Continuing from the topic of skipping class, we can see from the comments that there are two completely different viewpoints on $MSTR. On one hand, some believe that although the price of MSTR has dropped, the amount of #Bitcoin it holds has increased. The current low price of MSTR is attributed to Michael's use of hundreds of billions of dollars in ATMs, and Michael has publicly stated that he intends to sell stocks to buy #BTC. They believe that as long as BTC rises and the "cake" amount of MSTR increases, MSTR will rise along with BTC.

The more BTC rises, the more MSTR rises, because it has a leverage of about 1.5 times (currently) on BTC. More importantly, the reason it can support its premium is that it is the only BTC that can be purchased on the US stock market, and it can leverage BTC to implement a collateral phase to spiral long BTC in the US stock market.

This statement is a bit convoluted, but the general idea is that MSTR itself is about 1.5 times BTC, and after buying MSTR, one can achieve a leverage of less than 2.5 times through cyclical borrowing at the bank. It's similar to pledging #ETH to obtain 60% of the funds to continue buying ETH; the final cycle approaches 2.5 times.

So overall, it’s approximately a 3.75 times (actually less than that) long position on BTC. Some may ask why not directly trade on exchanges or CME to go long on #BTC, or use $IBIT for cyclical arbitrage. The reason lies in regulations; not all institutions can go long on CME, and many institutions cannot directly buy BTC on exchanges. Even those that can buy ETFs, currently #BTC and #ETH spot ETFs support borrowing at compliant banks in the US.

Additionally, $MSTR and $MSTX follow the same reasoning.

Essentially, those who are optimistic about MSTR are optimistic about BTC. Indeed, as long as BTC rises, the premium MSTR will rise even more, and the higher the "cake" amount, the higher the premium can be.

On the other hand, bearish investors or those who consider MSTR a "scam" believe that the same amount of money, say $100,000, could buy a complete BTC, but buying MSTR might only get you 45% of BTC and 55% of an inexplicable premium. Another viewpoint is that excessive ATMs will lower the price of individual stocks; even if the market cap rises, the value allocated to each share will decline, which is also the reasoning mentioned by the class skipper.

However, Michael fundamentally does not care about the stock price, or at least not in the short term. His viewpoint, as mentioned earlier, is that as long as he can get more money, he will buy more BTC. The more BTC rises, the higher his market cap will be, and the value allocated to each share will also increase.

Can you say he is wrong? No, because the logic is correct. However, this presents a significant pitfall for investors, which is why I mentioned there could be pitfalls when MSTR was preparing for a large issuance. Excessive issuance will dilute the value in investors' hands. Although there may be potential for future increases, the process of ATMs may have a higher probability of decline, unless all ATMs occur in a very FOMO-driven environment, which is practically impossible.

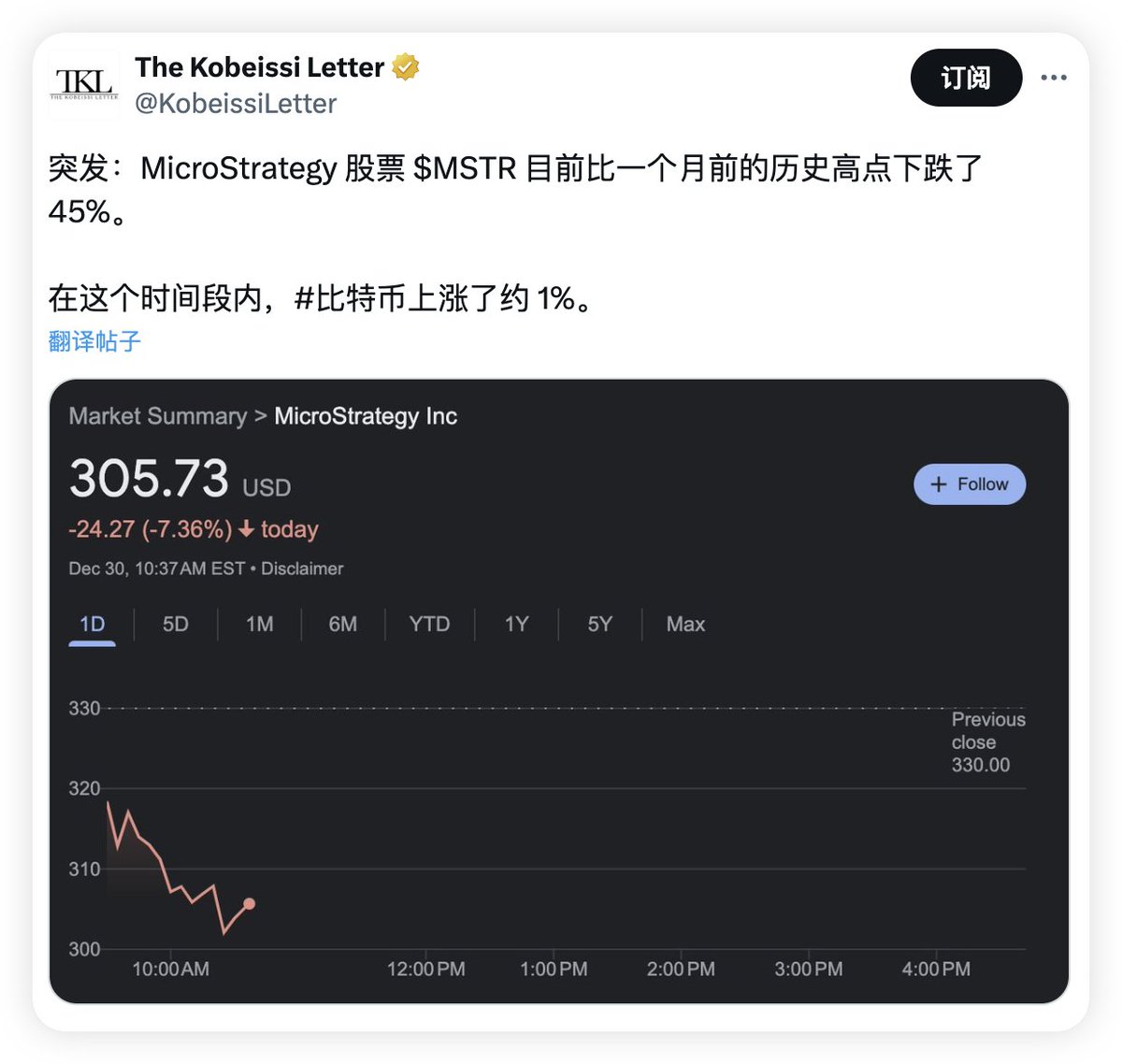

Therefore, there is really no absolute right or wrong. MSTR's decline is real, ATMs are real, and buying BTC is also real, but one can only step on the left foot while the right foot is on the ground when BTC is rising. When BTC falls, it can only accelerate MSTR's decline, especially when BTC drops, compounded by ATMs.

Of course, some may believe that ATMs are not important, but that is another matter.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。