Master Discusses Hot Topics:

As the new week approaches the end of the year, the overall market sentiment is as cold and desolate as the winter weather. In just two days, the bell for 2024 will ring. For this week, unless there is some explosive news, it is highly likely that we will see a fluctuating downward trend, as the market needs fresh stories to ignite passion.

In the past week, Bitcoin has slightly dipped around the 92k range. What seems like insignificant price fluctuations is actually a subtle struggle among the main players. Retail investors have already cut their losses and exited; the remaining chips have become the spoils of war for the larger players to test each other.

The current focus of the market has long shifted from harvesting retail investors to whales pecking at each other. The chips thrown out by institutions like Grayscale and Mentougou are seen as hot commodities by the main players. Why? Because they can enter the market in batches over a long time span, lowering their costs within the 90-110k range.

And what about retail investors? They cannot gain any benefits from this range of speculation. The master has mentioned many times that the rhythm of the main players' selling and buying is not something ordinary people can easily predict.

In the past week, Bitcoin-related ETFs saw a net outflow of $1.327 billion, the largest single-week outflow since the rise from 49k. Data does not lie; what does this signify?

It likely indicates that the market may continue to adjust in the short term, potentially breaking below the support range of 91,000-92,500, thus completing a breakdown adjustment. Why break? Because without breaking, there can be no establishment; only by forcing retail investors to completely abandon their fantasies can the main players comfortably buy the dip and start the next round of increases.

Looking at the turnover rate, the turnover data for the past week was only one-third of the weekend, mirroring the state during the long-term fluctuations at 65k and 26k. In street terms: the market has already "deteriorated," and retail investors who should have exited have done so; what remains is merely a smoke-free battle among the main players.

Unless there is significant positive or negative news, the market will basically maintain this fluctuating downward rhythm. Even if retail investors still harbor hopes, believing that breaking below 90k will present new buying opportunities, the main players clearly do not want to make it easy for anyone to buy the dip.

From the current support levels, if Bitcoin falls below 92,520 this week, the lower support can be seen between 89.6k-83.8k; if it holds above 92,520, it may directly start a new round of increases from this line, with upper resistance concentrated at the 10k integer mark and the 102,200 range.

The master's current view is that behind this wave of adjustment, the overall bullish sentiment in the market has not changed. In other words, the future of Bitcoin remains bright, but short-term fluctuations should not be underestimated. Each pullback is a buildup of strength for the next more vigorous rise.

Master Looks at Trends:

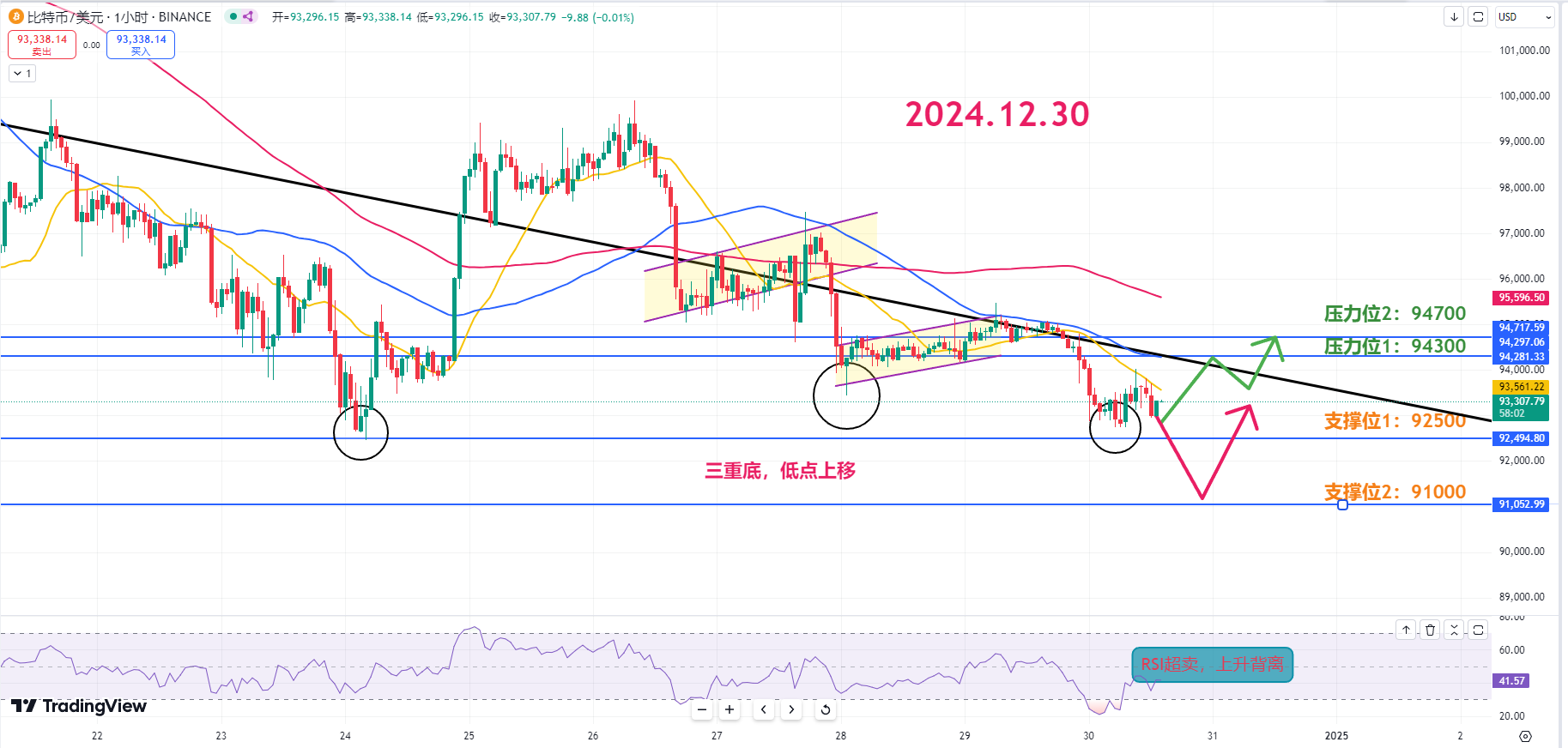

Resistance Levels Reference:

First Resistance Level: 94,300

Second Resistance Level: 94,700

Support Levels Reference:

First Support Level: 92,500

Second Support Level: 91,000

Today's Suggestions:

Bitcoin has currently formed a bearish flag pattern on a smaller scale, with a brief rebound in the oversold area after a decline. The current expectation is that the third bottom of the triple bottom formation has slightly risen and closed, which is seen as a positive signal.

However, as it is still in a downward trend, it is advisable to pay attention to opportunities for rebound and recovery, as well as the resistance of the 20-day and 60-day moving averages. Also, keep an eye on the resistance from the bearish flag pattern, while maintaining a bearish outlook and looking for short-term rebound opportunities.

Additionally, it is necessary to monitor whether there is a significant decline and verify the formation of the triple bottom pattern. A rise in the lows is also a positive signal for a rebound, and a risk-reward ratio range can be set. If important support levels are broken, it is necessary to adjust the viewpoint and respond flexibly to changes in the chart.

12.30 Master’s Wave Strategy:

Long Entry Reference: Light long positions in the 92,000-92,800 range; if it pulls back near 91,000, go long directly. Target: 94,300-94,700

Short Entry Reference: Light short positions in the 96,000-96,500 range. Target: 94,700-94,300

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). For more real-time investment strategies, liquidation, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above); other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing authenticity. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。