New Cycle, New Direction, New Applications.

Written by: Gyro Finance

The year 2024 is undoubtedly an important year in the history of cryptocurrency.

This year, the crypto industry successfully broke through, leveraging Bitcoin as the main tool, around two core narratives: ETFs and the U.S. elections. Publicly listed companies, traditional financial institutions, and even national governments have rushed in, significantly enhancing mainstream acceptance and recognition. The regulatory environment has also moved towards a clearer and more lenient path with the new government taking office. Mainstream collisions, path differentiation, and regulatory evolution have become the main themes of the industry this year.

01 Looking Back at 2024: Bitcoin Reaches New Heights, Ethereum Faces Competition, MEME Casinos Gain Attention

Looking at the major developments in the industry this year, Bitcoin is undoubtedly the core narrative.

ETFs and national reserves have successfully propelled Bitcoin to over $100,000, officially declaring Bitcoin as a robust anti-inflation asset globally, with its value storage being recognized. BTC is gradually transitioning from digital gold to a super-sovereign currency, marking a significant victory in this grand financial experiment that began with Satoshi Nakamoto. On the other hand, the Bitcoin ecosystem has expanded this year. Although inscriptions, runes, and even L2 solutions have experienced extreme highs and lows, a diverse Bitcoin ecosystem has begun to take shape. Applications in BTCFi, NFTs, gaming, and social sectors have continued to develop, with Bitcoin DeFi TVL skyrocketing from $300 million at the beginning of the year to $6.755 billion, growing more than 20 times throughout the year. Among them, Babylon has become the largest protocol on the Bitcoin chain, with a TVL of $5.564 billion as of December 20, accounting for 82.37% of the total. The broader BTCFi sector has also performed remarkably this year, with Bitcoin spot ETF shares soaring and MicroStrategy being included in the Nasdaq 100, which has been widely imitated, reflecting Bitcoin's overwhelming success in the CeFi space.

Returning to the public chain sector, Ethereum, the leader this year, has not had an easy time. Compared to other assets, its performance has been lackluster, with a decline in value capture and user activity, and the narrative has not been as strong as before. The "value theory" has put Ethereum under pressure. Although the call for a DeFi revival has taken shape, aside from the TVL nesting frenzy caused by re-staking, it seems that only Aave is shouldering the burden, with actual investment being noticeably insufficient. However, the emergence of the dark horse Hyperliquid in the derivatives market not only dealt a blow to CEX but also sounded the horn for DeFi's counterattack. On the other hand, after the Dencun upgrade, Ethereum Layer 2 has accelerated its competition, continuously encroaching on the mainnet's share, leading to a significant market discussion about Ethereum's mechanisms, with doubts emerging frequently. Even the rapid growth of Base has led to rumors that Ethereum's future belongs to Coinbase.

The strong rise of Solana stands in stark contrast. In terms of TVL, Ethereum's market share in public chains has dropped from 58.38% at the beginning of the year to 55.59%, while Solana has surged from obscurity at the beginning of the year to 6.9% by year-end, becoming the second-largest public chain after Ethereum. SOL has created a growth miracle, skyrocketing from $6 two years ago to $200 today, with over 100% growth just this year. In terms of recovery path, leveraging its unique advantages of low cost and high efficiency, Solana has targeted core liquidity positioning, relying on Degen culture to become the undisputed king of MEME, turning into a retail investor haven this year. Solana's daily on-chain fees have repeatedly exceeded those of Ethereum, and the growth of new developers has also surpassed Ethereum, showing a significant upward trend.

TON and SUI have also stood out this year. With 900 million users, Telegram has single-handedly ignited the blockchain gaming sector, opening a new entry point for Web3 traffic and providing a strong stimulus to a market that had been quiet for a long time before September. Backed by a strong foundation, TON has finally entered a growth fast lane after a long period of stagnation. According to Dune data, TON's cumulative on-chain users have exceeded 38 million, with a total transaction volume exceeding $2.1 billion. SUI has completely won over users with its price performance, rapidly advancing with the Move language public chain, diversifying protocols, and introducing airdrops, showing a bright outlook. Compared to the price-driven SUI, the public chain Aptos, despite its relatively weak price performance, has gained more favor from traditional capital, successfully establishing partnerships with BlackRock, Franklin Templeton, and Libre this year, with its compliant tone potentially bringing it into the spotlight in the new RWA and BTCFi cycle.

From an application perspective, MEME has been the main driver of the market this year. Essentially, the rise of MEME signifies a shift in the current market landscape, where VC tokens are not being valued, and excess liquidity is seeking targets, ultimately pouring into sectors with stronger fairness and profit-seeking characteristics. In this context, the connotation of MEME is also continuously expanding, evolving from a single speculative target to a typical representative of cultural finance, with "everything can be MEME" happening in reality. Although MEME accounts for less than 3% of the top 300 cryptocurrencies (excluding stablecoins) by market capitalization, its trading volume continues to occupy 6-7% of the market share, recently peaking at 11%, making it the main track for concentrated liquidity. According to Coingecko data, MEME accounted for 30.67% of investor attention this year, ranking first among all sectors. Where attention goes, money naturally follows, and indeed, looking at MEME this year, pre-sale fundraising, celebrity tokens, zoo battles, PolitFi, and AI have all been top trends in the industry.

Against this backdrop, the infrastructure surrounding MEME continues to solidify. The fair launch platform Pump.fun has emerged, not only reshaping the MEME landscape but also becoming one of the most profitable and successful applications of the year. In November, Pump.fun became "the first Solana protocol to exceed $100 million in monthly revenue." According to Dune data, as of December 22, Pump.fun's cumulative revenue has exceeded $320 million, with a total of approximately 4.93 million tokens deployed.

Of course, just because the platform is profitable does not mean retail investors are making money. Considering the one in a hundred thousand chance of a golden dog, and only 3% of users can profit over $1,000 on Pump.fun, coupled with the increasingly prominent institutional trend in MEME, from the user's perspective, regardless of how fair it seems, the risk of being cut is hard to avoid. Perhaps this is why adding fundamentals to MEME has become a new development model for projects. Most projects like Desci and AIMEME, which have relatively long cycles, have adopted this model, but currently, fleeting success remains mainstream, with the value of "running fast to live well" still on the rise.

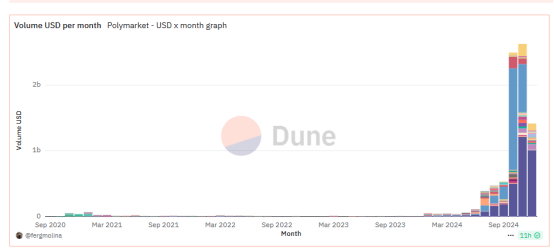

Influenced by the U.S. elections, another legendary application has emerged. Polymarket has surpassed all betting platforms on the market, gaining fame in the prediction market with high accuracy. In just October, Polymarket's website traffic reached 35 million visits, double that of popular betting sites like FanDuel, with monthly trading volume surging from $40 million in April to $2.5 billion. A broad user base and real demand equal clear value applications, and V God has praised it endlessly, but the only regret is that it has not achieved large-scale conversion of crypto users. However, the new fusion of media and betting is undoubtedly on the rise.

As the year comes to a close, large models have transitioned from technology to application, presenting an intense competitive landscape. After a year of AI swirling around Web3 hotspots, it has finally made a comeback as the dark horse of the year. MEME has ignited the spark, with Truth Terminal quickly bringing in golden dog GOAT, ACT, and Fartcoin, reviving the myth of hundredfold returns and opening a wave of niche applications for AI Agents. Currently, almost all mainstream institutions are optimistic about AI Agents, believing it to be the second phenomenon-level track after DeFi. However, as of now, the infrastructure in this field is still not complete, and applications are mostly concentrated on the surface, such as MEME and Bots, with little deep integration of AI and blockchain. But new also means opportunity; the cyber-style speculation on coins still needs to be observed.

On the other hand, looking at the core driving institutions of this bull market, PayFi, which seamlessly connects traditional finance and Web3, is bound to be at the forefront. Stablecoins and RWA are typical representatives. This year, stablecoins have truly revealed their potential for large-scale applications, not only growing rapidly in the crypto space but also starting to occupy a place in the global payment and remittance market. Sub-Saharan Africa, Latin America, and Eastern Europe have begun to bypass traditional banking systems, directly using stablecoins for transaction settlements, with a year-on-year growth of over 40%. Currently, the circulating value of stablecoins exceeds $210 billion, significantly higher than the billions in 2020, with an average of over 20 million addresses conducting stablecoin transactions on public blockchains each month. In just the first half of 2024, the settlement value of stablecoins has exceeded $2.6 trillion. Among new products, Ethena has been the standout stablecoin project this year, further sparking a trend for interest-bearing stablecoins, which is also a major driver of AAVE's revenue this year. As for RWA, it was completely ignited after BlackRock announced its entry, with the market cap of RWA expanding from less than $2 billion three years ago to $14 billion this year, covering multiple fields including lending, real estate, stablecoins, and bonds.

In fact, the development of PayFi is consistent with market trends. It is precisely because the internal market growth has encountered bottlenecks that the mainstream institutional market, as a source of incremental growth, is positioned at the beginning of a new cycle. To seek incremental space, PayFi has entered a critical process at this stage. It is worth noting that due to its integration with the traditional financial system, this field is also the most favored Web3 track by government agencies. For instance, Hong Kong has already listed stablecoins and RWA as important areas for development next year.

Of course, although it seems to be a positive outlook, it cannot be denied that under the dual background of nearly two years of macroeconomic tightening and industry downturn, the crypto sector has also undergone an exceptionally tough stress test. Innovative applications are hard to showcase, internal disputes have intensified, and continuous restructuring and mergers have occurred. The weakening of liquidity has led to path differentiation in the crypto industry, forming a pattern where Bitcoin's core inflow continuously siphons off other cryptocurrencies. The altcoin market has spent most of this year in a "garbage time," with the saying "this bull market has no altcoins" being repeatedly confirmed and refuted, only to rebound at the end of the year under Wall Street's attention, marking the beginning of the altcoin season. From the current perspective, path differentiation is expected to continue in the short term, with an increasingly intensifying trend.

02 Looking Ahead to 2025: New Cycle, New Applications, New Directions

As we look to the present, with the New Year’s bell about to ring, we anticipate 2025. With the Trump administration ushering in a new era for cryptocurrency, well-capitalized institutions are also eager to participate. As of now, over 15 institutions have released market predictions for next year.

In terms of price predictions, all institutions are optimistic about Bitcoin's value, with 6 institutions believing that the peak price range for Bitcoin will be between $150,000 and $200,000. Among them, VanEck and Dragonfly predict that the price will reach $150,000 next year, while Presto Research, Bitwise, and Bitcoin Suisse believe it could reach $200,000. If based on strategic reserves, Unstoppable Domains and Bitwise have even proposed forecasts of $500,000 or higher. As for other cryptocurrencies, VanEck, Bitwise, and Presto Research have provided predictions, estimating that ETH will be around $6,000 to $7,000, Solana will be between $500 and $750, and SUI could rise to $10. Presto and Forbes believe that the total market capitalization of cryptocurrencies will reach $7.5 to $8 trillion, while Bitcoin Suisse states that the total market capitalization of altcoins will increase fivefold.

Price predictions are naturally supported by various factors. Almost all institutions believe that the U.S. economy will experience a soft landing next year, with an improved macro environment, and that crypto regulation will also loosen. More than five institutions hold a positive view on Bitcoin's strategic reserves, believing that at least one sovereign nation and numerous publicly listed companies will include Bitcoin in their reserves. All institutions agree that increased ETF inflows will become an objective reality.

From a specific sector perspective, stablecoins, tokenized assets, and AI are the areas of greatest interest to institutions. Regarding stablecoins, VanEck believes that the settlement volume of stablecoins will reach $300 billion next year, while Bitwise states that with accelerated legislation, the application of financial technology, and the push for global settlements, the scale of stablecoins will reach $400 billion. Blockworks Mippo is even more optimistic, providing an estimate of $450 billion. A16z also believes that enterprises will increasingly accept stablecoins as a payment method, and Coinbase has pointed out in its report that the next wave of true adoption of cryptocurrencies (killer applications) may come from stablecoins and payments.

In terms of tokenized assets, A16z, VanEck, Coinbase, Bitwise, Bitcoin Suisse, and Framework all express optimism about the sector. A16z's predictions mention that as the cost of blockchain infrastructure decreases, the tokenization of non-traditional assets will become a new source of revenue, further promoting a decentralized economy. VanEck provides specific figures, estimating that the value of tokenized securities will exceed $50 billion, which aligns with Bitwise's predicted data. Messari offers a differentiated conclusion based on actual conditions, suggesting that as interest rates decline, tokenized government bonds are expected to face resistance, but idle on-chain funds may gain more favor, shifting focus from traditional financial assets to on-chain opportunities.

Regarding AI, A16z, which has heavily invested in the AI field, remains highly optimistic about the combination of AI and crypto. It believes that the autonomous agency capabilities of AI will be greatly enhanced, allowing artificial intelligence to have dedicated wallets for autonomous actions, while decentralized autonomous chatbots will become the first truly autonomous high-value network entities. Coinbase also agrees, pointing out that AI agents equipped with crypto wallets will be at the forefront of disruption. VanEck states that there are over 1 million on-chain activities involving AI entities, and Robot Ventures believes that the total market capitalization of tokens related to AI agents will at least grow fivefold. Although Dragonfly agrees that tokens will rise significantly, it holds a relatively conservative view on actual applications, believing that the application of underlying protocols may be relatively limited.

Bitwise and Defiprime highlight core use cases, with the former believing that AI Agents will lead the MEME explosion, while the latter states that DeFi is the deeply integrated scenario. Messari provides a more specific path, suggesting that the combination of AI and crypto has three major directions: first, new AI casinos like Bittensor and Dynamic TAO; second, blockchain technology will be used for fine-tuning small and specialized models; and third, the combination of AI Agents and MEME.

In other areas, institutions have different focal points in their predictions. For example, YBB believes that the revival of DeFi will be the main theme of 2025, Robot Ventures anticipates a wave of integration in application chains and L2 sectors, and Messari expects that almost all infrastructure protocols will adopt ZK technology by 2025. The DEPIN industry is projected to achieve revenue in the range of 8 to 9 figures by 2025, and VanEck and Bitcoin Suisse believe that NFTs will make a comeback, among other predictions. Due to the extensive content, we will not elaborate on each point here.

03 Conclusion: Where Do Investors Go?

Although there are slight differences in arguments and subfields, it is clear that all institutions hold optimistic and positive expectations for next year. Whether it is price increases, ecological expansion, or mainstream adoption, all are expected to continue to reach new heights in 2025.

It is foreseeable that, based solely on price, the mainstream cryptocurrency prices are bound to rise, especially in Q1 of next year, which will be a period of concentrated policy benefits. The altcoin market will continue to experience differentiation; influenced by ETFs, compliant altcoins will find it easier to attract capital inflows and maintain narratives, while other cryptocurrencies will slowly contract. If macro liquidity tightens, the risks associated with altcoins will become increasingly prominent.

From an industry perspective, while strong legacy public chains still hold ecological advantages, the impact from new public chains is also unavoidable. Ethereum's value capture and narrative methods will continue to ferment, but optimistically, the inflow of external capital may alleviate this situation, and the expansion of technical layers and the popularization of account abstraction will become significant breakthroughs for Ethereum in 2025. Solana continues to grow under capital influence, but its heavy reliance on MEME poses hidden risks, and competition with Base will intensify. Additionally, a new batch of public chains, such as Monad and Berachain, is expected to enter the market competition.

The shift from infrastructure to application development is the major direction for future industry growth, with consumer-level applications being the focus in the coming years. Application chains and chain abstraction may become the primary methods for building DApps. In terms of sectors, the revival of DeFi has become a consensus, but at this stage, it is still projected onto AAVE, while the focus of centralized finance is on the payment sector, with Hyperliquid and Ethena still worthy of close attention.

The speculative wave surrounding MEME is likely to continue in the short term, but the pace will significantly slow down, especially under the influence of the altcoin season. However, key directions such as Politifi still have relatively long narratives to explore. Nevertheless, the infrastructure surrounding MEME is expected to improve, optimizing user experience, lowering barriers to entry, and institutionalization of MEME is an inevitable trend. It is worth noting that new token launch methods will always spark a new round of excitement.

As the incremental market comes from institutions, sectors favored by institutions are expected to accelerate development, with stablecoins, AI, RWA, and DePin remaining key narratives for the next round. Furthermore, against the backdrop of tight liquidity, any on-chain liquidity tools and protocols that can increase leverage are likely to be favored.

A new cycle is about to arrive, and as investors, embracing the new while letting go of the old, discovering cycles, adapting to cycles, and engaging in in-depth research and participation is the only choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。