange in the competition for high-end users.

(2) Contract Trading Fees

With the rapid development of the derivatives market, contract trading has become the core battleground for competition among major exchanges. Each platform competes across different user tiers through refined fee structures and differentiated threshold strategies.

At the ordinary user level, the market-leading exchanges show significant consistency in basic fee rates. Binance and OKX adopt a unified fee structure (maker fee 0.0200%, taker fee 0.0500%), reflecting a price consensus in a mature market. Bybit maintains the same maker fee (0.0200%) while slightly adjusting the taker fee to 0.0550%, reflecting its strategy in revenue structure.

At the VIP user level, the competitive landscape is more intense and clearly differentiated. OKX stands out with the most aggressive fee strategy, offering a negative maker fee (-0.0050%) and a highly competitive taker fee (0.0150%) for top VIP users. Binance adopts a relatively conservative strategy, providing a maker fee of 0.0000% and a taker fee of 0.0170%, reflecting its stable position as a market leader. Bybit's fee strategy (maker 0.0000%, taker 0.0180%) is close to Binance's.

In terms of entry thresholds, the three exchanges show a clear gradient. Binance maintains the highest standard, requiring a trading volume of $25 billion over 30 days, highlighting its market leader status; OKX follows closely with a threshold of $20 billion, echoing its aggressive fee strategy; Bybit adopts a relatively accessible threshold of $5 billion, indicating its strategic intent to expand market share.

This differentiation in thresholds not only reflects the market positions of each platform but also illustrates their different philosophies in user selection and risk control. These fee designs reflect the strategies each platform employs to attract different user groups. As market competition intensifies, the differences in fees between platforms will become an important factor influencing user choices.

(3) Contract Funding Rates

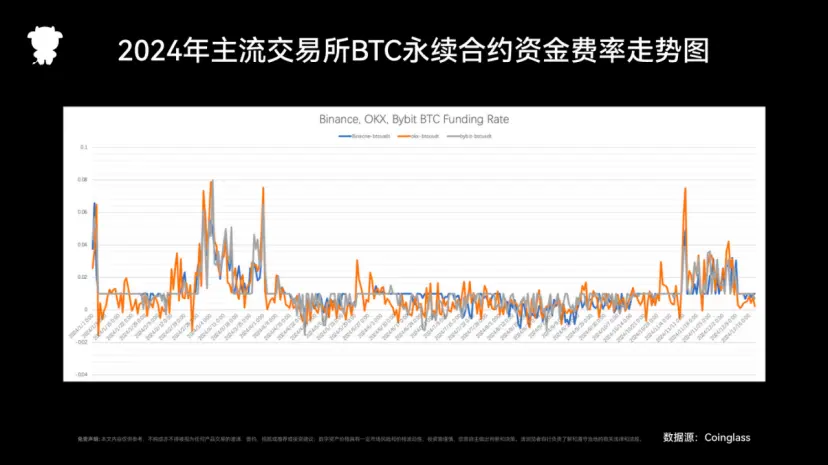

Funding rates, as a core mechanism of perpetual contracts, maintain the balance between contract prices and spot prices through regular exchanges of fees between long and short positions. A positive funding rate means that longs pay shorts, and vice versa. This indicator not only reflects market sentiment but also serves as an important reference for measuring market leverage preferences. (Note: This analysis is based on 8-hour funding rate data, with the annualized calculation method being: 8-hour funding rate × 3 × 365. For example, an 8-hour funding rate of 0.01% is approximately equal to an annualized rate of 10.95%.)

In 2024, the overall sentiment in the crypto market remained optimistic, as evidenced by the funding rate data. Binance maintained a positive funding rate for 322 days throughout the year, followed closely by Bybit with 320 days, and OKX with 291 days (based on daily 0:00 BTC - USDT Coinglass contract data). This sustained positive funding rate indicates that bullish sentiment dominated the market for most of 2024.

In 2024, the funding rates of major exchanges fluctuated with market conditions.

First Quarter: The ETF-Driven Frenzy

At the beginning of 2024, market sentiment was high. In early January, the 8-hour funding rates of the three major exchanges reached around 0.07%, annualized at approximately 76.65%, reflecting extremely optimistic market expectations. This coincided closely with the significant event of Bitcoin spot ETF approvals. Among them, OKX set a single-day high of about 0.078% in early March, annualized at approximately 85.41%.

Second to Third Quarter: The Rational Return Period

From April to August, the market entered a cooling period. Funding rates oscillated at lower levels, mostly remaining below 0.01% (annualized below 10.95%), with some periods even showing negative values. This indicates a cooling of speculative market sentiment, trending towards rationality.

Fourth Quarter: Policy Expectations Driving Period

In November, a peak was reached again, with the funding rates of the three major exchanges generally rising to the range of 0.04%-0.07% (annualized 43.8%-76.65%), and the market exhibited strong bullish sentiment once more. This may be related to year-end policy expectations and institutional capital inflows.

Leading exchanges, through differentiated fee strategies, further widen their advantages in market competition. This not only effectively enhances the efficiency of user capital utilization but also provides more targeted service options. This trend reflects not only the immediate changes in market supply and demand but also, to some extent, the ongoing exploration and refined operational capabilities of trading platforms in liquidity management, risk control, and user experience optimization.

Binance: As the largest cryptocurrency exchange globally, Binance's funding rate trends exhibit significant stability. The annual rate fluctuation range is relatively narrow, with extreme values occurring least frequently, and the annualized rate typically maintained in a rational range of 5%-15%. This characteristic confirms its position as a "market barometer."

OKX: In contrast, OKX demonstrates a stronger market sensitivity. Its funding rate exhibits the largest fluctuations, with an annualized range from -20% to 85%. This characteristic makes it an important reference for predicting shifts in market sentiment, especially suitable for high-frequency traders looking to seize short-term market opportunities, or it can be seen as a "sensitive market barometer."

Bybit: Bybit's funding rate changes typically fall between those of Binance and OKX, with an annualized fluctuation range between -10% and 60%. This "balanced market positioning" characteristic allows it to maintain market competitiveness while also providing users with a relatively stable trading environment.

Coinglass Exchange Ratings

Coinglass, as an authoritative data analysis platform in the cryptocurrency market, has established a comprehensive exchange rating system that evaluates major global cryptocurrency exchanges across multiple dimensions, including trading scale, platform reputation, and security transparency. This rating system not only provides investors with an objective reference for platform selection but also promotes the entire industry towards a more standardized and transparent direction.

Specifically, the rating system primarily progresses based on the following aspects:

Trading Scale Performance

In terms of spot and contract trading volumes, the market exhibits a clear stratification effect. According to Coinglass data, Binance leads the market with a mainstream contract average daily trading volume of $40 billion, while the mainstream spot average daily trading volume reaches an astonishing $6 billion. Following closely, OKX also performs impressively, with an average daily mainstream contract trading volume of $19 billion, showcasing strong market vitality. These data fully reflect the dominant position of leading exchanges in the market. This scale advantage not only reflects the trading depth of the platform but also embodies the trust users have in the platform.

Platform Reputation Assessment

In 2024, after undergoing multiple tests in the early market, the industry reputation and social influence of leading exchanges have further solidified. Major platforms have surpassed tens of millions in total user coverage on social media, with community activity showing a significant positive correlation with platform trading volume. Leading exchanges like Binance and OKX have established a professional and reliable brand image among user groups through continuous product innovation and service upgrades. Daily interactions and information transparency on mainstream social media platforms like X have also become important ways to enhance user trust.

Security and Transparency Performance

In the post-FTX era, security and transparency have become the primary considerations for users when choosing trading platforms. Leading exchanges generally adopt advanced security measures such as multi-signature and cold wallet storage, with no major security incidents occurring throughout the year, demonstrating the effectiveness of their risk control systems. Notably, OKX has set a new standard for industry transparency through its regularly published Proof of Reserves (PoR) system. Its clean asset ratio of 99.5% not only showcases a high-quality asset structure but also highlights the platform's professional capabilities in risk management.

Under Coinglass's rating system, Binance and OKX stand out in the market due to their respective advantages. Binance continues to maintain its global leadership position, relying on its strong market scale and complete ecosystem. The platform boasts the largest user base, with an average daily mainstream contract trading volume of $40 billion and a mainstream spot trading volume of $6 billion, fully demonstrating its market dominance. At the same time, its user fee structure is also highly competitive.

Following closely, OKX ranks second globally with a comprehensive score of 78, a result of the platform's balanced development across multiple areas. In terms of trading ecology, OKX provides a high-quality trading environment for users at different levels through a flexible fee structure (VIP users can enjoy a maker fee of -0.0050%) and a comprehensive derivatives toolchain. In terms of risk control and transparency, its leading asset reserve proof mechanism and efficient risk management system lay a solid foundation for the platform's sustainable development. Additionally, the professional design of the trading interface and a comprehensive product matrix ensure an excellent user experience.

The Coinglass rating system reveals the current development trends in the cryptocurrency trading market: trading scale is no longer the sole criterion for measuring platform strength; asset transparency and security are increasingly becoming core indicators of user concern, while product innovation capability and user experience have become new focal points of platform competition. The distinct development strategies of the two major exchanges, Binance and OKX, bring about healthy competition in the market. Binance focuses on expanding market scale and improving its ecosystem, while OKX seeks breakthroughs in innovative products and user experience. This differentiated competitive landscape ultimately benefits the entire industry, promoting it towards a more standardized, transparent, and professional direction.

Conclusion

The cryptocurrency market in 2024 exhibits characteristics of structural transformation and qualitative change. Driven by the dual forces of institutional capital inflow and the gradual improvement of regulatory frameworks, the market has not only achieved breakthroughs in quantitative indicators but has also undergone profound changes in market structure, trading mechanisms, and risk control.

In terms of market landscape, competition among leading exchanges has shifted from simple scale expansion to a multidimensional contest of comprehensive strength. Binance continues to lead the market with its strong ecosystem and an annual mainstream spot trading volume of $21.5 trillion, while OKX has established a unique advantage among professional traders with a net capital inflow of $4.602 billion and a clean asset ratio of 99.5% through product innovation and precise market positioning. This differentiated competitive landscape has driven the entire industry to enhance product depth, technological innovation, and risk management comprehensively.

The rapid development of the derivatives market has become one of the most significant structural changes in 2024. The average daily trading volume surpassing $150 billion reflects a fundamental change in institutional investors' demand for crypto asset allocation. The prosperity of the options market is particularly noteworthy, with the total open interest of Bitcoin options reaching $41.127 billion and Ethereum reaching $10.072 billion, indicating that market risk management tools are becoming increasingly sophisticated and institutional-level trading infrastructure is gradually maturing.

From the perspective of industry development trends, asset transparency and platform security have become core elements of market competition. The popularization of the Proof of Reserves (PoR) mechanism and the establishment of innovative risk control systems signify that the industry is transitioning from wild growth to standardized operations. Mainstream exchanges are establishing new industry standards in compliance, transparency, and risk management through technological upgrades and process optimization.

Looking ahead to 2025, the cryptocurrency market is entering a new round of innovation cycles. First, the continued approval of ETFs will deepen the integration of crypto assets with traditional financial markets, bringing more institutional-level liquidity to the market. Second, technological breakthroughs in DEXs may reshape the market's microstructure, driving trading models towards greater efficiency and transparency. Additionally, the acceleration of the asset tokenization wave will expand the boundaries of the crypto market, providing new business growth points for exchanges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。