Original author: HighFreedom (X: @highFree2028)

From recent times until around January 5th next year, we may gradually enter a favorable buying window for Bitcoin:

1. Macroeconomic Dollar Liquidity: Due to the usual year-end short-term liquidity squeeze, there has been a short-term spike in SOFR, squeezing risk assets.

It is expected that liquidity will recover around January 4th (at that time SOFR will fall below EFFR again; this was also the case at the end of 2023, and SOFR returned to normal on January 4th, 2024).

Specifically, the logic chain is: Financial institutions begin to reduce leverage and increase cash or cash equivalents to comply with year-end regulatory requirements -> Market liquidity is temporarily withdrawn -> Less money leads to a spike in ultra-short-term financing rates -> Strategies in the US stock market that are extremely sensitive to short-term rates are squeezed and forced to liquidate -> US stocks are squeezed -> Bitcoin follows suit.

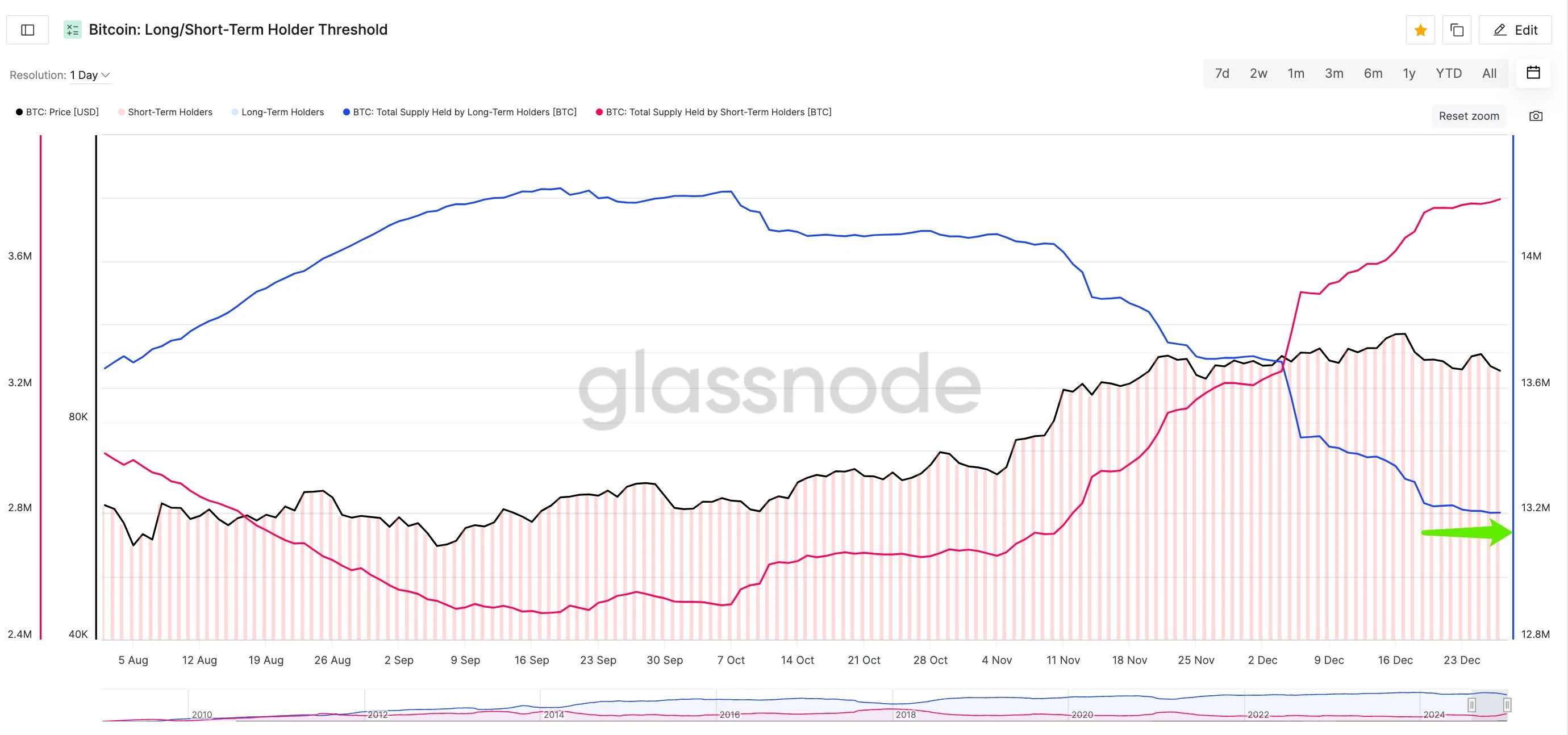

2. Large Holder Situation:

On the BTC chain: Long-term holders (LTH) have almost stopped selling after a large volume of sales following the election (a total of 1 million BTC sold), the trend of large holders selling has stopped.

Bitfinex large holders: Have started to continuously buy BTC spot at a premium of about 0.2%.

Bitfinex leveraged long BTC positions: Have been increasing since the evening of the 28th.

3. Americans are back to work:

Recently, there has been almost no issuance of USDT at the billion-dollar level, almost confirming that MSTR has not bought Bitcoin. It is expected that Americans will return to work and continue buying Bitcoin after January 1st (MSTR is a bit of an exception; in an optimistic scenario, there is a two-week blackout period from January 14th to February 5th during the earnings call when they cannot finance Bitcoin purchases; in a pessimistic scenario, there is a four-week blackout period starting from January 1st to February 5th during the earnings call when they cannot finance Bitcoin purchases).

4. The pullback has bottomed out:

Repeatedly grinding around 92-93, there has been a pullback of about 20% from the high of 108,000 to 92,000. Apart from the 30% pullback due to the black swan on August 5th, the pullback in this bull market has generally been around 20%.

5. The bubble squeeze is relatively clean:

Even though last Friday the US stock market fell mainly due to a short-term liquidity squeeze, during the day the Nasdaq fell by as much as 2%, I observed that Bitcoin was also around 93, dropping just over 2%, giving a clear sense that the bubble squeeze is relatively clean.

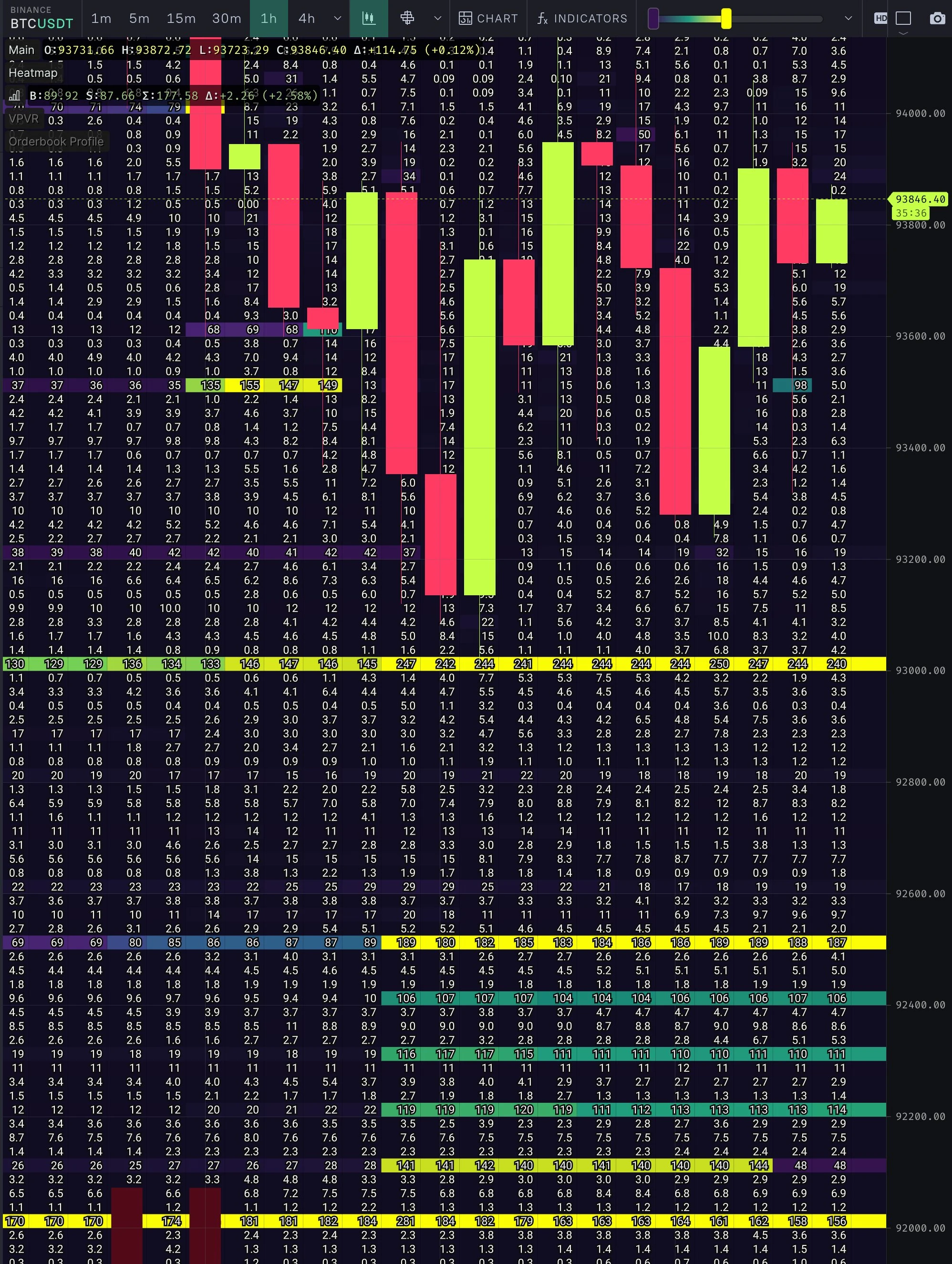

6. On the order book: In the last couple of days, there have been some dense and large orders starting to appear in Binance spot.

7. Altcoins: They seem to be struggling to drop further.

Risks:

1. Whether the BOJ will raise interest rates by 25bps on January 23rd is a sword hanging over our heads. Officials from the Japanese Financial Services Agency generally lean towards skipping the rate hike, but their statements are somewhat ambiguous, so we can only continue to observe. Currently, the market is pricing in a rate hike probability of about 40%; additionally, the JPY/USD exchange rate is once again approaching 160 (currently at 157.88, nearing 158). If it reaches 160, it may challenge the BOJ's bottom line to some extent, potentially increasing the probability of a rate hike.

Question: Can anyone advise, the recent high negative premium of BTC on Coinbase, is this a good signal or a bad signal?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。