Compiled by: Luan Peng, ChainCatcher

Important News:

- Former U.S. President Carter has passed away, and the U.S. will hold a state funeral

- Malaysian regulators demand Bybit to shut down local operations and stop advertising

- Cryptocurrency venture capital in 2024 reaches $13.7 billion, a year-on-year increase of 28%

- Hong Kong Legislative Council member Wu Jiezhuang: Bitcoin can be trialed as part of Hong Kong's foreign exchange fund assets

- Central Bank releases "China Financial Stability Report," mentioning Hong Kong's cryptocurrency compliance progress

- Hamster Kombat will build an L2 blockchain on the TON chain

- The ETF Store president: All 8 top ETFs launched in 2024 are related to cryptocurrency

- Bitcoin mining company Rhodium sells its Temple mine for $40.6 million, co-CEO has resigned

"What important events have occurred in the past 24 hours?"

Former U.S. President Carter has passed away, and the U.S. will hold a state funeral

According to China News Service, former U.S. President Jimmy Carter passed away on December 29, 2024, at the age of 100.

CNN reported that U.S. President Biden stated that in honor of Carter, he would order a state funeral to be held in Washington, D.C. Biden said in a statement, "To honor this great American, I will order a formal state funeral in Washington, D.C."

Malaysian regulators demand Bybit to shut down local operations and stop advertising

Bybit Technology Limited and its CEO Ben Zhou have been warned by the Malaysian Securities Commission (SC) for operating a digital asset exchange (DAX) without registration.

The Securities Commission stated that Bybit and Ben Zhou have been on the regulator's investor warning list since July 2021.

The SC has instructed Bybit to shut down all its websites and applications in Malaysia and stop advertising to Malaysian investors within 14 working days starting from December 11, 2024. Additionally, Bybit must terminate its Telegram support group for Malaysian users.

Cryptocurrency venture capital in 2024 reaches $13.7 billion, a year-on-year increase of 28%

According to The Block Pro's financing dashboard, venture capitalists invested approximately $13.7 billion in cryptocurrency and blockchain startups in 2024, a 28% increase compared to $10.7 billion in 2023. However, this figure is still far below the peak levels of $33.3 billion in 2022 and $29 billion in 2021.

Rob Hadick, a general partner at Dragonfly, stated that despite Bitcoin's rise of over 150% this year, venture capital funding has not accelerated, mainly because the limited partner (LP) market remains relatively calm, and many venture capital firms lack sufficient confidence to deploy remaining funds before raising new funds.

Early-stage financing dominated the market in 2024, with pre-seed deals reaching a record high of 1,180, a year-on-year increase of 68%. Seed-stage financing totaled $3.4 billion, close to the $3.8 billion in 2021. Series A financing exceeded 175 deals, raising $2.8 billion, a year-on-year increase of 46%. Late-stage financing saw a decline.

According to Hong Kong Wen Wei Po, Hong Kong Legislative Council member and chairman of the Web3 Virtual Asset Development Committee Wu Jiezhuang stated in an interview that Hong Kong needs to study how to maintain national financial security amid U.S. interference with Bitcoin and its impact on traditional asset markets.

He suggested that Hong Kong should leverage the advantages of "one country, two systems" to trial the inclusion of Bitcoin in the foreign exchange fund assets and explore ways to utilize Bitcoin. Regarding whether holding Bitcoin would help the Hong Kong government combat fiscal deficits, Wu Jiezhuang believes that while the government can use Bitcoin as a tool for asset appreciation, significant holdings are necessary for noticeable effects. Currently, the government's fiscal deficit has exceeded 100 billion, so only holding a small amount would not significantly help reduce the deficit, and the value preservation function of holding Bitcoin would outweigh its appreciation.

The People's Bank of China recently released the "China Financial Stability Report (2024)," which mentions global cryptocurrency regulatory dynamics, including Hong Kong's cryptocurrency compliance progress.

The report points out that due to the potential spillover risks of crypto assets on financial system stability, regulatory authorities worldwide are intensifying their oversight of crypto assets. Currently, 51 countries and regions globally have implemented prohibitions on crypto assets, and some economies have adjusted existing laws or re-legislated regulations.

Among them, Hong Kong is actively exploring a licensing management system for crypto assets, categorizing virtual assets into two types for regulation: securitized financial assets and non-securitized financial assets. It implements a distinctive "dual licensing" system for virtual asset trading platform operators, applicable to the Securities and Futures Ordinance and the Anti-Money Laundering Ordinance, requiring institutions engaged in virtual asset business to apply for registration licenses from relevant regulatory authorities. Additionally, Hong Kong requires large financial institutions like HSBC and Standard Chartered to include cryptocurrency exchanges in their daily client monitoring.

Hamster Kombat will build an L2 blockchain on the TON chain

Hamster Kombat announced on X that its DAO community has completed voting on the second proposal, deciding to build the Hamster L2 blockchain on the TON blockchain.

Hamster Kombat stated that development work will commence immediately.

The ETF Store president: All 8 top ETFs launched in 2024 are related to cryptocurrency

The ETF Store president Nate Geraci stated on X, "All 8 top ETFs launched in 2024 are now related to cryptocurrency, including 4 spot BTC ETFs, 2 spot ETH ETFs, and 2 MSTR ETFs. Nearly 740 new ETFs have been launched this year."

He also mentioned that a spot Solana ETF is expected to be approved in 2025.

Bitcoin mining company Rhodium sells its Temple mine for $40.6 million, co-CEO has resigned

Bitcoin mining company Rhodium Enterprises co-CEO Nathan Nichols has resigned, and the company completed the sale of its Temple mine in Texas for $40.6 million in cash.

Rhodium announced in an email to investors last week that Nichols has decided to resign, effective after the New Year. Just weeks ago, Rhodium's creditors filed a lawsuit against him and other co-founders, accusing them of fraud.

Rhodium also informed investors that the company had previously obtained $15 million from Galaxy Digital in debtor-in-possession financing out of a total of $30 million. After completing the sale of the Temple mine on December 18, the company used $16 million of that to fully repay Galaxy's debt, including fees and interest.

Musk: BlackRock's stake in xAI is less than 0.5%, one of many investors

Musk stated on X that BlackRock's stake in xAI is less than 0.5%, making it one of many investors.

Ripple CTO David Schwartz clarified that he is not a billionaire. Although in 2018, Ripple co-founder Chris Larsen's net worth soared to $54 billion due to holding 9 billion XRP, Schwartz chose to hold 2% of Ripple's shares and a salary instead of XRP.

In 2019, Forbes estimated Schwartz's wealth to be around $90 million, and in 2021 he stated that his net worth was still far below $170 million. He also revealed that most of his personal wealth is tied to volatile assets, which, while offering substantial returns, still carry risks. In addition to XRP, Schwartz also holds Bitcoin and several other altcoins.

Trader Eugene published a trading summary for December on his social platform, stating: "This month, I executed 47 trades with a win rate of 72%. The performance this month can be attributed to two main points: position size control and reducing unnecessary mistakes. December experienced the largest two drawdowns to date, with a loss of $3.3 million (-7.5%) on DOGE long positions and a loss of $6.5 million (-10.2%) on SOL long positions. The main profits this month came from short-term trades in ETH and BTC, as well as successful long positions in some small altcoins, including ENA, PEPE, and other meme coins. In unclear market conditions, it is necessary to reduce the position size for short-term trades in highly volatile assets.

Looking back at 2024, I achieved profits in 11 months and maintained good stability over different periods. I expect January to be a good trading opportunity for some quality altcoins, and I have already positioned in ETH and its related beta coins."

Data shows that K Bank, a bank associated with South Korea's leading cryptocurrency exchange Upbit, has reached a record high delinquency rate for credit loans linked to cryptocurrency accounts. Upbit accounts for over 70% of the country's cryptocurrency trading volume.

After two consecutive failed listings, K Bank is preparing for an IPO next year, with concerns that its over-reliance on Upbit and poor stability metrics may hinder its listing.

Data submitted to the Financial Supervisory Service by the office of National Assembly Political Committee member and People Power Party lawmaker Kim Jae-seop shows that as of the third quarter of this year, the delinquency rate for personal credit loans utilizing cryptocurrency-related accounts at K Bank is 1.28%, with a delinquent balance of 47.4 billion won. Since the bank launched cryptocurrency-linked accounts in June 2020, both the delinquency rate and delinquent balance have consistently reached historical highs.

It is reported that K Bank will restart its listing next month. The effectiveness of the listing preparatory review obtained in August this year will last until February next year, leading the industry to believe that K Bank may attempt to list again before then. Some analysts believe that the recent activity in the cryptocurrency market is beneficial for K Bank, as it can generate additional income by managing investor assets deposited on Upbit.

Binance to launch PHAUSDT and DFUSDT 1-75x USDT perpetual contracts

According to an official announcement, Binance's contract platform will launch perpetual contracts at the following times, with a maximum leverage of up to 75x:

· December 30, 2024, 19:30 (UTC+8): PHAUSDT perpetual contract

· December 30, 2024, 19:45 (UTC+8): DFUSDT perpetual contract

Grayscale Research stated that in Q1 2025, Grayscale will focus on tokens that involve at least one of the following three core market themes: the U.S. elections and their impact on industry regulation, particularly in decentralized finance (DeFi) and staking; ongoing breakthroughs in decentralized AI technology and the use of AI agents in blockchain; and the growth of the Solana ecosystem. Based on these themes, Grayscale has added six new assets to the Top 20 list for Q1 2025: HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS.

Galaxy Research: Predicts Bitcoin's market cap will reach 20% of gold's

According to Bitcoin.com, Galaxy Research predicts that Bitcoin (BTC) will exceed $150,000 in the first half of 2025 and may even reach $185,000 in the last quarter of the same year. The research institution believes that adoption at the institutional, corporate, and national levels is the main driver for this top cryptocurrency to reach these highs.

Galaxy Research also stated that it foresees BTC continuing to outperform other asset classes, including the S&P 500 index. Regarding gold, the Galaxy team expects BTC's total market cap to reach 20% of the total market cap of the precious metal. As of the time of writing (December 29, 2024), BTC's market cap is approximately $1.85 trillion, while gold's market cap is estimated to be close to $18 trillion.

Binance Megadrop launches Solv Protocol (SOLV)

According to an official announcement, Binance has announced the launch of Solv Protocol (SOLV) on the Megadrop platform, which focuses on a financial ecosystem for Bitcoin. The total supply of SOLV is 9,660,000,000 tokens, with Megadrop rewards amounting to 588,000,000 tokens. Specific trading times will be announced later.

"What are the exciting articles worth reading in the past 24 hours?"

With the continuous development of various technological fields, blockchain and artificial intelligence technologies are jointly driving an unprecedented technological revolution. In this transformation, DeepBrainChain (DBC), as a pioneer of decentralized AI public chains, is leading the future development of the AI industry with its unique charm and infinite potential. Since its establishment in 2017, DBC has been committed to building a decentralized AI infrastructure, gradually constructing a stable, efficient, and secure decentralized AI public chain network through continuous technological innovation and ecological expansion.

During our in-depth understanding of DBC, we had the privilege of interviewing DBC's founder, Feng. Feng shared DBC's ecological vision and planning, filling us with anticipation for DBC's future.

Virtuals is an AI agent asset issuance platform launched on the Base network, currently valued at nearly $2.5 billion, with over 100,000 agents issued on its platform. Its ecosystem has birthed several standout AI agents, including the virtual person Luna, who does live streaming and tweeting, the crypto "KOL" AIXBT who provides project suggestions, and G.A.M.E, which offers an agent development framework for developers.

Virtuals was originally established in 2021 as a gaming guild called PathDAO. However, as Axie Infinity fell from grace, operating a gaming guild became increasingly difficult. During this time, the team attempted multiple transformations and developed various platforms, including a social app, an AI music project, and lending services for gamers. It wasn't until 2023, with the release of GPT, that the team recognized the importance of AI, and Virtuals officially began to focus on AI as its main direction.

The popularity of GOAT has sparked a wave of AI agents in the Web3 space, but beyond memes, what other possibilities do AI agents hold?

ChainCatcher interviewed Virtuals co-founder Wee Kee, who believes that AI agents can autonomously create sustainable cash flow assets. Tokenizing them can provide quality returns for investors while incentivizing more developers to create better AI Agents. He used the well-known Luna and G.A.M.E on Virtuals as examples to illustrate the money-making mechanisms and tokenization processes of AI agents.

In the future, Wee Kee hopes to build a community composed of both AI agents and humans, where a true economic cycle can form between AI and AI, as well as between AI and humans, greatly liberating human productivity.

In this conversation, we discussed the money-making mechanisms of AI agents on Virtuals, the development ecosystem, and his vision of an AI society.

Envious of Tether's billions in profits, banks rush to issue stablecoins

The stablecoin USDT, the "anchor" of the crypto world, is quietly disrupting traditional finance.

An increasing number of banks are entering the stablecoin market. According to Bloomberg, banks such as Société Générale in France, Oddo BHF in Germany, Revolut in the UK, and even the Hong Kong Monetary Authority are all beginning to lay out their strategies in the stablecoin market, hoping to get a piece of the pie.

Previously, the world's largest stablecoin issuer, Tether Holdings Ltd., projected that its net profit would exceed $10 billion in 2024. CEO Paolo Ardoino stated in an interview that the company has already invested more than half of its net profit this year.

Naveen Mallela, co-head of global digital assets at JPMorgan's Kinexys, stated that stablecoins issued by banks are expected to accelerate development and become mainstream products within the next three years. With the improvement of policy frameworks and technological advancements, stablecoins are expected to become an important component of future financial markets.

2024 AI Agent popular project review: Transitioning from memes to infrastructure tokens

In the bull market of the second half of 2024, in addition to the pure meme projects sweeping the market, the AI Agent sector has demonstrated strong discussion heat and a shocking "wealth creation effect" due to its unique technological innovations and practical applications. As a pioneering field of deep integration between Crypto and AI, the rise of AI Agents has not only attracted widespread attention within the industry but also drawn a significant amount of on-chain capital.

In the Web3 world, security and transparency are always core principles, while AI relies on efficient parallel computing and faces numerous challenges due to its "black box" nature. The emergence of AI Agents not only addresses these integration challenges but also provides new possibilities for the combination of the two. It is foreseeable that AI Agents are destined to become one of the most promising and highly regarded sectors in 2025. Before looking ahead to 2025, Odaily Planet Daily will take you through a review of the representative leading projects in the rapidly developing AI Agent sector in the second half of 2024.

Understanding MSTR MicroStrategy's Bitcoin Strategy in One Article

Compared to BTC ETFs or other Spot Bitcoin ETPs launched by companies like BlackRock, MicroStrategy's Bitcoin strategy is more aggressive. It purchases Bitcoin through financing methods such as using idle company funds, issuing convertible bonds, and increasing share issuance, allowing the company to gain potential profits from Bitcoin's rise while also bearing the potential risks of Bitcoin's decline, whereas ETFs/ETPs focus more on price tracking.

With the gradual improvement of infrastructure and the implementation of application scenarios, the crypto AI Agent ecosystem is becoming increasingly prosperous, presenting a new market development trajectory, with liquidity and user participation continuously rising. In this wave of AI Agent enthusiasm, ai16z and Virtuals Protocol are undoubtedly the two most prominent representative projects, attracting various capital eager to capitalize on their ecosystems.

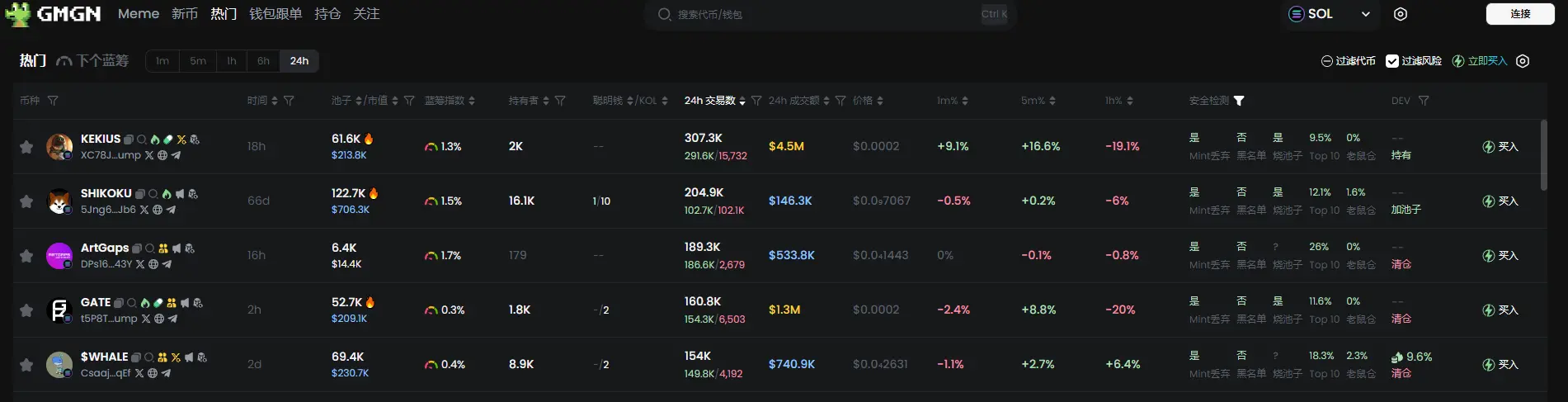

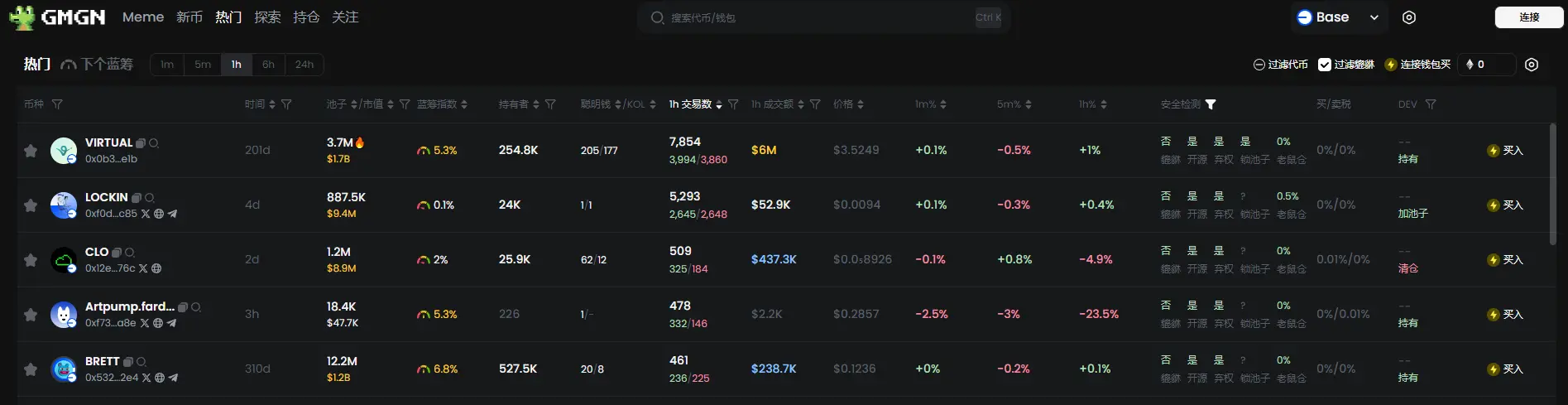

Meme Popularity Rankings

According to the meme token tracking and analysis platform GMGN, as of December 30 at 19:30:

The top five popular Ethereum tokens in the past 24 hours are: RAI, SEN, KEKIUS, ULTi, MYSTERY

The top five popular Solana tokens in the past 24 hours are: VIRTUAL, LOCKIN, CLO, Artpump.fa, BRETT

The top five popular Base tokens in the past 24 hours are: COPE, SKICAT, MOEW, CLANKER, BRETT

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。