The biggest downside of running around is that it's hard to manage time. It's already 5 AM, and I've just finished dealing with things, and I still haven't submitted my assignments. In five hours, I have to go out again, so going out is really a headache, especially since I plan to study some newer tracks in 2025. Time is really not enough, and I intend to reduce going out in 2025.

Back to the point, in the past few days, there has been a lot of talk about "garbage time." When there was a sudden drop tonight, some friends asked if the bull market was over, or if something had happened, or even if there was a war. Before I could answer, the price started to rise again, and it is now close to $95,000, having risen nearly $3,500 from the bottom.

In fact, the U.S. stock market is also experiencing a drop and then a rebound, so during this "garbage time," without any obvious positive or negative news, #BTC will still have a certain correlation with the U.S. stock market, especially as we approach the holidays. Speaking of which, I illustrated the lack of liquidity yesterday and mentioned several times that today, being a weekday, wouldn't be much better. In reality, it is likely just as I said; we are in a liquidity lull, and a wider range of fluctuations is quite normal.

Therefore, I still insist that in the absence of clear positive or negative news, being bullish when prices rise and bearish when they fall may not be correct.

Looking at BTC data, after the workweek started, the turnover rate increased, but we can see from the trading volume that there hasn't been a significant increase, almost equivalent to the previous workday. So we can also understand that a large amount of turnover is either not happening on exchanges or is not fundamentally related to the price. From the current turnover, it is still dominated by losing chips, meaning that even if it occurs on exchanges, it is mainly investors with losses who are significantly reducing their holdings.

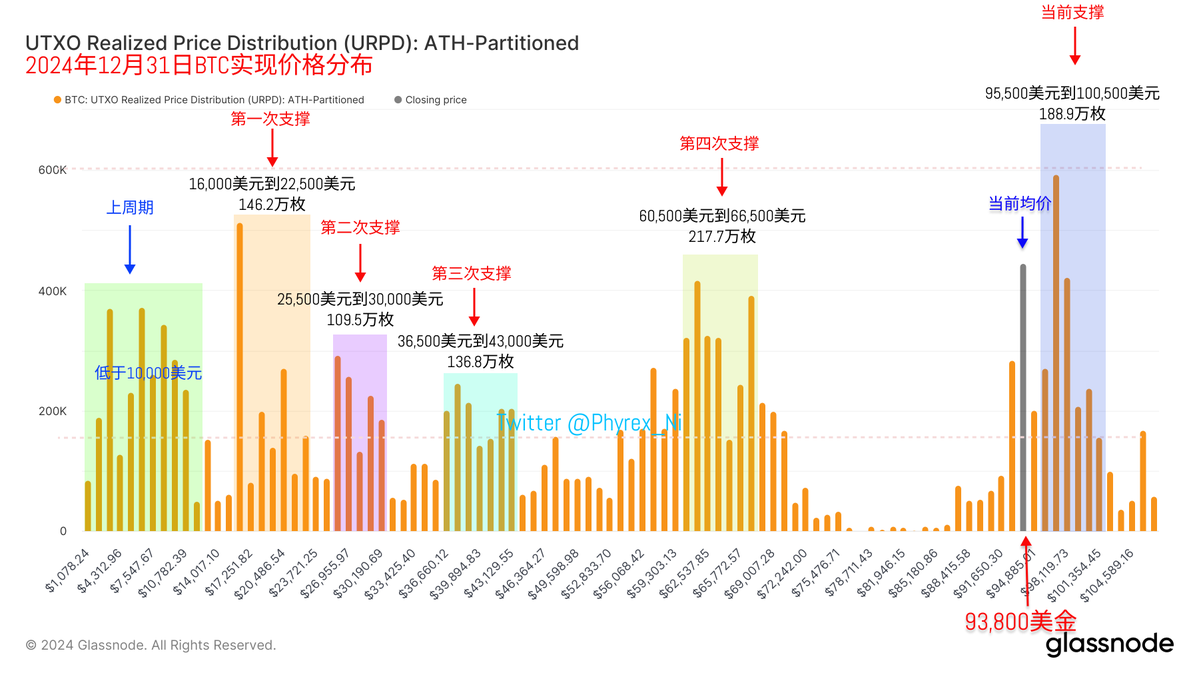

Currently, there are indeed signs that support is starting to shift downwards, a point I mentioned yesterday. Since we are in a liquidity lull, I won't focus on the downward support for now; I will revisit this data after liquidity recovers next week.

Overall, it is still more likely that we are in a fluctuating "garbage trading time."

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。