Introduction

Today, the internet, a symbol of globalization, is actually a product of the peak of the Cold War.

In 1969, during the era of "nuclear deterrence," the U.S. military sought a network that could avoid centralized single points of failure and autonomously recover in the event of a nuclear strike. Thus, the prototype of the internet, ARPAnet, was born with the original intention of "decentralization," adopting a fully distributed architecture of "end-to-end connections."

However, over the past 55 years, from Web1 to Web2, the rapid expansion of the internet's golden age has instead fostered a centralized architecture of "endpoints connecting to servers," increasingly diverging from its original intent. In the fragmented platform system, Web2 giants have established dominion, wielding absolute discretion over the online world and holding significant influence and power over value distribution.

Therefore, the recent rise of the Web3 wave, which champions decentralization and de-platforming narratives, is just beginning. Simple application of decentralization cannot resolve fundamental contradictions; issues such as efficiency bottlenecks and security risks still exist. The key is how to thoroughly transform the underlying technology stack of the internet to disrupt the efficiency and security problems caused by the overly centralized Web2.

In this context, DePIN may offer a new solution worth noting: By combining the financial attributes and incentive mechanisms of Web3, DePIN can construct an efficient P2P physical resource network, creating "decentralized physical network infrastructure" and enabling the network to possess programmable capabilities, helping to achieve the elevation of "DePIN+" to build a new species entirely different from traditional internet architecture.

At the same time, the explosive growth of AI in Web3 not only injects new vitality but also witnesses a fact: blockchain applications are gradually expanding from on-chain activities to the real world, such as RWA, AI, and DePIN.

The narrative of DePIN also signifies that the gap between physical reality and the ever-expanding blockchain world is gradually blurring. Next, let us take a look at the present and future of DePIN.

Part 1: Overview of DePIN: What & Why

What is DePIN?

The concept of DePIN has been widely discussed, but it is still necessary to rearticulate it from an organizational perspective, focusing on the basic operational model of DePIN. By definition, DePIN (Decentralized Physical Infrastructure Network) is a model that combines physical infrastructure resources with blockchain technology, coordinating global resource collaboration through distributed ledgers, token incentives, and smart contracts.

In simple terms, DePIN creates a "resource sharing + economic incentive" bilateral market by linking hardware with blockchain. This community-driven model is more flexible than traditional single-point resource management and exhibits greater scalability and robustness.

Generally, a complete DePIN network consists of project parties, off-chain physical devices, suppliers, and demanders, with the basic operational model divided into five steps:

1. Off-chain hardware devices: Typically provided or requested by the project party, mainly categorized as:

Customized dedicated hardware: For example, Helium requires users to purchase Helium hardware hotspots from third-party manufacturers to provide hotspot signals for nearby IoT devices and earn mining rewards; Hivemapper encourages users to contribute to the map network through its dedicated dashcam (HiveMapper Dashcam).

Professional-grade hardware: Idle computers equipped with GPU and CPU chips can start participating in computing power/data supply by simply downloading a browser plugin. For instance, Heurist allows owners of idle GPU devices to download its miner program and set up miner nodes to start earning mining rewards by sharing their computing power, with the entry threshold for device networking specified as NVIDIA GeForce RTX 3050 in io.net's participation method.

Smart mobile devices: Represented by smartphones, smartwatches, bands, and even rings, these lightweight mobile devices can join the DePIN network in two ways: running node programs to become control ends of DePIN hardware or directly providing sensor data or computing resources. For example, Silencio uses the built-in microphones of people's smartphones to map dynamic noise pollution worldwide; Acurast utilizes the storage space of old phones to build a decentralized cloud that anyone can contribute to.

2. Proof: The data generated by physical devices needs to be uploaded to the blockchain for recording in a tamper-proof ledger, providing stakeholders with transparent and auditable operational records of the infrastructure, proving that they have performed certain work to earn incentives. This verification method is called Proof of Physical Work (PoPW).

3. Identity verification: After the data is verified, the on-chain account address of the device owner needs to be checked, typically using public and private keys for identity verification. The private key is used to generate and sign the proof of physical work, while the public key is used externally to verify the proof or as the identity label of the hardware device (Device ID).

4. Reward distribution: After verifying the data, the token rewards obtained by the off-chain physical devices are sent to the corresponding on-chain address, involving the token economics of DePIN. Token economics, as the economic foundation of the data value network, is crucial for the sustainable operation of DePIN projects.

BME: Token burning mechanism, where users on the demand side destroy tokens after purchasing services, with the degree of deflation determined by demand; in other words, the stronger the demand, the higher the value of the tokens.

SFA: Requires users on the supply side to stake tokens to become qualified miners, with supply determining the degree of deflation; that is, the more miners providing services, the higher the value of the tokens.

5. Demand matching: A DePIN market platform where both supply and demand sides can buy, sell, and lease, completing resource exchange and matching; at the same time, the DePIN market provides real-time market data, including asset prices, historical performance, and energy production data, helping to ensure fair pricing, typically managed by a decentralized autonomous organization (DAO) that allows stakeholders to participate in the decision-making process.

Image Source: FMG

Why do we need DePIN?

A simple example: Noise pollution is a particularly common phenomenon in urban life. Quantifying noise pollution data is not only commercially valuable for real estate developers, hotels, and restaurants but also has reference significance for urban planning and academic research. However, would you be willing to let a private company install microphones all over your city? Or imagine the upfront costs of doing so; how far could its coverage expand? How fast could it grow?

If this were a user-initiated noise detection network, everything would be much simpler. For example, Silencio deploys noise pollution sensors through its application downloaded on users' phones, allowing mobile users to provide accurate, hyper-local noise pollution data to establish a global measurement network and earn token rewards. Meanwhile, the platform profits by selling noise pollution data.

This is one of the significances of DePIN. In traditional physical infrastructure networks (such as communication networks, cloud services, energy networks, etc.), due to massive capital investment and operational maintenance costs, the market is often dominated by large companies or giants. This centralized industrial characteristic brings several dilemmas and challenges:

Centralized control: Controlled by centralized institutions, there is a risk of single points of failure, vulnerability to attacks, and low transparency, with users lacking control over data and operations.

High entry barriers: New entrants must overcome high capital investment and complex regulatory hurdles, limiting market competition and innovation.

Resource waste: Centralized management leads to idle or wasted resources, resulting in low resource utilization.

Insufficient incentive mechanisms: Lack of effective incentive mechanisms leads to low user participation and contribution of network resources.

The core value of DePIN can be summarized in four points:

Resource sharing and digitization: Transforming idle physical resources (such as storage, communication, computing power) into tradable digital assets in a decentralized manner;

Decentralized governance: Based on open protocols and cryptoeconomic models, users contribute capital, assets, and labor towards a common goal and receive transparent and fair incentives;

On-chain settlement: Blockchain reduces costs by becoming a single source of shared ledgers for all market participants;

Innovation: In an open, permissionless global system, the speed of experimentation is an order of magnitude higher than that of centralized infrastructure.

Current Development Status of DePIN

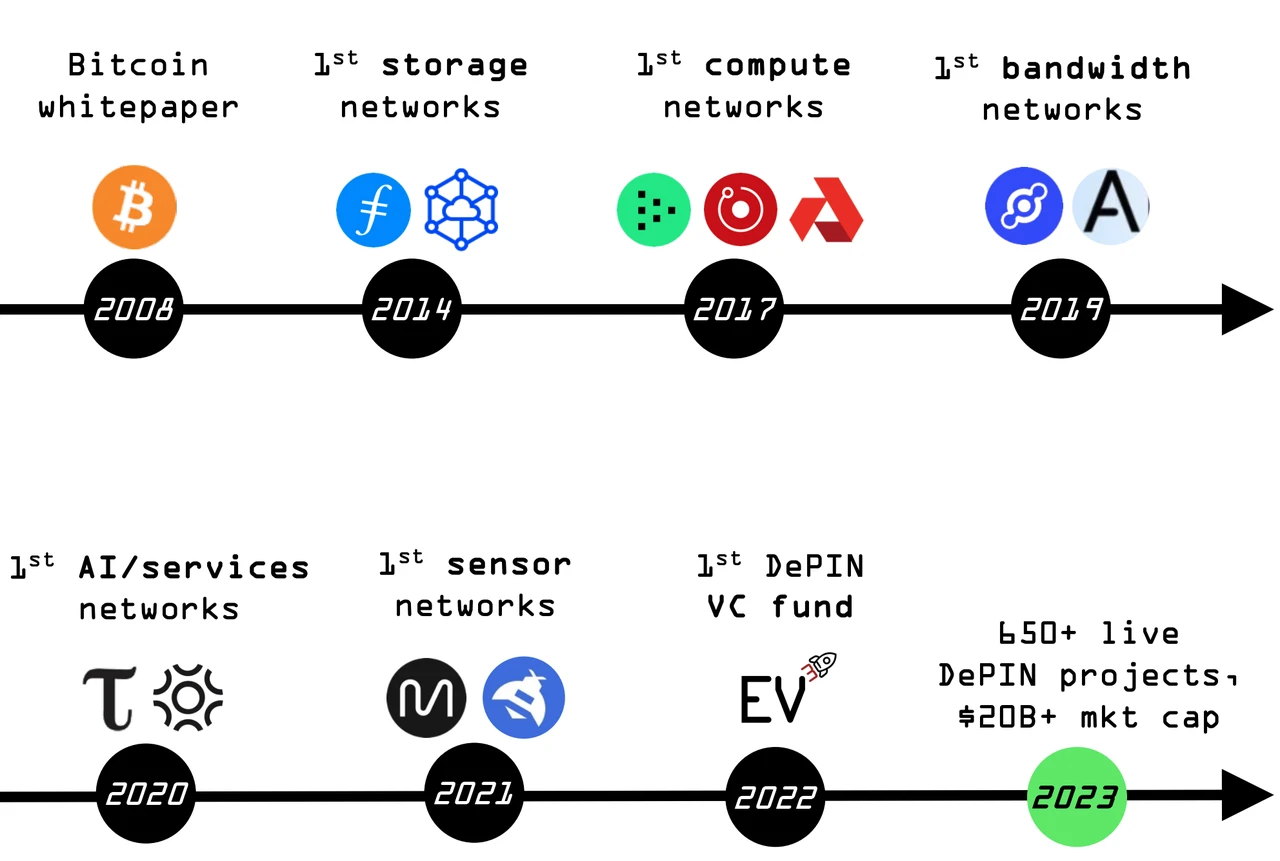

Track: As one of the earlier fields of blockchain development, DePIN has been evolving for a long time. The earliest established projects, such as the decentralized network Helium and decentralized storage solutions like Storj and Sia, primarily focus on storage and communication technologies.

Image Source: Messari

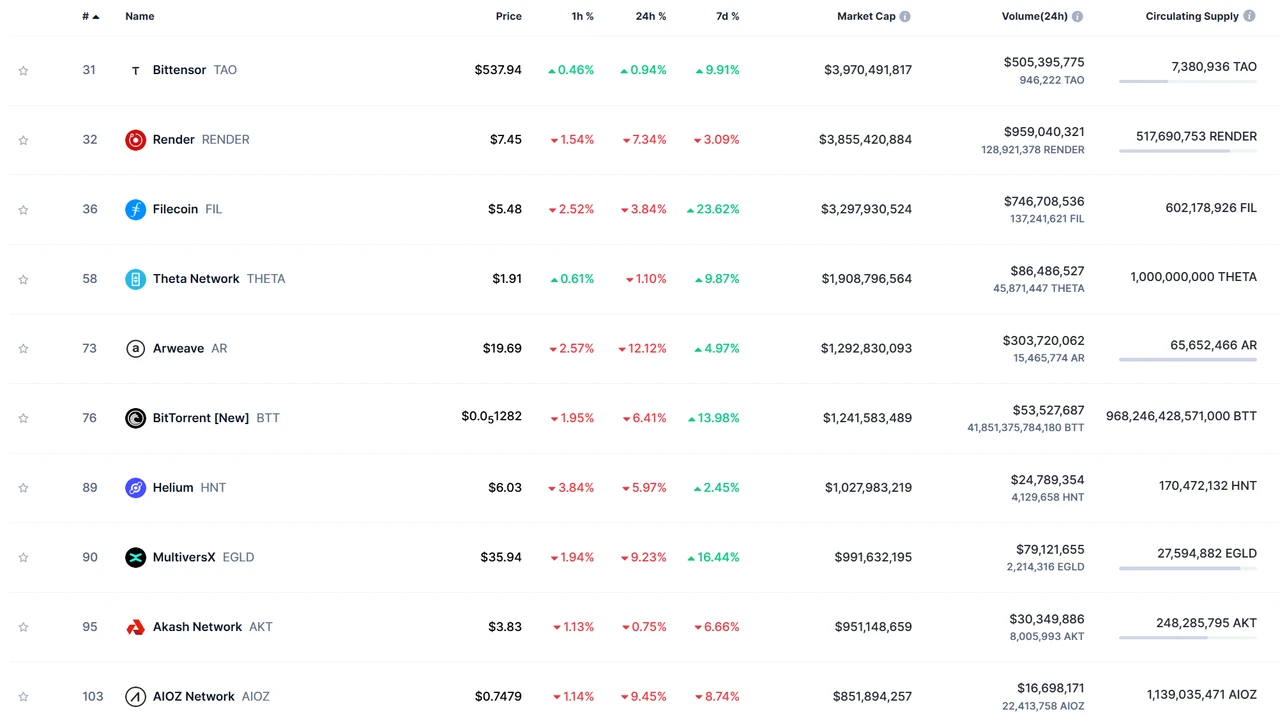

However, with the continuous development of the internet and the Internet of Things, the demand for infrastructure requirements and innovations is increasing. DePIN projects have mainly expanded into computing power, data collection and sharing, wireless, sensors, energy, and more. However, looking at the current top 10 projects by market capitalization in the DePIN field, most belong to the storage and computing power sectors.

AI is a key term in this cycle of DePIN, as DePIN is inherently suitable for the decentralized sharing needs of AI data and computing power, leading to the emergence of a number of AI DePIN projects dedicated to integrating global resources such as computing, storage, networking, and energy to provide underlying infrastructure support for AI model training, inference, and deployment.

Image Source: CoinMarketCap

Market Size: According to data from DePIN Ninja, the number of DePIN projects that have gone live has reached 1,561, with a total market capitalization of approximately $22 billion. For the total potential market size of the DePIN sector, Messari has made a prediction: by 2028, the DePIN market size could exceed $3.5 trillion, potentially adding $10 trillion to global GDP over the next decade (reaching $100 trillion in ten years).

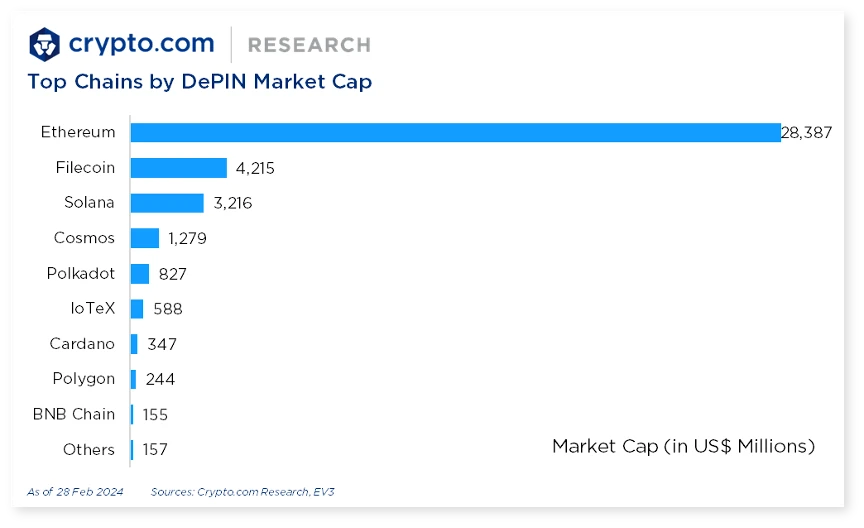

L1/L2: Due to high throughput and low gas fees, current DePIN projects are primarily concentrated on deploying on the Solana public chain, as well as on DePIN-specific chains like IoTex and Peaq. Meanwhile, Polygon and Arbitrum are gradually emerging as rising stars.

Image Source: Cryptoresearch

As the hardware supply chain has matured, project parties do not need to invest significant R&D efforts. Therefore, based on their focus areas, current DePIN projects can be divided into two directions: one focuses on the middleware for DePIN; the other focuses on expanding the demand side of DePIN.

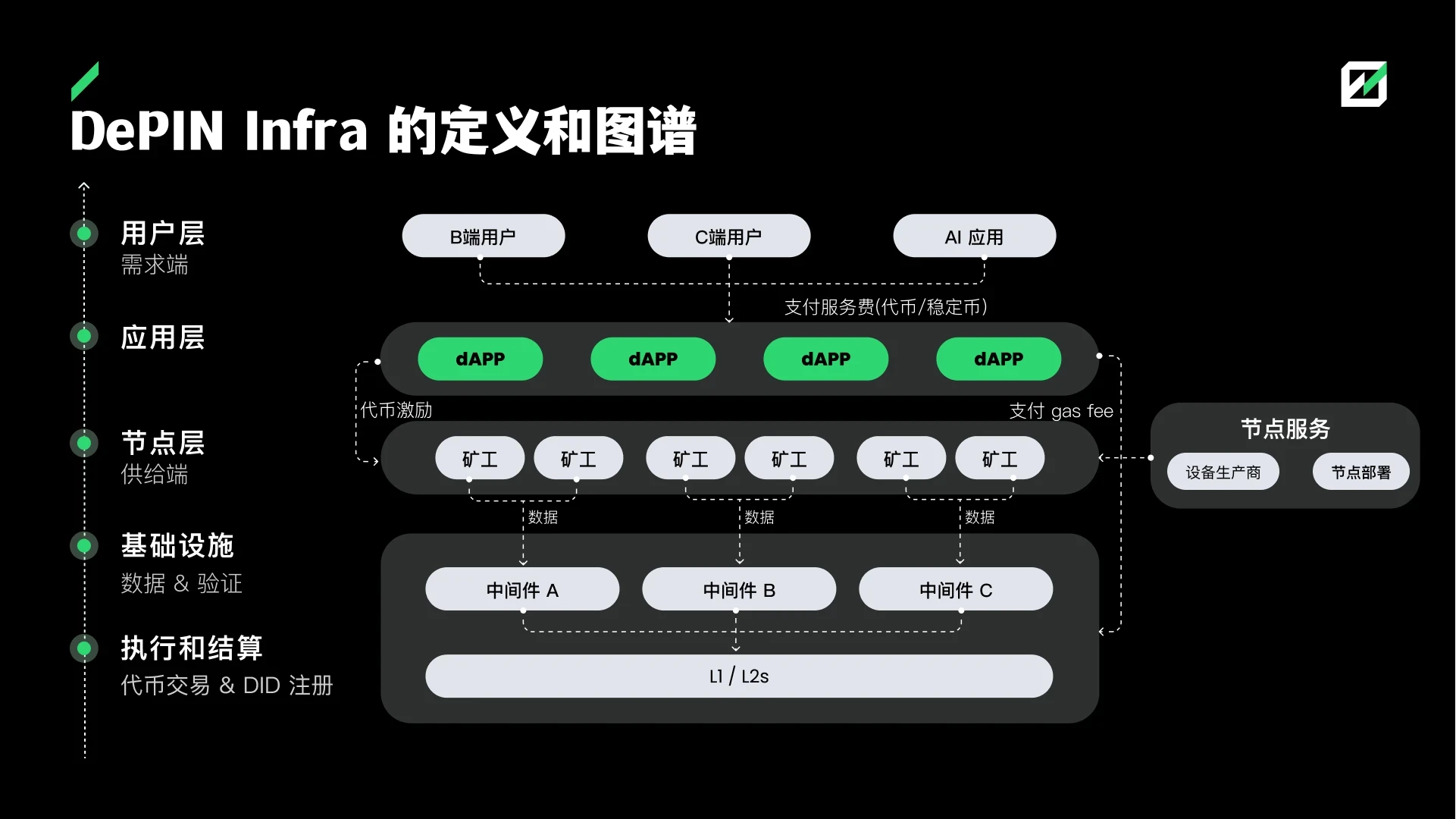

Part 2: DePIN Middleware

There are technical challenges and liquidity pressures in connecting IoT devices related to DePIN to the blockchain on a large scale, such as hardware design and production, how to achieve credible transmission and data processing of off-chain data on-chain, and token economic design. As a result, the DePIN sector has given rise to middleware that connects devices to the DePIN network, involving connection and bidirectional services, aimed at helping project parties quickly launch DePIN application projects by providing development frameworks, developer tools, overall solutions, and more.

This includes not only developer-friendly tools and one-stop services like DePHY and Swan but also dedicated re-staking protocols for DePIN like Parasail, which aims to enhance the liquidity and value utilization of the native tokens in the DePIN network.

DePIN Infra

DePHY: Aims to provide open-source hardware solutions, SDKs, and tools for DePIN projects, and reduces the manufacturing and network messaging costs of bridging hardware products to the blockchain through off-chain network nodes operating at 500ms synchronization with the blockchain.

W3bStream: The off-chain computing protocol W3bstream allows IoTeX DePIN projects to easily generate logic based on smart device data to trigger blockchain operations. Some well-known IoTeX-based DePIN projects include Envirobloq, Drop Wireless, and HealthBlocks.

Currently, as the number of DePIN projects providing frameworks and solutions increases, DePIN application layer projects built on this infrastructure are also beginning to emerge, such as IoTeX-based Pebble's EnviroBLOQ, W3bstream-based Dimo and Drife, and DePHY-based Starpower and Apus Network, among others.

Liquidity Solutions

PINGPONG is a DePIN liquidity and service aggregator that optimizes and maximizes mining yields across multiple networks through innovative tools and solutions.

Parasail is a re-staking protocol specifically for DePIN, which activates idle assets (such as staked or re-staked tokens) in mature networks to provide economic guarantees for DePIN services, helping DePIN projects attract more users and service providers.

Taking Parasail as a detailed example, it currently primarily provides re-staking services on the Filecoin chain, with plans to open re-staking on IoTeX, Arbitrum, and Ethereum chains in the future. Here’s how Parasail works using FIL as an example:

Staking FIL Tokenization: Storage providers can stake FIL and mint pFIL tokens at a 1:1 ratio.

Open Market for pFIL: Storage providers can sell pFIL to gain liquidity, while token holders can purchase pFIL to earn FIL mining rewards.

Risk Recovery and Reward Distribution: When the staked FIL is released or miners receive block rewards, the Repl protocol recovers FIL and repurchases pFIL through auctions, with excess profits distributed as rewards.

Part 3: DePIN Application Layer

The DePIN application layer occupies a significant portion of the DePIN sector, and this article, based on publicly available research reports and a summary of DePIN browser projects, is mainly divided into four major sectors: cloud networks (storage, computing), wireless networks (5G, WiFi, Bluetooth, LoRaWAN), sensors (environmental, geographical, health), and energy.

Cloud Networks

DePIN's domain in cloud networks includes decentralized storage and computing.

▼ Storage

Decentralized storage is a key component of the DePIN ecosystem, aimed at solving the high costs, privacy risks, and insufficient censorship resistance of traditional centralized storage:

As one of the most well-known DePIN projects, Filecoin is based on IPFS technology (IPFS itself is a widely recognized distributed file system), utilizing a storage proof mechanism to ensure data integrity and authenticity. Miners earn FIL rewards by contributing storage space, and users pay for data storage as needed. This model not only reduces storage costs but also activates a large amount of idle hard drive resources globally.

Arweave offers a permanent storage solution, where users only need to pay a one-time fee, making it ideal for data that needs to be preserved long-term, such as historical archives, NFT metadata, or blockchain transaction records.

Overall, compared to traditional cloud storage, decentralized storage clearly excels in censorship resistance and transparency, although storage speed and initial entry barriers may still need optimization.

▼ Computing

As the core productive resource of the current AI wave, decentralized computing and other DePIN projects serve as a complementary alternative to the existing centralized cloud giants' computing service landscape (CePIN), rather than a direct replacement: cloud service giants with massive computing resources handle large model training and high-performance computing for "urgent and critical needs," while the decentralized cloud computing market addresses more diverse "flexible low-cost needs" such as small to medium model computation, large model fine-tuning, and inference deployment.

Essentially, it provides a more inclusive dynamic balance between cost-effectiveness and computing power quality, aligning with the economic logic of optimizing resource allocation in the market. Represented by established decentralized computing projects like Render Network and Akash Network, as well as this year's latest DeAI narrative giant io.net:

Render Network: Provides decentralized GPU rendering services, capable of offering flexible, low-cost computing support for applications requiring real-time computation (such as virtual reality, 3D rendering, and industrial automation), particularly valuable in the metaverse and real-time interaction fields.

io.net: Goes further, not only serving as a platform for matching computing resources but also achieving efficient collaboration of distributed GPUs through a complete product architecture:

"IO Cloud": Supports users in creating GPU clusters based on their needs for complex tasks like AI model training.

"IO Worker": Provides management tools for computing power suppliers, including temperature control monitoring and computing power utilization analysis.

"IO Explorer": Offers visualization of network statistics and reward data, making it easier for users to track the dynamic flow of computing resources.

PinGo is an AI and DePIN project on the TON network, aimed at solving the fragmentation and idleness of idle computing resources, providing the computational foundation for building AI models. PinGo was initially a Cpin Web2 company with nearly 100,000 devices, which will be integrated into its own DePIN network in the future.

However, decentralizing computing power to activate idle resources is not easy; large model training requires stability, and interruptions can lead to high sunk costs. Due to the complexity of the technical details of computing power delivery, the bilateral scheduling model similar to Uber and Airbnb fails here. Additionally, NVIDIA's CUDA software environment and NVLINK multi-card communication make replacement costs extremely high, as NVLINK's physical distance limitations require GPUs to be concentrated in the same data center.

In this context, the business model for decentralized computing power supply is difficult to realize, reducing it to mere narrative, with many computing power projects forced to abandon the training market in favor of serving the inference market. However, in the absence of large-scale application explosions, inference demand is insufficient, and large enterprises find it more stable and cost-effective to build their own solutions to meet inference needs.

Wireless Networks

Dewi (Decentralized Wireless) is a particularly important part of the DePIN sector, allowing many independent entities or individuals to collaborate to establish token-incentivized wireless infrastructure, providing services for IoT and mobile communications. Shareable wireless networks include:

Hive 5G: Provides high download speeds and low latency, such as Pollen Mobile, which builds a distributed 5G network using decentralized base stations, aiming to reduce mobile communication costs and improve coverage;

WiFi: Provides network connections in specific areas, such as Wicrypt, where users can purchase dedicated devices to contribute WiFi and earn tokens; Metablox (now renamed Roam) is similar to a "Web3 universal key," allowing users to share their self-built global public WiFi networks; Wifi Dabba primarily collaborates with local priority television operators in India.

Low Power Wide Area Network (LoRaWAN): Facilitates IoT communications, with leading DePIN project Helium being a typical representative, providing low-cost, high-coverage communication services for IoT devices through LoRaWAN routers, thereby replacing the centralized service model of traditional telecom networks. Users earn HNT rewards by running routers, making this model particularly suitable for scenarios requiring large-scale device coverage, such as agricultural IoT, logistics tracking, and environmental monitoring.

Bluetooth: Enables short-distance data transmission.

This network model is suitable for smart cities, agricultural IoT, and other scenarios. However, the advantage of decentralized communication lies in its low-cost alternative to traditional telecom infrastructure, while deployment efficiency and the maintenance of physical devices remain challenges that cannot be ignored. Dewi needs to leverage the power of traditional operator networks to expand its market, serving as a supplement to traditional operators or providing them with relevant data.

Sensors

Sensor networks are another niche area of DePIN, essentially composed of interconnected devices, each designed to monitor and collect specific data from their environment, primarily through monitoring and capturing data related to the environment, geography, and health:

Environment: An obvious use case is weather forecasting. WiHi aims to become a unified platform connecting all these entities, simplifying data sharing, improving prediction accuracy, and enhancing climate monitoring. Any entity operating weather sensors can apply to contribute data to WiHi.

Geography: For example, HiveMapper collects the latest high-resolution data (4K street-level images) through cameras installed in vehicles by holders (such as taxi drivers and couriers), contributing their data for map imaging in exchange for token rewards. Demand-side users can purchase existing maps or reward new area data for sudden events. Currently, there is real commercial value in obtaining timely data on the external conditions of houses for insurance assessments, providing developers of autonomous vehicles with the latest road conditions and construction zone information, as well as real-world assets (RWA).

Energy

The traditional energy market faces the following issues: mismatched supply and demand in regional energy networks, lack of a transparent and tradable energy market, a vast untapped clean energy market, and slow and costly expansion of energy networks. Through the decentralization of energy networks, DePIN enables users to utilize their surplus energy production directly. This approach not only encourages more prudent energy consumption but also reduces dependence on traditional energy suppliers. The DePIN approach to energy networks can provide a more democratic, efficient, and beneficial model for energy production and consumption.

Starpower: Creates decentralized virtual power plants (VPPs) that connect small power supply networks with the demand side, reducing energy transmission and improving energy utilization efficiency.

Powerpod: Changes the way electric vehicle (EV) charging is done by creating a decentralized community charging station network.

Arkreen: Incentivizes providers to offer capacity for solar installations and other similar data, including pathways for renewable energy certification (REC) issuers and green computing operators to provide access to data, building applications and services.

Part 4: How to View the Future of DePIN?

DePIN Trends

▼ Integration with Web2 Application Scenarios

The potential of DePIN lies not only in its underlying decentralized technological advantages but also in its wide-ranging applications across various Web2 industries, spanning IoT, smart cities, energy sharing, edge computing, and more. Each of these fields represents an important role for DePIN in promoting the integration of the physical world and digital networks.

One can envision a future living scenario: on a morning in 2030, Alice, on her way to work, activates Helium to provide communication support for nearby pedestrians and devices. While driving to work, she opens DIMO to record her vehicle's device data and continuously contributes the latest map data to Hivemapper. Upon reaching her office, which is a solar energy company, Alice skillfully installs Arkreen collection devices on various solar components, allowing users to track their carbon footprints.

Image Source: Waterdrip Capital

▼ Lower Hardware Barriers

Previously, DePIN devices primarily included computing power, storage, and bandwidth, with devices typically fixed in one location. Currently, DePIN is transitioning from professional-grade devices to consumer-grade products, such as mobile phones (Solana Mobile Saga), smartwatches (WatchX), AI smart rings (CUDIS), and e-cigarettes (Puffpaw). These devices are compact and portable, even wearable.

As the most ubiquitous hardware devices, the reduction of hardware barriers is expected to further expand the user base: on one hand, the sensors and computing modules of encrypted phones serve as natural recruitment endpoints, allowing them to participate in the DePIN economy, lowering sales barriers and increasing usage frequency; on the other hand, the built-in encrypted application market of encrypted phones serves as an excellent entry point for dApps. This market is diverse and has a wide range of applications, waiting to be further explored, representing a vast potential blue ocean.

▼ Financialization

The tokenization of physical hardware also opens up imaginative possibilities for on-chain finance in DePIN:

Staking liquidity pools to increase revenue sources, such as the HONEY-JitoSOL liquidity treasury incentive program launched by Hivemapper, further enhancing incentive effects.

On-chain securitization of DePIN hardware assets, issuing products similar to traditional financial REITs;

Based on the tokenization of data assets, financial products supported by data can be created, such as DIMO's automotive data being used for on-chain car loans.

▼ Mutual Nourishment of DePIN and AI

The characteristics of DePIN are also naturally suited for the development of AI.

Firstly, DePIN can serve AI at multiple levels, including computing power, models, and data, releasing capabilities that AI originally lacked in a decentralized manner. AI is essentially an intelligent system trained on massive amounts of data, and the rich edge data collected by IoT devices in DePIN provides extensive training and application scenarios for AI. Currently, many AIPIN projects capture data through hardware sensors and then use AI to optimize data processing capabilities, achieving end-to-end process automation at the application level and unlocking the potential of industry-specific scenarios.

At the same time, the integration of AI makes DePIN smarter and more sustainable. AI can enhance device efficiency and optimize network resource allocation through deep learning and predictions, help audit smart contracts, provide personalized services, and even dynamically adjust the economic incentive models of DePIN projects through algorithms.

Constraints on the Scaling of DePIN

Despite the attractive concept of DePIN, the complexity of technical implementation, market acceptance, and regulatory policies significantly increase the difficulty of achieving scalability:

From storage to computing power, from communication to energy, each DePIN solution requires the integration of different types of physical hardware and decentralized protocols, which places high demands on hardware manufacturers, network developers, and participating nodes;

Additionally, the market's acceptance of the DePIN model remains unclear. In practical applications, how to persuade enterprises or individuals to switch to DePIN's network infrastructure and bear the high initial costs remains an unresolved challenge;

The uncertainty of profit models also limits the attractiveness of DePIN. Currently, many projects rely on token economic incentives for participants to provide resources, but whether this model can maintain long-term sustainability depends on the market's recognition of token value and the actual growth rate of demand. The issue is that most projects' narratives seem somewhat outdated, and product experiences are often insufficient, making it difficult to compete with Web2. If they rely solely on token incentives to attract users, a collapse of the incentive model could lead to a "death spiral." Due to their dual reliance on hardware sales revenue and token models, the stability of the economic system is crucial. If token values fluctuate too much or the costs of hardware deployment and maintenance are too high, the economic incentives of the entire system will be difficult to sustain, potentially leading to user attrition and even network paralysis.

Furthermore, since DePIN involves key areas such as storage, computing, and communication, its potential impact may trigger national or regional legal and policy interventions. For example, decentralized storage networks may be used to store sensitive or illegal content, leading regulatory authorities in certain countries to exert pressure on the entire network to implement stricter content review mechanisms (previously, some individuals have used decentralized storage projects to store politically sensitive information);

In summary, from the complexity of technology to market acceptance, and to regulatory uncertainties, each step is crucial to whether it can truly become a new benchmark for infrastructure. How to break through this pattern and allow users to truly feel the economic and unique value of DePIN is the competitive pressure it must face.

Part 5: Factors to Consider for a Potential DePIN Project

▼ Hardware

Homemade VS Third-Party: Currently, most DePIN projects use third-party hardware production. The advantage is that it ensures professionalism, but the concern is that its expansion may be affected by the third-party supply chain. In contrast, projects with strong hardware supply chain capabilities can achieve rapid business growth in the first curve phase through equipment sales and agency models.

One-Time VS Ongoing Costs: Some DePIN networks have one-time costs, such as Helium, where users provide passive coverage to the network after purchasing hardware devices and setting up hotspots without needing to do much extra work. Others require continuous user participation. If contributors pay a one-time cost (in time or money) at the beginning rather than ongoing costs, the expansion of the DePIN network will be easier; passive networks are easier to set up and therefore easier to scale.

High Density VS Low Density: The density of hardware coverage also needs to be considered in DePIN projects, such as XNET, which is establishing a carrier-grade CBRS wireless network. Their network radios need to be installed by local ISP professionals, making installation difficult and unfavorable for density deployment, but due to their more specialized equipment, their network still has expansion potential. High-density networks require more contributors to reach threshold scale. In contrast, lower-density networks can utilize more complex hardware and/or specialized contributors.

Scarce VS Common: For example, XNET is establishing a carrier-grade CBRS wireless network. Their network radios need to be installed by local ISP professionals, making installation difficult and unfavorable for density deployment, but due to the more specialized and scarce resources, their network still has expansion potential.

▼ Token Economics Design

Token economics, as the economic foundation of the data value network, is key to whether DePIN projects can operate well. The two mainstream models are BME (burn and mint equilibrium) and SFA (stake for access). BME and SFA form the basic core framework of DePIN projects, while empowering tokens enhances the token economy, such as:

Using points as a pre-mining commitment to miners, which can be exchanged at a certain ratio after token issuance, or adopting a points + token economic model.

Granting governance functions to tokens, allowing holders to participate in major network decisions, such as network upgrades, fee structures, or fund redistribution.

Staking mechanisms incentivize users to lock tokens, maintaining token price stability;

Project parties can also use a portion of their revenue to buy tokens and pair them with other major cryptocurrencies or stablecoins to add to liquidity pools, ensuring that tokens have sufficient liquidity for users to trade without significantly affecting prices.

These mechanisms help ensure that the interests of users on both the supply and demand sides remain aligned with the interests of the project parties over the long term, thus achieving the project's long-term success.

Summary

Looking at the macro perspective, we find that Web3, as a value network, has the immense potential to reshape production relationships and unleash productivity. The core logic of DePIN is to build a distributed bilateral market by adopting the "Web3 + token economy" infrastructure. From this perspective, whether it is storage, computing power, data, or communication networks, all have the potential to be revitalized through the new model of DePIN.

By integrating global idle resources (such as storage, computing power, communication devices, etc.), it addresses the issues of resource monopoly and inefficient distribution under traditional centralized models. This model effectively connects global hardware resources with user demands, not only reducing the cost of resource acquisition but also enhancing the resilience and risk resistance of infrastructure, laying the foundation for the popularization and application of decentralized networks.

However, although DePIN shows great development potential, it still faces challenges in terms of technological maturity, service stability, market acceptance, and regulatory environment. Today, the performance of blockchain, the increasingly rich and mature token economic models, and market cycles are all preparing for the explosion of DePIN, while large-scale applications still lack opportunities. "Bending down to keep one's position, waiting for the right time, cannot contend with fate," DePIN relies on the flywheel effect, needing to observe broadly and select carefully, accumulating thickly and releasing thinly, and will never become a silent narrative.

Reference

State of DePIN 2023

https://DePIN.ninja/leader-board

https://DePINhub.io/rankings/investors

FMG in-depth report: Five opportunities in the DePIN track from the bottom up

Archaeology of DePIN, seeking the "orthodoxy" of the track

*All content on the Coinspire platform is for reference only and does not constitute an offer or advice for any investment strategy. Any personal decisions made based on the content of this article are the sole responsibility of the investor, and Coinspire is not responsible for any profits or losses arising therefrom. Investment involves risks, and decisions should be made cautiously!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。