Combining the design of airdrops closely with community values allows users to feel valued rather than exploited.

Author: Three Sigma

Translation: Deep Tide TechFlow

What is the secret to a successful airdrop?

We will deeply analyze the behavioral patterns behind user participation and how to transform short-lived enthusiasm into long-term loyalty through strategy. Want to know how to discover true value signals? Click to see the full insights!

1. Introduction and Concept

Airdrops have become a powerful tool for blockchain projects to attract communities, rewarding users while encouraging more people to participate in network activities. At the same time, airdrops can facilitate faster market circulation of tokens, allowing more people to use these tokens.

However, community reactions to airdrops often vary based on perceived value, timing, and whether they are seen as "gifts" or "rewards." This article will explore the acceptance and influence of airdrops from psychological, philosophical, and historical perspectives, helping you better understand the logic behind them.

Introduction

The original design of airdrops aimed to enable more people to hold tokens, thereby achieving a more decentralized ecosystem. However, the role of airdrops has now shifted; they have become an important tool for incentivizing network activity. This surge in user behavior not only provides valuable data metrics for projects but also helps attract investors, paving the way for financing before and after token generation events (TGE).

However, viewing the role of airdrops merely as a means of injecting funds is too narrow. In fact, airdrops have become an important marketing strategy, helping to build user bases by attracting new users and encouraging their participation in projects. While initial interactions are crucial, only by successfully retaining users can the long-term value of airdrops be realized. Users need to recognize the significance of holding and participating in rewards, rather than merely claiming them for short-term gains and quickly selling off. In this process, "mindshare" (the collective awareness and emotional connection of community members) plays a key role.

Imagine an explorer who accidentally discovers a hidden path filled with countless treasures. These treasures have yet to be valued, but the explorer realizes that he cannot fully excavate this wealth alone. He then gathers friends to join the exploration team, sparking a wave of excitement and attracting more participants. As the activity gains momentum, the surrounding market begins to pay attention to these treasures. Although they do not yet have a clear market value, the anticipation and attention indicate that once these treasures are unearthed, their value will be extraordinary.

This collective attention and participation lay the groundwork for a high initial valuation when the treasures enter the market, while also generating powerful network effects, enhancing the project's reputation, and bringing considerable future returns to all participants. However, if the final treasures do not meet expectations, will this arduous journey leave people feeling disappointed? And how will the emotional connections within the community be affected?

In this process, "mindshare" is particularly important as it is the bond that sustains user participation. Only when users develop a genuine emotional connection to the project will they view the tokens in their possession as long-term opportunities rather than short-term arbitrage tools. This emotional identification can effectively prevent tokens from being quickly sold off, thereby stabilizing price fluctuations. Projects that successfully establish strong mindshare often create a sense of belonging and mission among users, leading them to actively participate in governance, provide feedback, and promote the project within their social circles. This deeper level of engagement can transform passive recipients into active contributors, laying the foundation for the project's long-term development and stability.

Overview of Community Sentiment and Mindshare

"Community sentiment" or "mindshare" is an important indicator of a project's status within the cryptocurrency ecosystem. It reflects the collective awareness, cognition, and emotional connection of community members to the project.

In the context of airdrops, this sentiment is particularly crucial. If users maintain a long-term emotional reliance on the project, the effects of airdrops will be more pronounced. Therefore, to maximize the impact of airdrops, project teams need to deeply understand how to stimulate positive mindshare and what factors can foster lasting community sentiment.

Research shows that building a sense of community belonging relies on four core elements: membership, influence, satisfaction of needs and integration, and shared emotional connections. These elements can form a tight bond, and when aligned with project goals, users feel they are an important part of the project's success. By designing airdrop activities that reflect these principles, such as assigning users specific roles or establishing common milestones, users' roles can be transformed from passive token recipients to active community members.

The Importance of Community Sentiment in Airdrops

Airdrops are often the first step for users to engage with a project, making their initial experience crucial. Research indicates that users' sense of reliance on the community is closely related to the community's future growth potential and the quality of social interactions provided. In airdrop activities, if users can be offered actual utility or clear paths for participation, they will feel like part of the project, thereby stimulating long-term loyalty. Related studies also suggest that project teams can deepen users' sense of participation by fostering optimistic expectations for the future and creating more social opportunities, all of which can help establish lasting connections beyond the initial airdrop.

Additionally, from an economic perspective, the value of a gift largely depends on the intent behind the giving.

The meaning of gifts and airdrops often hinges on whether they are perceived as sincere expressions or mere transactional behaviors. If recipients view it as a strategically motivated gift, it may resemble a marketing tactic rather than a goodwill gesture, potentially undermining trust. Similarly, if the design of the airdrop reflects a clear intent to add value—such as granting recipients meaningful governance rights or providing unique exclusive benefits—it is more likely to receive positive feedback and enhance community engagement.

The Psychology and Sociology of Gift Perception

The perception of gifts is influenced by psychological and social contexts, which directly determines whether airdrops are seen as "gifts" or merely "rewards." Research indicates that the essence of a gift lies in the cycle of "giving—receiving—reciprocating," which effectively enhances social connections. When airdrops are distributed in unexpected ways, they often elicit strong positive reactions, similar to how unexpected bonuses in the workplace can enhance employee loyalty and trust. Studies show that unexpected incentives can stimulate goodwill and motivation more effectively than anticipated rewards. Applying this principle to airdrops, unexpectedly distributed tokens can make recipients feel valued, thereby motivating them to reciprocate through higher levels of participation.

Moreover, the perception of airdrops also depends on whether they are seen as a "right" or a genuine "gift." Research indicates that behaviors perceived as contractual incentives often lose their motivating effect. If airdrops are regarded as routine procedures, they may struggle to ignite community enthusiasm. In contrast, unexpected airdrops can significantly enhance the experience, as recipients feel genuinely valued and are therefore more inclined to support the project in the long term. Thus, carefully designed "surprise airdrops" can help projects maintain positive community sentiment while avoiding the creation of fixed expectations for regular distributions.

Key Factors Influencing Community Sentiment in Airdrops

Many factors influence the effectiveness of airdrops, among which timing and distribution methods are particularly important. Research shows that airdrops that align with the core values of the community and provide clear practical uses are more likely to enhance user loyalty and engagement. Additionally, historical performance can significantly impact community expectations. If previous airdrops have yielded substantial returns, recipients may anticipate higher rewards; conversely, if multiple distributions have been underwhelming, it may lead to disappointment within the community. Therefore, project teams need to manage these expectations by designing each airdrop to have unique value, thereby retaining community trust while avoiding overly predictable patterns.

Another important factor is the transparency of the airdrop's purpose. Research indicates that projects need to clearly and explicitly communicate the goals of the airdrop to reduce recipients' tendencies to sell tokens immediately. When users understand the true intent of the airdrop (such as encouraging governance participation or building an active community user base), they are more likely to feel a sense of value and mission, thereby enhancing their identification with the project and increasing long-term loyalty.

Understanding and enhancing community sentiment is key to designing successful airdrops. By drawing on theories from community psychology and gift-giving behavior research, project teams can build tighter community bonds, enhance trust, and stimulate ongoing user participation. If airdrops are designed well, their role can transcend simple token distribution, becoming a profound expression of user recognition and community value.

Based on existing research, here are several key points to focus on when designing airdrop strategies that can establish deep, lasting connections with users:

User mindshare as a driver of loyalty: Research shows that fostering strong community sentiment (user mindshare) helps enhance users' sense of belonging to the project, thereby increasing loyalty and long-term retention.

Transforming recipients into active participants: Studies on community belonging indicate that incorporating design elements such as membership and shared milestones can shift users from passive reward recipients to active community contributors.

The importance of initial participation: Community psychology research emphasizes that providing airdrops with actual value and a sense of participation can leave a good first impression, thereby stimulating users' long-term engagement and loyalty.

Balancing sincerity and strategy: Economic research indicates that when airdrops are perceived by users as sincere "gifts" rather than mere transactional tools, it is easier to build trust and positive sentiment, promoting deeper user interactions.

The motivational effect of unexpected rewards: Psychological research finds that unexpected rewards (such as surprise airdrops) can significantly enhance user enthusiasm and loyalty. At the same time, transparent communication can prevent tokens from being sold off, thereby supporting long-term user participation.

2. Background

Understanding human behavior in specific environments, as well as the psychological characteristics of users at both individual and group levels, is fundamental to analyzing the effectiveness of airdrops. Through empirical research, we can assess the performance of different airdrops and user behavior patterns, identifying commonalities and differences between successful and failed cases. This requires the collection of relevant data metrics and observation in conjunction with the market environment at the time of the airdrop launch.

In recent years, several airdrop activities have been launched, each with its unique design and varying effects. To gain deeper insights into the impact of these airdrops, we need to focus on analyzing representative airdrop cases across different industries.

In this study, we selected airdrop strategies from three key areas for analysis: L2 Networks, Perpetual Trading Protocols (PerpDEX), and Liquid Restaking Protocols. These categories are essential components of the blockchain ecosystem, and their airdrop activities provide valuable references for how projects achieve early growth, attract users, and promote long-term participation.

Ethereum-based Layer 2 Solutions

L2 projects play a crucial role in expanding the blockchain ecosystem. They significantly enhance network efficiency by alleviating congestion and high transaction costs on first-layer networks like Ethereum. These solutions improve transaction throughput while maintaining the security and decentralization of the underlying network. Due to their scalability potential and ability to facilitate broader adoption, L2 projects often attract substantial venture capital. A notable feature of L2 is its high fully diluted valuation (FDV), reflecting its potential to replicate the success of first-layer networks while providing infrastructure for decentralized applications.

This study analyzes the following four L2 projects:

Arbitrum

The airdrop of Arbitrum (ARB) aims to reward users who actively participate in its Layer 2 network. Eligibility for the airdrop primarily focuses on users who bridge funds to @Arbitrum and complete transactions within its ecosystem. Unlike other projects, Arbitrum emphasizes broad distribution to ensure more users participate. By focusing on early users, the project successfully cultivated community loyalty and engagement, laying a solid foundation for governance. Additionally, activities that reward diverse applications within the ecosystem make Arbitrum's airdrop stand out in terms of inclusivity and promoting mass adoption.

Starknet

The airdrop of @Starknet focuses on rewarding users who utilize zk-rollup technology, particularly those participating in its testnet and mainnet activities. Eligibility for the airdrop is related to whether users interact with decentralized applications (dApps) and whether they attempt its innovative scaling solutions. Starknet's uniqueness lies in its emphasis on technological adoption, rewarding users who test the protocol during its development phase and provide feedback. This strategy not only incentivizes user participation but also fosters a technology-oriented community aligned with its zk-rollup vision.

zkSync

@zkSync's airdrop focuses on attracting early user participation in its zk-rollup-based Layer 2 solution. Users must bridge assets to zkSync, interact with its dApp ecosystem, and explore zero-knowledge proof-supported features to qualify for the airdrop. By incentivizing widespread network activity, this airdrop successfully attracted a group of community members highly invested in the protocol's development and long-term vision.

Perpetual Decentralized Exchanges (PerpDEX)

Perpetual trading markets are becoming one of the most dynamic and promising directions in the DeFi space. Compared to the massive trading volumes of centralized exchanges, perpetual trading still has significant development space in the decentralized realm. As DeFi continues to evolve, perpetual protocols are achieving decentralization and inclusivity in futures trading through innovative technologies, gradually opening up a new niche market. These protocols use airdrops as a strategic means to attract traders, liquidity providers, and early users, effectively positioning themselves as strong alternatives to centralized platforms. In this study, we selected three representative projects for analysis to explore their strategies and impacts:

Aevo (formerly Ribbon Finance)

Aevo, formerly @RibbonFinance, conducted an airdrop. During its rebranding and token migration, @Aevoxyz launched a new platform focused on derivatives trading, particularly options trading. To encourage users to migrate to the new platform, Aevo decided to allocate part of its funds as airdrop rewards, prioritizing those early users who demonstrated sustained trading activity (such as placing orders and executing trades). Aevo's uniqueness lies in its focus on options trading, a niche market that allows it to precisely attract specific types of traders.

Drift Protocol

Drift's airdrop targets users who actively trade on its decentralized perpetual exchange. Eligibility criteria focus on trading volume and frequency to ensure that rewards cover loyal users who contribute to the platform's liquidity and activity. @DriftProtocol is characterized by the professional-grade trading tools it offers, which stand out in a decentralized framework, making it particularly attractive to advanced traders. The goal of this airdrop is to further solidify its user base by rewarding loyal users and encouraging ongoing participation in the derivatives trading ecosystem.

Jupiter Exchange

Jupiter's airdrop primarily rewards users who use its Solana aggregator platform to find the best trading paths and liquidity options. Users must interact with the platform's routing tools and actively participate in token swaps to qualify for the airdrop. Unlike Drift and Aevo, which focus on derivatives trading, @Jupiter Exchange emphasizes usability and liquidity aggregation, targeting everyday DeFi users. This airdrop not only incentivized users' continued use but also solidified its position as the preferred tool for token swaps on Solana.

Liquid Restaking

Liquid restaking protocols are a rapidly emerging field in DeFi, originating from the restaking model proposed by EigenLayer. The initial intent of these protocols is to enhance the utilization of staked assets by allowing them to secure multiple networks simultaneously, thereby unlocking additional value from idle funds.

As they develop, these protocols have gradually expanded beyond their original functionality, exploring more innovative uses to further enhance the value of the protocol itself and its tokens. The Liquid Restake Token (LRT) protocol initially relied on EigenLayer's Ethereum restaking platform but is now gradually building an independent ecosystem. By developing unique application scenarios and expanding their use cases, these protocols aim to reduce reliance on EigenLayer and become multifunctional and sustainable solutions.

LRT projects generally benefit from EigenLayer's incentive mechanisms. While users pursue EigenLayer rewards, LRT further attracts users through additional points or tokens, amplifying the overall rewards. If users stake directly on EigenLayer without participating in LRT, they will miss out on these extra benefits.

Ether.fi

The airdrop of Etherfi aims to promote its decentralized Ethereum staking protocol, primarily targeting users who actively stake ETH or participate in governance. Unlike other protocols, @Ether_fi emphasizes complete user control over assets, allowing users to maintain custody of their assets while using LRT. Eligibility criteria for this airdrop include staking activity and governance contributions, prioritizing those users who align with the protocol's decentralization philosophy and actively participate.

Puffer Finance

The airdrop of Puffer aims to lower the barriers to entry for liquid restaking by attracting users through deep integration with EigenLayer. Users need to interact with EigenLayer's restaking infrastructure to qualify for the airdrop, targeting both novice users and experienced users trying modular staking solutions. Unlike Etherfi or Renzo, @Puffer_finance emphasizes ease of operation, reducing the technical barriers for user participation while maximizing user returns through advanced restaking mechanisms. This strategy makes it an ideal starting point for users exploring Ethereum staking or seeking innovative staking methods.

Renzo Protocol

The airdrop of Renzo targets users who participate in liquid restaking through its platform, with eligibility criteria focused on the behavior of restaking assets and contributing to liquidity pools. This ensures that rewards are distributed to those actively supporting the ecosystem's liquidity and security. The core advantage of @RenzoProtocol lies in its focus on capital efficiency, allowing users to earn rewards while staking assets and using those assets for other DeFi applications. This dual utility attracts users looking to optimize returns in a flexible staking environment.

Community Mindshare

Analyzing community mindshare is a highly challenging task. It requires not only attention to obvious metrics like social media activity but also consideration of less quantifiable factors such as interpersonal conversations and underlying emotional shifts. Although some existing tools attempt to assess sentiment by aggregating user posts and interactions, their accuracy is often limited due to bot interference and insufficient historical data. Based on this, we propose a new method to evaluate community mindshare.

Our approach combines quantitative and qualitative analyses. Quantitative data primarily assesses user engagement and activity metrics within the community, while qualitative data focuses on users' sentiments and perceptions regarding the execution of airdrops. By comparing data before and after the Token Generation Event (TGE), we hope to uncover patterns that drive user behavior and mindshare, revealing the actual impact of airdrops.

Quantitative Metrics

The following metrics provide data support from user engagement, economic activity, and platform performance, helping to analyze how airdrops drive community participation and ecosystem adoption:

Layer 2 Solutions

Daily Active Users (DAU)

DAU measures the number of unique users interacting with the protocol daily. For L2 solutions, DAU is an important indicator of network attractiveness, reflecting user participation due to low transaction fees, faster transaction speeds, and seamless dApp integration. A surge in DAU before the airdrop typically indicates increased user interest, while stable growth in DAU after the airdrop suggests user trust and recognition of the platform's functionality.

By monitoring DAU, we can determine whether the airdrop successfully converts users into long-term retention or merely attracts short-term "airdrop hunters." This analysis is crucial for consolidating user stickiness and network activity post-TGE.

Daily Netflows

Daily netflows measure the amount of assets bridged from Ethereum to the L2 network. Pre-airdrop inflows often reflect users transferring assets to earn rewards, while sustained inflows post-airdrop indicate user trust and willingness for long-term adoption of the network.

If inflows remain active after the airdrop, it suggests that the airdrop has successfully driven ecosystem growth. Research shows that while predictable rewards (like airdrops) can attract users, sustained participation only occurs when actual value is provided after the rewards.

Total Value Locked (TVL)

TVL reflects the total amount of assets locked in the protocol and is an important indicator of user economic trust. TVL typically increases before the airdrop as users meet participation criteria, while post-airdrop changes in TVL indicate whether users view the protocol as a long-term investment platform or merely a means to obtain short-term rewards.

Stable growth in TVL after the airdrop indicates increased user confidence in the platform and reflects the protocol's long-term value. Users will only choose to invest long-term if they believe the platform can consistently provide reliable services and innovative opportunities.

Perpetual Decentralized Exchanges (PerpDEX)

Trading Volume

Trading volume reflects the total value of trades on PerpDEX and is a core indicator of platform activity levels and liquidity. A surge in trading volume before the airdrop is often related to speculative trading by users to meet eligibility, while sustained growth in trading volume post-airdrop indicates the platform's success in attracting long-term active traders.

Ongoing trading volume not only reflects user trust in the platform but also indicates that it maintains sufficient attractiveness and liquidity within the ecosystem.

Open Interest (OI)

Open interest reflects the number of unsettled contracts on PerpDEX and is an important indicator of active trader participation. Before the airdrop, OI typically increases as users engage in trading to earn rewards. A stable or growing OI post-airdrop indicates that the platform has successfully retained core users and attracted them to continue participating in derivatives trading.

Growth in OI after the airdrop is not only a sign of the platform maintaining user stickiness but also a crucial foundation for building a sustainable trading ecosystem.

Daily Active Users (DAU)

The DAU metric for PerpDEX measures the platform's trading activity and the number of independent traders. A surge in DAU before the airdrop is often associated with speculative trading, while stability in DAU post-airdrop directly reflects user trust in the platform.

By analyzing DAU, we can determine whether users continue to trade after receiving rewards or choose to exit. This is critical for assessing the long-term effects of the airdrop.

Liquid Restaking Tokens (LRT)

Total Value Locked (TVL)

In LRT protocols, TVL reflects the total amount of assets staked and restaked within the platform. Growth in TVL before the airdrop typically indicates users deploying funds to meet airdrop eligibility, while post-airdrop performance in TVL can reveal user trust in the staking mechanism and confidence in the protocol's future reward capabilities.

For LRT projects, the stability of TVL post-airdrop is an important indicator for evaluating airdrop effectiveness. Research shows that when users perceive rewards as genuine and valuable, they are more likely to continue investing in the ecosystem. This ongoing economic participation also helps enhance users' sense of belonging to the community, promoting healthier ecological development.

User Count

In LRT protocols, DAU measures the activity of stakers and restakers. Pre-airdrop activity typically reflects users' speculative interests, while stability in DAU post-airdrop indicates users' long-term trust in the protocol's staking mechanism and reward system.

DAU is a key indicator of whether the airdrop successfully transforms users from passive participants into active community members. Research indicates that protocols that can maintain user activity post-airdrop often establish deeper emotional connections through incentive mechanisms. This connection not only enhances user loyalty but also further promotes users' deep participation in governance and other areas.

Qualitative Metrics

To comprehensively assess the effects of airdrops and their impact on the community, we analyze the design of airdrops and user feedback from multiple angles. Here are some key features and their significance:

Percentage of Airdrop in Total Supply: Reflects whether the project is willing to achieve decentralization through token distribution while rewarding early users.

Total Value of Airdrop ($): The financial value at the time of airdrop distribution, directly affecting user interest and sentiment towards the project.

Number of Airdrop Recipients: The total number of addresses receiving the airdrop. A broader coverage may indicate the project's desire to attract more users, while a smaller distribution may imply higher scarcity.

Is the Distribution Fair?: Examines whether a few users hold a majority of the tokens to assess the fairness of the distribution.

Is it the First Airdrop?: First-time airdrops typically generate greater user attention and anticipation.

Are Users Participating for the Airdrop or Actual Need?: Distinguishing whether users participate for rewards or due to the actual value of the product helps assess the authenticity of user engagement.

Duration of the Activity: Analyzes the time span from the start of the activity to the airdrop distribution to understand users' long-term investment levels.

Is Participation Time-Consuming?: Evaluates the time cost required for users to participate in the activity; excessive time costs may affect ordinary users' willingness to participate.

Is Participation Expensive?: Analyzes the financial cost of obtaining airdrop eligibility, including transaction fees or other necessary investments, which may affect users' participation thresholds.

Is Long-term Liquidity Required?: If users need to maintain liquidity for at least one month, this may reduce short-term speculative behavior and promote more long-term ecological participation.

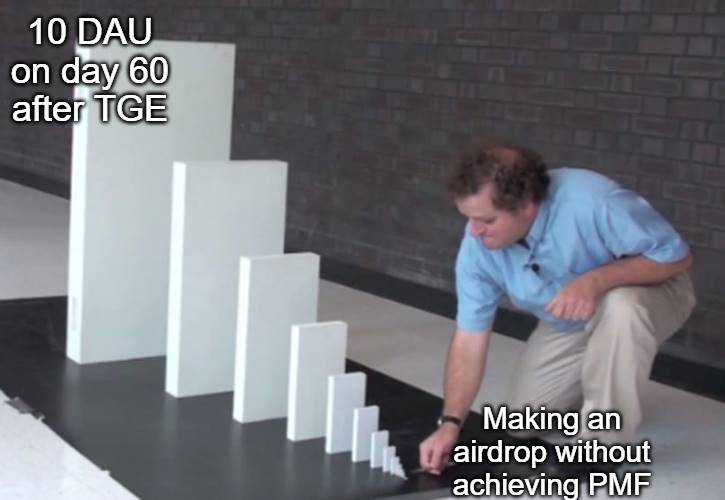

Has the Project Achieved Product-Market Fit (PMF) Before the Airdrop?: Ensures that the airdrop complements an ecosystem with market value rather than being merely a user acquisition tool.

How Satisfied Are Users with the Project?: Evaluates the project's attractiveness beyond the airdrop by analyzing user feedback on core products like dApps and blockchains.

Are There Related Airdrops from Similar Projects?: If similar projects in the same category have conducted similar airdrops, this may influence user expectations and behavior patterns.

Collateral Airdrops

In this study, we analyze whether users can earn additional rewards while farming the main airdrop. This additional incentive mechanism may significantly enhance user interest and participation.

To better understand the subjective factors in the airdrop mechanism, we conducted a survey of over 150 airdrop participants via Telegram and X platform, collecting real user feedback. The survey focused on the following key questions:

Is the airdrop fairly distributed?

Did you participate for the airdrop rewards or because you actually need to use the product?

How was your experience with the product or project?

By analyzing these questions, we hope to reveal the actual effects of airdrops in enhancing community engagement and user stickiness.

3. Data Presentation

In this section, we categorize the data into quantitative and qualitative types, showcasing the quantifiable metrics of platform activity and insights into community sentiment. Through this data, we can more clearly observe the trends in user behavior before and after the airdrop.

Quantitative Metrics

To visually present the data, we designed charts centered around the airdrop date, with the horizontal axis extending three months before and after the airdrop. This design helps us capture user behavior and trends before and after the airdrop.

Layer 2 Solutions:

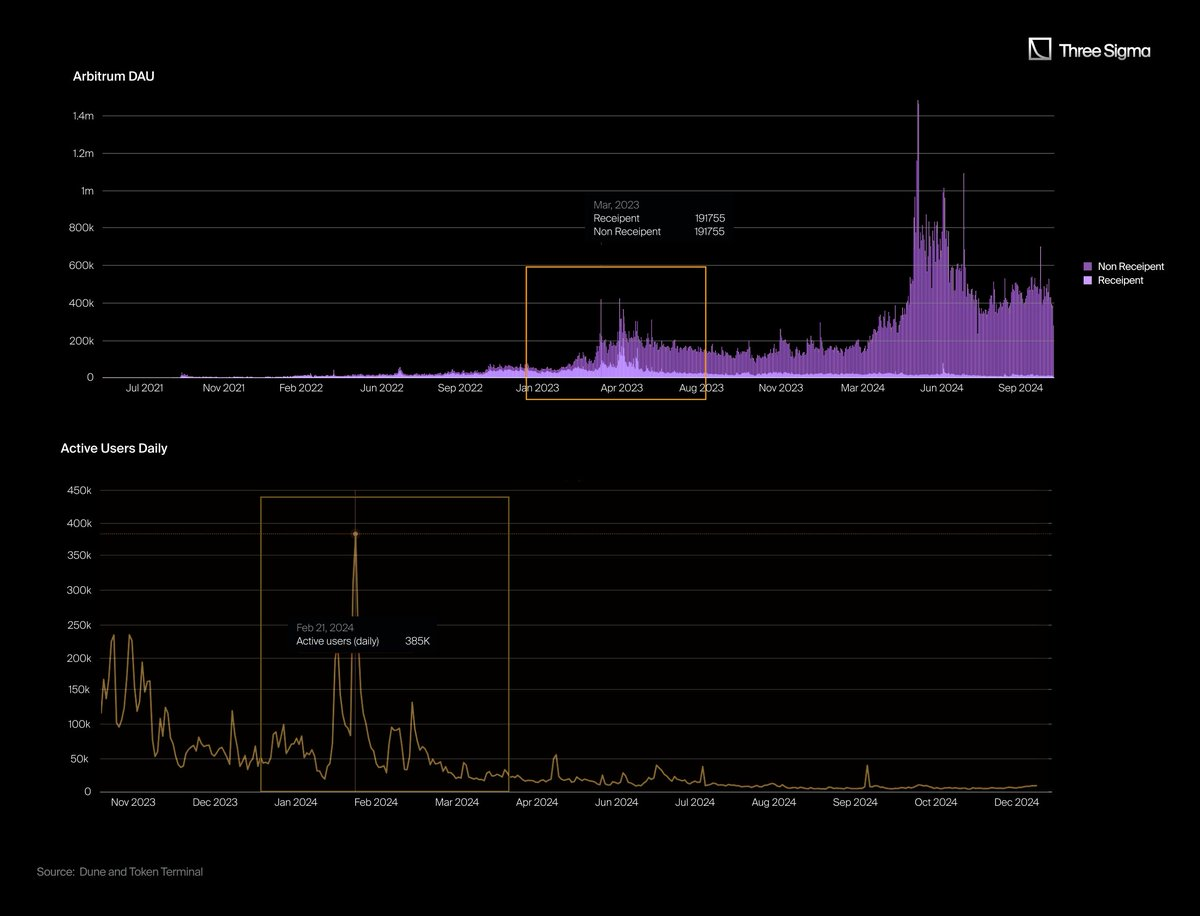

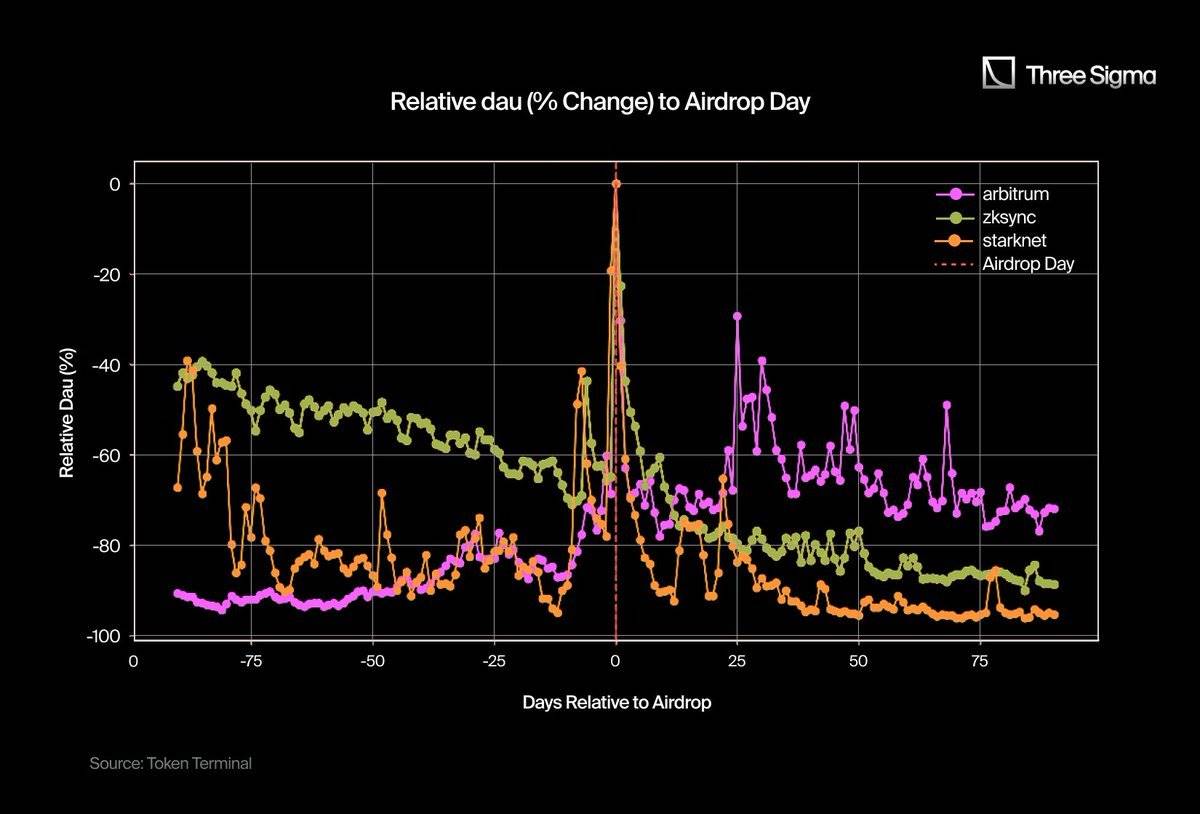

Daily Active Users (DAU): DAU reflects the number of unique addresses interacting with the network daily. Before the airdrop, user activity remained stable or slightly increased, indicating a gradual rise in user engagement with the network. On the day of the airdrop, DAU across all networks saw a significant spike, showing a concentrated burst of user activity.

However, after the airdrop, user activity on StarkNet and zkSync rapidly declined, indicating a decrease in user interest once the incentives disappeared. In contrast, Arbitrum experienced a smaller decline in user participation, demonstrating stronger user retention.

Notably, Arbitrum's activity steadily increased before the airdrop, even though the team only officially announced the plan a week prior to the airdrop. This strategy effectively drove user growth. Conversely, StarkNet and zkSync's airdrop plans were publicly disclosed in advance, leading to a prolonged farming period that caused some users to drop off due to the long wait.

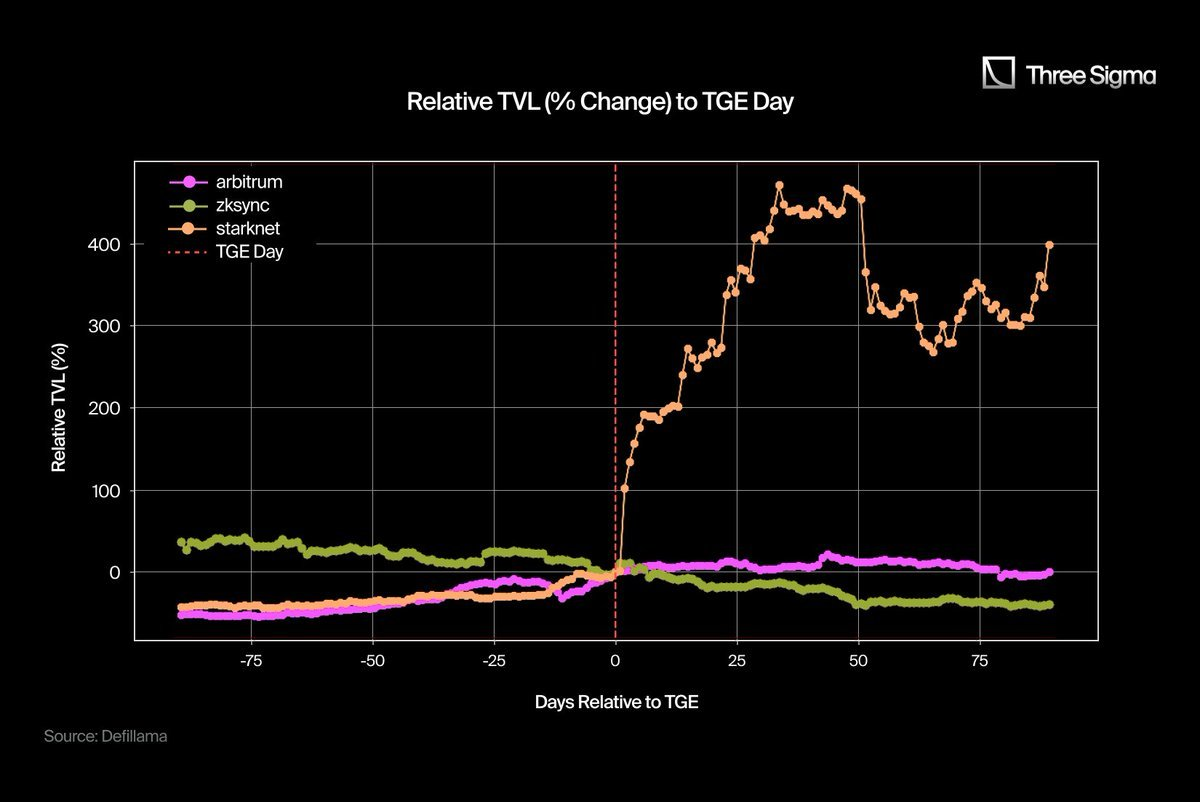

The chart shows that before the TGE, the project's TVL remained relatively stable with slight growth, reflecting steady participation. After the TGE, as users deposited funds into the network, StarkNet's TVL surged dramatically; Arbitrum's TVL also increased, although it was far lower than StarkNet's. In contrast, zkSync's TVL declined post-airdrop, maintaining a downward trend. These differences highlight the varying levels of capital inflow across the networks during this period.

As illustrated, StarkNet's TVL experienced a significant spike. To understand this outcome, we analyzed on-chain data and found that this growth was driven by the rapid expansion of StarkNet's leading protocol, Nostra. Just one month after the TGE, Nostra's TVL skyrocketed from $15 million to an ATH of $220 million, accounting for 68% of the network's total TVL at that time. This growth was fueled by substantial deposits from whales and the launch of the STRK token (airdropped to the protocol and users) in the DeFi market.

In Nostra, the top 30 wallets in the ETH market (currently holding $95 million) control 68% of the supply, along with other lending markets like STRK and USDC. This indicates that a significant portion of the TVL comes from a few large deposits, driving rapid growth post-TGE. These contributions helped stabilize the protocol and solidify its position as a key player in the StarkNet ecosystem.

Before the TGE, Arbitrum and zkSync experienced fluctuations in net flows, with noticeable inflow peaks, possibly reflecting users preparing for the event, while StarkNet remained relatively stable with minor changes. After the TGE, Arbitrum exhibited a significant peak in network flows, indicating increased capital activity, while zkSync and StarkNet showed more consistent trends, suggesting more stable capital flow dynamics within these networks.

Perpetual Decentralized Exchanges (PerpDEX):

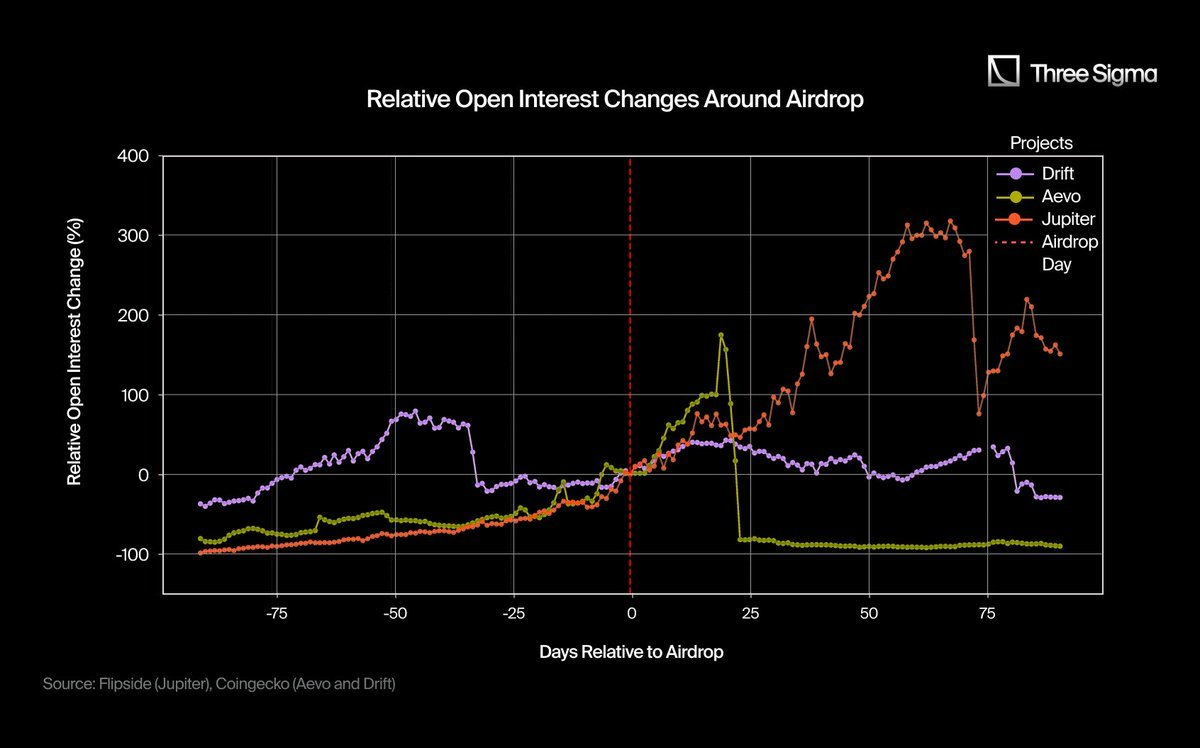

Open Interest (OI)

Before the airdrop, Drift and Aevo's open interest consistently grew, indicating users were gradually increasing their positions. Jupiter's open interest showed less fluctuation, reflecting a more stable growth trend. After the airdrop, Drift maintained a high level of open interest, indicating continued market participation, while Aevo saw a decline.

In contrast, Jupiter's open interest significantly increased post-airdrop, reflecting growing user engagement and confidence.

The sharp decline in Aevo's open interest post-airdrop is related to the project's decision to weaken its trading reward activities. After the TGE, Aevo launched a 16-week reward program, paying rewards in AEVO tokens. This initiative led to a surge in wash trading, increasing both trading volume and open interest.

In response, Aevo weakened its reward structure to curb wash trading, resulting in a noticeable decline in trading activity and a sharp reduction in open interest. While this adjustment aimed to address the unsustainable quantities caused by over-incentivization, it had a direct impact on engagement metrics and market participation.

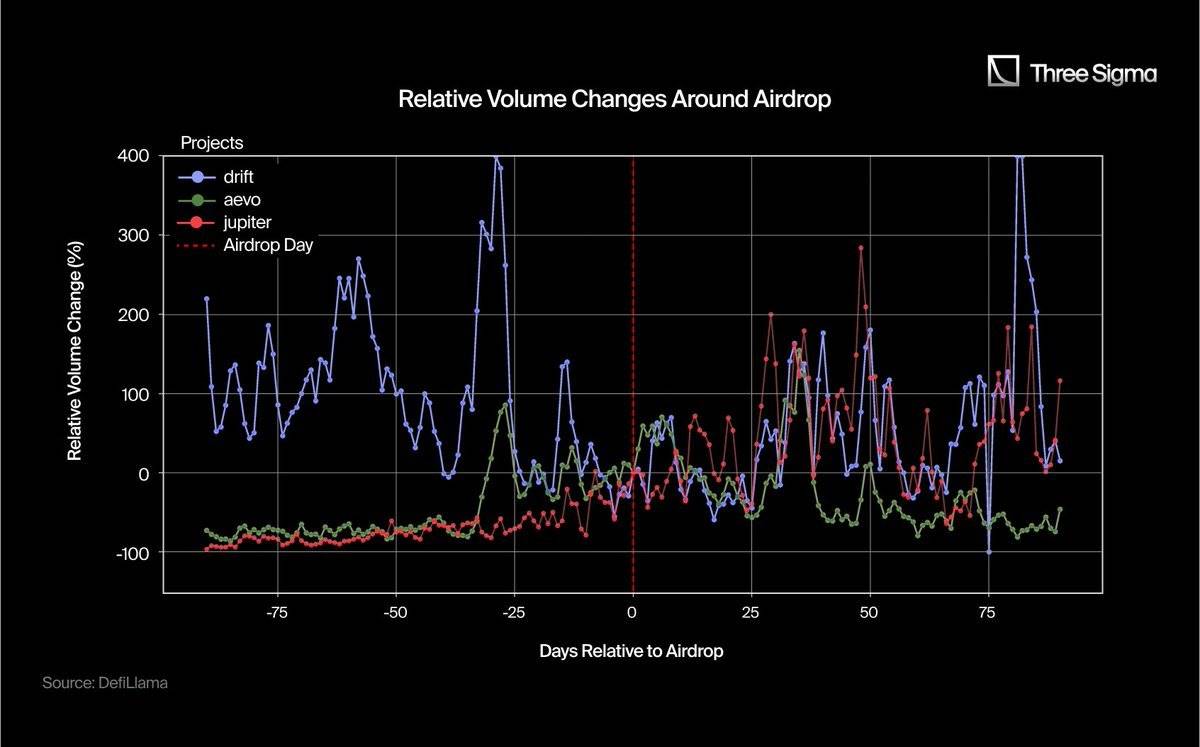

Before the airdrop, Drift's trading volume exhibited significant fluctuations and a sharp increase, indicating speculative activity as users prepared for the airdrop. Aevo and Jupiter showed a more stable but gradually increasing trend.

After the airdrop, Drift maintained high trading volume during fluctuations, while Jupiter demonstrated continuous growth, highlighting ongoing activity. However, Aevo stabilized at lower levels, indicating reduced trading participation.

Liquid Restaking Projects:

- Total Value Locked (TVL): Refers to the total value locked on-chain, excluding the portion of native tokens. The data in this article is based on a comparative analysis of TVL on the day of the airdrop.

Before the airdrop, users allocated funds in anticipation of the event, with both Etherfi and Renzo showing significant growth trends in TVL. Renzo's growth reflected a gradual increase in user interest, while Etherfi's growth was more pronounced. In contrast, Puffer's locked asset growth was slower but more stable.

Post-airdrop, Etherfi's TVL achieved significant growth driven by sustained capital inflows. Renzo initially maintained a slight upward trend but gradually declined thereafter. Puffer's TVL saw a drop shortly after the TGE (Token Generation Event), possibly indicating a decrease in user engagement or capital withdrawal.

From the perspective of Daily Active Users (DAU), Etherfi's DAU exhibited significant fluctuations and notable growth before the airdrop, indicating high user activity prior to the event. In contrast, Renzo and Puffer's DAU trends were more stable with less fluctuation, showing that while their user interaction levels were consistent, overall activity was lower than Etherfi.

Post-airdrop, Puffer's DAU experienced a brief surge after the event, but this growth was not sustained, quickly declining to levels below those before the airdrop.

Renzo's performance remained relatively stable with minor fluctuations, but post-airdrop activity was lower than pre-airdrop, only showing some degree of growth approximately two months later. Etherfi's DAU continued to exhibit periodic peaks, although the intensity of these peaks gradually diminished over time.

Qualitative Metrics:

The following table summarizes qualitative data collected from on-chain and off-chain sources.

4. Conclusion

By combining quantitative and qualitative data, we can identify certain patterns and summarize the common characteristics of successful and unsuccessful airdrops across various domains. These insights provide important references for the design and execution of future airdrops.

4.1. Layer 2 Solutions (L2)

Success Case: Arbitrum

Quantitative Analysis:

Arbitrum's daily active users (DAU), total locked value (TVL), and net flows maintained stability or showed positive growth trends post-airdrop, indicating a continuous increase in user engagement and trust.

Qualitative Analysis:

Is it a first mover? No—Arbitrum is not the first L2 airdrop, being the second after Optimism. This means users had certain expectations and foundational knowledge regarding airdrops. Despite the lack of novelty, Arbitrum succeeded due to its strong fundamentals.

Airdrop Distribution: The distribution was fair, avoiding user concerns about inequitable reward allocation.

Participation Cost and Complexity: The barriers to participating in the airdrop were low, requiring no significant time or financial investment.

Product-Market Fit (PMF): Yes—PMF was achieved before the airdrop, instilling confidence in users that the airdrop was a reward for them rather than an experimental activity.

User Sentiment: Users expressed strong affection for Arbitrum and its decentralized applications (dApps), driving natural adoption rather than relying solely on economic incentives.

Conclusion:

Arbitrum's experience shows that fair distribution, low participation barriers, clear product-market fit, and positive user sentiment can compensate for a lack of novelty. Even as a second mover, Arbitrum successfully converted the airdrop into long-term user engagement, relying on an active community and solid fundamentals.

Additionally, Arbitrum's funding of the ecosystem has driven the development of innovative products, providing users with real on-chain value and further enhancing user retention.

Failure Case: Starknet and zkSync

Quantitative Analysis:

Post-airdrop, zkSync and Starknet saw a significant decline in daily active users (DAU). Although Starknet's total locked value (TVL) initially grew, it later stagnated, reflecting insufficient user engagement. This growth was primarily driven by incentive activities from Nostra Finance, which accounted for 68% of the network's total TVL, but it lacked sustainability.

Net flows remained stable but showed little fluctuation, lacking significant growth compared to Arbitrum.

Qualitative Analysis:

Airdrop Distribution: The reward distribution was uneven, leading to feelings of unfairness among users.

Participation Behavior: The primary motivation for users participating in the airdrop was to obtain rewards rather than genuinely using the product.

Participation Cost: Although the cost of participation was low, the requirement to maintain liquidity for at least a month increased operational difficulty.

Product-Market Fit and User Feedback: Neither achieved PMF before the airdrop, and user recognition of the projects was low.

Impact of Multiple Airdrops: The airdrops of zkSync and Starknet were not first movers, leading to higher user expectations, while users also participated in other L2 airdrop activities, diluting their appeal.

Conclusion:

Unfair distribution and lack of product-market fit were the main reasons for the failure of zkSync and Starknet's airdrops. Additionally, the high participation threshold (such as liquidity requirements) limited ordinary users' involvement, ultimately resulting in a decline in user activity post-airdrop.

4.2. Perpetual Decentralized Exchanges (PerpDEX)

Success Case: Jupiter

Quantitative Analysis:

Jupiter's daily active users (DAU) steadily increased post-airdrop, with open interest (OI) and trading volume also rising, indicating a gradual enhancement in user engagement and confidence.

Qualitative Analysis:

Airdrop Distribution: The distribution was fair, avoiding the concentration of rewards in a few addresses.

Is it a first mover? Jupiter's airdrop was not the first of its kind, but it was one of the first large airdrops in the Solana ecosystem.

Participation Complexity: Although participation required some time and funds, users were primarily organic users with actual needs for the product. This indicates a close relationship between practicality and positive user feedback.

User Sentiment and Product-Market Fit: Users held a positive attitude towards Jupiter's aggregator platform, and its established PMF provided confidence, making them long-term participants.

Additional Airdrops: Jupiter users received additional rewards from other projects while participating in its airdrop. This synergy enhanced user activity.

Conclusion:

Jupiter's success demonstrates that even if it is not a pioneering project, it can still perform excellently if users genuinely value its product. The presence of additional airdrops further enhanced community engagement.

The timing of the airdrop is also crucial; Jupiter chose to launch during a rapid growth phase in the Solana ecosystem, helping its token perform well in the market.

Failure Case: Aevo and Drift

Quantitative Analysis:

Both Aevo and Drift saw declines in daily active users (DAU) and trading volume post-airdrop, indicating reduced user engagement and trading activity. Drift's open interest (OI) remained stable but lacked growth, while Aevo experienced a decline.

Qualitative Analysis:

Distribution and Costs: The airdrop distributions for both were not reasonable (the fairness of Drift's distribution is still in dispute), and the high participation threshold hindered ordinary users' involvement.

Product-Market Fit and User Feedback: Both failed to achieve PMF, and user evaluations of their products were poor. Relying solely on incentives could not attract long-term user retention.

Originality and Additional Rewards: The airdrops of Drift and Aevo lacked uniqueness and failed to differentiate themselves from other similar projects. Additionally, users did not receive other additional rewards for participating in the airdrop.

Conclusion:

High barriers, poor user feedback, and lack of product-market fit were the main reasons for the poor performance of Aevo and Drift's airdrops. In a competitive environment, projects need to attract users through fair distribution and unique advantages; otherwise, they risk being replaced by more appealing competitors.

4.3. Liquid Restaking Tokens (LRT)

Success Case: Etherfi

Quantitative Analysis:

Post-airdrop, Ether.fi saw continuous growth in total locked value (TVL), thanks to stable capital inflows and user trust. Meanwhile, daily active users (DAU) also exhibited periodic peaks, indicating sustained interest in the project.

Qualitative Analysis:

Is it a first mover? Yes—As the first airdrop of liquid restaking tokens, Etherfi attracted significant attention through its novelty and encouraged active participation from early users.

Airdrop Distribution: The distribution was fair, and the participation threshold was low, although it required some capital investment and at least a month of liquidity locking.

User Sentiment and Product-Market Fit (PMF): Before the airdrop, Etherfi successfully achieved PMF, and users rated the project highly. This solid foundational appeal further amplified its advantages as a pioneer.

Additional Airdrops: Users participating in Etherfi also received rewards from other airdrops. This multi-airdrop model not only did not distract users but also enhanced their overall experience through Etherfi's unique position and clear market fit.

Conclusion: Etherfi successfully launched a highly popular airdrop due to its first-mover advantage, fair distribution, product-market fit, and positive user sentiment. Novelty did not replace the project's fundamentals but rather provided a strong complement. Additionally, the opportunity for additional airdrops further increased the ecosystem's appeal, providing users with more reasons to participate.

Etherfi also gained the trust of large capital depositors through deep integration with mainstream protocols like Aave and Pendle. This technological and ecological leadership positioned it prominently in the market.

Failure Case: Puffer and Renzo

Quantitative Analysis:

Renzo's total locked value (TVL) briefly stabilized post-airdrop but then began to decline, while Puffer's TVL dropped sharply. Both saw significant reductions in daily active users (DAU), indicating a sharp decline in user interest and engagement.

Qualitative Analysis:

Airdrop Distribution and Participation Threshold: The distribution was not fair enough, and participation required capital locking, which deterred many potential users. Additionally, the requirement to maintain liquidity for at least a month further increased operational difficulty.

User Sentiment and Product-Market Fit (PMF): Although both formally achieved PMF, user interest in the projects was insufficient, leading to rapid drop-off after reward collection.

Lack of Novelty: Neither was the first of its kind, lacking novelty and uniqueness, making it difficult to attract long-term user attention.

Effect of Additional Airdrops: Although users could receive other airdrops during participation, this did not significantly improve user retention. Unlike Etherfi, Puffer and Renzo failed to provide enough appeal for users to continue participating.

Conclusion:

The failures of Puffer and Renzo can be attributed to low user sentiment, high participation thresholds, and unappealing strategies. Additionally, compared to Etherfi, they failed to leverage novelty or the advantages of additional airdrops, leading to rapid user drop-off post-airdrop. Delays in governance token distribution and declines in token prices after the TGE further weakened user confidence, leaving these projects significantly behind in competition.

Key Insights Across Domains

Novelty and First-Mover Advantage: Being the first of its kind (like Etherfi) can spark initial enthusiasm, but without product-market fit (PMF) and fair distribution, novelty alone cannot ensure long-term user engagement. In mature fields, focusing on solid fundamentals is more effective than relying on novelty.

Impact of Multi-Airdrop Models: When projects exhibit good user sentiment and PMF (like Etherfi or Jupiter), additional airdrops can enhance the ecosystem's appeal. However, for projects lacking these advantages (like Renzo and Puffer), multiple airdrops may dilute user attention, reducing loyalty and retention.

Fairness, Accessibility, and PMF are Core to Success: Successful airdrops (like Arbitrum, Jupiter, Etherfi) typically demonstrate fair token distribution, low participation requirements, and clear utility or PMF. These factors help build user trust and promote long-term engagement post-airdrop.

User Sentiment and Participation Patterns: When users hold positive sentiments and recognize the value of a project (like Jupiter and Etherfi), airdrops can serve as catalysts for growth. Conversely, when users feel dissatisfied or skeptical (like Drift, Aevo, Renzo, and Puffer), airdrops often result in only temporary spikes in activity without long-term impact.

The success of an airdrop relies not only on short-term incentives but also on the overall construction of the project ecosystem, fairness, user sentiment, and unique positioning. Whether a project is a market pioneer or offers multiple rewards, these factors are secondary to the core drivers of long-term user engagement: trust, perceived utility, and genuine community connections.

5. Final Reflection

Insights gained from quantitative and qualitative analyses, combined with philosophical and psychological frameworks, indicate that designing a successful airdrop is not merely about token distribution. More importantly, it is about maintaining a positive community atmosphere (also referred to as "user mind capture") after the initial rewards end. As research suggests, users' perceptions of the sincerity of "gifts" (Pine, 2011; Reinstein, 2010), whether rewards carry an element of surprise (IZA World of Labor, 2022), and the sense of community belonging and integration (McMillan & Chavis, 1986) all profoundly influence users' long-term engagement and loyalty.

Successful projects (whether L2 solutions, perpetual decentralized exchanges (PerpDEX), or liquid restaking protocols) share a common trait: they closely align the design of their airdrops with community values, making users feel valued rather than exploited. In these cases, airdrops are not merely tools for attracting funds but rather a sincere gesture that enhances user trust and deepens emotional connections. Whether through Arbitrum's community-friendly strategies or Etherfi's clever combination of novelty, product-market fit, and fair distribution, their shared success lies in establishing a positive and sustainable sense of user identity around the project.

This successful model aligns with research conclusions in the fields of gift-giving and community psychology. Studies indicate that gifts perceived as sincere, rather than mere transactional behaviors, can enhance trust and encourage ongoing user participation (Reinstein, 2010; Pine, 2011). This underscores the need for airdrop designs to fully consider user expectations. Similarly, when emotional connections are established among community members (McMillan & Chavis, 1986) and optimism about future developments is maintained (Messias, Yaish, & Livshits, 2023), users often transition from passive beneficiaries to active contributors, injecting more vitality into the project's long-term development.

However, these findings also prompt a deeper philosophical reflection: Is price a reflection of emotion, or does emotion determine price? In fact, the relationship between emotion and price is cyclical and mutually reinforcing. A positive community atmosphere can build trust, stimulate user participation based on practicality, and subsequently drive improvements in market performance. Conversely, rising token prices can further enhance user confidence and loyalty, strengthening community cohesion. This mutually causal cycle indicates that price and emotion do not exist in isolation but interact to jointly determine the long-term success trajectory of a project.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。