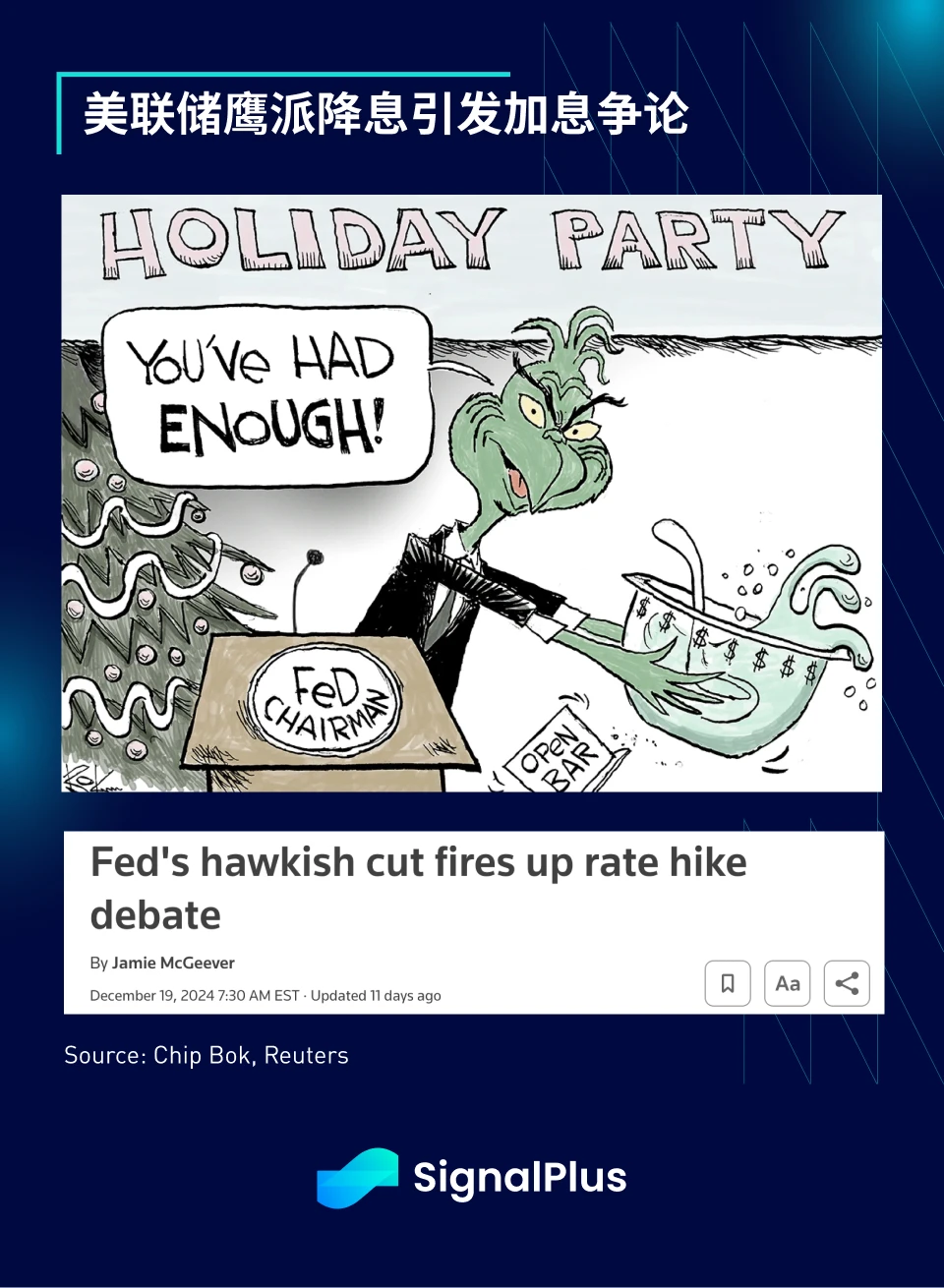

The year 2024 is drawing to a close, and the last few trading days of this year are more important than expected. While the Bank of England and the Bank of Japan maintained interest rates as the market anticipated and leaned towards a dovish stance, the Federal Reserve's "hawkish rate cut" and the technical adjustment to the overnight reverse repurchase rate surprised the market, indicating that liquidity conditions will tighten by the end of the year.

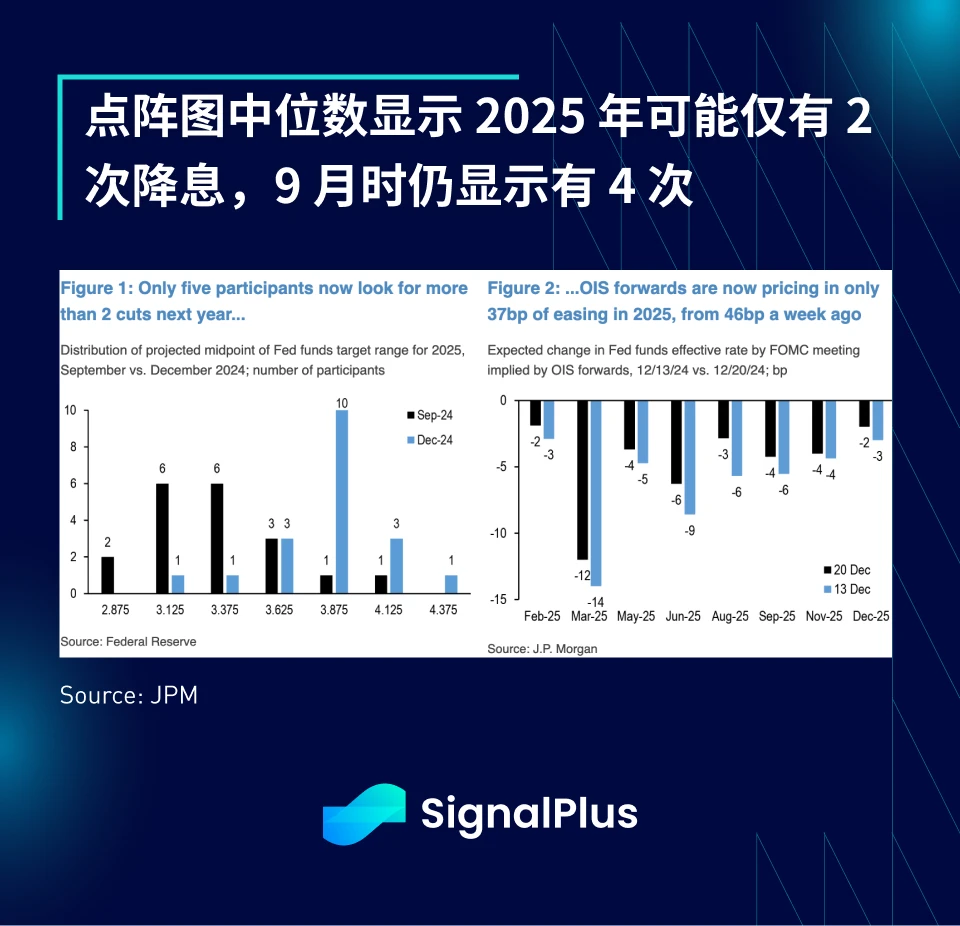

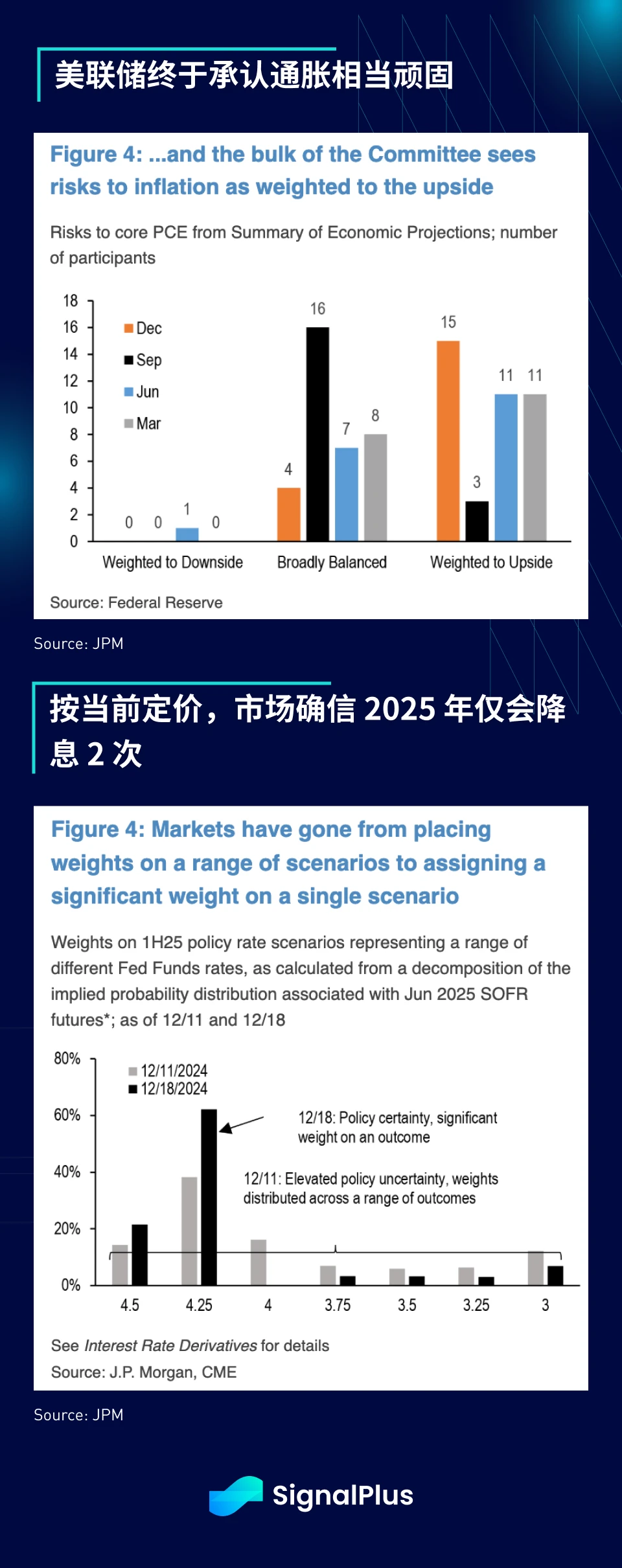

In terms of interest rates, although Powell announced a 25 basis point rate cut as expected, his statement carried a distinctly hawkish tone, particularly mentioning the "magnitude and timing" of future rate cuts, reminiscent of the language used during the pause in rate cuts in 2006-07. Clevent Federal Reserve Chair Hammack also expressed opposition to rate cuts and hopes to maintain rates unchanged, while the Summary of Economic Projections (SEP) dot plot also showed a hawkish stance, with only 5 members believing that there will be more than 3 rate cuts in 2025. The median of the dot plot predicts only 2 rate cuts in 2025, and with economic conditions remaining robust, long-term interest rate expectations have also risen to 3.0%.

More importantly, the core PCE inflation median for 2025 has also risen to 2.5% (+0.3%), and the "inflation risk distribution" has increased to 15 (up from only 3 in September), highlighting the stickiness of inflation over the past quarter. Additionally, during the Q&A session of this year's last FOMC meeting, Powell explicitly stated that he is "very optimistic" about the economic situation and believes that the Federal Reserve has now entered a new phase where it should "act cautiously" after cutting rates by 100 basis points, which indeed carries a strong hawkish implication.

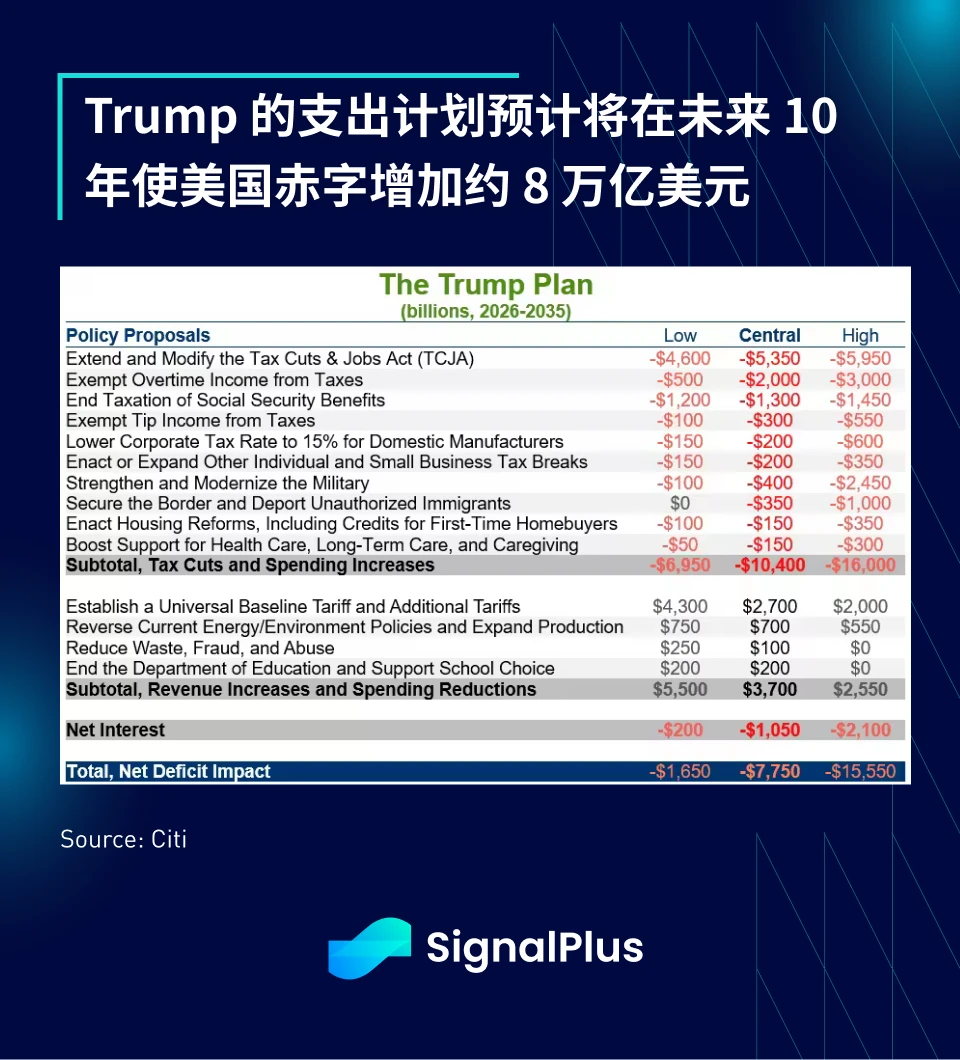

In terms of fiscal policy, Trump's campaign proposals are expected to increase the U.S. deficit by $7.7 trillion over the next 10 years (with the CRFB estimating a range of $1.7 to $15.5 trillion), which would push the U.S. debt-to-GDP ratio to around 145% by 2035. The extent of ultimate inflationary pressure will depend on how many measures he can implement during his second term, and Trump's recent dramatic shift in attitude towards the TikTok ban may indicate that the actual enforcement of his policies may not be as strong as expected.

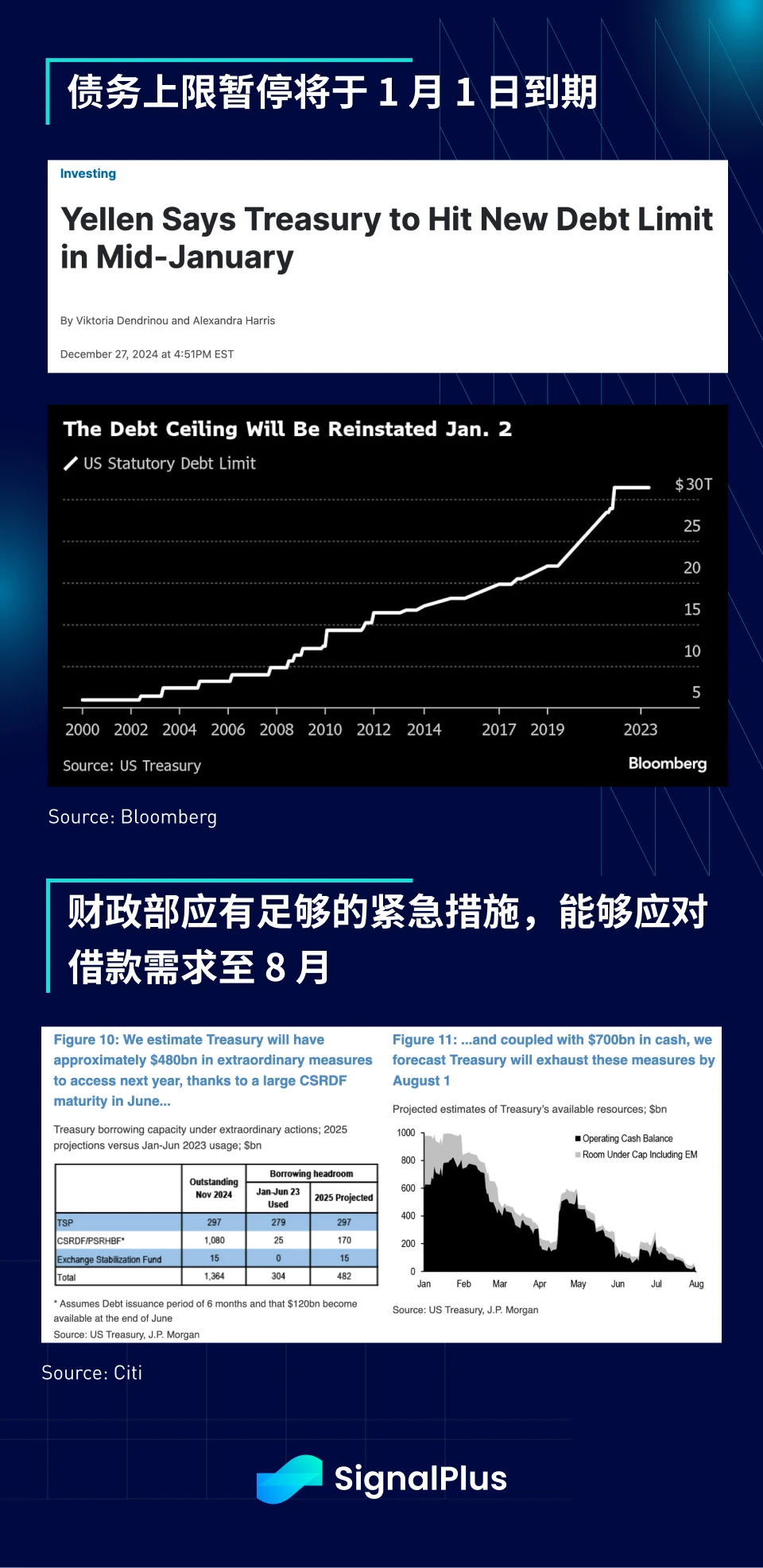

Regarding government spending, the current debt ceiling suspension will expire on January 1, prompting Secretary Yellen to take a series of "extraordinary measures" to create more borrowing space. According to estimates from Wall Street, the Treasury should have enough emergency funds available until August, so the debate over the debt ceiling may not become a news focus until after spring at the earliest.

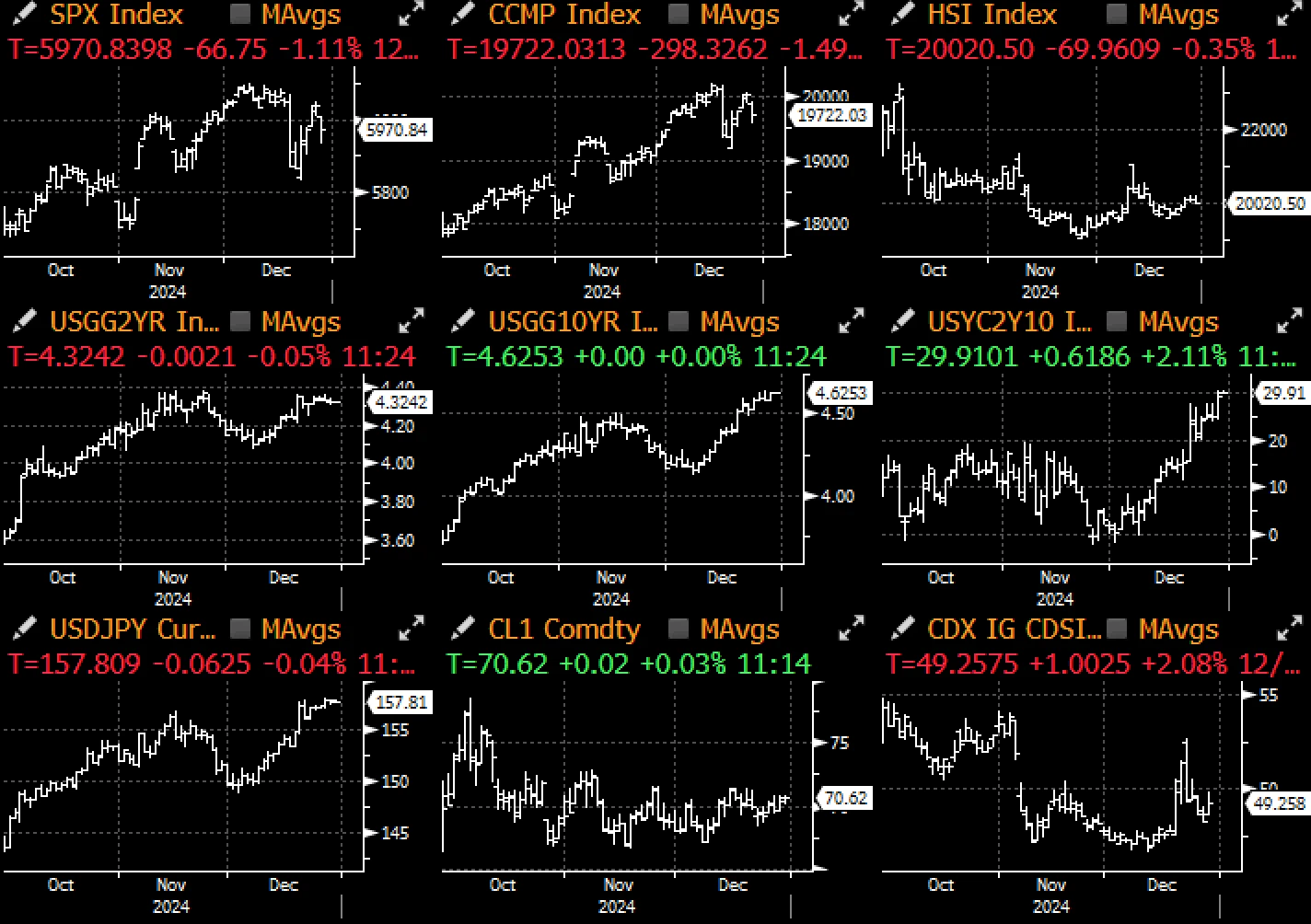

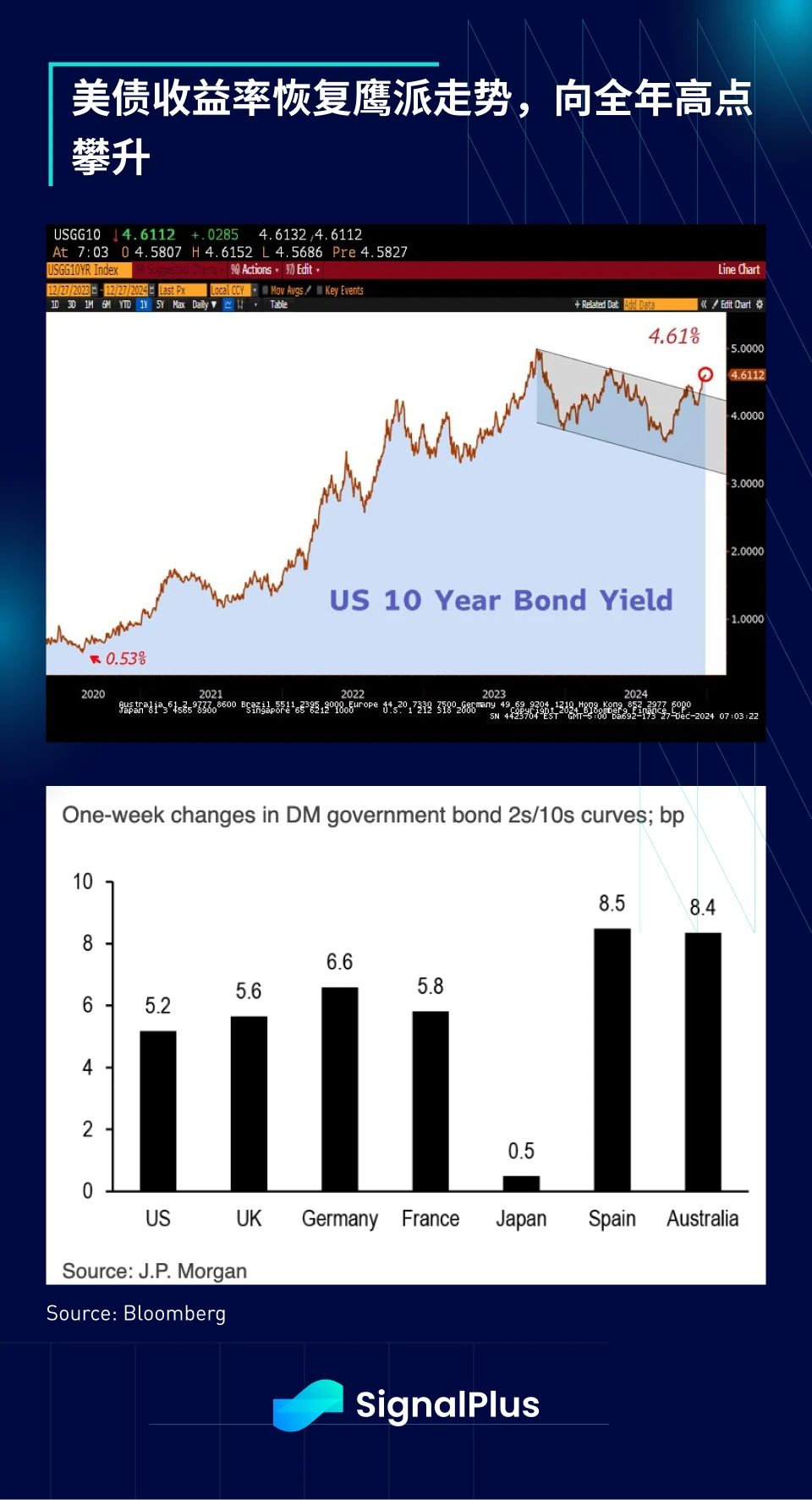

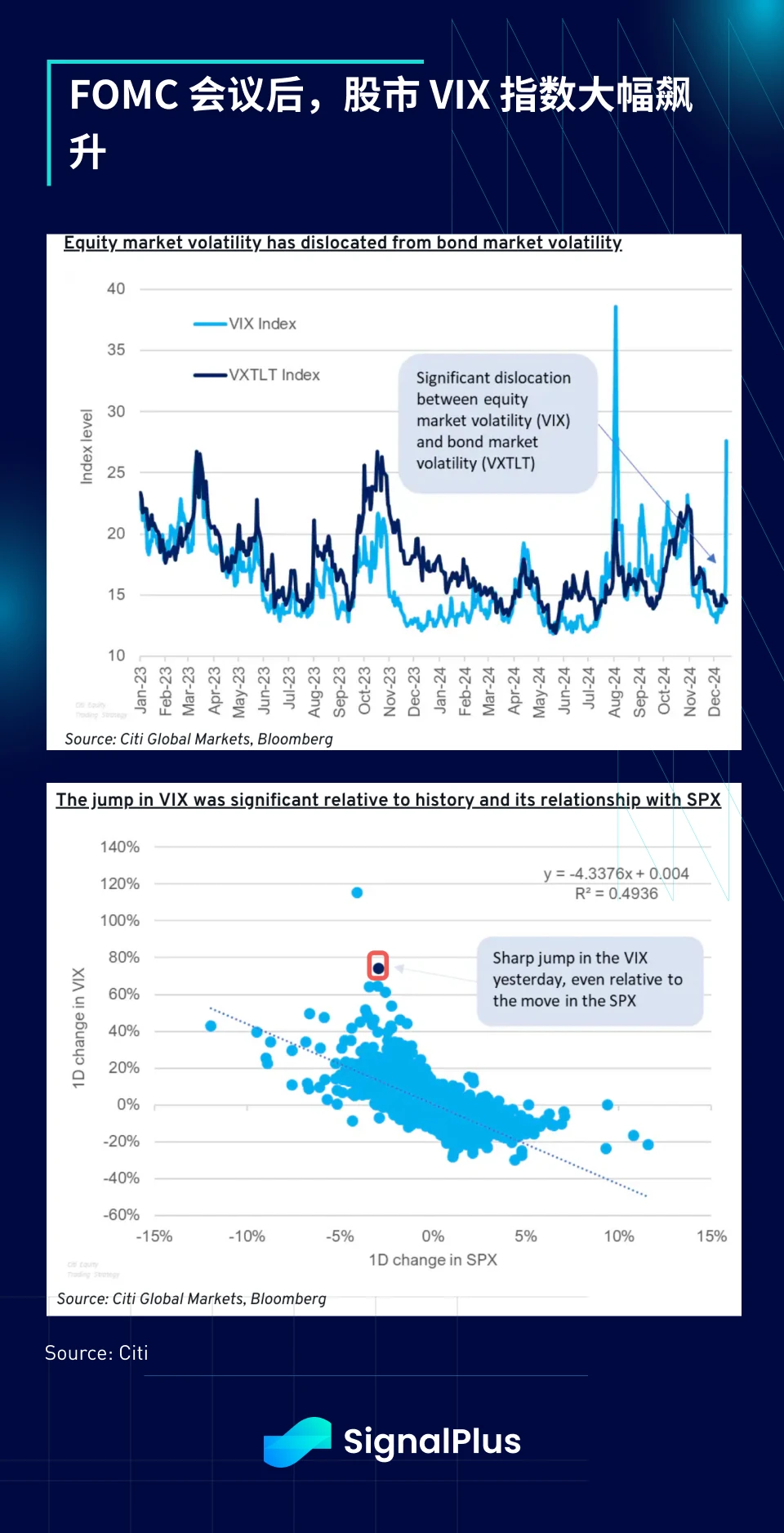

A series of hawkish messages have brought significant negative risk effects, with the SPX index dropping 200 points, and the U.S. Treasury yield curve showing a bear steepening trend, with the 10-year yield breaking through the downward channel and moving towards the year's high, having risen 15 basis points in just the past week.

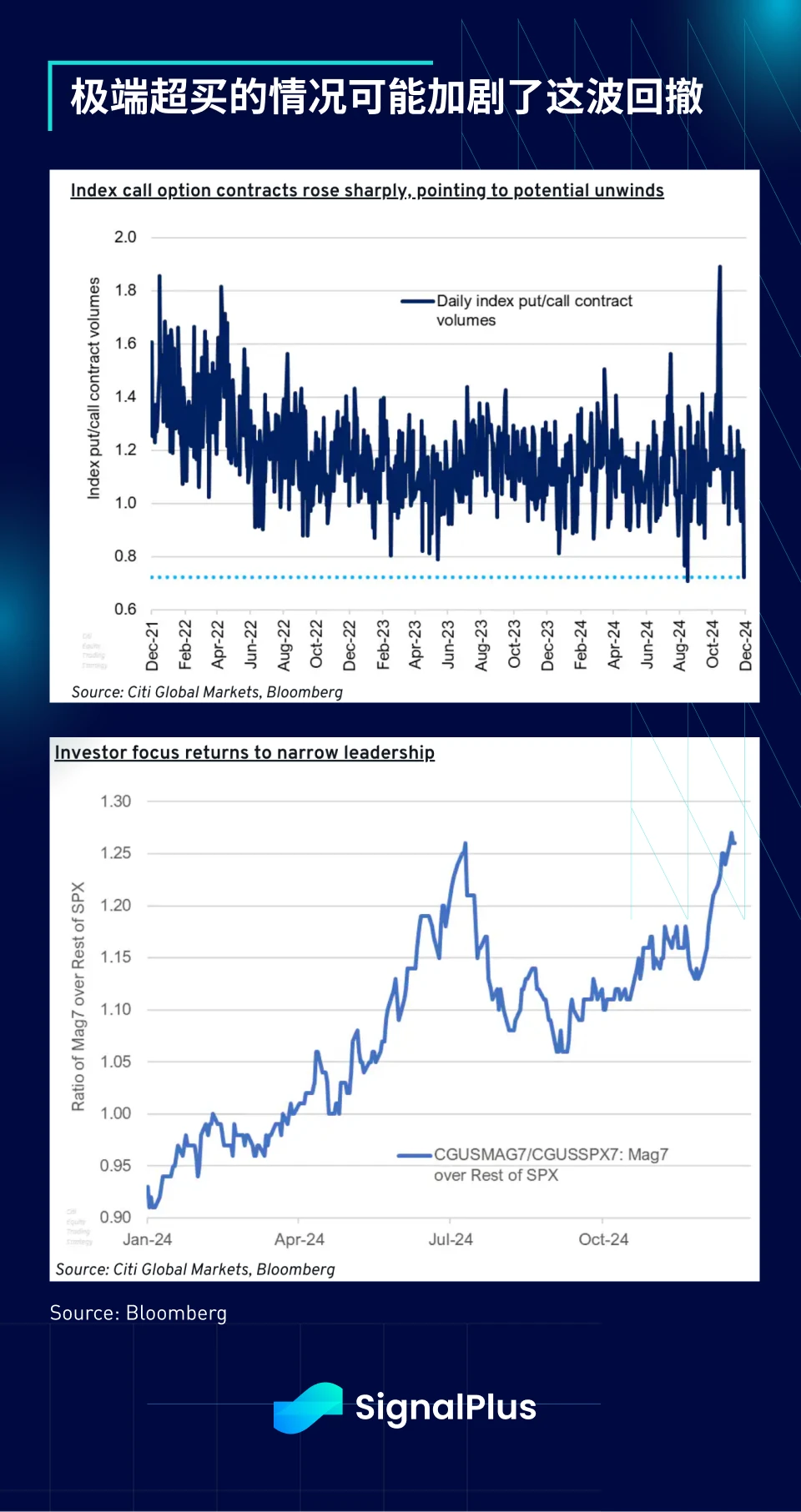

The SPX index experienced a slight crash after the FOMC meeting, with the volatility index (VIX) soaring significantly. Before the sell-off occurred, there was a substantial overbuying of call options in index options, and the leading range of the stock market narrowed to levels exceeding those in July, both of which may have played a significant role in the surge of the VIX. In extreme oversold conditions, the stock market quickly rebounded to nearly 6000 points in the past few days, but whether the market has emerged from danger remains to be seen.

The so-called "Christmas rally" may have some indicative value, revealing how the risk market wraps up and welcomes the new year. Historical data shows that negative performance in the last week often accompanies subsequent sell-offs in January. Will there be a year-end rally? We will know the answer in a few days…

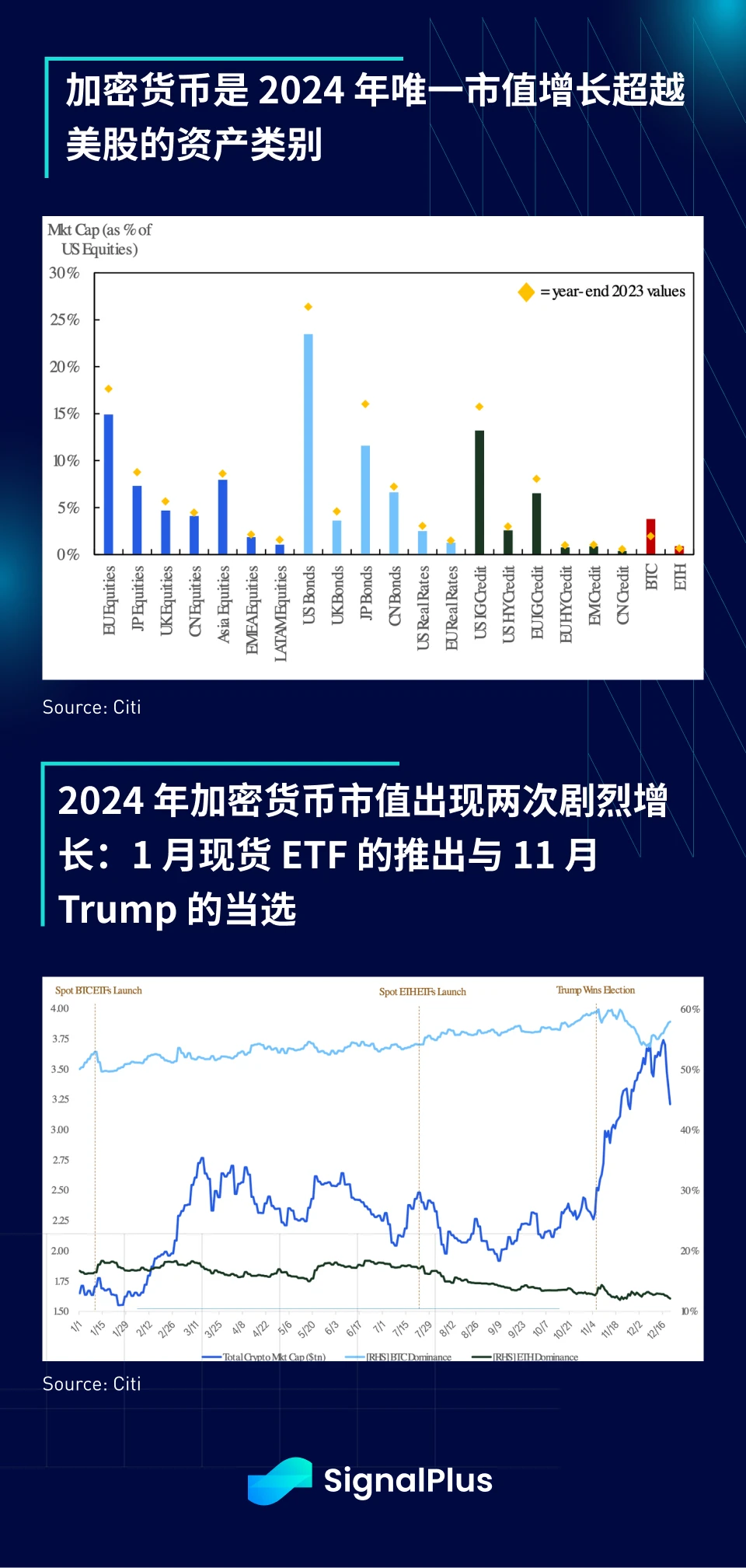

In the cryptocurrency space, 2024 will undoubtedly go down in history, with the cryptocurrency market cap rising over 90% this year, from $1.65 trillion to $3.2 trillion. Incredible as it may seem, cryptocurrency is the only asset class in 2024 that has outperformed U.S. stocks based on market cap growth, thanks to the launch of spot ETFs in January and the regulatory optimism following Trump's election.

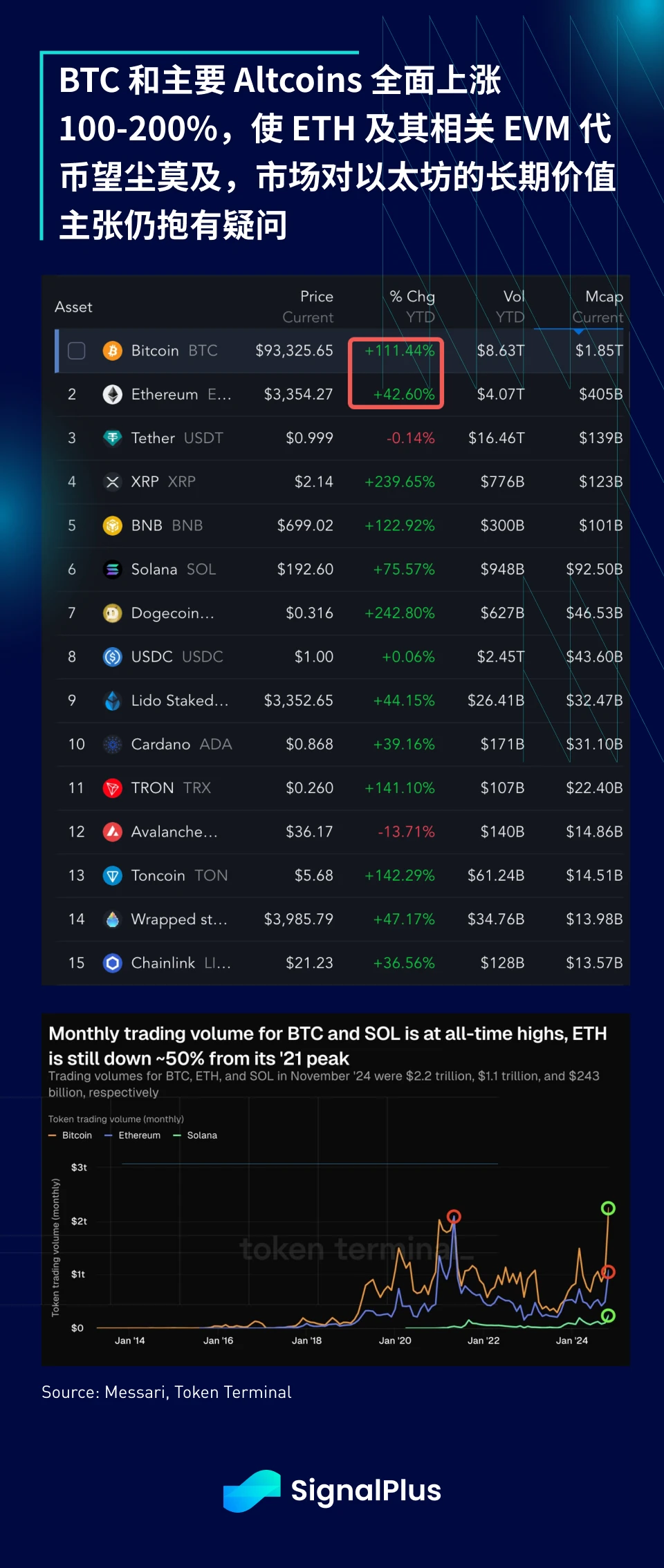

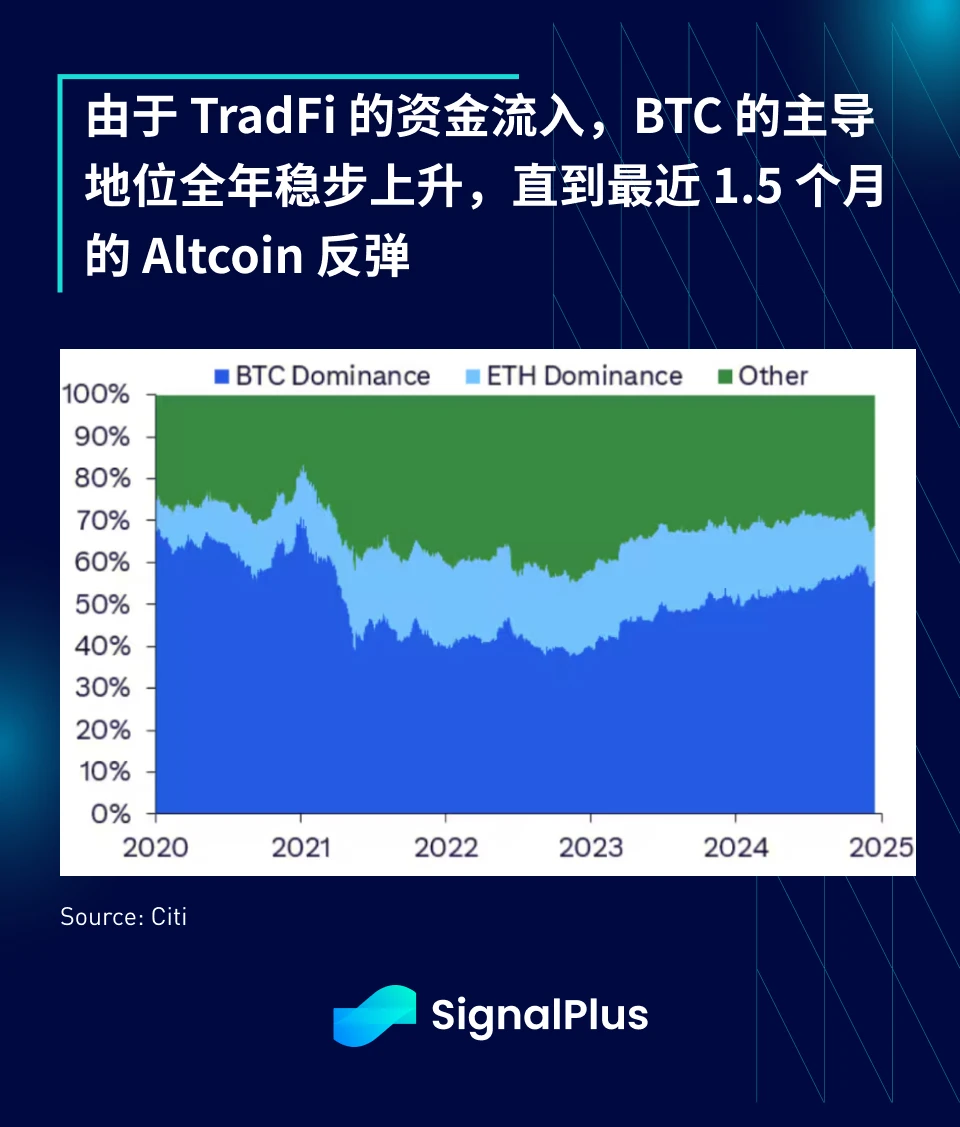

The surge in cryptocurrency this year was initially driven by BTC, whose dominance rose from a low of 40% to over 60%. Overall, this year's market activity consists of three significant phases: in the first quarter, the approval of spot ETFs drove a significant rally; in the second and third quarters, market activity was dull and lacked sustained momentum, leading to a sideways trend; finally, Trump's re-election made altcoins the dominant force in the market again, driving the recent rally, with XRP and Dogecoin rising over 200% for the year, while other major altcoins also saw increases of around 150%, making ETH's 40% rise this year seem modest by comparison.

The influence of mainstream markets on cryptocurrencies is best reflected in the high correlation between BTC and the SPX index. By the end of 2024, the SPX index remains the asset class most correlated with BTC. Additionally, Citigroup's research indicates that ETF inflows can explain nearly half of the volatility in BTC's weekly returns, and this trend is likely to continue into the new year.

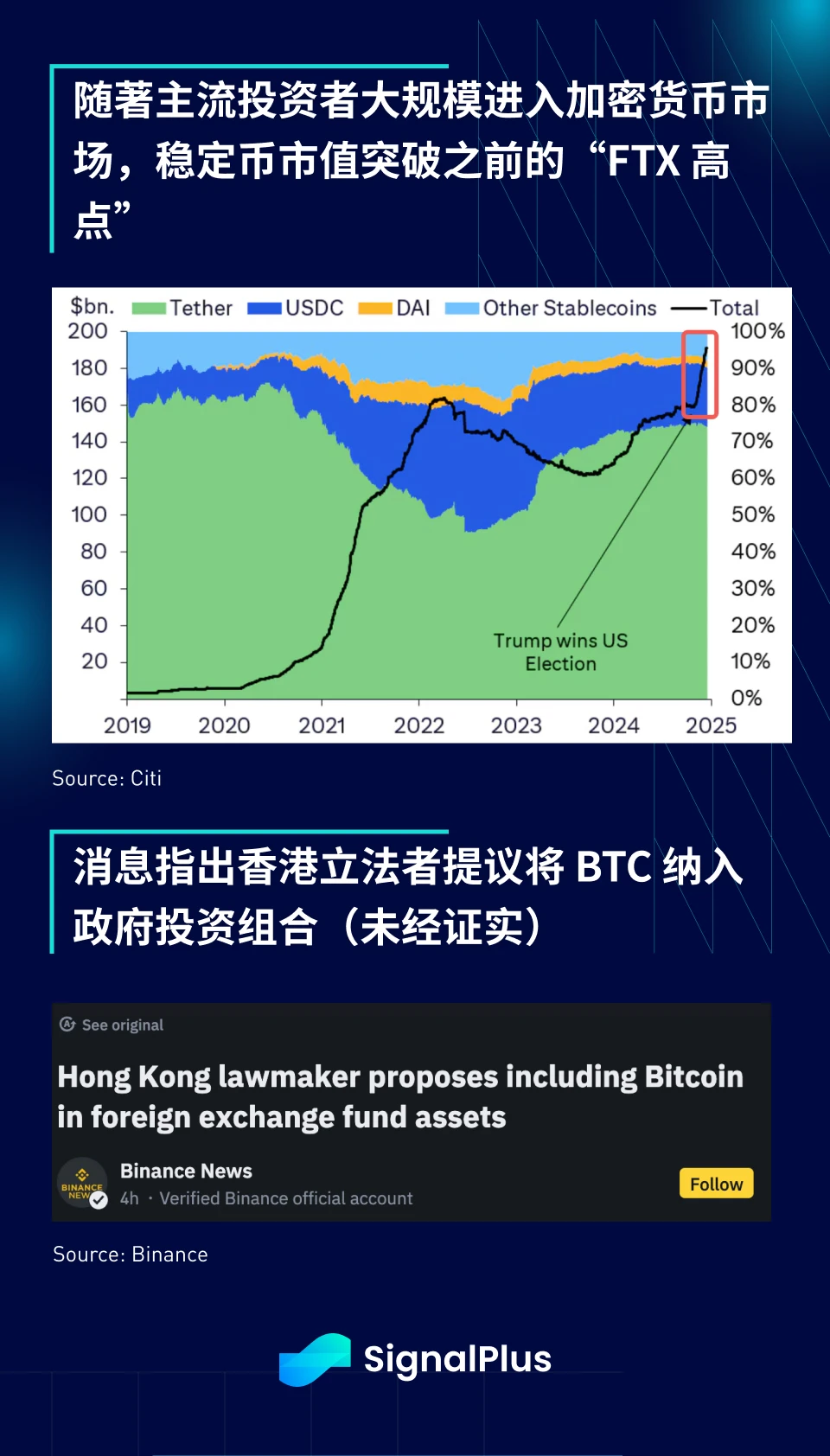

Furthermore, using stablecoin market cap as an indicator, mainstream capital has massively re-entered the cryptocurrency market since Trump's election, with the current stablecoin market cap nearing $190 billion, far exceeding the peak during the 2022 FTX period. At the same time, discussions among governments about BTC reserves are becoming increasingly popular, with unverified media reports indicating that Hong Kong lawmakers recently proposed that the government should consider including BTC in its foreign exchange reserve portfolio.

BTC is gradually becoming another sign of a mainstream asset class as actual volatility continues to decline, ultimately providing more diversification benefits and excess returns for traditional 60/40 portfolios. As the asset class matures, volatility should continue to decrease, and the development path of cryptocurrencies is no different from that of other asset classes.

Finally, we conclude with an unresolved chart of BTC and M2. As global liquidity continues to decline, should we remain cautious about the rise of BTC? Will the continued inflow of new TradFi funds and the U.S. friendly regulations towards cryptocurrencies lead to a breakthrough change in this correlation? Or will macro factors prevail, allowing skeptics to prove that BTC is merely a part of liquidity performance?

Thank you all for accompanying us through an exciting 2024, and we look forward to sharing more insights on cryptocurrencies and macro markets with you in the new year! Happy holidays!

You can use the SignalPlus trading indicator feature at t.signalplus.com to get more real-time cryptocurrency information. If you want to receive our updates instantly, feel free to follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。