Original authors: E. Johansson, L. Kelly, DL News

Original translation: Tao Zhu, Jinse Finance

Venture capital is set to make a strong comeback in 2025.

This is what venture capital firms and market observers said in interviews before the New Year.

What will drive the market up? How much capital do investors hope to invest?

Mike Giampapa, General Partner at Galaxy Ventures

Mike Giampapa, General Partner at Galaxy Ventures

With the establishment of the most pro-cryptocurrency administration and legislative bodies in U.S. history, it is hard to overstate the potential impact this could have on the cryptocurrency industry.

With a more favorable SEC, we expect enforcement actions to decrease, regulations to become clearer, and the likelihood of blockchain companies going public in the U.S. to increase.

We are also more optimistic than ever that banks will engage more openly with cryptocurrencies, introduce stablecoin legislation, and create broader crypto market infrastructure laws.

These measures will create the necessary transparency, guardrails, and protections for contractors and users across the industry.

In this context, the adoption of stablecoins and the use of underlying blockchains as financial rails are expected to accelerate in 2025.

Fintech companies—from newcomers to established firms, from consumer-facing businesses to B2B enterprises—will increasingly integrate with cryptocurrency rails to provide customers with faster, cheaper, and more efficient financial services.

The application of stablecoins will continue to grow, expanding beyond savings and payments to spending use cases. We expect merchant acquirers and card networks to increasingly enable crypto payments at checkout, allowing users to use stablecoins as easily as fiat currency.

Alex Botte, Partner at Hack VC

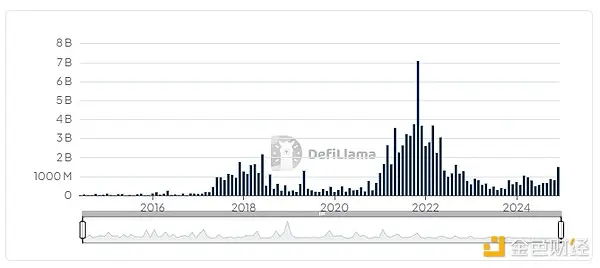

By 2025, we expect venture capital in the cryptocurrency and blockchain space to rebound to previous highs.

Galaxy data shows that currently, venture capital is still significantly lagging behind the peak in Q1 2022, when approximately 1,350 deals amounted to about $12 billion in investments.

In Q3, this figure was $2.4 billion, down 80%, involving 478 deals (a 65% decline).

This gap is at least partly due to the ongoing lack of traditional venture capital and institutional investors, especially in the U.S.

The private market, particularly early-stage venture capital, often lags behind liquid markets, with major tokens like Bitcoin and Solana recently hitting all-time highs.

However, as market cycles mature and investor confidence rebounds, we expect venture capital to increase, potentially even surpassing previous highs.

With the pro-cryptocurrency Trump administration and Congress in place, clarity in U.S. regulation has improved, which may attract more institutional participants than in previous cycles, accelerating venture capital as well.

Robert Le, Cryptocurrency Analyst

Robert Le, Cryptocurrency Analyst at Pitchbook

We predict that venture capital in the cryptocurrency space will recover in 2025, with total financing for the year exceeding $18 billion, and multiple quarters exceeding $5 billion in financing.

This would mark a significant rebound from the average of $9.9 billion annually and $2.5 billion quarterly during 2023-2024.

Macroeconomic stability, institutional adoption, and the return of generalist venture capital may drive this trend.

Heavyweights like BlackRock and Goldman Sachs may increase their participation in cryptocurrencies, which in turn would boost investor confidence and regulatory trust, paving the way for broader institutional participation.

Their involvement could drive mainstream adoption and attract asset management firms, hedge funds, and sovereign wealth funds into the cryptocurrency space.

After a period of retreat, returning generalist venture capital will focus on showcasing startups with traditional metrics such as recurring revenue and measurable appeal.

This approach may facilitate a broader integration of cryptocurrencies with artificial intelligence, fintech, and traditional finance, emphasizing sustainable growth over speculative investments.

Improvements in global liquidity and declining interest rates will further promote venture capital, with token prices aligning with public and venture markets.

However, this optimistic scenario depends on regulatory stability (especially in the U.S.) and ongoing macroeconomic conditions.

Karl Martin Ahrend, Founding Partner at Areta

Karl Martin Ahrend, Founding Partner at Areta

In 2025, we expect a surge in mergers and acquisitions (M&A) and IPOs, highlighting the transformative shift in the industry.

Traditional financial institutions are increasingly entering the space, seeking exposure to crypto projects with strong product-market fit. These companies often lack the expertise to build solutions internally, driving a wave of collaborations and acquisitions.

At the same time, political tailwinds, including the potential for a more crypto-friendly U.S. Securities and Exchange Commission under new leadership, are creating optimism for clearer regulations. This regulatory clarity, combined with advancements in security, enhances investor confidence and paves the way for more public offerings and strategic transactions.

Looking ahead, this intersection of institutional interests and favorable regulatory shifts may continue to drive M&A and IPO activity, shaping the future of the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。