Original Author: BitMEX

Key Highlights

Merry Christmas to everyone! The market has remained in a consolidation phase this week, with moderate trading volume. New tokens and the DeFi sector continue to perform strongly, while Bitcoin hovers below the $100,000 mark.

In this issue's trading analysis column, we will delve into the development status of the Bitcoin ecosystem in 2024 and why, despite many favorable factors, it has not met market expectations.

Data Overview

Best Performers This Week

$PENGU (+29.9%): Continues to reach new all-time highs after a large-scale airdrop, with strong buying pressure.

$MOVE (+21.4%): Continues its upward momentum from last week.

$HYPE (+18.3%): Price volatility due to rumors of North Korean hacker attacks.

Worst Performers This Week

$APT (-22.0%): Significant price drop.

$ONDO (-12.2%): Price decline due to insider selling.

$FTM (-11.2%): Price still drops despite the upcoming Sonic upgrade.

This Week's News Brief

Macro Dynamics

ETH ETF weekly inflow: +$302 million (source)

BTC ETF weekly outflow: -$89 million (source)

France intensifies crackdown on cryptocurrency scams (source)

Do Kwon's extradition appeal rejected by Montenegrin court (source)

Thailand actively promotes Bitcoin adoption, while Japan remains cautious (source)

The proportion of profitable Bitcoin addresses drops to 88% (source)

Top 10 NFT collections outperform token markets in weekly returns (source)

SpaceX uses stablecoins to hedge against foreign exchange risks (source)

Project Dynamics

Animoca Brands founder Yat Siu's X account hacked to promote fake tokens (source)

Sonic Labs launches FTM to S token swap feature (source)

Aave and Lido's total net deposits exceed $70 billion (source)

Rumors of North Korean hacker attacks lead to significant price fluctuations for HYPE tokens (source)

Floki DAO proposes to provide early liquidity for European ETPs (source)

Trading Insights

Disclaimer: The following content is for reference only and does not constitute investment advice. This is a summary of market news, and we recommend conducting your own research before making any trades. We are not responsible for any trading outcomes and do not guarantee profits.

2024 Year-End Review of the Bitcoin Ecosystem: Strong Start, Lackluster Finish

As 2024 comes to a close, the crypto market has experienced a year of ups and downs. Although Bitcoin's price has risen over 130% this year, the development of the Bitcoin ecosystem (including infrastructure, Layer-1 token protocols, Layer-2 scaling solutions, and staking projects) has not met market expectations set at the beginning of the year.

Strong Start

Ordinals and Layer-1 Assets: The popularity of Ordinals and BRC-20 tokens from late 2023 to early 2024 brought the Bitcoin ecosystem into the spotlight. Major exchanges began listing these new tokens, and the trend quickly spread to other asset issuance protocols (such as ARC-20, SRC-20, PIPE), leading to waves of new project launches and airdrops.

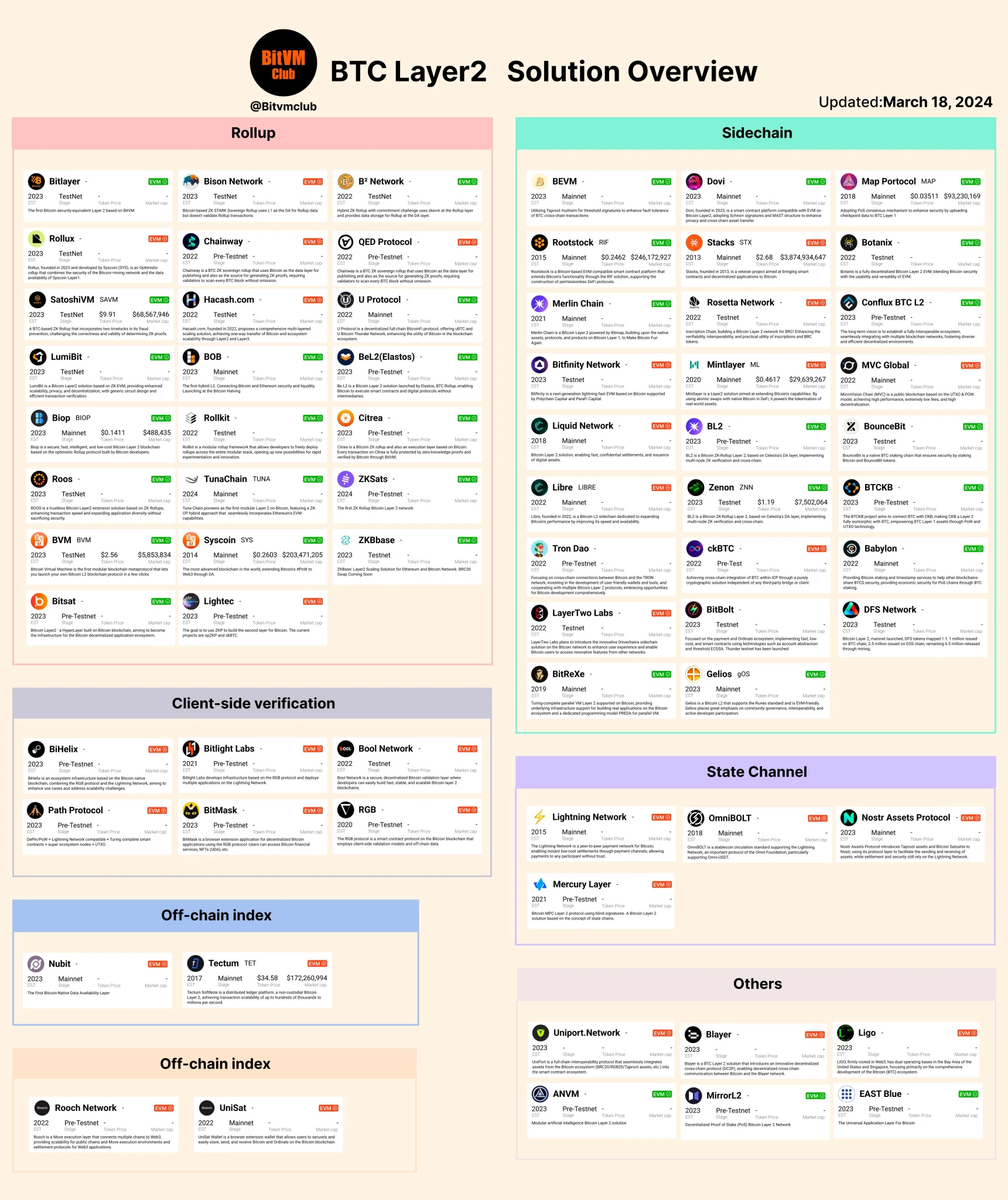

Layer-2 Wave: To address network congestion and expand Bitcoin's functionality, developers launched numerous Layer-2 solutions. Over 100 projects emerged, with many investors hoping to replicate the success of Ethereum's L2 in the Bitcoin ecosystem.

Staking and Re-staking: The launch of Babylon at the end of 2023 sparked discussions about "Bitcoin staking" and "re-staking," a concept derived from Ethereum's EigenLayer model. Given Bitcoin's strong foundational consensus, the market generally expected large holders to actively participate in staking activities, potentially creating a vibrant new market.

Numerous Challenges

Cooling Token Issuance: Despite some peaks at the beginning of 2024 (especially with the Runes protocol), the prices and market activity of newly issued tokens have continued to decline. Well-known tokens have suffered significant losses, with only occasional rebounds. Market saturation, community fragmentation, and limited capital inflows are the main reasons for this decline.

L2 Project Elimination: Most early Bitcoin ecosystem L2 projects simply transplanted EVM designs and relied on short-term TVL incentives. While some projects briefly achieved high TVL, the enthusiasm quickly faded, with very few projects surviving on DeFiLlama. Currently, the total locked value of the entire ecosystem's L2 is even lagging behind that of a single Ethereum L2.

Skepticism Towards Re-staking: Although Babylon has demonstrated impressive TVL and deposit amounts, its "re-staking" model faces increasing skepticism. Critics point to the lack of a strong penalty mechanism (which is crucial in systems like EigenLayer), arguing that these products resemble "pseudo-staking" rather than true trustless solutions. Major Bitcoin holders remain cautious about exchanging "digital gold" for uncertain returns.

Outlook for 2025

Looking ahead, builders and investors see several potential catalysts for the development of the Bitcoin ecosystem:

1. Continued Development of Community Projects: Communities like ORDI, DOG, and PUPS remain actively developing, laying the groundwork for potential growth in 2025.

2. Infrastructure and L2 Innovations: Wallet teams (such as OKX Wallet, Unisat) and persistent L2 pioneers continue to work on scaling and user experience issues. Upcoming projects like OP_CAT are expected to bring more robust designs.

3. Babylon Token Issuance and Subsequent Development: Babylon plans to conduct a token generation event (TGE) in early 2025. Its ability to implement advanced staking mechanisms (including real penalty mechanisms or new security assurances) will be key. If successful, it may attract more Bitcoin holders to participate in on-chain activities.

4. Technological Breakthroughs: Observers emphasize that effective re-staking and advanced L2 frameworks require foundational innovations to fully leverage Bitcoin's core security model. Without these breakthroughs, protocols may struggle to achieve widespread adoption.

Conclusion

Despite the Bitcoin ecosystem experiencing fluctuations from early excitement to project eliminations, it still maintains a dedicated group of builders and an active community. As 2025 approaches, key developments, including OP_CAT, Babylon token issuance, and infrastructure improvements, may unlock greater potential for the network. The success or failure of these next-generation protocols will determine the ecosystem's direction in the coming year.

Reference:

@web3_golem

@Bitvm_club

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。