Bitcoin Strategic Reserve: A Long and Challenging Road

Author: Mu Mu | Plain Language Blockchain

Since the early November confirmation of Trump's victory, the crypto market, especially Bitcoin, has entered a strong expectation of a "U.S. Bitcoin Strategic Reserve." Clearly, the market will focus heavily on the implementation of this commitment after Trump takes office in 2025. Some analysts assert that this will break the Bitcoin bull-bear cycle, meaning that any "interruption" in the future could lead to significant market turbulence. What we can do now is to pay attention to its progress, anticipate possible timelines for implementation, and prepare accordingly.

01

Latest Developments

The idea of a "Bitcoin Strategic Reserve" has actually been proposed and discussed before the U.S. presidential election. Senator Cynthia Lummis proposed the "Bitcoin Act of 2024" on July 31, 2024, which suggests purchasing 200,000 Bitcoins annually, reaching a total of 1 million within five years.

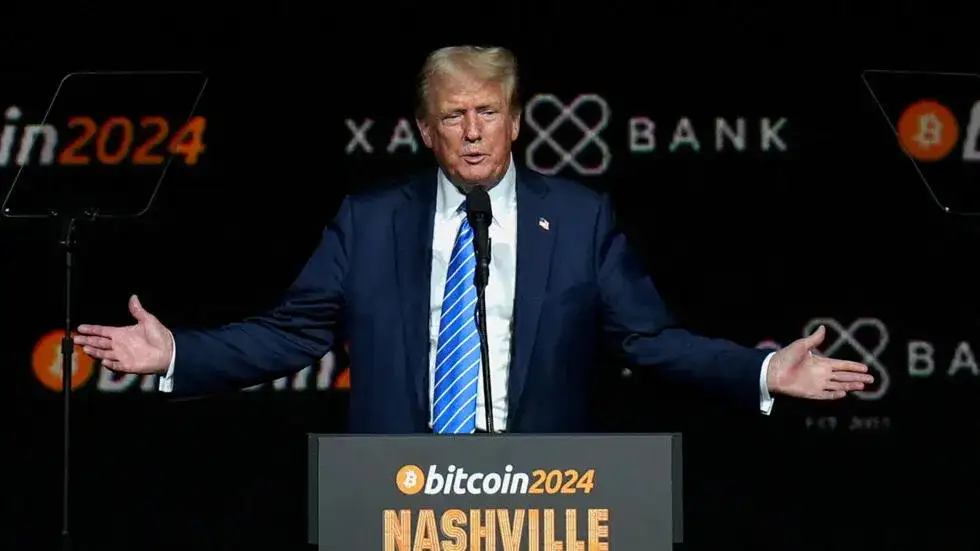

Subsequently, during the campaign, Trump promised at a Bitcoin conference in the crypto industry that he would become the "crypto president." The industry hopes he will fulfill this promise by creating a Bitcoin inventory through executive orders, ensuring that the industry can access banking services, and establishing a cryptocurrency committee.

On December 17, 2024, the Bitcoin Policy Institute (BPI) (note, this is a non-official organization, but a nonprofit focused on Bitcoin policy research, and it remains one of the important think tanks for policymakers on Bitcoin-related issues) recently released a draft of an executive order, attempting to provide reference opinions for Trump's "Bitcoin Strategic Reserve" executive order framework. The draft explicitly suggests allocating 1%-5% of national debt assets for purchasing Bitcoin to form a long-term reserve, led by the Treasury Department with cooperation from the Federal Reserve, gradually establishing reserves, etc.

On December 19, 2024, Federal Reserve Chairman Powell (expected to continue his term after Trump takes office) expressed cautious views at a press conference, stating that the Federal Reserve has no intention of participating in any government accumulation of Bitcoin, as such matters fall under Congress's responsibilities, and the Federal Reserve is not seeking to change existing laws to allow for Bitcoin holdings.

From the latest situation, despite the conservative stance of the Federal Reserve Chairman, the favorable conditions of a crypto-friendly U.S. Treasury Secretary nominated by Trump and the rapid issuance of "presidential executive orders" after taking office will not affect Trump's team from continuing to push for the inclusion of Bitcoin in the U.S. strategic reserve plan.

02

Earliest Implementation Timeline

Given that the "Bitcoin Strategic Reserve" is not a small issue and cannot be executed immediately on a whim by the U.S. president, we will not see its implementation right away. Based on the current administrative order or legislative process in the country, if Trump wants to implement the Bitcoin strategic reserve, he will need to have the cryptocurrency committee conduct policy research and feasibility assessments immediately after taking office, formally propose a plan upon completion, and then proceed through two paths:

Path One: Presidential Executive Order (Earliest in the second half of 2025)

Issuing an executive order directly after taking office is the quickest path, as it can bypass conservative and opposing resistance from the Federal Reserve and Congress, and it references the draft provided by the "Bitcoin Policy Institute," instructing the U.S. Treasury to utilize the Exchange Stabilization Fund (ESF) to directly allocate Bitcoin.

However, while this method is quick and convenient, it has side effects; although the Treasury's Exchange Stabilization Fund does not require Congressional approval, it can be investigated and legislated against by Congress. An executive order can also be overturned and modified by the next president, so its durability and stability are not as strong as legislation.

Path Two: Congressional Legislation (Earliest in the second half of 2026)

If pursued through a more stable legislative path, it will require a longer process. After the policy research and feasibility assessment by the cryptocurrency committee, the bill needs to be submitted to Congress and reviewed by the Senate Banking Committee, then passed by the Senate, House of Representatives, and signed by the president before it can be officially legislated.

This process may experience various back-and-forths and is relatively complex, as many conservative lawmakers will likely raise objections and attempt to obstruct it. Thus, while this path can yield a lasting and stable bill, it will take a long time, likely not until the second half of 2026 or 2027 for implementation.

Recently, there have been reports that the crypto industry is pushing for Trump's team to issue an executive order on his first day in office next month, initiating his promised cryptocurrency policy reforms to help promote the mainstreaming of crypto. If this is done through an executive order, we might see the implementation of the Bitcoin strategic reserve as early as mid-2025.

03

Key Time Nodes

During the process of the relevant executive orders or bills for the Bitcoin strategic reserve "going through the process," the following key time nodes may significantly impact the market:

1) January 20, 2025, around Trump's inauguration

Trump will officially take office on this day, and from this point, he can formally start "issuing orders." This time node will mark the beginning of the new president's governance, and related policy directions may gradually emerge. The market will closely watch the inaugural speech and the release of early executive orders. This inauguration is expected to be quite lively, with many guests invited by Trump, and the financial markets will pay close attention.

2) Mid-2025, completion of the policy research phase

Based on the timeline, the cryptocurrency committee's policy research is expected to be completed and a feasibility report and draft regarding the Bitcoin reserve proposed by mid-2025. Trump can then sign the executive order, marking the official introduction of the "Bitcoin Strategic Reserve."

3) Second half of 2025 to early 2026, implementation details and potential Congressional tug-of-war

After signing the relevant executive orders and determining the framework, the U.S. Treasury, Federal Reserve, and other relevant departments will begin to formulate specific implementation details, including Bitcoin procurement methods, reserve ratios, asset management rules, etc., and then begin formal implementation.

During this period, it is unlikely to be too smooth, as opposing members of Congress will join in to obstruct and create back-and-forths.

Finally, if everything goes smoothly and the Bitcoin reserve strategy brings objective "benefits," it may further promote legislation in the future, which will have a profound impact on the landscape of the crypto market.

04

Conclusion

The road to the "Bitcoin Strategic Reserve" seems full of twists and turns, and it is not something that can be implemented overnight; the earliest it could happen is in six months. However, regardless of the outcome, Trump's "U.S. Bitcoin Strategic Reserve" has created good expectations and also "set a template" for central banks, financial institutions, and publicly listed companies in various countries to research and explore the feasibility of Bitcoin reserves. Although there may still be many uncertainties regarding policy details and the final implementation timeline, we still need to follow and pay attention to key time nodes and be ready to make adjustments as needed.

Article link: https://www.hellobtc.com/kp/du/12/5606.html

Source: https://mp.weixin.qq.com/s/TkbKhH4dc9D6RO_iXvSoOw

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。