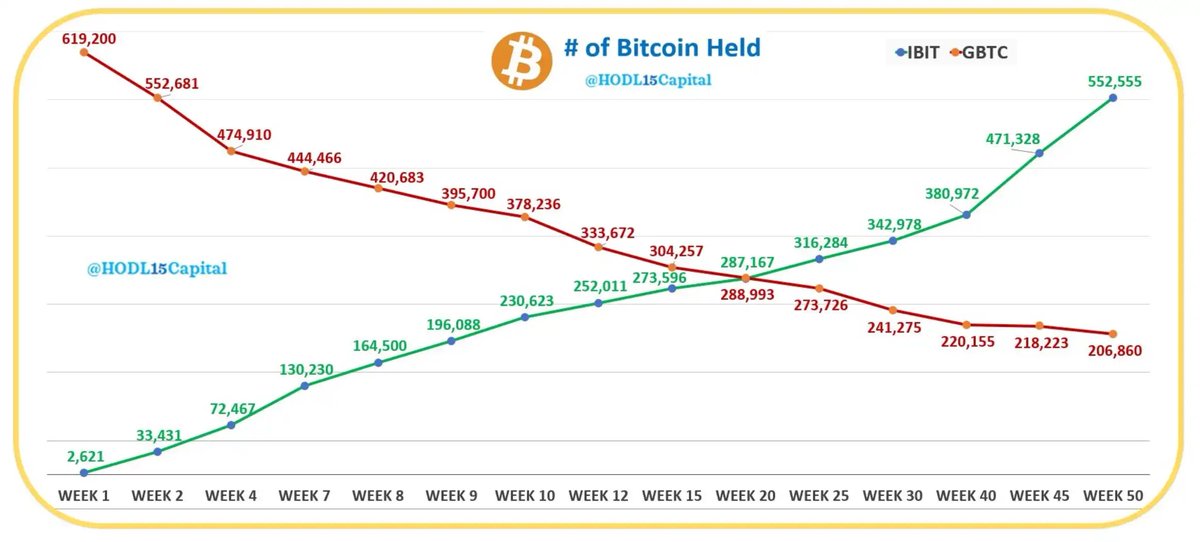

⚡️According to HODL15Capital data, the U.S. Bitcoin spot ETF has been online for 50 weeks, and BlackRock's IBIT has completely absorbed the selling pressure from Grayscale's GBTC——

At that time, after the launch of the BTC and ETH spot ETFs, the prices did not immediately soar, and many people felt that there was no hope for the market.

In fact, most people did not understand that this awkward period of favorable news but continued decline or fluctuation was inevitable. Because the process of absorbing selling pressure is——

Profit taking

Transitioning to low-fee platforms

Selling pressure being gradually consumed by inflows from other ETFs

Back then, there was immense worry about whether Genesis would directly liquidate GBTC if it couldn't fill the huge hole on its balance sheet, becoming a giant "gray" swan.

Now looking back, that was just a small ditch on the broad road; the course of history can be delayed or have twists and turns, but it cannot be changed or reversed. The light boat has already passed through ten thousand mountains!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。