The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and reject any market smokescreens.

Today, I want to talk about the overall layout. Many friends have been asking Lao Cui about the overall trend of Bitcoin in 2025. To be honest, Lao Cui's view is not so optimistic. Good news is emerging endlessly, and blockchain technology can be said to be flawless. Not only the United States, but also Russia, Japan, and a series of European countries have the possibility of listing Bitcoin as a strategic reserve, especially Japan, which is preparing to initiate a project recently. However, after serious research, Lao Cui found that Japan's approach is merely watching the United States' face; the domestic opinion is mainly pessimistic. Even if Bitcoin has the attributes of future currency, from the current financial perspective, how long it can sustain is indeed a question. Everyone should be clear that many friends do not understand blockchain technology very well. Why does blockchain need computing power? It is actually the overall encryption system at work; the encryption technology indeed becomes easier due to the increase in computing power. In other words, if Nvidia's computing power continues to improve, the biggest impact will be on the cryptocurrency market.

At the current stage, it indeed takes more than ten years to calculate all the Bitcoins. If technology undergoes iteration, it may end the clearing of cryptocurrencies in five years. The increase in computing power also means that decryption becomes simpler, and opening blocks will also become easier. To put it simply, the current cost of producing one Bitcoin is about 1.5-2 WU. If computing power increases, it is very likely that the cost can be controlled to below 1 WU, which will correspondingly lower the price. In the past few days, due to many friends' inquiries, Lao Cui specifically looked at the semiconductor market because the coin circle is indeed closely related to the computing power of graphics cards. Under the current technology, everyone can understand that computing power is indeed increasing, and it is growing at a rate of about ten percent per year, while power consumption is also increasing, which is considered good news for the coin circle. After eliminating power consumption, the increase in computing power is roughly maintained at around five percent, a growth rate that the coin circle can bear. The biggest problem is the fear of revolutionary technologies, such as the rapid development of artificial intelligence, and whether it can redefine the computing power of graphics cards in this way. These are all uncontrollable factors.

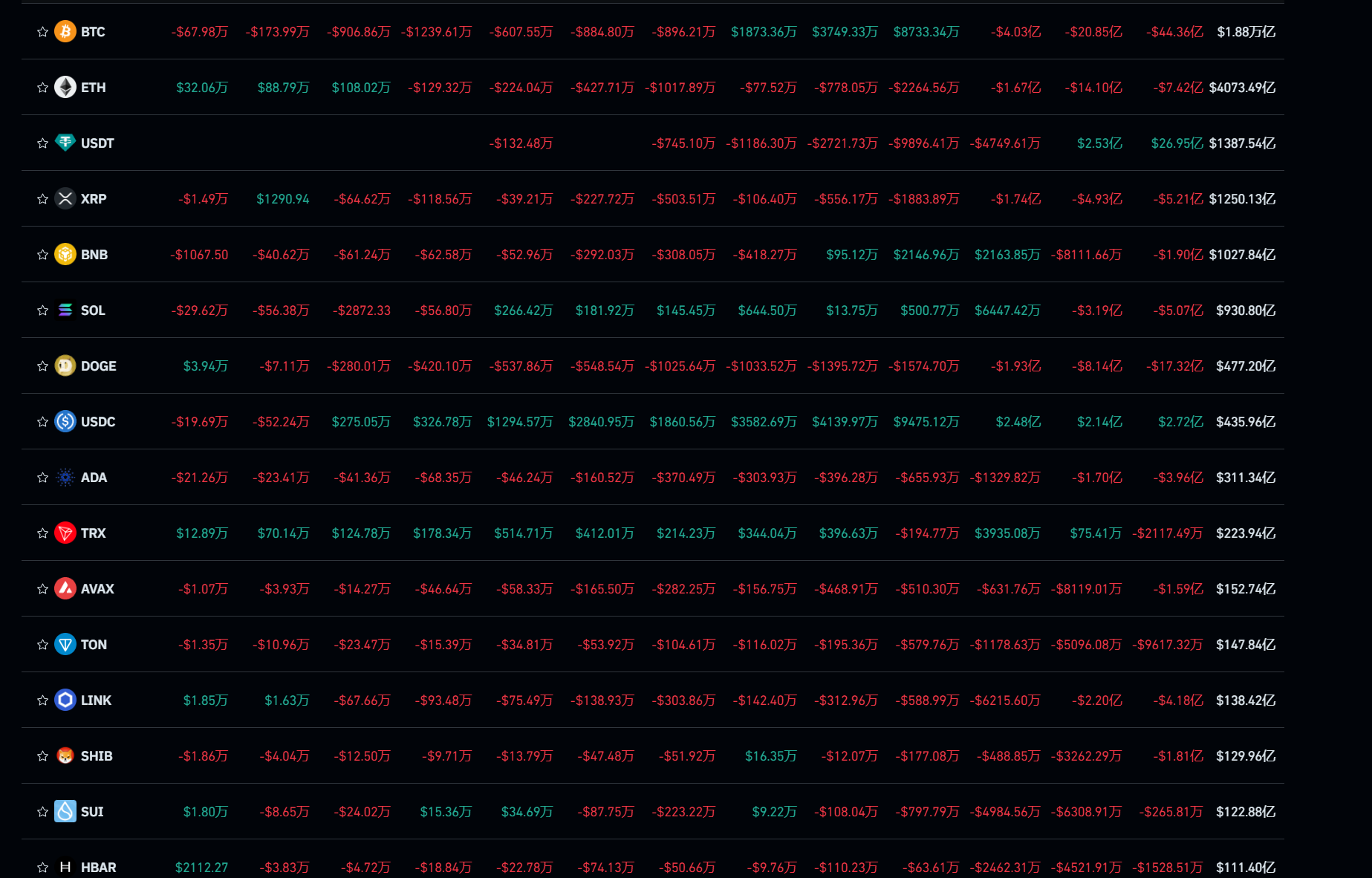

Therefore, Lao Cui's view of the cryptocurrency market may not be as optimistic as everyone thinks. The current cryptocurrency market indeed has the ability to break through traditional currencies. There is a certain possibility of completely replacing their existence, but in the long run, there are indeed too many uncontrollable factors. So Lao Cui's view is to focus on the medium term, which means to first take the profits that belong to oneself before considering future matters. In Lao Cui's eyes, Bitcoin will never be defined as a safe-haven asset in the long term. It has speculative attributes in the short term and investment attributes in the medium term, and it will still be very stable for at least the next five years. From a short-term perspective, with Trump in office, the United States may use this as a reserve asset, coupled with the corresponding implementation by Russia, Japan, and Europe. As long as the United States can implement it, the following countries will definitely follow suit. The implementation of these measures will certainly push Bitcoin to a new height. For retail investors, this is the closest opportunity to leap across classes. What we need to do is seize this opportunity; the subsequent issues are not what we should consider. Even if there are technologies that improve the cryptocurrency market, it is merely a confrontation between the spear and the shield. From the price, it can be seen that the Bitcoin market is basically unrelated to retail investors; it has become a battleground for capital. The market that retail investors can still consider is Ethereum. Today is the last weekend of December, and everyone should carefully consider the timing of entering the market!

The biggest problem in the coin circle is that it cannot be observed from the perspective of traditional finance. It can be said that no one can predict how Bitcoin's price will be in the next decade. The price of Bitcoin itself is a synchronous thing. How high will the United States push Bitcoin? And will the next U.S. president continue to promote the strategies of the coin circle? These are all questions. Of course, this is not to look down on the coin circle; in fact, there is something in traditional finance that is quite similar. That is the U.S. dollar, which decoupled from gold and created a system of credit currency. In the short term, it has indeed been very successful, at least extending to the present, bringing nearly fifty years of dominance to the United States. It has also given the United States a king-like position in the financial market, and the current financial rules are entirely created by the United States. If the bubble problem cannot be solved, they will start to promote the rules of Bitcoin. If Bitcoin can really replace the U.S. dollar, it will at least extend the United States' dominance for another thirty to fifty years. This will certainly test the choices of its competitors: whether to follow the United States closely or to innovate themselves. The choice lies with the leadership, which is not something we can consider.

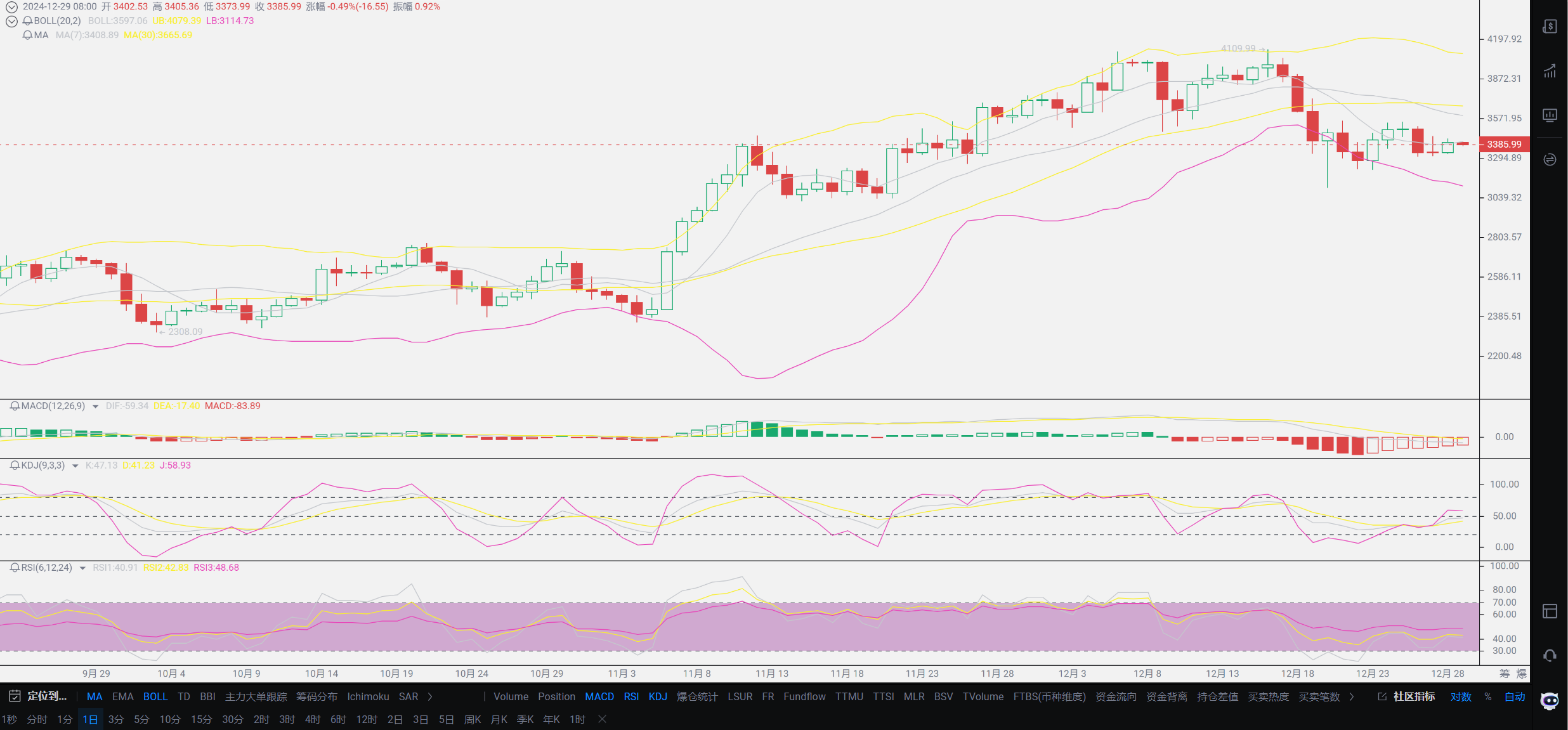

Setting aside these long-term factors, Lao Cui wants to say, is the current trend the peak of the coin circle market? It is hard to draw a conclusion, but the opportunities in front of everyone can be seen. Those who can read Lao Cui's article must have a great connection with the coin circle; this is an opportunity for everyone. Based on the current analysis, we can clearly know that next year's Bitcoin price will definitely be higher than this year's. Trump almost controls the legislative and law enforcement agencies of the United States, including Powell's so-called strategic idea of holding Bitcoin without constitutional amendments, which may all be broken by Trump. Having a sword is different from having no sword in hand. Trump's several confrontations with Powell have all ended with Trump's victory, and this time Trump also has a huge winning edge. The power of these two at least allows Powell not to dare to act rashly during Bitcoin's growth phase. As long as he does not stand on the opposite side of the coin circle, it is also a success for the coin circle. The struggle between the Federal Reserve and Trump seems to be profit-driven, but it has always been about what Trump calls the deep state in the United States; he is here to solve this problem. The competition for the right to issue currency has already begun. The multiple changes in the Rothschild family may be hinting at some information; perhaps he is the next Kennedy or he may become Trump. Everything is an unknown future, just like the current coin circle, which is very powerful yet extremely fragile.

Lao Cui summarizes: There is no need for everyone to worry unnecessarily. Trump dares to risk his life to try to change things. What we need to do is to survive in the cracks. As long as he can govern healthily, it is good news for us. At the same time, Lao Cui can say frankly that when Trump takes office, Bitcoin will definitely reach a new high. 110,000 is just the starting point, and 120,000 will not be the endpoint. Everyone should be clear that Trump's rise also means the establishment of regulatory agencies in the coin circle, which means that the United States will continue to purchase Bitcoin as a strategic reserve in the next four years. At the same time, Russia's settlements will also use Bitcoin, Japan will follow the United States' pace, and the European Union will open market trading. This is completely just waiting for the right moment. Do not believe the smokescreens that the bull market is over; the future of Bitcoin has just begun. Issues at the military level will also apply to the technology of the coin circle; what is there to worry about? Finally, I remind everyone that Trump has been continuously holding currency at the current price, mainly in Ethereum. At the end of the article, I remind you again that today is the last weekend of December, and there is less than a month until Trump takes office. The countdown for everyone to enter the market has already begun!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。