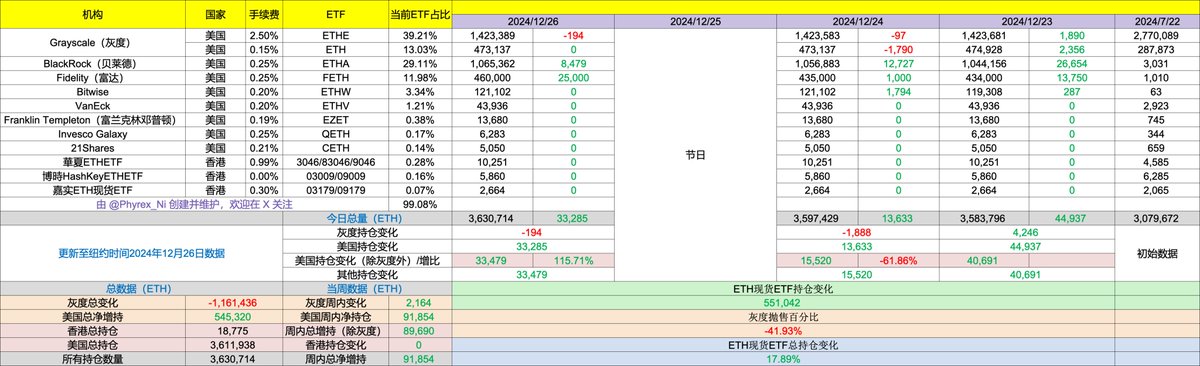

On Thursday, the data for ETH spot ETFs still showed good performance. Over the past week, whether during market downturns or intense market activity, the buying volume of ETH in ETFs has remained strong, mainly thanks to BlackRock and Fidelity. On Thursday, Fidelity aggressively purchased 25,000 #ETH, while BlackRock bought nearly 8,500 ETH. Unfortunately, aside from these two, only Grayscale's $ETHE reduced its holdings by less than 200 ETH, while others remained at zero.

Many friends are wondering why there is a significant amount of ETH buying, yet the price remains stagnant. This is a phase that #BTC has also experienced. It seems that a large number of institutions and high-net-worth investors are starting to position themselves. Since they are operating through AP, the price impact may not be obvious, but ETH's stability has been quite good recently.

In just a few days, December will be over, and we can expect more favorable conditions starting in January, especially with the power transition on January 20. The overall market should perform well, and we are looking forward to Trump saying a few positive words about cryptocurrency in his inauguration speech, which would greatly boost the market.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。