Introduction

Stablecoins have long been regarded as an important tool for combating volatility in the cryptocurrency market due to their price anchoring characteristics. However, the limitations of traditional stablecoins (such as USDT and USDC), which provide trading convenience and value stability, have gradually become apparent due to their lack of asset appreciation capabilities.

Emerging yield-bearing stablecoins like BUIDL, USDe, and USD0 are rapidly rising and attracting widespread attention. Unlike traditional stablecoins, yield-bearing stablecoins not only maintain relative price stability but also provide additional investment returns to holders through innovative yield models. This characteristic not only meets the market's demand for safe assets but also offers investors the potential to hedge against inflation, making them a new favorite among investors in the current market.

This article will start with the definition and operational mechanisms of yield-bearing stablecoins, deeply analyze their unique advantages and market demand, while also exploring the challenges they face and their future development potential, providing readers with a comprehensive understanding of yield-bearing stablecoins.

Overview of Yield-Bearing Stablecoins

1. What are Yield-Bearing Stablecoins

Yield-bearing stablecoins are a new type of digital asset that not only possesses value stability characteristics but also brings considerable returns to holders. Their core feature lies in the ability to achieve asset appreciation through innovative yield models, allowing holders to benefit without excessive active management. This type of stablecoin combines the stability of traditional stablecoins with the return capabilities of investment tools, offering users a new financial experience.

The main characteristics of yield-bearing stablecoins include:

Price Stability: Pegged to fiat currencies like the US dollar, maintaining a 1:1 exchange rate.

Yield Generation: Providing returns through investments in low-risk assets (such as government bonds), staking native tokens, or structured financial strategies.

Liquidity: Maintaining high liquidity, available for trading or redemption at any time.

Yield-bearing stablecoins not only expand the functional boundaries of traditional stablecoins but also provide users with more attractive reasons to hold them through their yield capabilities, making them a new choice for investors.

2. Core Advantages

(1) Hedge Against Inflation: In a global economic environment characterized by instability and high inflation levels, the purchasing power of fiat currency is gradually declining. Yield-bearing stablecoins provide an effective means of preserving and appreciating value by distributing asset returns to holders, such as interest returns from investing in short-term government bonds.

(2) Provide Diverse Sources of Returns: The yield models of yield-bearing stablecoins vary by project, including:

Government Bond Investment Returns: For example, BUILD and USD0 provide stable returns of around 5% annually through holding short-term US government bonds.

Structured Strategy Returns: For instance, USDe offers floating annual returns of up to 30% through financial derivatives and hedging trades.

Staking Rewards: For example, FRAX and eUSD provide higher annual returns by utilizing ETH staking or blockchain ecosystem yields.

(3) Enhance User Participation: Through the transparent mechanisms of smart contracts, users can not only clearly understand the sources of returns but also directly participate in on-chain governance and ecosystem development. This model reduces the interference of centralized operations, providing users with higher security and trust.

Representative Projects of Yield-Bearing Stablecoins

1. USDe

USDe is a new synthetic dollar stablecoin developed by Ethena Labs, aimed at providing a decentralized, scalable, and censorship-resistant stablecoin solution.

Operational Mechanism: The core mechanism of USDe is to maintain a 1:1 peg to the US dollar through a delta-neutral strategy. Whitelisted users (typically institutions, exchanges, and large holders) can use crypto assets such as ETH, BTC, USDT, and stETH as collateral to mint USDe. Ethena Labs uses these collateral assets to open corresponding short perpetual contracts or futures positions to hedge against price fluctuations, ensuring the stability of USDe's value. This strategy allows USDe to achieve stability and scalability without requiring over-collateralization.

Currently, ordinary users cannot directly deposit ETH or BTC to mint USDe; they can purchase USDe using stablecoin assets (such as USDT, USDC, DAI, crvUSD, etc.) to avoid liquidation risks.

The yield of USDe primarily comes from two sources:

Staking Returns: When users use liquid staking tokens (such as stETH) as collateral, these tokens generate staking returns, including inflation rewards from the consensus layer, transaction fees from the execution layer, and maximum extractable value (MEV). These returns accumulate over time, enhancing the value of USDe.

Funding Rates and Basis Returns: In the perpetual contract and futures markets, traders holding long positions typically need to pay funding rates to traders holding short positions. Additionally, the basis of futures contracts (the difference between futures prices and spot prices) can also generate returns. Ethena Labs utilizes these mechanisms to provide additional sources of returns for USDe holders.

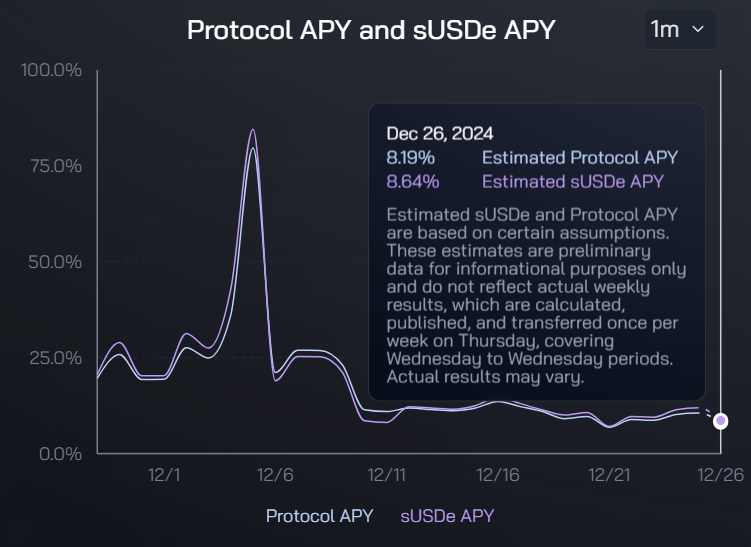

Staking USDe can yield sUSDe to enjoy staking returns, and the yield of USDe fluctuates based on market volatility and changes in funding rates for hedging positions. It has reached an annual percentage yield (APY) of 80%, and as of December 26, the current yield for sUSDe is approximately 8.64%.

Source: https://app.ethena.fi/dashboards/apy

Additionally, Ethena Labs announced the launch of USDtb on December 16, which provides USDe holders with a tool to "cope with difficult market conditions." When market changes occur, Ethena can close the hedging positions behind USDe and reallocate its supporting assets to USDtb to further reduce risk. 90% of USDtb's reserves are backed by BlackRock's BUIDL, with the remaining 10% provided by stablecoins like USDC.

2. USD0

USD0 is a decentralized stablecoin issued by Usual Labs, pegged 1:1 to the US dollar, aimed at providing users with a secure, transparent, and compliant digital dollar alternative.

Operational Mechanism: The value of USD0 is supported by a basket of tokenized real-world assets (RWA), primarily including ultra-short-term US government bonds and other highly liquid, low-risk financial instruments. These assets are tokenized through partners (such as Hashnote) and managed and verified on-chain. Users can mint equivalent USD0 by depositing these tokenized assets, ensuring that each USD0 is backed by real assets.

USD0 itself does not directly generate returns, but users can choose to convert it into USD0++, a liquid staking token (LDT). By holding USD0++, users can earn the following returns:

Base Interest: USD0++ holders are entitled to the base returns generated by the real-world assets they collateralize, such as interest income from US government bonds. These returns are periodically distributed through the protocol, ensuring holders receive stable returns.

Protocol Growth Yield: In addition to base returns, USD0++ holders can participate in governance and decision-making of the Usual protocol by obtaining the governance token $USUAL. As the protocol develops and gains adoption, the value of $USUAL may increase, providing additional returns to holders.

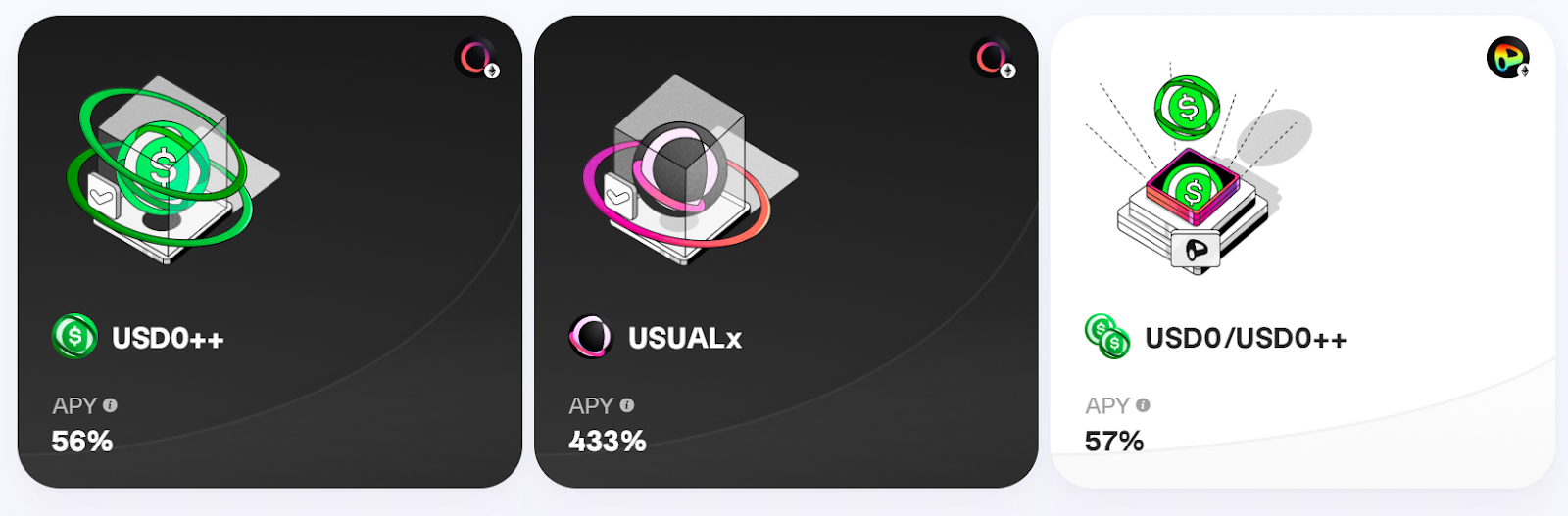

Currently, the yield for USD0++ is as high as 56%. Additionally, holders can participate in the protocol's growth returns by obtaining $USUAL tokens. It is important to note that the staking period for USD0++ is four years, and holders should consider the liquidity constraints brought by this long lock-up period.

Source: https://usual.money/

3. BUIDL

BlackRock launched its first tokenized fund, named BUIDL (BlackRock USD Institutional Digital Liquidity Fund), on the Ethereum network in March 2024, aimed at providing investors with digital asset investment opportunities pegged to the US dollar.

Operational Mechanism: The BUIDL fund issues tokenized shares on the Ethereum blockchain, allowing investors to hold and trade fund shares digitally. The fund's assets are primarily invested in cash, US government bonds, and repurchase agreements, ensuring that each BUIDL token is backed by real assets, striving to maintain a stable value of $1 for each token.

Investors holding BUIDL tokens can earn the following returns:

Daily Accrued Dividends: BUIDL tokens accrue daily returns, which are directly paid to investors' wallets in the form of new tokens each month. This means that investors' returns will be reflected in the incremental increase of tokens, increasing the number of BUIDL tokens they hold.

Flexible Transfer and Custody: Investors can transfer their tokens to other pre-approved investors at any time, providing high liquidity. Additionally, fund participants have flexible custody options, allowing them to choose different ways to hold tokens.

As of December 26, 2024, the total asset value of the BUIDL fund has exceeded $620 million and has expanded to five other blockchains beyond Ethereum, including Polygon, OP Mainnet of Optimism, Avalanche, Arbitrum, and Aptos. Currently, its yield is roughly comparable to that of US short-term government bonds, around 4.5%.

Source: https://app.rwa.xyz/assets/BUIDL

4. USDY

USDY (Ondo U.S. Dollar Yield) is a yield-bearing dollar token launched by Ondo Finance, aimed at providing investors with a digital asset that is pegged to the US dollar and generates yield.

Operational Mechanism: The value of USDY is supported by highly liquid, low-risk financial instruments such as short-term US government bonds and bank demand deposits. Investors can purchase USDY using stablecoins like USDC, and holding USDY is equivalent to indirectly holding these underlying assets. The yield of USDY is realized through the interest income from the underlying assets, compounded daily, and distributed to holders monthly. It is important to note that USDY is only available to non-U.S. individual and institutional investors, and there is a 40-day lock-up period after purchase during which it cannot be transferred.

Investors holding USDY can earn the following returns:

Returns from Underlying Assets: The short-term US government bonds and bank deposits represented by USDY generate interest income, which is directly distributed to investors after deducting management fees.

Compound Returns: The yield of USDY is compounded daily and distributed monthly, causing the value of investors' holdings to grow over time.

As of December 26, 2024, the annualized yield of USDY is approximately 4.65%, with a total asset value exceeding $450 million, supporting multiple blockchain networks including Ethereum, Solana, Mantle, Noble, Sui, and Arbitrum.

Source: https://app.rwa.xyz/assets/USDY

5. FRAX

FRAX is an innovative stablecoin that belongs to the Frax Finance protocol, maintaining a 1:1 peg to the US dollar through a combination of partial collateralization and algorithmic mechanisms.

Operational Mechanism: FRAX employs a mixed mechanism of fractional reserve and algorithmic stability. Specifically, minting each FRAX stablecoin requires a certain proportion of collateral (such as USDC) and governance tokens (FXS). For example, when the collateral ratio (CR) is 90%, minting one FRAX requires 0.9 USDC and 0.1 FXS. When market demand increases, the system mints more FRAX to meet the demand; conversely, when demand decreases, the system reduces the supply of FRAX. This dynamic adjustment mechanism helps maintain FRAX's peg to the US dollar.

Frax Finance has introduced an Algorithmic Market Operations Controller (AMO), allowing FRAX's monetary policy to be managed through open market operations rather than solely relying on collateral. This flexibility enables FRAX to respond more effectively to market fluctuations.

Users holding FRAX can earn returns in the following ways:

Interest Income: Users can earn interest by staking USDC or FXS. The staked assets are used to support the liquidity and stability of FRAX, while users also receive corresponding returns.

Liquidity Mining: Users can earn additional rewards by providing liquidity (such as providing liquidity for FRAX on decentralized exchanges). These rewards are typically distributed in the form of FXS or other tokens.

Governance Token FXS: Users holding FXS can participate in protocol governance and earn returns through mechanisms such as minting taxes and minting/redemption fees. Additionally, the value of FXS may increase with the success of the protocol, providing capital appreciation opportunities for holders.

As of December 26, 2024, the annualized yield of USDY is approximately 10%, with a market capitalization exceeding $646 million.

Source: https://facts.frax.finance/

Recently, Securitize Markets submitted a governance proposal to Frax Finance, suggesting the inclusion of BlackRock's BUIDL token in the reserve assets of the FRAX stablecoin. This collaboration with BlackRock would significantly reduce the counterparty risk of its reserves. If the proposal is approved, FRAX will adopt the BUIDL token as a supporting asset, similar to stablecoins like Ethena's USDtb.

Development Potential of Yield-Bearing Stablecoins

1. Market Environment Drivers

In recent years, the global economy has faced high uncertainty, with multiple factors such as inflation, geopolitical conflicts, and monetary policy adjustments driving an increased demand for stable assets.

(1) Inflationary Pressure: With global inflation rates remaining high, the purchasing power of fiat currencies is declining. Yield-bearing stablecoins provide an effective inflation hedge through government bond yields or staking returns.

(2) Market Volatility and Risk Aversion: The stock and cryptocurrency markets are highly volatile, leading funds to flow into lower-risk assets. Stablecoins serve as a risk-hedging tool, providing value stability, while yield-bearing stablecoins further enhance their appeal.

(3) Changes in Interest Rate Environment: With the Federal Reserve raising interest rates, the yields on low-risk assets (such as short-term government bonds) have increased, providing a stable source of income for yield-bearing stablecoins. This yield model attracts more institutional and individual investors seeking stable returns.

2. Core Investor Demands

The rise of yield-bearing stablecoins is driven not only by changes in the market environment but also by their ability to meet the diverse needs of investors.

(1) High Security: The reserve assets of yield-bearing stablecoins are often short-term government bonds or high-quality crypto assets, which satisfy the needs of risk-averse investors due to their low-risk characteristics. Compared to traditional bank deposits, yield-bearing stablecoins avoid the liquidity and credit risks associated with commercial banks.

(2) Yield Generation: In contrast to the "zero yield" of traditional stablecoins, yield-bearing stablecoins offer annual returns (5%-30%) that are highly attractive. This yield generation not only attracts individual investors but also draws in institutional funds.

(3) Diverse Application Scenarios: Yield-bearing stablecoins can be used in various scenarios such as DeFi lending, liquidity provision, and cross-border payments, providing investors with flexible asset allocation options. For example, users can stake USD0 and convert it to USD0++ to participate in higher-yield investment opportunities.

3. Industry Trends

As investor demands continue to evolve, yield-bearing stablecoins are becoming an innovation engine for the entire cryptocurrency market.

(1) Rapid Growth of Market Size: According to the latest data, the total market capitalization of yield-bearing stablecoins has surpassed $200 billion and continues to grow. Emerging stablecoin projects like USDe and USD0 are attracting significant capital inflows, indicating a rapid increase in user demand for high-yield stablecoins.

(2) Diversification of Product Types: The types of yield-bearing stablecoins are continuously expanding, moving from single yield models (such as government bonds) to multiple yield models (such as staking and structured strategies). For instance, USDe stands out with its flexible structured financial strategies, while USDY focuses on the low-risk government bond yield market.

(3) Integration with Traditional Finance: Traditional financial institutions are gradually entering the yield-bearing stablecoin space, with the BlackRock-supported BUIDL fund becoming a significant player in this field. This integration not only enhances the legitimacy of yield-bearing stablecoins but also brings in more institutional users.

Potential Risks and Challenges of Yield-Bearing Stablecoins

1. Sustainability of Returns

The appeal of yield-bearing stablecoins lies in their ability to generate returns, but this characteristic may be constrained by multiple external factors.

(1) Dependence on External Market for Yield Models: A decline in government bond yields may weaken the attractiveness of yield-bearing stablecoins based on government bond returns.

(2) Uncertainty in the Cryptocurrency Market: The yields of stablecoins based on crypto asset staking are closely related to price fluctuations in the crypto market. In the event of significant market volatility, staking returns may struggle to cover risks.

(3) Intensifying Competition Leading to Yield Wars: As the variety of yield-bearing stablecoins increases and competition intensifies, different projects may only attract more users by raising yield rates, leading to a yield competition. However, high yields imply high risks, and balancing sustained high yields with safety becomes a dilemma for projects.

(4) Interference from Macroeconomic Policies: Adjustments in central bank monetary policies, such as interest rate hikes or cuts, directly affect government bond yields, thereby altering the yield levels of yield-bearing stablecoins based on government bond investments. In a rapidly changing global financial environment, the sustainability of yield models may face challenges.

2. Liquidity and Lack of Use Cases

Yield-bearing stablecoins face a trade-off between high yields and liquidity, which may limit their application and growth.

(1) Liquidity Risk: Yield-bearing stablecoins often require locking up assets to earn returns, which may lead to insufficient liquidity, especially during periods of heightened market volatility when redemption demands surge, potentially triggering a liquidity crisis. Some protocols employ complex staking mechanisms, which may further reduce the liquidity of user funds.

(2) Limitations of Use Cases: Compared to traditional stablecoins, the application scenarios of yield-bearing stablecoins are still not rich enough, primarily focused on asset appreciation. In scenarios requiring high liquidity, such as payments and trade settlements, yield-bearing stablecoins may struggle to compete with traditional stablecoins.

3. Technical and Contract Risks

Yield-bearing stablecoins rely on smart contracts and blockchain technology, which provide transparency and efficiency but also introduce technical risks.

(1) Smart Contract Vulnerabilities: Code flaws in smart contracts may lead to protocol hacks, resulting in fund losses. Although many yield-bearing stablecoin protocols have undergone audits, contract risks always exist, especially in complex yield mechanisms.

(2) Black Swan Events: Technical failures, blockchain network congestion, or external attacks may temporarily disrupt the redemption functions of yield-bearing stablecoins. For example, during surges in on-chain transaction volumes or issues with cross-chain bridges, users may be unable to access liquidity in a timely manner.

(3) Insufficient Risk Management: Some projects may overlook risk management measures during rapid expansion, such as failing to establish adequate insurance funds or effectively manage reserve assets. This situation may lead to the inability of stablecoins to maintain their pegged value during market turmoil.

4. Regulatory and Compliance Pressures

As an innovative financial tool, yield-bearing stablecoins are receiving heightened attention from global regulatory agencies.

(1) Global Regulatory Trends: Governments worldwide are strengthening regulations on stablecoins, such as the EU's MiCA legislation and the U.S. stablecoin legislative proposals, which impose higher requirements on reserve assets, transparency, and compliance. Regulatory agencies may particularly focus on whether the yield distribution models of yield-bearing stablecoins comply with financial regulations.

(2) Conflict Between Decentralization and Compliance: The decentralized nature of yield-bearing stablecoins may conflict with compliance requirements (such as KYC/AML), potentially limiting their market expansion. For example, some projects may need to relinquish certain decentralized features to meet regulatory requirements, which could weaken their core competitiveness.

(3) Increased Operational Costs: To meet regulatory requirements, yield-bearing stablecoin projects may need to allocate more resources for compliance audits, transparency disclosures, and other aspects, which may increase operational costs and reduce investment returns.

Conclusion and Outlook

The rise of yield-bearing stablecoins has not only changed the landscape of the stablecoin sector but also injected new vitality into the cryptocurrency field. As a type of asset that combines stability and yield, yield-bearing stablecoins successfully merge the stability of traditional stablecoins with the value-added capabilities of innovative financial instruments, providing investors with a new asset choice. They have become an important component of the crypto market and are gradually attracting attention from the traditional financial sector.

Looking ahead, yield-bearing stablecoins may occupy a significant share of the stablecoin market and become mainstream financial tools. They could expand from asset appreciation to more application scenarios such as payments, insurance, and savings, becoming a new type of reserve asset in the digital economy era, driving the global financial system towards a more open, transparent, and efficient direction.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play and Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed breakdowns of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking in-depth insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。