Author: Pzai, Foresight News

With the maturation of blockchain technology and the improvement of the regulatory environment, 2024 has become a key turning point in the crypto space, both in market and application aspects, marking the transition of this technology from early financial innovation to widespread commercial application.

Globally, the development of the crypto field shows a trend of diversification and deepening, achieving significant breakthroughs not only in finance but also demonstrating enormous potential in various application-level fields. This year, we witnessed innovations and evolutions in blockchain technology in areas such as asset and financial derivatives trading, as well as the crypto space stepping into the realms of social, AI, and even traditional internet applications.

With Trump's rise to power and the influx of global capital, the cryptocurrency sector is pursuing its dawn in different ways, embarking on a journey towards greater horizons. This article provides a brief review of the progress in Mass Adoption in the crypto field in 2024.

Polymarket: The "Coliseum" of All Things

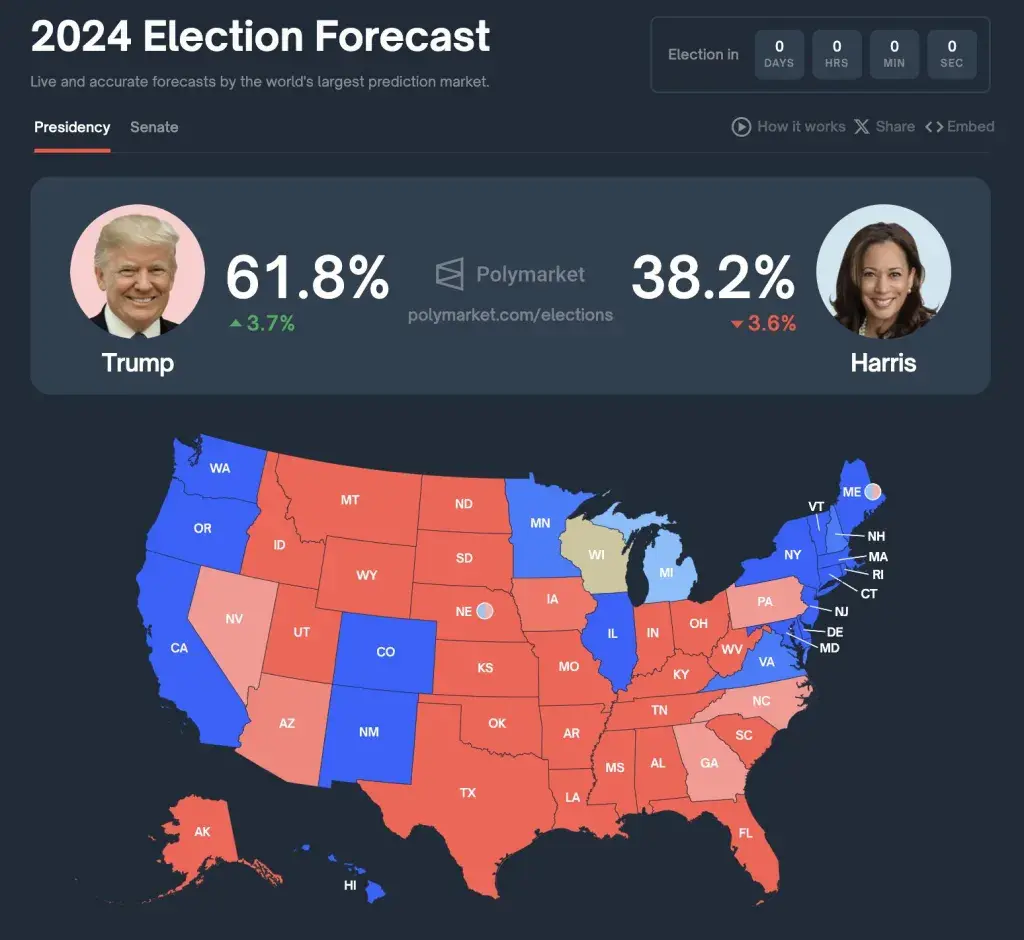

This year's intense U.S. elections brought a spring breeze to the crypto field, propelling the prediction market Polymarket to the center stage of the world. As a prediction market, the outcomes of all things are displayed on Polymarket in real-time as probabilities of yes or no, with each real transaction reflecting the market's game.

For this election, it even played the role of a "prophet," as its feedback on polling distributions was closer to the actual election results compared to traditional media polls. Its success is not only reflected in its accurate predictions of election outcomes but also in how it demonstrates that decentralized prediction markets can serve as an efficient information aggregation tool.

On this platform, users can place bets on the outcomes of various events without permission, and these betting behaviors reflect the collective expectations of participants regarding future events. As more people engage in such markets, the price mechanism can better reflect the likelihood of events occurring, thus providing more comprehensive and timely data points than a single source. The platform's ease of use and flexibility have quickly attracted a large number of new users, especially among the younger generation and tech enthusiasts. According to reports, the platform once ranked second on Apple's free app chart, only behind another prediction market app, Kalshi, indicating a high level of user engagement.

As a concept favored by Ethereum founder Vitalik Buterin, prediction markets have grown from niche experimental projects among blockchain tech enthusiasts to influential public decision-making reference tools. As more people begin to recognize the value of such platforms, Polymarket is expected to continue expanding its influence and exploring more diverse application scenarios, such as financial derivatives and policy evaluation. In this "coliseum," the game of opinions brings a different perspective to the world.

Farcaster and Onchain Summer: Positive Attempts in SocialFi

The Base ecosystem, as a "evergreen tree" and main "engine" of the Ethereum system, has garnered significant attention since its launch. Backed by the ecosystem support and user base of Coinbase, along with the vibrant community atmosphere driven by Jesse Pollak and others, the foundation for the explosion of the Base ecosystem has been laid. It is precisely because of the thriving ecosystem atmosphere that it has become fertile ground for the mass adoption of Web3.

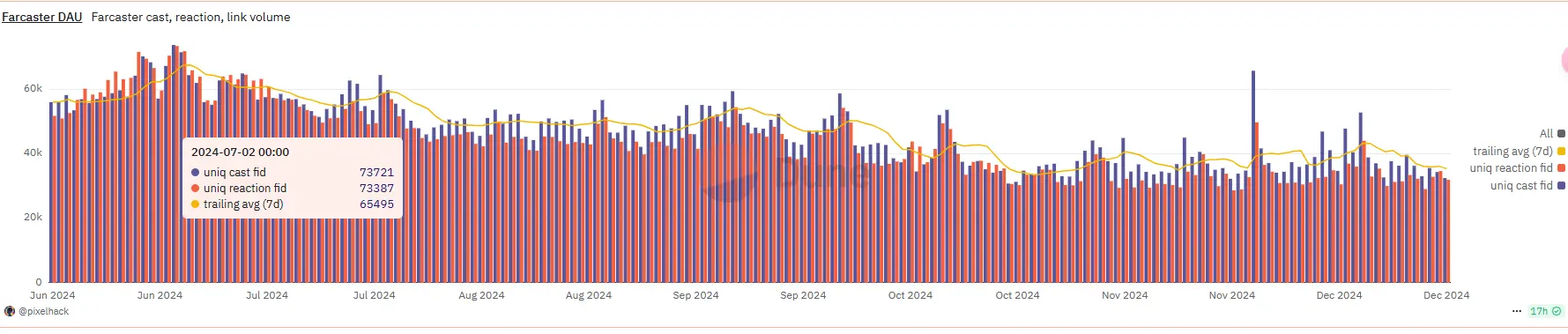

Last year, the Base ecosystem's Friend.tech once led the fervor of SocialFi, with numerous KOLs and users interacting within the protocol, resulting in substantial profits for many users. However, due to issues with its tokenomics and slowing user growth, Friend.tech gradually lost market focus. In contrast, the decentralized social protocol Farcaster has successfully attracted a large number of users' attention and support by building a more open, inclusive, and vibrant community ecosystem. Since opening registration last October, Farcaster has successfully become a social protocol with an average of 40,000 monthly active users, already demonstrating a certain scale effect.

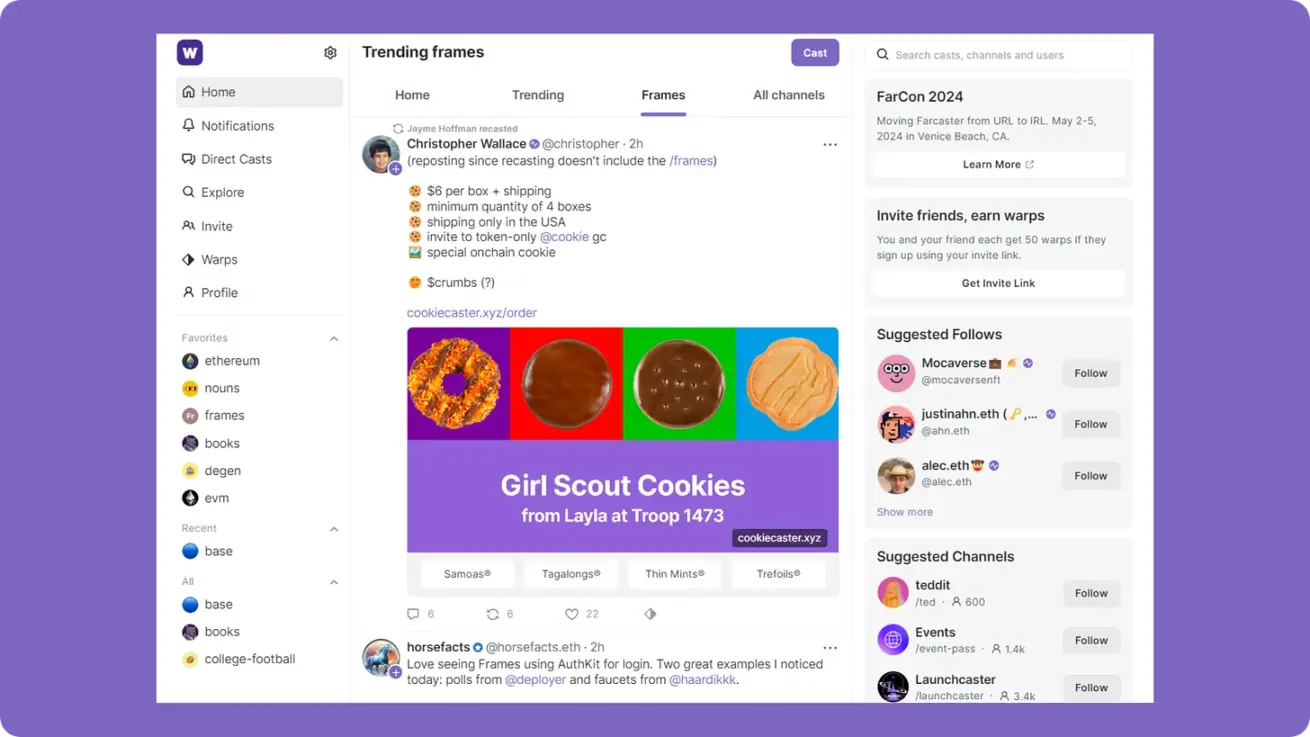

What sets Farcaster apart from other applications is that it is not just a single social application but plays more of a protocol layer role, allowing users to fully control their data and social graphs, freely migrating between different applications. Different developers can also create diverse front-end applications and services based on various APIs and frameworks. For example, Warpcast, as a primary client, provides a user experience similar to Twitter.

Additionally, frameworks like Farcaster Frames allow users to interact with on-chain applications and perform various operations directly within a single Cast front end, such as gaming, NFT minting, and article subscription services, creating more opportunities for users to engage with on-chain applications. Its unique community culture has also spawned community projects like DEGEN and HIGHER, gradually building community attention through token reward mechanisms while enhancing the influence of the Base chain itself.

As more well-known figures (such as Ethereum founder Vitalik Buterin) join, Farcaster has formed a vibrant and continuously growing community environment. For users, the new on-chain social paradigm combines the ease of traditional social applications with the flexibility of on-chain economic systems, providing more convenient interactions as applications like AI Agents develop.

Meanwhile, the global online hackathon event Onchain Summer held on the Base chain has also become a major highlight of the first half of the year, aiming to attract developers, artists, brands, and creators to participate in on-chain activities through a series of incentives. This event not only attracted over 7,500 developers who submitted more than 1,250 projects but also showcased the broad application possibilities of Web3 technology in various fields such as payments, commerce, and creator tools. An interesting fact is that you can now use USDC to buy your coffee at 49 coffee shops worldwide (even without miner fees on Coinbase Wallet).

AI Agent: A New Paradigm in the Cyber World

AI Agents, as an important component of humanity's cyber future, are emerging as a new form of economic entity—this not only changes the face of technology but also profoundly impacts how humans interact within the new system. As AI gradually integrates into daily life with characteristics increasingly resembling those of humans, cryptocurrency exists as the economic layer and protocol interaction layer for Agents.

Imagine a future where we can coexist with AI in a cyber environment, with token economies becoming the key medium for interaction. For example, on the Base chain, AI Agents are seamlessly embedded into the ecosystem of decentralized applications (DApps), reshaping crypto rules through activities on these platforms.

Virtual Protocol is a protocol built on the Base chain, aimed at constructing an ownership layer for AI Agents in the gaming and entertainment sectors, promoting the development of agents through tokenized channels. The highlight of this protocol is that it is not just a simple token issuance platform but attempts to create a self-sustaining and continuously appreciating economic system.

The first AI Agent Aethernet, created by HIGHER community member Martin in Farcaster, issued NFTs on Zora and received significant creator incentives. As a bridge between human creativity and digital possibilities, Aethernet not only actively participates in on-chain activities but also promotes economic behavior within social relationships, bringing valuable positive emotions.

With the improvement of AI Agents' infrastructure and as more developers begin to focus on the unique role AI can play in the crypto economic system, AI is expected to truly achieve synchronization with the real world, perceiving the real temperature of water and continuously iterating towards AGI. Consequently, the strong feedback from the crypto world to the real world will soon arrive.

DeSci: Changing Scientific Research through Decentralization

In the field of scientific research, DeSci (Decentralized Science) is gaining increasing attention as an emerging concept. It refers to the use of Web3 technology and distributed ledgers to build secure, durable, and transparent research record systems. In this way, scientists can better protect intellectual property, promote open collaboration, and ensure the authenticity and traceability of research results. According to predictions from the crypto organization Spartan, DeSci will gain more attention in 2024, becoming a powerful use case for blockchain. This is because DeSci not only addresses the data silo issues present in traditional research processes but also provides new possibilities for knowledge sharing on a global scale.

The representative Molecule DAO has already provided practical support for dozens of biopharmaceutical projects, most of which have reached the stage of patent monetization or Series A financing. Under this concept, platforms for researchers in niche fields such as BIO Protocol, VitaDAO (focused on funding longevity-related biological researchers), and PsyDAO (for the development of psychoactive drugs) have also emerged.

Specifically, DeSci tracks the progress of each research project through the autonomous nature of DAOs, including all stages from experimental design and data analysis to final publication. This not only helps improve the transparency of the entire research process but also effectively prevents academic misconduct.

At the same time, leveraging the smart contract mechanism, researchers can issue fundraising and collaboration processes without permission, thereby simplifying the collaboration processes between institutions. More importantly, DeSci platforms typically adopt token economic models to incentivize participants to contribute high-quality content and services, thus forming a self-sustaining and continuously growing ecosystem. This also demonstrates DeSci itself as a manifestation of sustainability in the crypto field, providing ample soil for the advancement of science.

TON Mini Apps: A New Attempt to Lower Barriers to Entry

If we can find the greatest focal point of intersection between the crypto field and traditional sectors, then Telegram (TON) is most likely to become that focal point. Imagine being able to access on-chain and off-chain services through a diverse and convenient front end and Bot operations all within one application. By the end of May 2024, the monthly active users (MAU) of Telegram Mini Apps had reached 400 million, increasing to 500 million in July, with over half of Telegram users actively engaging in the crypto space.

The explosion of countless mini apps this year has brought a glimmer of hope for many to reach countless users through social platforms, and in terms of user engagement, some applications are also entering from different ecological niches. TADA from Singapore is a typical example, demonstrating how to utilize existing communication platform features to achieve seamless connections between online communication and offline services.

As a ride-hailing service platform, TADA not only offers competitive pricing but, more importantly, successfully simplifies the payment process, allowing users to complete transactions directly within Telegram using various cryptocurrencies. This innovation not only revolutionizes traditional travel models but also provides a successful example for the practical implementation of Web3 application scenarios. For the industry, TADA's case shows that when the right technology and business model are combined, it can effectively drive more people to accept and use DeFi services.

Notcoin is a simple airdrop mini app based on Telegram that has rapidly gained popularity since its launch in early 2024. The game attracts millions of players through a simple mechanism while introducing a token economic model that encourages users to participate and earn rewards through airdrops. Over time, some users have begun to explore deeper functionalities within TON, such as investing in DeFi products or participating in other forms of on-chain activities. The success of Notcoin proves that through fun and immediate feedback mechanisms, new users can be effectively guided into the complex world of crypto. In terms of customer acquisition strategy, TON has also successfully achieved a closed loop of "click-to-earn traffic—token airdrop—user conversion to DeFi applications" through its "mini apps."

RWA: Bridging On-Chain and Off-Chain

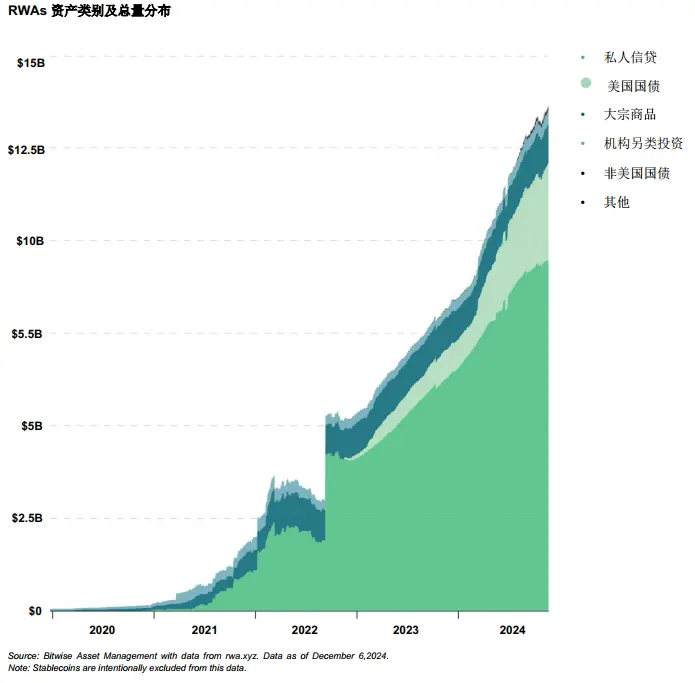

The interconnection of on-chain and off-chain assets has long been one of the "pain points" explored by many projects in crypto across multiple cycles, and with the loosening of the regulatory environment, the future of RWA (Real World Assets) is unfolding before us. According to Bitwise statistics, the total amount of RWA assets in the global market has exceeded $12.5 billion, including most private credit and government bond-related derivatives.

For on-chain users, the accessibility of off-chain asset yields is gradually becoming an important part of the entire economic system. When Sky transitioned from DAI to USDS, it was already prepared in the RWA field (the introduction of Spark's RWA provided certain experience for Sky), finding considerable off-chain yield opportunities for capital in the crypto space.

Stablecoins like Usual and Anzen, which focus on RWA yields, have recently launched their Token Generation Events (TGE), reflecting the market's robust enthusiasm for RWA yield opportunities. Usual integrates the liquidity of platforms like Hashnote with the liquidity of general stablecoins, flexibly providing yields to holders through USD0 and Bond models, while Anzen Finance offers diversified yield sources by using private credit asset pools as collateral.

Recently, the MiCA bill passed in Europe has accelerated the progress of regional stablecoin and crypto custody compliance, and Trump's rise to power has also provided imaginative space for the on-chain issuance of off-chain assets. With the accelerated promotion of crypto compliance in various regions, and as major capital like BlackRock and Citigroup gradually enter the RWA track, it is believed that the RWA sector will soon provide diverse options for crypto users.

Conclusion

In 2024, the crypto field has ushered in a flourishing scene, marking not only a key moment of technological advancement but also an important turning point for countless projects in the crypto space to transition from concept to reality. With the increasing maturity of blockchain technology and the gradual improvement of the regulatory environment, we have witnessed the widespread acceptance and in-depth development of cryptocurrencies and their related applications globally.

As the flowers bloom in full splendor, it is time to set sail. We hope that in the near future, we will see many people owning crypto wallets and participating in various economic activities on-chain, even coexisting peacefully with AI in the cyber society, building harmonious interpersonal relationships.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。